Tag Archive: newsletter

Wichtige Morning News mit Oliver Klemm #54

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Where Will Fed Rate Hikes Be Worst Felt?

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(2/9/23) Google's AI debut was marred by a fact-checking gaffe, and Alphabet stock plunged 8%; the CNN Fear & Greed Index is overwhelmingly greedy; the conundrum of technical bullishness vs fundamental bearishness; parsing Powell's pontifications vs competing market narratives; the ugly truth behind the January Jobs report: No new...

Read More »

Read More »

Zinsen, Anleihen und neue Perspektiven: Podcast mit Peter Lechner

Nach einem katastrophalen Jahr 2022 sind Anleihen aktuell wieder im Fokus. Das hängt logischerweise stark mit den steigenden Zinsen zusammen.

Im aktuellen DJE Podcast spricht Anleihen-Fondsmanager Peter Lechner über die aktuelle Lage am Anleihemarkt, die Qualitätskriterien in der Auswahl von Bonds und gibt einen Ausblick zur weiteren möglichen Entwicklung im Jahresverlauf.

#anleihen #zinsen #perspektive

► Webseite: https://www.dje.de

► Podcast:...

Read More »

Read More »

Wird der Euro zu einer Schrottwährung? | Hans-Werner Sinn | Viertel nach Acht

Das Thema von Hans-Werner Sinn:

„Man muss anerkennen, dass die EZB endlich die Kurve gekriegt hat. Sie hätte schon 2021 handeln müssen, denn schon damals stellte die Inflation der gewerblichen Erzeugerpreise alles in den Schatten, was wir in der Geschichte der Bundesrepublik haben sehen können. Selbst die Ölkrisen der 1970er verblassten dagegen. Die EZB wird weitere Zinserhöhungen durchführen, aber sie wird die langfristigen Zinsen nicht so weit...

Read More »

Read More »

NEWS: Nord-Stream Anschläge – USA schuld?

"Die USA haben die Nord-Stream-Anschläge durchgeführt", das behauptet jetzt der bekannte Investigativjournalist Seymour Hersh. Mehr dazu in einem spannenden Video heute Abend!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:

https://www.marc-friedrich.de/

►...

Read More »

Read More »

US Interest Rate Adjustment Post-Jobs is Over as the 2-Year Yield Backs Away from 4.50%

Overview: The capital markets have shrugged off the

more than 1% loss of the Nasdaq and S&P 500 yesterday and have jumped back

into risk assets. The stocks and bonds have been bought and the dollar sold. Chinese

and Hong Kong shares gained more than 1% today. Japan was mixed and Taiwan and

South Korean equites saw minor losses. Europe's Stoxx 600 is up over 1%. Nasdaq

futures are up nearly 1.2% while the S&P 500 is lagging slightly....

Read More »

Read More »

NQ weekly analysis according to support and resistance, 09.02.2023

Maximize your trading potential with candlestick patterns and professional indicators! In this video, we explore how using candlestick patterns in conjunction with popular indicators like the RSI, MACD, and Bollinger Bands can help predict market reversals and confirm trends. We take a close look at a recent reversal and show you what to watch for when the price reaches 13000. Get the inside edge on your trades and stay ahead of the market. Watch now!

Read More »

Read More »

Chinas Bedeutung für die deutsche Wirtschaft: Von Völlerei zur Unterernährung?

China war für Deutschlands Wirtschaft lange das, was für die Made der Speck ist. Doch da sich die Kalorienzufuhr aus China immer mehr reduziert, wird uns die extreme Abhängigkeit vom chinesischen Schlaraffenland erst bewusst. Für alternative Ernährungsquellen steht Amerika leider nicht zur Verfügung. In Deutschland droht wirtschaftlich Schmalhans zum neuen Küchenmeister zu werden. Robert Halver aus der Wirtschafts-Küche

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #53

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Aktien sind Überflüssig… mit diesem… #shorts

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr hier. Mein 6-stelliges Aktien-Depot habe ich bei Swissquote und Yuh. Für meine privaten Finanzen nutze ich Zak von der Bank Cler. Meine Säule 3a für die Altersvorsorge betreibe ich bei frankly der Zürcher...

Read More »

Read More »

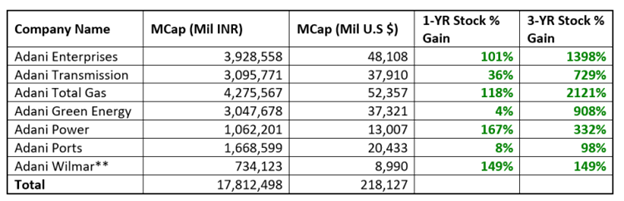

The Case of Adani versus Hindenburg

Between 2019 and 2022, the fortune of India’s Gautam Adani swelled from $9 billion to $127 billion. As the value of his seven publicly traded companies—providers of everything from natural gas to digital services—soared, he was briefly the world’s second-richest person.

Read More »

Read More »

Yes, the US Government Has Defaulted Before

The regime is trying to whip up maximum hysteria or the chances that the US government could default on its debts if the debt ceiling is not raised. Anyone whose been paying attention for a while, however, knows there's a 99.99 percent chance that the parties involved will soon raise the debt ceiling and the US will go back to adding to its $30-trillion-plus debt hoard as usual.

Read More »

Read More »

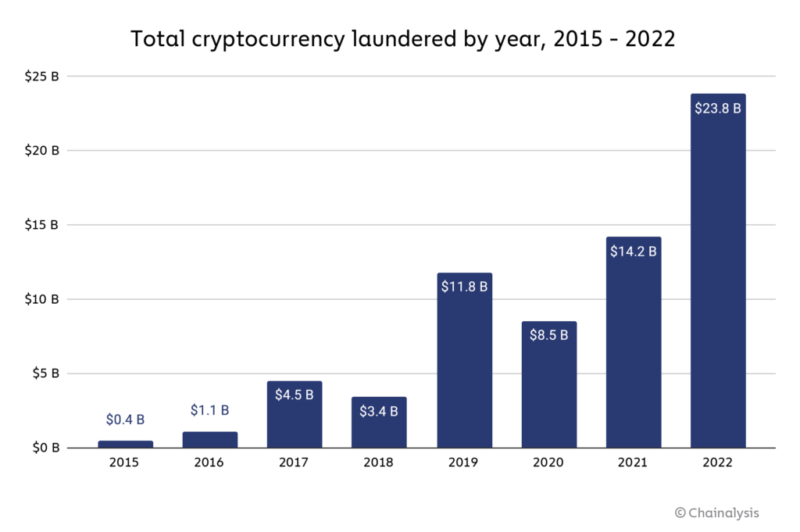

Crypto Money Laundering Reaches New Heights; Totaled US$23.8B in 2022

In 2022, cryptocurrency money laundering reached a new record, with illicit addresses sending US$23.8 billion worth of crypto, a figure which represents a 68% year-on-year (YoY) increase, new data from Chainalysis, an American blockchain analysis firm, show.

Total cryptocurrency laundered by year, 2015-2022 Source: Chainalysis, Jan 2023

Just under half of the funds sent from these addresses traveled directly to centralized exchanges, making these...

Read More »

Read More »

Viertel nach Acht – 08. Februar 2023 | mit Peter Hahne, Henryk M. Broder, Patricia Platiel

Viertel nach Acht, heute mit:

- Prof. Dr. Dr. Hans-Werner Sinn / Wirtschaftswissenschaftler und emeritierter Präsident des ifo Instituts

- Peter Hahne / Journalist und Autor

- Michael Grosse-Brömer / CDU-Bundestagsabgeordneter und Vorsitzender des Wirtschaftsausschusses des Deutschen Bundestags

- Henryk M. Broder / Publizist und Autor

Moderatorin: Patricia Platiel

Inhalt

0:00 Intro

1:35 Schlagzeile des Tages – Bundestag gönnt sich...

Read More »

Read More »

ENTHÜLLUNG: Die Wahrheit kommt raus! (Corona, Pfizer)

Das Corona Narrativ bröckelt immer mehr und die Wahrheit bricht sich ihren Weg. Immer mehr Lügen der letzten drei Jahre kommen heraus. Enthüllungsjournalisten haben in den USA einen führenden Pfizer Forscher heimlich gefilmt und unglaubliches zu hören bekommen…

Reaction-Hauptvideo:

https://twitter.com/Project_Veritas/status/1618405890612420609

Pfizers Statement:

https://www.pfizer.com/news/announcements/pfizer-responds-research-claims

Gezeigte...

Read More »

Read More »

CHINA ERSETZT UNS!

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

►Folge Oliver auf...

Read More »

Read More »

So analysieren wir Dividenden-Aktien bevor wir Investieren. | Sparkojote Dividenden Donnerstag

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Der #DividendenDonnerstag Livestream findet jeden Donnerstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

??Kanal von Johannes ►► @Johannes Lortz

#DividendenDonnerstag #2023 #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★...

Read More »

Read More »

Japanese Candlesticks, Samurai Swords, and a 2023 Economic Outlook – Robert Kiyosaki, Gary Wagner

For most people, the concept of making money when the market is going up is easy. However, many are stumped when thinking of ways to make money when the market goes down.

Read More »

Read More »