Tag Archive: newsletter

US Indizes schwach mit Raum für mehr – US Opening Bell mit Marcus Klebe – 21.10.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de...

Read More »

Read More »

Sprott Money “Ask The Expert” – October 2022, Michael Oliver

Technical and momentum analyst, Michael Oliver, joins us and answers your questions regarding the markets, Fed policy, gold, silver and the mining shares.

Have questions for us? Send them to [email protected] or simply leave a comment here.

Check out https://www.sprottmoney.com, or to learn more about Chris Vermeulen: https://www.thetechnicaltraders.com.

Read More »

Read More »

Marc Faber: Own Physical Gold! Don’t Be Greedy !

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3VKkHRR

▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactSilverNews_subscribe

▶︎ Join the official 1000x Telegram channel! Join us on the road to 1000x: https://t.me/official1000x

Marc Faber is a Swiss investor based in Thailand. He is the publisher of the Gloom Boom & Doom Report newsletter and the director of Marc Faber Ltd, which acts as an investment advisor and fund manager....

Read More »

Read More »

Marc Faber: People Will Lose All Their Money..

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3T7j2UF

▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactInvestorNews_subscribe

▶︎ Join the official 1000x Telegram channel! Join us on the road to 1000x: https://t.me/official1000x

Marc Faber is a Swiss investor based in Thailand. He is the publisher of the Gloom Boom & Doom Report newsletter and the director of Marc Faber Ltd, which acts as an investment advisor and fund manager....

Read More »

Read More »

Is There a Positive Side to Inflation?

(10/21/22) Higher inflation is no reason to stop making contributions to your retirement savings, regardless of mode: Just alter the allocations. No Shift. What happens after the mid-terms? Inflation isn't budging; the Fed went too far, and we'll see more adverse effects in 2023. There's no place to hide but in Cash. What happens if Yields continue to rise; interest rates can only go so far. When is Inflation is a Good Thing? COLA on Social...

Read More »

Read More »

Was Dir keiner über passives Einkommen sagt

Passives Einkommen heißt: Geld kommt rein, ohne dass Ihr viel Aufwand habt. Aber wie passiv ist es wirklich und könnt Ihr davon leben? Das sagt Euch Saidi im Video.

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Finanztip Basics ►...

Read More »

Read More »

Darf sich China am Hamburger Hafen beteiligen?

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Student Loan Debt: The Financial Time Bomb Politicians Want to Ignore

Media reports claim this debt prevents economic recovery. Chuck Schumer would erase it with the flick of a pen. Elizabeth Warren would remove it to free students’ ability to buy a house and form a family. Janet Yellen opines paying off student loan debt (SLD) will free up venture capital. Alexandria Ocasio-Cortez claims the proposed Biden plan is inadequate.

Read More »

Read More »

Greenback Holds Above JPY150, while BOJ goes MIA

Overview: The continued surge in US rates and inability of the equity market to sustain gains saw the post-Truss sterling rally unwind amid a broader recovery of the dollar. Sterling has been sold to new lows for the week.

Read More »

Read More »

DREI Dinge die du im SHORT-TRADING beachten solltest | Mario Lüddemann

Der perfekte Einstieg in einen Shorttrade. ? Gibt es ihn überhaupt oder ist es vollkommen egal, wann ich ein- und aussteige? ? Diese Frage wird mir immer wieder gestellt.

Deshalb möchte ich Dir anhand eines Beispieltrades kurz skizzieren, ✍️ wie ich die passenden Aktien für das Shorttrading finde, wie ich einsteige und natürlich auch wie ich dann wieder aussteige. ?

► Sichere dir Marios Watchliste der trendstärksten Aktien zum Traden für nur 1...

Read More »

Read More »

Wunsch-Aktien in der Analyse: Bayer, Varta und Givaudan unter der Chartlupe

Cashkurs*Academy: Schnuppern Sie kostenlos in den Kurs Charttechnik rein – Jetzt den Code „Wunschanalysen“ einlösen und das erste Modul gratis belegen: https://bit.ly/CKA_charttechnik

In diesem Video bespricht unser Experte Mario Steinrücken die von der Cashkurs*Community gewünschten Titel am Chart: Heute sehen Sie hier die kurz, knackigen Analysen von Bayer, Varta und Givaudan. Hier geht’s zum vollständigen Video mit weiteren spannenden Titeln...

Read More »

Read More »

Bitcoin Nach Meinem Tod Vererben? ?

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Digitaler Nachlass - Kann ich meine Kryptos vererben? @Relai - Learn Bitcoin

Julian Liniger der Gründer von Relai ist als Podcast Gast zu Besuch. Relai ist eine einfache, benutzerfreundliche und sichere App, um Bitcoin zu kaufen. Ausserdem sind sie einer der günstigsten Anbieter in Europa.

#bitcoin #erben...

Read More »

Read More »

ACHTUNG! Grüne wollen ENTEIGNUNG durch Vermögensabgabe und Bundestag sagt ganz klar: …

Bundestag lässt ENTEIGNUNG und Vermögensabgabe NEU prüfen mit klarem Ergebnis!

4-Augen-Geldgespräche: https://thorstenwittmann.com/telefontermin-formular-hpc/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Grüne zeigen unverblümt ihr wahres Sozialisten-Gesicht und wollen Enteignungen

Nicht nur beim Thema Krieg zeigt die ehemalige Friedenspartie ihr wahres Gesicht, sondern auch was das Grundrecht auf Eigentum betrifft.

Das...

Read More »

Read More »

Rep. Alex Mooney Advocates for Gold Standard Bill on Fox Business

Rep. Alex Mooney (R-WV) joined Fox Business in support of H.R. 9157, the Gold Standard Restoration Act. “The Federal Reserve note has lost more than 30 percent of its purchasing power since 2000, and 97 percent of its purchasing power since 1913,” the Congressman from West Virginia told host Kennedy.

Read More »

Read More »

The Anti-Communist Interventionist Racket Continues

New Jersey Congressman Albio Sires is complaining about financial aid that international agencies are providing Nicaragua under what he says is “the pretext of poverty reduction, disaster relief and small business support.”

Read More »

Read More »

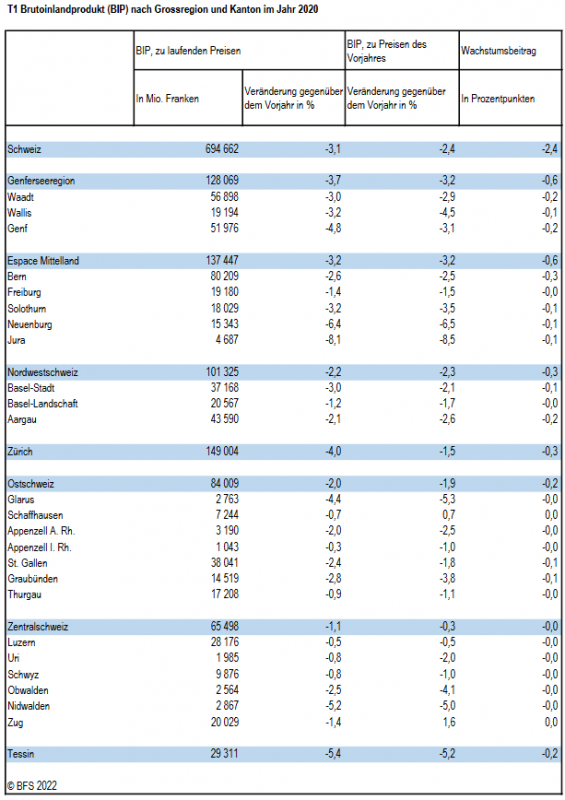

Switzerland Gross domestic product fell in almost all cantons in 2020

2020 was marked by the COVID-19 pandemic, which affected the entire regional economic fabric in Switzerland. National growth in gross domestic product (GDP) fell to –2.4% at the previous year's prices and almost all cantons recorded a decline in activity. Jura was the most affected (–8.5%), followed by Neuchâtel (–6.5%), Glarus (–5.3%) and Ticino (–5.2%).

Read More »

Read More »

Hans-Werner Sinn: Der Markt ist nicht gerecht, aber effizient

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/3EPdPw9

HANS-WERNER SINN ONLINE

▶︎ Hans-Werner Sinns Webseite: https://www.hanswernersinn.de/

▶︎ Hans-Werner Sinns Bücher auf Amazon: http://bit.ly/Hans-Werner-Sinn-auf-Amazon

#hanswernersinn #mehrwertnews #inflation #finanzmarkt #zentralbank #euro #fiatgeld

Hans-Werner Sinn: “Der Markt ist nicht gerecht, aber effizient”...

Read More »

Read More »

Voehersage mit BRISANZ! Dr. Markus Krall entlarvt die Politik!

Markus Krall WARNT! Nun kommt es GEWALTIG, die Stimmung kippt!

Sie interessieren sich für Inhalte zum Thema Geld und Finanzen?

Read More »

Read More »

Switzerland sets out power contingency plans for winter

The Swiss government has put forward plans to create reserve power plants aimed at shoring up the country’s energy supplies during the winter.

Read More »

Read More »

Wie Sie erfolgreich im Ausland sind

Verschiedene Kulturen haben einen großen Einfluss auf ihr privates und berufliches Leben! Ich teile meine Erfahrungen und Empfehlungen mit Ihnen, damit Sie erfolgreich in der internationalen Welt sind. Vorsicht vor den "Deal Breakers"!

Fettnäpfchenführer - https://amzn.to/3ESxBHl

Geschäftsreise China - https://amzn.to/3SaUvfT

102 English Things to Do - https://amzn.to/3SkGi02

_

Dr. Markus Elsässer, Investor und Gründer der Value Fonds...

Read More »

Read More »