Tag Archive: newsletter

BE CAREFUL! “It Begins…” (Charlie Munger)

Being a vice chairman of Berkshire Hathaway and the closest partner (right-hand man) of Warren Buffett, Charles T. Munger has a net worth of around $2 billion. He is a profoundly wise man who is absolutely worth listening to, especially when it comes to investing, the psychology of wealthy people, rationality, and life experience.

Read More »

Read More »

Rezession ist jetzt wichtiger als Inflation

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Die Inflation steigt im Vorfeld einer Rezession, sinkt aber während der Rezession selbst dann wieder. Dieses Verhalten preist der Markt gerade ein. Eines der Hauptwerkzeuge, um die Inflation im Rahmen zu halten, sind die von den Zentralbanken festgelegten Zinssätze, die vorgeben, wie teuer ein Kredit ist. Das Problem ist nur, wenn trotz einer Rezession die Inflation nicht fällt, weil die Komponenten...

Read More »

Read More »

Optimistische Zurückhaltung: DJE-plusNews Dezember 2022 (Marketing-Anzeige)

In der letzten Ausgabe der PlusNews im Jahr 2022 spricht Mario Künzel mit Stefan Breintner, Leiter Research und u.a. Fondsmanager des DJE – Gold & Ressourcen und des DJE Gold & Stabilitätsfonds. Im Mittelpunkt des Gesprächs stehen die Themen Energie und Rohstoffe, darunter vor allem die Gasversorgung in Deutschland und die Aussichten für den traditionellen „sichereren Hafen“ Gold. Aber auch aktuelle Marktfaktoren wie die...

Read More »

Read More »

Die Rezession 2023: Lehren aus der Vergangenheit | Sparkojote feat. @bxswiss

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Überlebe die 2023 Rezession | Sparkojote feat. @bxswiss ?

Das nächste Jahr könnte turbulent starten, bevor sich die Konjunktur und damit auch die Börsen in der zweiten Jahreshälfte erholen. Was erwartet könnte uns 2023 erwarten?

#rezession #finanzentipps #Finanzrudel

Auf 2023 vorbereiten? ►►...

Read More »

Read More »

Swiss food giant Nestlé to open new factory in war-torn Ukraine

The Swiss multinational Nestlé says it will invest CHF40 million ($42. million) to launch a new production facility in western Ukraine.

Read More »

Read More »

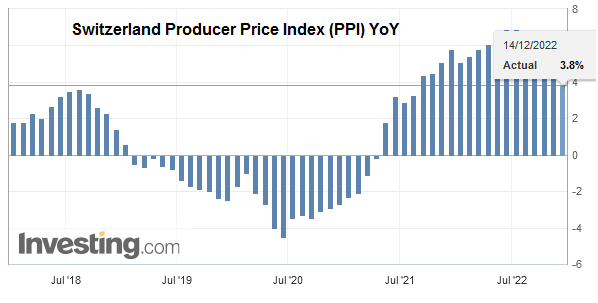

Swiss Producer and Import Price Index in November 2022: +3.8 percent YoY, -0.5 percent MoM

The Producer and Import Price Index fell in November 2022 by 0.5% compared with the previous month, reaching 109.2 points (December 2020 = 100). Lower prices were seen in particular for pharmaceutical and chemical products as well as for petroleum and natural gas. In contrast, petroleum products became more expensive. Compared with November 2021, the price level of the whole range of domestic and imported products rose by 3.8%.

Read More »

Read More »

And So It Begins: Digital Currency Becomes Possible in our Future

In mid-November, while the whole world was focused on the Ukraine crisis, the US midterms or whatever other “big story” the media decided was more important, a truly momentous shift took place in the global financial system. It might seem like a small step on the surface, but it has the potential to bring about a real and possibly irreversible sea change in the way we use money; or better said, the way it uses us.

Read More »

Read More »

US CPI ZAHLEN LASSEN MÄRKTE PUMPEN!!

Märkte Pumpen, was ist los? Ist jetzt endlich der Winter vorbei und Ist der Pump wirklich nachhaltig? SBF ist verhaftet, wirklich? Binance FUD, was steckt dahinter? All das erfährst du in diesem Video!

Wir suchen neue Mitarbeiter:

- Content Creator/Strategist: https://www.linkedin.com/posts/ewald-serafini_offene-stelle-13-content-creatorstrategist-activity-6993258601909743618-WX70?utm_source=share&utm_medium=member_desktop

- Social Media...

Read More »

Read More »

Tax Cuts Do Not Cause Inflation. Printing Does.

The narrative to attack any tax cut and defend any increase in government size is reaching feverish levels. However, we must continue to remind citizens that constantly bloating government spending and increasing the size of monetary interventions are some of the causes of the widespread impoverishment of the middle class.

Read More »

Read More »

What the heck happened after the CPI report? Russell 2000 technical analysis

One and half minute analysis showing a technical perspecitve why profit takers sold where they did, post the CPI report. Many traders were confused as the equities futures blasted off before the standard hours of the market, continued at the open, and then signficantly faded to return more of the gains. Here's why.

That same technical analysis map can help traders navigate the technical picture of the FOMC meeting reaction coming next. What the...

Read More »

Read More »

Why money should never be your goal

#Money is not the #goal, it's just a tool to help get there. #principle #raydalio #shorts

Read More »

Read More »

DU WIRST NICHTS BESITZEN UND GLÜCKLICH SEIN…

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Ich habe Angst!! Das erwartet uns am 28.12.2022 (Wir können es nicht glauben…)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

The Sad Saga of Sam Bankman-Fried

(12/27/22) Sam Bankman-Fried arrested in Bahamas; the saga of FTX & future of crypto. Possible sentencing for SBF; who will be the next FTX to fail? Real people lost real money, and it was all they had. A review of SEC charges against SBF; civil liability + Federal criminal liability; a brief history of the SEC and regulation likely to come.

0:00 -The Saga of Sam Brinkman-Fried & FTX

SEG-4: SEC vs SBF & FTX & History of SEC...

Read More »

Read More »

World Economic Forum – Ernst Wolff im Gespräch mit Alexander Kühn

Das neue Buch "World Economic Forum: Die Weltmacht im Hintergrund" ist hier erhältlich:

►► https://bit.ly/3zuC9jz (Die ersten 2000 signierten Exemplare (Klarsicht Verlag) )

►► http://bit.ly/3Ev6nGg (Bei Hugendubel)

►► http://bit.ly/3O0gtSy (Bei Thalia)

Das im Schweizer Kanton Genf angesiedelte World Economic Forum hat es seit seiner Gründung 1971 geschafft, zu einer Schaltzentrale globaler Macht zu werden. Seit über 50 Jahren versammelt...

Read More »

Read More »

Gerd Kommer: Diesen Fehler sollten sich Investoren unbedingt sparen

"Ich nenne es den Game-Over-Effekt", sagt Gerd Kommer im exklusiven Interview. Aber was meint der Experte damit? Es geht ums sogenannte Leveraging, also ums Hebeln beim Investieren. Der Vermögensverwalter erklärt, warum es so gefährlich ist und was die meisten Anleger unterschätzen ... du erfährst in diesem Video, wie der Aktienkauf auf Pump abläuft, wann der Margin Call droht und warum es sich nicht lohnt ...

Blog-Beitrag von Gerd...

Read More »

Read More »

Einnahmen & Ausgaben analysiert: Auszubildende teilt ihre Finanzen

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker: *https://www.minimalfrugal.com/smartbroker

► Comdirect: *http://www.minimalfrugal.com/comdirect

► Onvista:...

Read More »

Read More »

Andreas Beck: Was Anleger nicht nur für 2023 wissen müssen / Börse und Aktien

Ein turbulentes Börsenjahr geht zu Ende. Und auch die Aussichten für nächstes Jahr sind schwierig. Hohe Preise und eine schrumpfende Wirtschaft sind nur zwei der Herausforderungen. Was ist da die beste Strategie? Darüber habe ich mit dem Portfolio-Manager Andreas Beck gesprochen.

» Hier meinen Newsletter bestellen: https://rene-will-rendite.com/

Wichtige Stellen

00:00 Rückblick auf 2022

04:12 Der Auslöser von Krisen und die Folgen für...

Read More »

Read More »

Schwarze Schwäne – Krieg, Inflation und ein energiepolitischer Scherbenhaufen

Prof. em. Hans-Werner Sinn, Präsident a.D. des ifo Instituts

12. Dezember 2022

https://www.ifo.de/veranstaltung/2022-12-12/schwarze-schwaene-krieg-inflation-und-ein-energiepolitischer

Schwarze Schwäne sind Ereignisse, die man vor kurzem für undenkbar hielt. Unter diese Definition fällt die aktuelle galoppierende Inflation, aber auch die veritable Energiekrise, die eine grundlegende Revision des Modells der grünen Transformation der Wirtschaft...

Read More »

Read More »