|

Well, that wasn’t he had in mind. The whole point of a rate cut, any rate cut let alone an emergency fifty, is to signal especially the stock market that the Fed is in the business of…something. The public has been led, by and large, to assume that something good happens when the Fed Chair shows up on TV. If you ask anyone to be specific, however, they can’t really answer you beyond the primitive superstition of low rates being especially beneficial to borrowers. How do lower borrowing costs help when the borrower like the lender is seized up with fear? Don’t answer that because you aren’t supposed to ask the question. The stock market seems to have finally managed one of those OH SH$# moments. The first rule of central banking is to not make a bad situation worse. That’s the risk of any action, emergency or otherwise; if the markets are already a little panicky, a big move from the Fed can be taken as likewise panicky on the part of policymakers. As to the rate cuts, it is therefore a crap shoot (particularly in light of the last three of them which today not a single selling shareholder remembers). And this isn’t something new. Milton Friedman wrote about it in his seminal 1963 book A Monetary History recalling the Federal Reserve’s policies as described in the 1920’s. |

Total Credit Market, 1980-2015 |

Three rate cuts were enough, Powell said, a signal of insurance to get the strong economy on to its 1998 scenario. Now an additional fifty, and unscheduled double, and its an even stronger signal for an even stronger economy. It was dubious last summer, only more so in March 2020. But a signal to whom or what? Rate cuts aren’t actually easing in any meaningful monetary sense. Monetary policy hasn’t had any money in it in decades, therefore all that is left is the credibility of any gesture. So long as economic and financial agents believe rate cuts are helpful, they are supposed to act on that belief and thereby, self-fulfilling prophecy, that’s really the only way in which rate cuts can actually be helpful. If the issue for “modern” “monetary” policy is emotion, it may be that this is the right place to start. Consumer sentiment. |

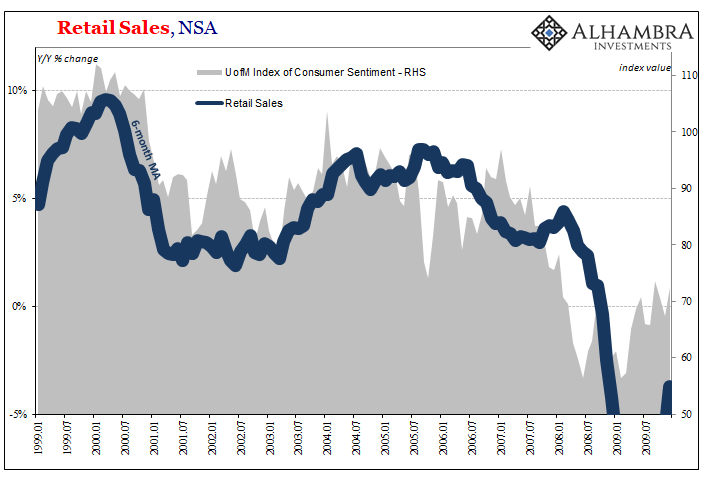

Retail Sales, NSA 1999-2009 |

| Thing was, there had been a time about a twelve years ago when consumer sentiment largely matched real economy outcomes. Thus, the game; make people happy with positive thoughts about “easing” and whatnot, and then sit back and watch them spend away. The problem has been the other side of that divide (don’t ask which one, either, these R* people continue to claim there was nothing especially special about 2008).

In other words, if the key is optimism in consumers (as well as businesses), then how does one policymaker get from the federal funds target (or range) into that sentiment? While thinking about the transmission, he must first see the potential faults in it. |

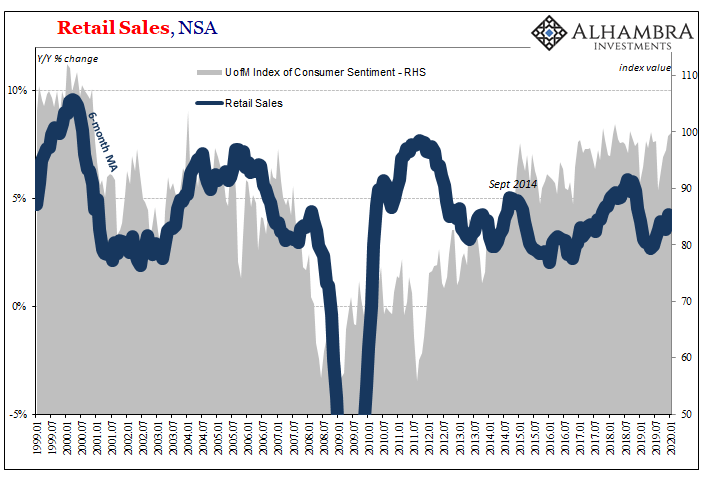

Retail Sales, NSA 1999-2020 |

| What I mean is abundantly clear post-crisis. |

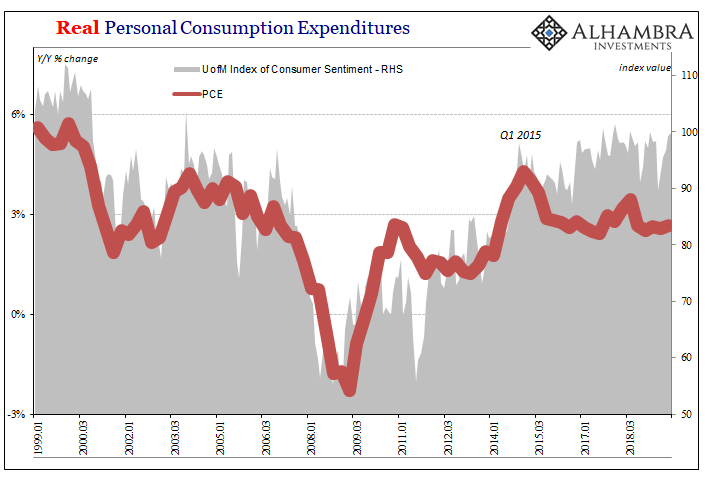

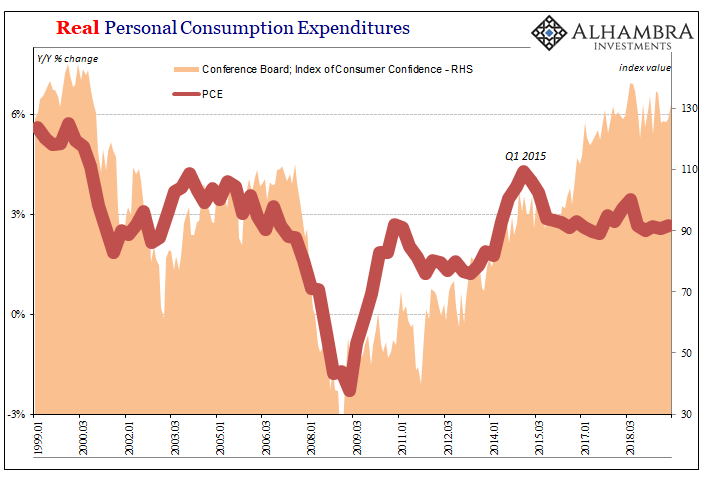

Real Personal Consumption Expenditures, 1999-2018 |

| The relationship between consumer sentiment (surveys) and consumer-related economic accounts has further broken down (it was never really as close as the charts above make it seem). This is true for Retail Sales (strictly goods) as well as Personal Consumption Expenditures (PCE; includes spending on services as well as goods). Somewhere around 2014-15 (imagine that), the magic just seems to have further disappear.

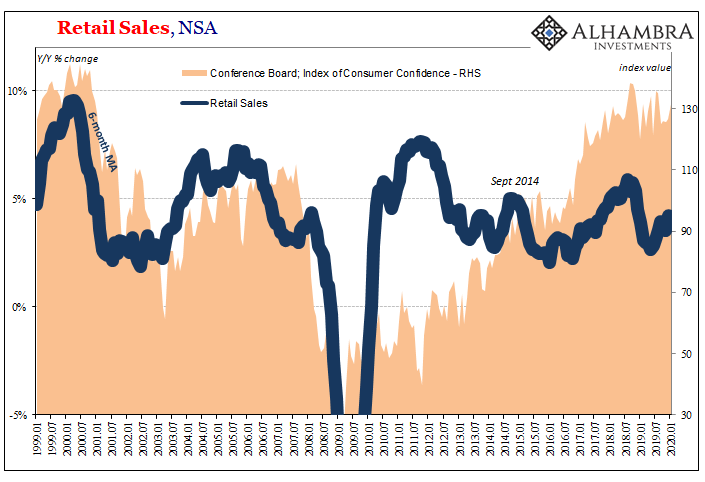

And it doesn’t matter which survey you use; the University of Michigan’s survey of consumers shown above is actually the more restrained of them. When substituting the Conference Board’s index of consumer sentiment, for example, the dichotomy has become even more extreme. |

Reatail Sales, NSA 1999-2020 |

Real Personal Consumption Expenditures, 1999-2018 |

|

| Consumers report that they are sky high about the state of the world, and have been for several years. Yet, they aren’t spending at all in a manner consistent with such sentiment. It’s as if they are saying one thing but doing another; getting their views of a seemingly faraway economic condition while at home acting upon a very different set of circumstances. Especially since 2014!

The source of the difference is relatively obvious; the one thing that did change around 2016 and it wasn’t the economy. |

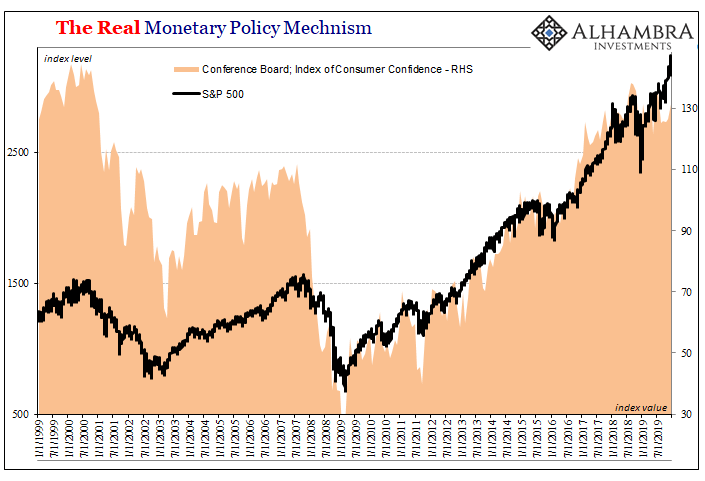

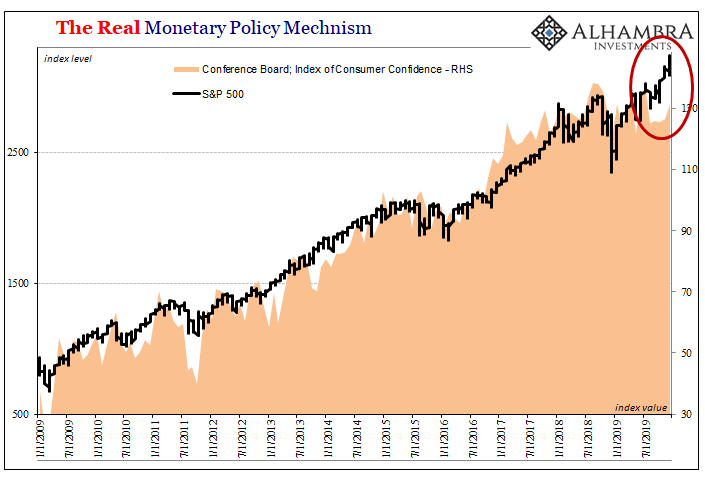

The Real Monetary Policy Mechnism, 1999-2019 |

| Ironically, on a day like today, it wasn’t just rate cuts but rather rate hikes which helped strengthen and maintain this relationship. Again, monetary policy the signaling mechanism. Janet Yellen and then hawkish Jay Powell said in 2017 and 2018 that things were really picking up, that they were already cooking. Globally synchronized growth was, they declared, a game changer.

Stocks surged as much as the unemployment rate dropped. Consumers took their cues on “the economy” from them. All the while, though, something really was different after Euro$ #3, something actually meaningful. Policymakers can talk up the strong labor market all they want, they can even convince themselves that rate hikes are the appropriate course, but the data doesn’t lie about what had really happened the past half-decade. |

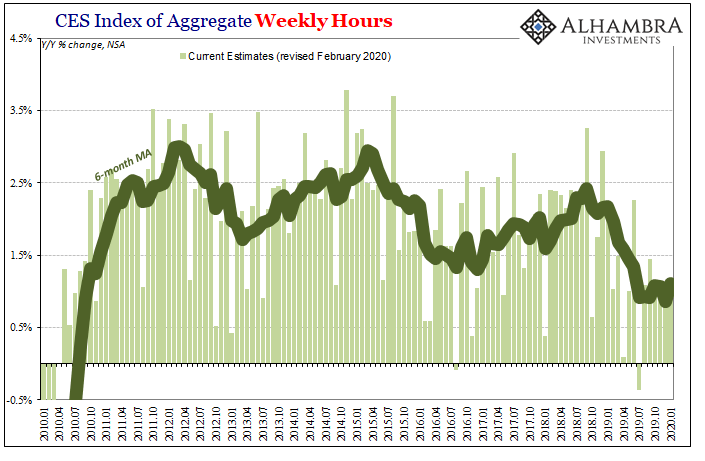

CES Index of Aggregate Weekly Hours, 2010-2020 |

Labor Market Growth Rates by Calendar Year, 1995-2019 |

|

| Even 2018’s supposedly big surge in payrolls proved to be a mirage. The real recovery, what little there had been, peaked about six years ago. It’s been modestly downhill, but downhill nonetheless, ever since.

But most people don’t pay much or even any attention to these economic statistics. The one they are familiar with is the unemployment rate which always, always gets the top spot in the media. With stocks surging on expectations-heroine, not monetary stimulus, people tell the surveyors at the UofM or Conference Board that their view of “the economy” closely aligns to the valuations-stretching rationalizations at the NYSE. So long as the Fed keeps the positive signals, hikes as well as cuts, equity prices rise and consumers say the economy must be booming. The problem, one of many, is that they can’t actually see it in their own daily lives (far too many, anyway). It is a remote phenomenon, thus political and social dissatisfaction. While everyone is telling the layperson the economy is booming and what little he or she watches seems to agree, it has become harder and harder to see it on a granular level (again, for too many people). |

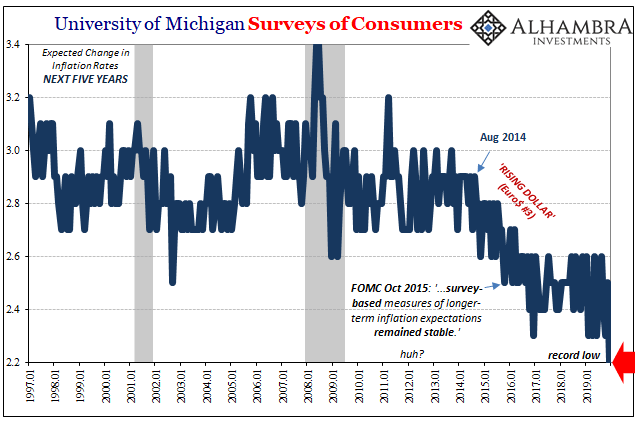

University of Michigan Surveys of Consumers, 1997-2019 |

| Thus, while they tell the nice folks at the University of Michigan seeking their input that the economy must be booming, at the very same time they also tell them the complete opposite when it comes to inflation. Especially since, say it with me, 2014.

Consumer sentiment reflects the Fed’s signals to the stock market while the real underlying economy is reflecting instead in the more esoteric and indirect framework of inflation expectations. Two very, very different views of erstwhile the same thing. Jay Powell, though, already had a big problem on his hands before the coronavirus. After all, there had been three rate cuts before today’s unscheduled fifty. The economy was, despite his views, on the downswing heading into 2020. Inflation expectations should have told him that, in addition to bond yields. The rate cuts, however, were viewed along with the Fed’s repo operations (that don’t involve the repo market) in exactly the way Powell wanted. Stocks surged on not-QE plus the three. Consumer sentiment, though, not so much; not this time. |

The Real Monetary Policy Mechnism, 2009-2019 |

| There had been a stunted transmission mechanism at work, it just didn’t (because it couldn’t) complete that final step into the real economy. Fed to stocks to consumer sentiment but falling short of finally influencing spending behavior.

Over the last several months, despite the surge in shares consumer sentiment started to behave more like consumer (and market) measures of inflation expectations. Increasingly uncertain to the point of concern. The rate cuts already weren’t working even in their post-2014 minimalist sense. Shares were bid in typical Pavlovian fashion last fall while consumers as workers were undermined by what really looks like a true labor market slowdown. The downturn was winning before the calendar turned 2020. Therefore, “in years of adversity, monetary policy is said to have little leeway but is largely the consequence of other forces…” The rate cuts weren’t even transmitting into consumer sentiment in 2019, just stocks alone. |

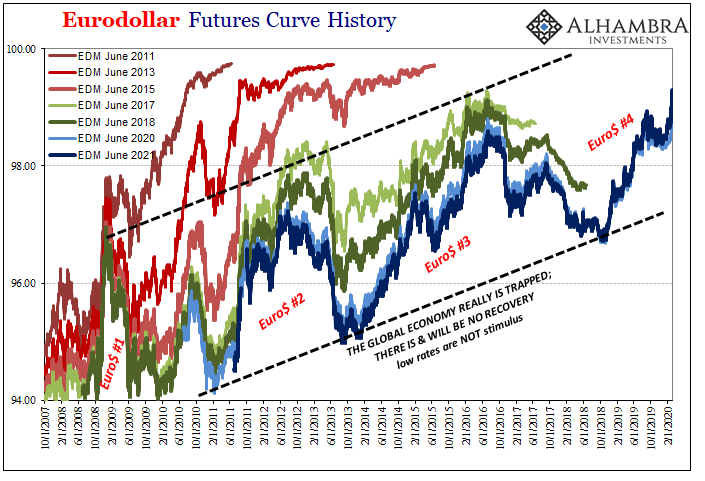

Eurodollar Futures Curve History, 2007-2020 |

| In truth, monetary policy has no leeway because it is all a puppet show. It’s been this way all along, a fact revealed by the events of 2008. People paying close attention back then saw it. The majority of the bond market picked up on it after the second crisis in 2011. And by 2014 even the proverbial man on the street understood something was different even if unable to make any connection to what, exactly, had changed.

In everything that matters, since 2008 nothing has. Slowly but surely all the mounting evidence has peeled off supporters of the Big Myth: rate cuts or QE, they all help the economy by “easing.” It’s just not true, and I wonder, after today, if fewer still still believe it; the theater, no longer a sellout like it had been under the “maestro”, a bit emptier. |

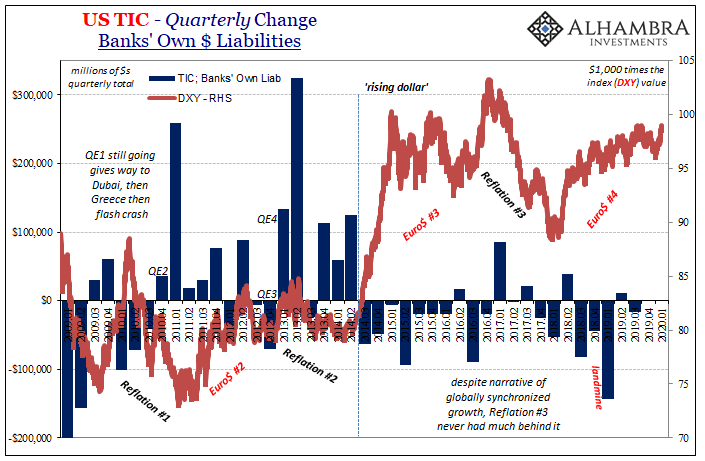

US TIC, 2009-2020 |

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,Consumer Sentiment,currencies,economy,eurodollar system,Federal Reserve/Monetary Policy,FOMC,jay powell,Markets,newsletter,rate cuts,S&P 500,stock bubble