Tag Archive: newsletter

World Economic Forum ABRECHNUNG! EU-REPUBLIK, Insekten & Privatjets

Das World Economic Forum endet morgen Abend und was soll ich sagen? Neben Tausenden Privatjet-Flügen ging es um Insekten zum Essen, Escort-Damen und jede Menge andere spannende Themen

bis zu 100 Euro bei Depoteröffnung für ETFs & Sparpläne gewinnen ► http://link.aktienmitkopf.de/Depot *

Bitcoin sicher kaufen? 20 Euro Bonus bei Bison

► https://link.aktienmitkopf.de/Bison *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT...

Read More »

Read More »

Neue Gewinnchancen: Diese Strategie wird der Hammer 2023

Das Börsenjahr 2023 wird den Börsenhandel für viele grundlegend verändern, weil bisherige Strategien einfach nicht mehr so profitabel werden. Aus diesem Grund zeige ich dir heute meine Top-Strategie, mit der du dieses Jahr an der Börse viel Geld verdienen kannst.

Sicher dir jetzt dein Ticket für den Börsen-Strategie-Tag:

https://jensrabe.de/boersenstrategietag2023

0:00 Die Marktsituation der letzten Jahre

3:15 Aktuelle Lage am Markt erklärt

6:24...

Read More »

Read More »

How to make poor areas richer

Many people in the rich world are feeling the pinch, particularly in its poorest regions. As the cost of living rises, how can such “left behind” areas be made richer?

Film supported by @mishcondereya

00:00 - How can rich countries address regional inequality?

01:10 - How did regional inequality emerge?

04:45 - How local politicians can help close economic gaps

06:20 - Why making poorer areas better off is a priority

07:30 - How this German city...

Read More »

Read More »

Paypal Aktie und Tesla Aktie: Marc Faber sieht Tech-Aktien “immer noch hoch bewertet”

#MarcFaber #tesla #paypal

▶️YouTube-Channel "Finanzwissen - biallo"

https://www.youtube.com/channel/UC6H1dV9ue8BqLFihyqp9OGg

▶️Ganzes Interview mit Marc Faber:

▶️The Gloom Boom & Doom Report:

https://www.gloomboomdoom.com/

Unsere Seiten:

Homepage: https://www.biallo.de/

Impressum: https://www.biallo.de/impressum/

Twitter: https://twitter.com/biallo_de

Instagram: https://www.instagram.com/biallo.de/

Facebook:...

Read More »

Read More »

Bremst sich der US Markt wieder ein? – US Opening Bell mit Marcus Klebe – 19.01.23

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de...

Read More »

Read More »

The forex market reacts modestly to the better US data dump today

In this Forex technical currency report, we take a look at the EURUSD, USDJPY, and GBPUSD. The US dollar has rebounded a bit due to a better-than-expected data dump in the US. We analyze the movements of the EURUSD, USDJPY, and GBPUSD and what traders should be watching for in the coming days.

Read More »

Read More »

The Fed Calls for More Rate Hikes

(1/19/23) The Fed Whisperer says there are more rate hikes coming, despite the weight of inflation on markets & the economy. Retail Sales in December were off more than 1% (and 70% of the economy is consumer-driven). Stil to come will be the recessionary effect on earnings, as well as the lag effect of rate hikes. Debt Ceiling Deadline: There will be no default; the Crypto crunch; meanwhile, the same Fed rhetoric: More Rate Hikes to come. When...

Read More »

Read More »

Poor US Data Cast Doubts on New Found Hopes of a Soft-Landing

Overview: Yesterday's string of dismal US economic

data delivered a material blow to those still thinking that a soft-landing was

possible. Retail sales by the most in the a year. Manufacturing output fell by nearly 2.5% in the last two months of 2022. Bad

economic news weighed on US stocks. The honeymoon of New Year may have ended

yesterday. The US 10-year yield fell below 3.40% for the first time since the

middle of last September. The Atlanta...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #40

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #41

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Want to Know Where the Economy Is Going? Watch The Top 10%

Should the wealth effect reverse as assets fall, capital gains evaporate and investment income declines, the top 10% will no longer have the means or appetite to spend so freely. Soaring wealth-income inequality has all sorts of consequences.

Read More »

Read More »

Crypto crash fails to deliver death blow to Swiss ambitions

The crypto sector appears to be suffering an existential crisis, shedding jobs, client funds and credibility. Switzerland looks to have escaped with a glancing blow – if industry data is anything to go by.

Read More »

Read More »

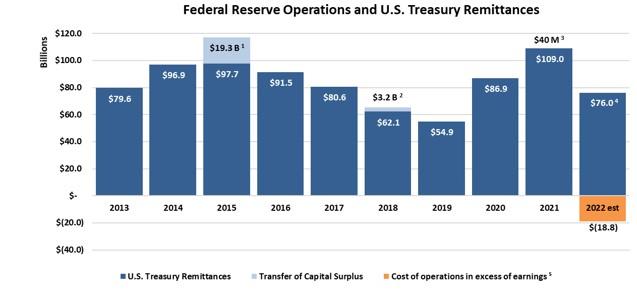

Why the Fed Is Bankrupt and Why That Means More Inflation

In 2011, the Federal Reserve invented new accounting methods for itself so that it could never legally go bankrupt. As explained by Robert Murphy, the Federal Reserve redefined its losses so as to ensure its balance sheet never shows insolvency.

Read More »

Read More »

The Rise and Fall of Good Money: A Tale of the Market and the State

Ludwig von Mises's book The Theory of Money and Credit is a masterwork of monetary theory. Despite being written in the early twentieth century, its arguments and conclusions are still valid and interesting today. Mises describes five characteristics that are vital to the function of money: marketability, durability, fungibility, trustworthiness, and convenience.

Read More »

Read More »

Sprott Money “Ask The Expert” – January 2023, Ronald Peter Stoeferle

Fund Manager, and author of the In Gold We Trust-report, Ronald Stoeferle joins us and answers your questions regarding the precious metals markets.

Read More »

Read More »

So kann es nicht weitergehen… (Meinungsfreiheit)

Ich muss mit euch reden. Denn Zensur und Bekämpfung von Meinungsfreiheit hatten wir in der Coronazeit doch schon genügend, oder nicht? Gerade deswegen sollten wir heute umso mehr für den offenen Diskurs und die Meinungsfreiheit kämpfen. Was ich teilweise unter meinem letzten Interview mit Sandra Navidi gelesen habe, enttäuscht mich aber enorm. Nein, man muss nicht ihrer Meinung sein und auch ich bin es in vielen Punkten nicht. Dennoch sollte jeder...

Read More »

Read More »

Digesting the Secure Act 2.0

(1/20/23) The basics of Estate Planning: How to begin? The confusion in Required Minimum Distributions (RMD); Why the Roth is not going away; excess 529 transfers to Roths.

SEG-1: Estate Plan Basics

SEG-2: The Laughable Price Index (LPI) Digesting the Secure Act 2-0

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP w Senior Advisor Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

--------

Watch the full shows...

Read More »

Read More »

Die Erfolgsformel der Super-Investoren!

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs - 100% gratis: http://lars-erichsen.de/

► NEU: Gewinne von bis zu +170%… Mein exklusives Lars-Erichsen-Depot: https://www.rendite-spezialisten.de/video/depot/

Sieben Jahre hat die Studie gedauert. 45 der besten Fondmanager auf diesem Planeten wurde genaustens auf die Hände geschaut, analysiert wurden über 30 000 Depotaktien, um sie heraus zu bekommen. Die Superformel der Top-Investoren...

Read More »

Read More »