Tag Archive: newsletter

Andréa M. Maechler / Thomas Moser: Return to positive interest rates: Why reserve tiering?

It is with great pleasure that my colleague Thomas Moser and I welcome you to this year’s Swiss National Bank (SNB) Money Market Event in Geneva. We are very glad that so many of you have joined us this evening, be it on site or remotely.

Read More »

Read More »

Preparing for Inevitable Higher Taxes

(11/18/22) There is no Fed pivot in sight, and denial in the markets is high; repercussions of the COVID lockdown are still being felt; credit card debt, HELOC debt is on the rise. A generation of bailed-out citizens. The once-in-a-lifetime opportunity for converting IRA's to Roths; dealing with charitable donations; Was FTX worse than Enron? Stanford? Carvana's incredible demise; fear & greed never change. Conversations you should have this...

Read More »

Read More »

Kosteninformation bei ETFs erklärt

Was kosten ETFs wirklich? Saidi erklärt Euch im heutigen Video alles was Ihr über die Kosten von ETFs wissen müsst.

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Finanztip ETF-Vergleich ►...

Read More »

Read More »

Welchen Einfluss haben die Midterm – Wahlen in der USA? (Marketing-Anzeige)

Die zunächst erwartete "rote Welle" bei den Midterm-Wahlen in den USA ist ausgeblieben. Zwar konnten die Republikaner sich im Repräsentantenhaus eine Mehrheit sichern, aber diese ist deutlich knapper ausgefallen als viele Demoskopen es prognostiziert hatten. Was bedeutet dieses Wahlergebnis für die Kapitalmärkte? Und wie sind die jüngsten, positiven Inflationszahlen aus den USA zu bewerten? Das und mehr diskutieren Dr. Ulrich Kaffarnik,...

Read More »

Read More »

Jahresendrallye sorgt für 2 stellige RENDITEN | Mario Lüddemann

Ein spannendes und turbulentes Handelsjahr 2022 ? neigt sich dem Ende zu. ? Und wie in den meisten Jahren ? waren auch in diesem Jahr in der Jahresendrallye wieder zweistellige Renditen möglich. ?️? Warst Du auch wieder mit dabei? Oder kanntest Du die besten drei Monate an der Börse bisher gar nicht? ? Wie ich 12 % Rendite ? machen konnte und wie auch Du das schaffen kannst, erkläre ich Dir in meinem neusten Video. ? Auch für Dich kann die...

Read More »

Read More »

DAX-Konzerne erzielen Gewinnrekord!

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Zuri-Invest Keynote with Ronald Stöferle: KOYAANISQATSI – Life Out of Balance

Ronald Stöferle, author of the "In Gold We Trust" report and fund manager at Incrementum poses the question of balance in the financial markets in his presentation, giving new and exciting macro analysis on global currencies, central banks and interest rates, the U.S. dollar, inflation, equities and what it all means for the precious metals markets as they too are in "Inbalance".

https://www.incrementum.li/

Want to ask direct...

Read More »

Read More »

Higher Japanese CPI Won’t Change the BOJ’s Stance

Overview: The capital markets are heading into the

weekend mostly quietly in a consolidative fashion. Ambiguous signals from yesterday’s US

equities saw a narrowly mixed performance among the large Asia Pacific bourses,

but of note, Hong and China markets saw this week’s gains trimmed. Europe’s

Stoxx 600 is up around 1% near midday and is slightly above last week’s

close. US equity futures are trading

with a firmer bias ahead of a large...

Read More »

Read More »

Mario Lüddemann – Der große Marktausblick 15.11.2022

Jetzt ein MetaTrader Livekonto eröffnen: https://fxflat.news/livekontoYT

Kennen Sie eigentlich schon unser TWS Konto zum Handel von Aktien, Optionen und ETF´s?

Hier gibt es alle Informationen: https://fxflat.news/twsYT

------------------------------------------------------------------------------------------------------------------------------------------

Mario Lüddemann, Management-Trainer & Börsen-Coach von Markttechnik erfolgreich handeln...

Read More »

Read More »

Meine ECHTEN Aktien-Depots (100% Transparenz)

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Ich zeige euch meine ECHTEN Depots ?

Es ist wieder soweit in diesem Video zeige ich euch meine Aktien und gehen auf die verschiedenen Depots ein.

#finanzen #depot #finanzrudel

?Yuh 50 CHF Trading Credit mit dem Aktionscode: YUHSPARKOJOTE ►► http://sparkojote.ch/yuh

? Schmerzen bei Aktien Depot ►►...

Read More »

Read More »

Krieg gegen die EU-Bürger – Wie sich Deutschland selbst zerstört in 10 Schritten

Der Krieg der Politik gegen die eigenen Bürger?

Geldtraining: https://thorstenwittmann.com/geldsicherheit-garantiert/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Schaffen sich Deutschland, Österreich und die EU selbst ab?

Das heutige Freitagstippvideo hat es thematisch in sich, denn wir schlüsseln in 10 verschiedenen Bereichen auf, wie – ich kann es einfach nicht anders sagen - gegen die Bevölkerung Krieg geführt wird....

Read More »

Read More »

3rd quarter 2022: the number of employed persons rose by 0.8%, the unemployment rate based on ILO definition fell to 4.3%

In the 3rd quarter of 2022, the number of employed persons in Switzerland increased by 0.8% compared with the same quarter of 2021 and the number of actual hours worked per week, per employed person, increased by 2.0%.

Read More »

Read More »

Prof. Dr. Max Otte – Gold bleibt gefragt, Deutsche investieren stark

Eine reale Edelmetallmesse ist kein Vergleich zu den zurückliegenden virtuellen Veranstaltungen. Vor über 10 Jahren interessierte sich nur ein kleiner Kreis der Deutschen für Edelmetalle, doch das hat sich in Zeiten hoher Inflation geändert. Beim Pro-Kopf-Besitz an Edelmetallen sind die Deutschen ganz oben mit dabei. Und Gold bietet Potential und ist nicht überbewertet, natürlich auch Silber. Wer neu ist, bleibt besser beim physischen Metall und...

Read More »

Read More »

DAS MACHT DEN UNTERSCHIED BEI UNTERNEHMEN – Einsichten aus der Geschichte für Karriere & Investments

Wie die Geschichte den Blick auf die Zukunft verändert und welchen riesigen Effekt die Firmengeschichte auf Unternehmen hat.

_

2.? "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als Hörbuch *https://amzn.to/3xnT6rW

1.? "Des klugen Investors Handbuch" *https://amzn.to/38UCXQg

Als Hörbuch *https://amzn.to/3nAM7IU

_

Dr. Markus Elsässer, Investor und Gründer der Value Fonds

„ME Fonds - Special Values“ - WKN: 663307

„ME...

Read More »

Read More »

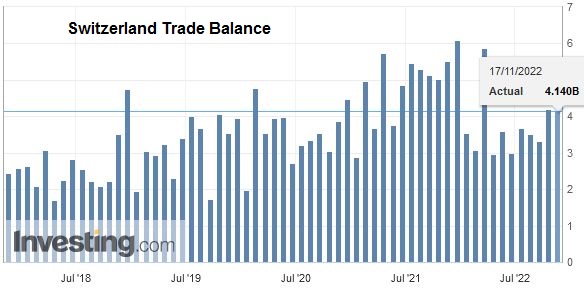

Swiss Trade Balance October 2022: declining foreign trade

In October 2022 and after two consecutive monthly increases, seasonally adjusted exports fell by 1.1% (real: −1.8%). However, they remain on a positive trend. Imports fell by 1.4% over one month (actual: −0.8%), but have stagnated since the middle of the year. The trade balance ends with a surplus of 3 billion francs, the highest recorded in the last six months.

Read More »

Read More »

Global goods inspector SGS to shed 1,500 jobs

The world’s largest goods inspection and testing group SGS will shed 1,500 jobs worldwide in a cost saving drive.

Read More »

Read More »

What I Learned from my Grandfather about Money

When I was a child, my mother and I would take the Long Island Railroad to Brooklyn to see relatives a few times a year. My grandfather was always outside in front of the apartment house in Park Slope, where he and my aunts and uncles lived. Upon seeing him, I would run down the sidewalk to greet him, but before I could say “Hi, Grandpa!,” he would without fail press a shiny silver dollar into my hand.

Read More »

Read More »

SNB-Maechler: Rückkehr zu positiven Zinsen bedingt neuen Ansatz für Geldpolitik

Die erste Leizins-Erhöhung seit 15 Jahren im Juni bezeichnet SNB-Direktoriumsmitglied Andréa Maechler als historischen Moment.

Read More »

Read More »