Tag Archive: newslettersent

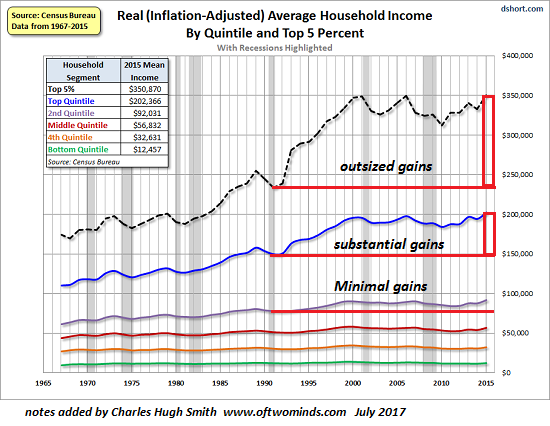

The Two Charts That Dictate the Future of the Economy

The stock market, bond yields and statistical measures of the economy can be gamed, manipulated and massaged by authorities, but the real economy cannot. This is espcially true for the core drivers of the economy, real (adjusted for inflation) household income and real disposable household income, i.e. the real income remaining after debt service (interest and principal), rent, healthcare co-payments and insurance and other essential living expenses.

Read More »

Read More »

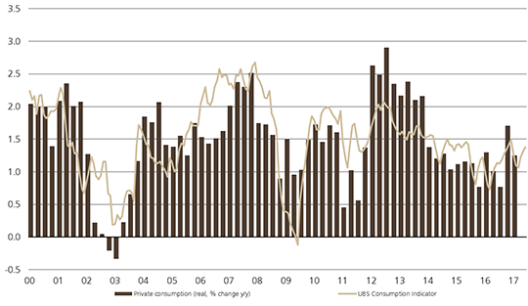

Switzerland UBS Consumption Indicator June: Subdued Growth

UBS consumption indicator printed 1.38 in June, pointing to subdued growth in Swiss private consumption in recent months. Relatively weak growth in employment was much to blame for the lackluster number, however this was offset somewhat by robust new car registrations data and overnight hotel stays by Swiss nationals.

Read More »

Read More »

FX Daily, July 26: Quiet Fed Day without Yellen

By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month's rate hike, there is practically no chance of a new policy initiative either on the balance sheet or the Fed funds target.

Read More »

Read More »

Stories making the Sunday papers

Employee work hours, more storm damage in Switzerland and electricity companies’ fears of cyber attacks are among the main headlines in the Sunday papers. Not all younger employees in Switzerland prefer the freedom of more flexible work hours as companies try to adapt quickly to an increasingly digital world, reports the Swiss newspaper SonntagsZeitung.

Read More »

Read More »

Le prix de l’or est manipulé. Egon von Greyerz

La léthargie estivale des marchés a tendance à insuffler un sentiment de fausse sécurité. Les actions et l’immobilier approchent de leurs plus hauts historiques, les taux d’intérêt sont à un plus bas de 72 ans, et la plupart des investisseurs se sentent plus riches que jamais. Les banques centrales envoient les signaux d’économies fortes en annonçant des hausses de taux et une réduction de leurs bilans.

Read More »

Read More »

U.S. Consumer Price Index, Oil Prices: Why It Will Continue, Again Continued

Part of “reflation” was always going to be banks making more money in money. These days that is called FICC – Fixed Income, Currency, Commodities. There’s a bunch of activities included in that mix, but it’s mostly derivative trading books forming the backbone of math-as-money money. The better the revenue conditions in FICC, the more likely banks are going to want to do more of it, perhaps to the point of reversing what is just one quarter shy of...

Read More »

Read More »

FX Daily, July 25: Summer Markets Ahead of FOMC

The global capital markets are subdued today; a dearth of fresh news and tomorrow's FOMC meeting are making for light activity and limited price movement. The US dollar is little changed against most of the major currencies. The net change on the day through most of the European morning is +/- 0.15%. The exception is the Norwegian krone and Swedish krona, which is about 0.25% stronger.

Read More »

Read More »

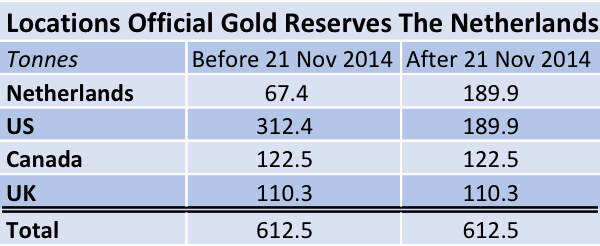

Did The Dutch Central Bank Lie About Its Gold Bar List?

Head of the Financial Markets Division of the Dutch central bank, Aerdt Houben, stated in an interview for newspaper Het Financieele Dagblad published in October 2016 that releasing a bar list of the Dutch official gold reserves “would cost hundreds of thousands of euros”. In this post we’ll expose this is virtually impossible – the costs to publish the bar list should be close to zero – and speculate about the far reaching implications of this...

Read More »

Read More »

Adult habits in line with global average

In Switzerland, 21% of the adult population on average are daily smokers, according to a report from the World Health Organisation. That is firmly in line with average rates of current smoking among adults globally, which have declined to 21% in 2015 down from 24% in 2007.

Read More »

Read More »

Commercial Property Market Is Inflated and May Burst Again – McWilliams

Dublin property investors had better hope that Brexit happens soon. They should also hope that it’s not just a ‘hard’ Brexit, but a granite Brexit — a Brexit that’s as hard as possible. They should be betting on the buffoonery of Boris Johnson, down on both knees praying for a massive barney between Davis and Barnier.

Read More »

Read More »

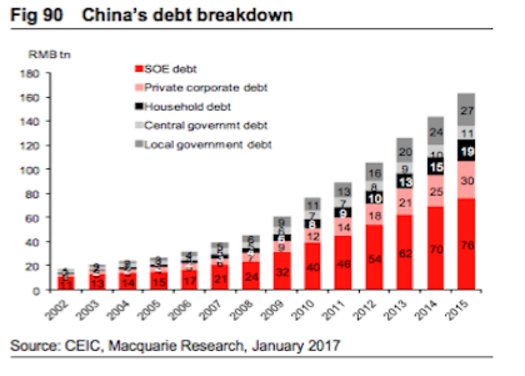

There Is Only One Empire: Finance

There's an entire sub-industry in journalism devoted to the idea that China is poised to replace the U.S. as the "global empire" / hegemon. This notion of global empire being something like a baton that gets passed from nation-state to nation-state is seriously misleading, in my view, for this reason:

Read More »

Read More »

The Student Loan Bubble and Economic Collapse

The inevitable collapse of the student loan “market” and with it the take-down of many higher educational institutions will be one of the happiest and much needed events to look forward to in the coming months/years.

Read More »

Read More »

FX Daily, July 24: Euro Recovers from Softer Flash PMI

The euro made a marginal new high in early Asia, but participants rightly drew cautious ahead of the flash eurozone PMI. The flash PMI was softer than expected, and although the composite fell to six monthly lows, it is more a reflection of how steady it has been at elevated levels.

Read More »

Read More »

UBS Outlook Switzerland: Generation Silver in the labor market

A longer working life can counteract the demography-related shortage of skilled workers and spiraling social security expenditure. For this to happen, however, the reintegration of older employees must be improved and gainful employment made more attractive beyond the age of retirement. New, innovative concepts are needed that point the way toward a labor market that is more flexible and better-oriented to the needs older employed workers.

Read More »

Read More »

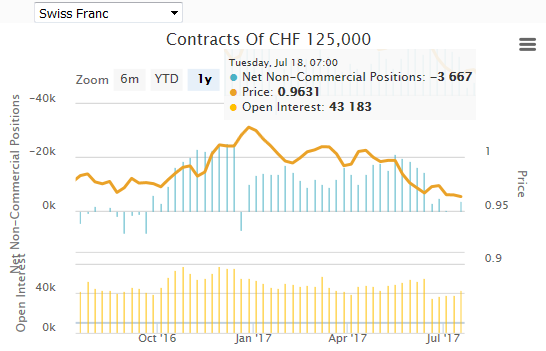

Weekly Speculative Positions (as of July 18): Speculators short CHF against USD again

The net speculative CHF position has changed from -0.2K long to 3.7K contracts short (against USD). Since the beginning of May the Canadian dollar has been the strongest of the major currencies. However, until the most recent CFTC reporting week ending July 18, speculators in the futures market were net short.

Read More »

Read More »

Italy demands data on billions in suspect Swiss accounts

Italian financial crime investigators have asked the Swiss authorities for help in tracking down the beneficial owners of €6.7 billion (CHF7.4 billion) held in Switzerland. The information came to light during an investigation by the Milan authorities into the activities of Credit Suisse.

Read More »

Read More »

FX Weekly Preview: Don’t Be Confused by the Facts or Why Neither the Data nor the Fed Will Alter Market Trends

FOMC is the highlight of the week. Early look at July inflation in Europe may see less pressure. Overall household consumption in Japan is rising, helped by robust labor market, but little new price pressures. The data this week is expected to confirm what many investors have come to assume.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mixed on Friday, but largely firmer over the entire week. Top performers were BRL, KRW, and ZAR, while the worst were ARS, MXN, and RUB. FOMC meeting this week poses some potential risks to the global liquidity story that’s supporting EM. Within EM, the low inflation/easy monetary policy narrative should continue with data and events this week.

Read More »

Read More »

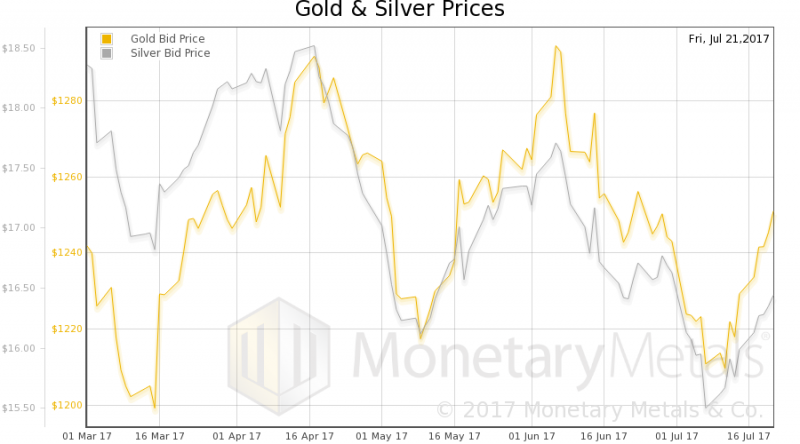

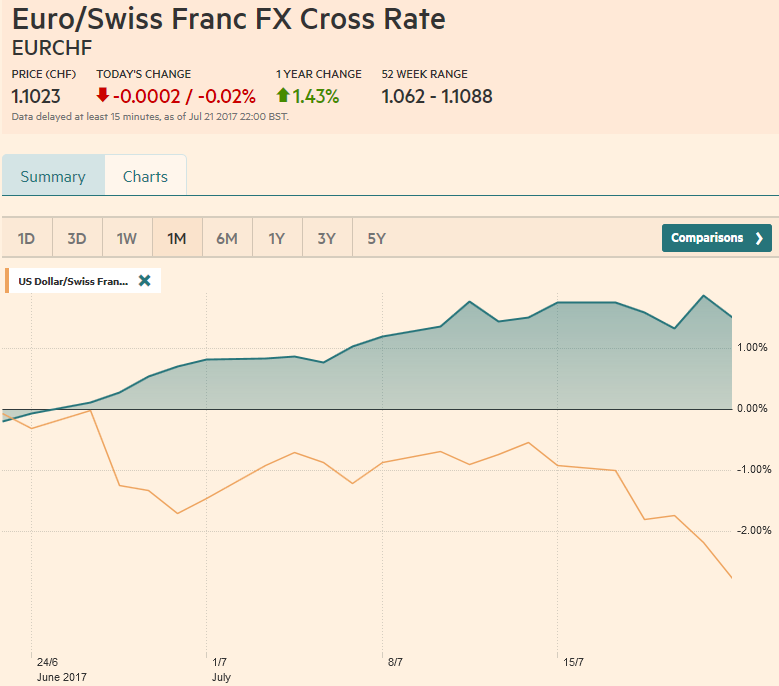

FX Weekly Review, July 17 – July 22: Euro and CHF move upwards against Dollar

Both Swiss Franc and Euro were moving upwards against the dollar. So CHF gained 3% versus the dollar in the last month. CHF losses against the euro are smaller, around 1.3%.

Read More »

Read More »