Tag Archive: newsletter

How pension payments are making Swiss housing unaffordable

Under pressure to invest, Swiss pension funds are ploughing money into real estate, considered a safe and profitable option. As this drives up housing prices, however, desperate residents are fighting back through direct democracy. Building land in central Switzerland is scarce, and apartments and houses expensive, especially in cities.

Read More »

Read More »

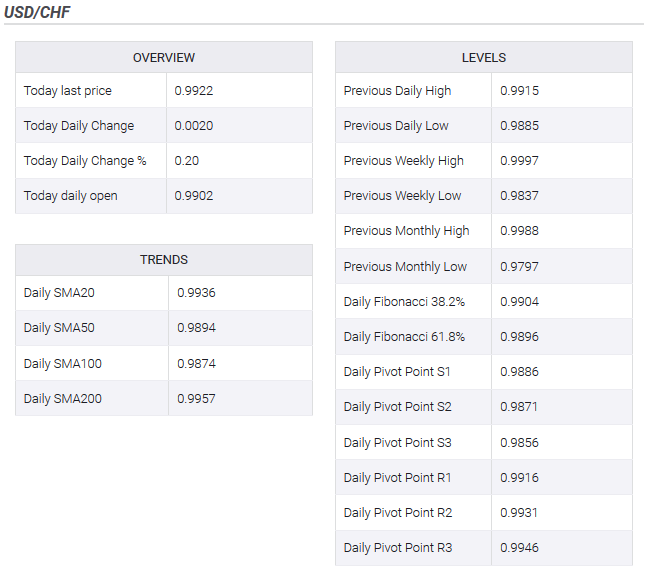

USD/CHF technical analysis: Jumps back closer to over 1-week tops

The intraday pullback finds decent support ahead of 0.9900 handle. Move beyond 0.9935 will set the stage for additional near-term gains. The USD/CHF pair did witness some intraday pullback but showed some resilience below 38.2% Fibonacci level of the 1.0028-0.9837 recent downfall. The pair managed to find decent support near 200-hour SMA and has now moved back closer to over one-week tops set earlier this Friday.

Read More »

Read More »

Five things to come out of Zuckerberg’s Libra testimony

Mark Zuckerberg testified in front of the US Congress on Wednesday about his company’s plans to launch a new, global digital currency. During a marathon hearing, the Facebook chief executive and founder attempted to change the narrative surrounding Project Libra. The proposed currency has been beset by criticism from regulators and politicians, while support from corporate partners has dwindled.

Read More »

Read More »

Zurich residents take on real estate investors to keep their homes

In a modest Zurich neighbourhood, long-time residents of a sprawling apartment complex will lose their homes if a planned renewal project backed by a pension fund goes ahead. Similar projects are happening across Switzerland as funds invest heavily in real estate amid low interest rates.

Read More »

Read More »

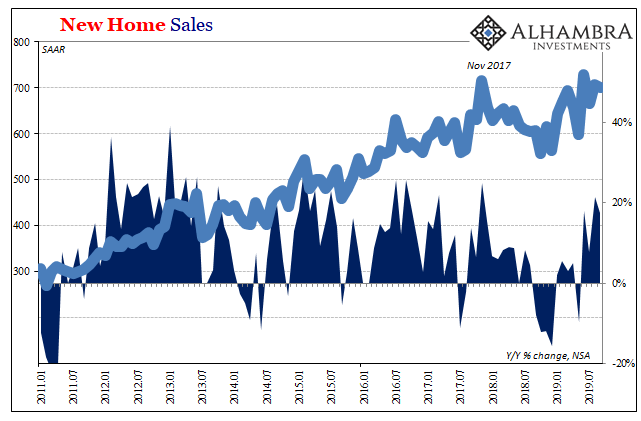

Downward Home Prices In The Downturn, Too

The Census Bureau reported today New Home Sales remained at a better than 700k SAAR in September following the big jump over the previous few months. Though the number was slightly lower last month than the month before, it wasn’t meaningfully less. As discussed yesterday, while that might seem the Fed’s rate cut psychology combined with the bond market’s pessimism (reducing the mortgage rate) is having a positive effect, I don’t see it that...

Read More »

Read More »

FX Daily, October 25: Limping into the Weekend both Fighting and Talking

Overview: Amazon and Intel earnings offered conflicting impulses for Asia Pacific equities, but Japanese, Chinese, Australian, and South Korean shares advanced. This will allow the regional MSCI benchmark to solidify its third consecutive weekly gain. Europe's Dow Jones Stoxx 600 is little changed, and it too is closing in on its third weekly advance.

Read More »

Read More »

USD/CHF rises to one-week highs at 0.9930

US Dollar strengthens during the American session after US data. Swiss Franc fails to benefit from the demand for safe-haven assets. The USD/CHF pair rebounded at 0.9890 and climbed to 0.9930, the highest level since October 17. As of writing, trades at 0.9920, up almost 20 pips for the day, on its way to the fourth daily gain in-a-row.

Read More »

Read More »

Self-censorship increases online amid data privacy concerns

The Swiss are using the internet more than ever but have growing angst about companies like Facebook violating their privacy. The consequence is a rising trend to self-censorship: not looking for certain information or not expressing oneself online.

Read More »

Read More »

Startups struggle to make a mark in the conservative luxury industry

Swiss luxury startups are finding it difficult to break into an established market that can be averse to change due to longstanding traditions. “When I was working for an auction house a couple of years ago the chairman handed me a gadget a client had given him. It was a USB stick and he did not know what it was.”

Read More »

Read More »

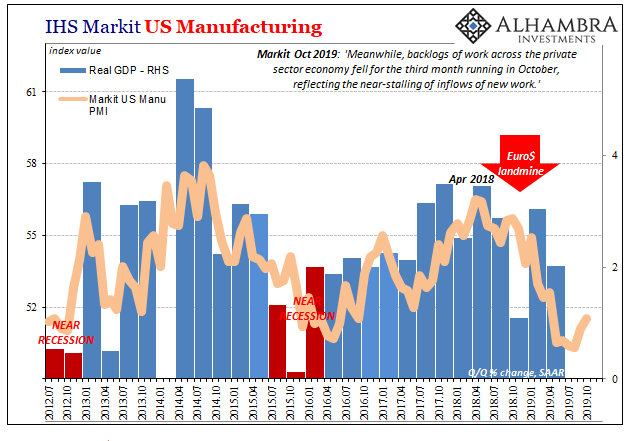

More Down In The Downturn

Flash PMI’s from IHS Markit for the US economy were split in October. According to the various sentiment indicators, there’s a little bit of a rebound on the manufacturing side as contrary to the ISM’s estimates for the same sector. Markit reports a sharp uptick in current manufacturing business volumes during this month.

Read More »

Read More »

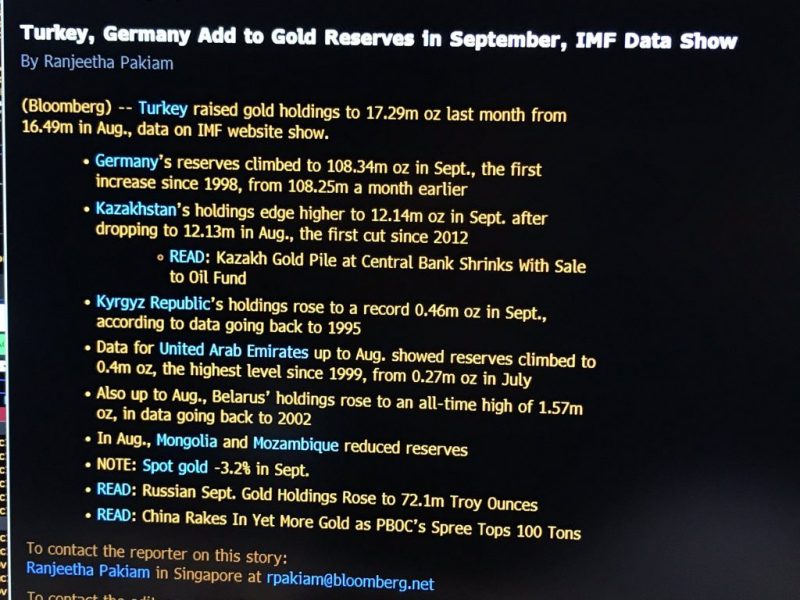

Bundesbank Buys Gold – Increasing Concerns About Deutsche Bank, European Banks, the Euro and Dollar

◆ The End Of Fiat In One Chart?◆ For the first time in 21 years, Germany has openly bought gold into its reserve holdings◆ With ECB mutiny and Deutsche Bank’s rapid demise, fears are rising of a looming financial crisis, and with that, Germany has shown a renewed interest in gold

Read More »

Read More »

FX Daily, October 24: Flash PMIs Disappoint Despite Negative Interest Rates

Overview: As the UK awaits the EU's decision on its request, disappointing flash PMI readings Japan, Australia, and Germany have filled the news vacuum. Sweden's Riksbank retained a hawkish tone while keeping rates on hold, and Norway's Norges Bank also stood pat. The market expects Turkey to deliver a rate cut, while the ECB meeting is Draghi's last at the helm.

Read More »

Read More »

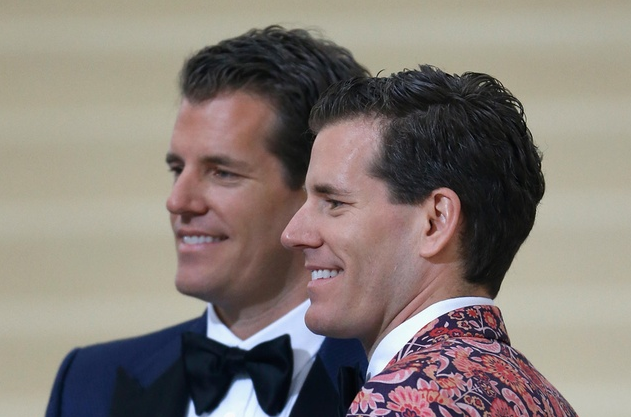

Bitcoin billionaire twins to address St Moritz crypto event

Cameron and Tyler Winkelvoss, who made a fortune out of bitcoin, are to deliver a keynote speech at next year’s Crypto Finance Conference in St Moritz. The annual gathering of cryptocurrency entrepreneurs and investors has become a fixture event, running just before the World Economic Forum’s flagship Davos summit.

Read More »

Read More »

Nestlé remains among top plastic polluters in the world

The Swiss food giant has been placed second behind Coca-Cola in an audit of plastic waste by a coalition of environmental organisations. The results of the analysis, released on Wednesday by the Break Free From Plasticexternal link movement, prompted the authors to single out the corporations that finished in the top three for the second year in a row – Coca-Cola, Nestlé and PepsiCo – for having offered “mostly false solutions to the plastics...

Read More »

Read More »

Cool Video: China Still Needs to Provide more Stimulus

The IMF projects that China will expand by less than 6% in 2020, but unless China provides more stimulus, it may be difficult to achieve. This is not only my view but also the view of Helen Qiao, the chief economist for Greater China at Bank of America. I was on the Bloomberg set with Alix Steele and Ms. Qiao earlier today.

Read More »

Read More »

Macro Housing: Bargains and Discounts Appear

While things go wrong for Jay Powell in repo, they are going right in housing. Sort of. It’s more than cliché that the real estate sector is interest rate sensitive. It surely is, and much of the Fed’s monetary policy figuratively banks on it. When policymakers talk about interest rate stimulus, they largely mean the mortgage space.

Read More »

Read More »

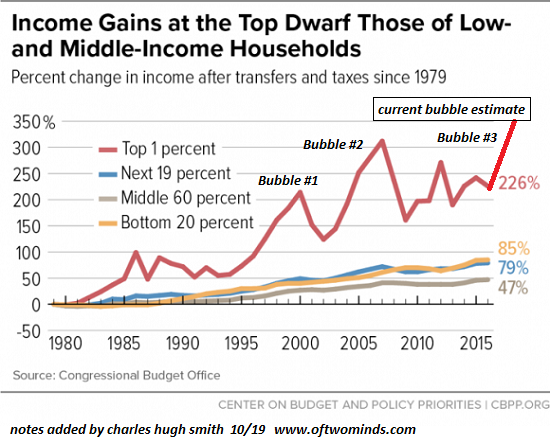

The Unraveling Quickens

Even if we don't measure the erosion of intangible capital, the social and political consequences of this impoverishment are manifesting in all sorts of ways. The central thesis of my new book Will You Be Richer or Poorer? is the financial "wealth" we've supposedly gained (or at least a few of us have gained) in the past 20 years has masked the unraveling of our intangible capital: the resilience of our economy, our social capital, i.e. our ability...

Read More »

Read More »

JPMorgan Warns U.S. Money Market Stress to ‘Get Much Worse’

◆ Severe funding pressures in U.S. money markets tipped to resurface heading into year-end by JPMorgan who warn that financial stresses are likely to ‘get much worse’ ◆ Goldman Sachs and Bank of America also warn funding issues remain (see below) ◆ Federal Reserve will start buying $60 billion of Treasury bills every month ◆ Funding markets are on notice for a possible year-end liquidity crunch

Read More »

Read More »

Germany Increase Gold Reserves In September For The First Time In 21 Years – IMF

◆ The gold reserves of the German Bundesbank rose in September for the first time in 21 years; German gold reserves rose to 108.34 million ounces in September from 108.25 million ounces last month◆ It was the Germany’s first gold purchase since 1998 and while the amounts are not huge at 90,000 troy ounces, it highlights the Bundesbank and German concerns about the global monetary system and euro itself as Christine Lagarde takes over the ECB

Read More »

Read More »

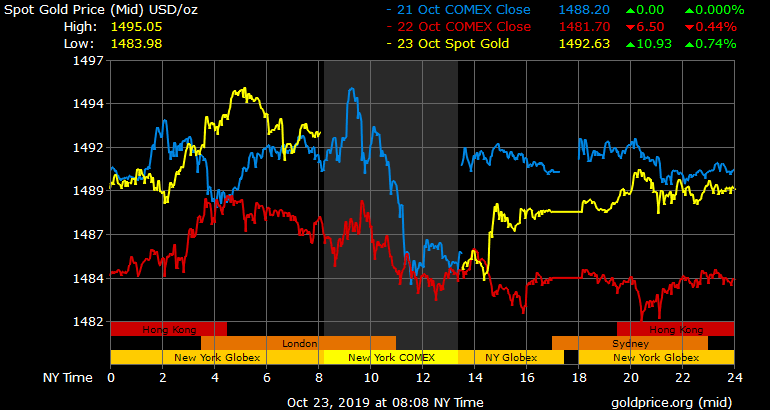

FX Daily, October 23: Markets Lack Much Conviction, Await Fresh Developments

Overview: UK Prime Minister Johnson is neither dead in a ditch as he said he would prefer to be than request an extension of Brexit, nor will the UK leave the EU at the end of the month. Yesterday's vote rejected the attempt to fast-track the legislation needed to support the divorce agreement. It all but ensures that such a delay will be forthcoming.

Read More »

Read More »

-637076048529841650-800x391.png)