Tag Archive: newsletter

Sprott Money “Ask The Expert” – February 2023, John Rubino

Former Wall Street financial analyst John Rubino joins us this month and answers your questions regarding the precious metals markets.

Have questions for us? Send them to [email protected] or simply leave a comment here.

Read More »

Read More »

The USD is moving higher after hotter US Core PCE. What levels are in play today.

The USD is moving higher after the hotter than expected US Core PCE data. In this report I look at the technical breaks in the EURUSD, USDJPY and GBPUSD. Also as a reminder Adam Button is conducting his FREE WEBINAR. You can register and watch by clicking HERE.

Read More »

Read More »

Why Libertarians Should Support the Multipolar World

Western intellectuals and their political allies are pushing relentlessly toward a unipolar world. Freedom lies in the multipolar direction.

Original Article: "Why Libertarians Should Support the Multipolar World"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Tax Tips for 2022 You Can Still Use

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(2/24/23) It's "Go Texas Day," with boot-buying tips for the uninitiated; The Fed's target rate has risen to north of 5%: Be prepared to "call an audible." The good news about higher interest rates: Better yields on bonds. Tax Tips for 2022 you can still use now: deductible IRA contributions, self-employment Roth; prepare...

Read More »

Read More »

Bezieht Europa weiter Gas aus Russland? Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

THG-Quote für E-Auto kassieren: Den besten Anbieter finden

Kennst Du die THG-Quote? Nein? Saidi erklärt Dir was das ist und wie Du Dir damit Geld dazu verdienen kannst.

Ratgeber: THG-Quote/Prämie ► https://www.finanztip.de/autostrom-portalvergleich/thg-quote/

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Saidis Podcast: https://www.finanztip.de/podcast/geld-ganz-einfach/...

Read More »

Read More »

Artificial Intelligence Can Serve Entrepreneurs and Markets

Marketplace competition is reaching a new high with the era of artificial intelligence—deep machine learning capabilities offered to the entrepreneur as specialized services. AI tools as services spanning the marketplace are popping up at a rate that is seemingly increasing firms’ productivity and competitiveness.

However, what implications do offering AI and deep learning as a service have for market operations, buyers, and sellers? When AI...

Read More »

Read More »

Nordstream Sprengung: Peinlichste ARD Blamage bei Faktencheckern!

Die Tagesschau "Faktenfinder" haben sich bis auf die Knochen blamiert! Da sie Artikel nicht im original lesen, sondern übersetzen müssen, dachten sie, Seymour Hersh hätte behauptet, die Amerikaner hätten Sprengstoff in Form von Pflanzen an die Nordstream Pipelines angebracht :D

? kostenloses Aktiendepot für Aktien & ETFs ► http://link.aktienmitkopf.de/Depot *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine...

Read More »

Read More »

Ueda Day

Overview: Rising rates and falling stocks provided the

backdrop for the foreign exchange market this week. The dollar appreciated

against all the G10 currencies but the Swedish krona, which is still correcting

higher after the hawkish pivot by the central bank. The market looks for a

later and higher peak in the Fed funds rate. This coupled with the risk-off

sentiment helped the dollar extend its recovery after falling since last...

Read More »

Read More »

IMPRIMIR DINERO… ¡CAUSA INFLACIÓN!

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Klartext: Wir zerstören unseren Wohlstand!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

Weg aus der EU – Auswandern und Plan B in Paraguay

PARAGUAY – Wie ist es wirklich? Spektakulär unspektakulär!

LIVE Paraguay-Reisevorstellung: https://thorstenwittmann.com/frei-leben-2023

Paraguay-Infos: https://thorstenwittmann.com/paraguay/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Warum ist Paraguay spektakulär unspektakulär?

Paraguay ist in vielerlei Hinsicht einzigartig und liefert ein hochinteressantes Gesamtpaket:

Lukrative Investmentmöglichkeiten für jeden...

Read More »

Read More »

Wenn der AKTIEN-MARKT Crasht, bin ich abgesichert…

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Wenn es zum KOLLAPS kommt… ☢️

Was passiert, wenn unsere Gesellschaft zusammenbricht und wie können wir uns darauf vorbereiten? Finden Sie es hier heraus!

#weltkrieg #kollaps #Finanzrudel

Wie viel muss man investieren, um finanziell frei zu werden? ►►...

Read More »

Read More »

Überoptimierung von Trading Systemen – alles was du dazu wissen musst

✅ Gratis Trading Basiskurs: https://thomasvittner.com/traderkurs1

▶️ Alle Ausbildungsangebote: https://thomasvittner.com/trading-angebote/

#######über dieses Video#######

Die Überoptimierung ist das größte Problem beim Backtesting. Dieses Video zeigt die Auswirkung der Überoptimierung, die auf den ersten Blick nicht sichtbar ist.

Mehr über dieses Problem "Überoptimieren" findest du hier in unserem Blog-Beitrag:...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #63

NEUER GRATIS TRADING WORKSHOP (3. - 5. März 2023):

? https://us02web.zoom.us/webinar/register/9216758012881/WN_XKE_2oV-QjWsy2PgXG8xDQ

Jetzt anmelden!! Plätze begrenzt...

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram:...

Read More »

Read More »

INVESTIEREN bei UNSICHERHEIT: Wie man sein Kapital inflationssicher anlegt!

In diesem Video spricht Markus Elsässer über eine der wichtigsten Fragen in unsicheren Zeiten: Wie kann man sein Kapital inflationssicher anlegen und dennoch Zugriff darauf behalten? Er teilt seine Gedanken und Ideen zu Börse, Aktien und Firmenbeteiligung, und gibt wertvolle Tipps, wie man auch in unruhigen Zeiten auf erstklassige Qualität setzen kann, um langfristig erfolgreich zu sein. Dabei beleuchtet er verschiedene Branchen und...

Read More »

Read More »

WICHTIG!! COINBASE BASE DIE NÄCHSTE TOP 10 BLOCKCHAIN??

Coinbase launcht ihre eigene Blockchain "Base". Solltest du und kannst du auch in Base investieren? Was sind die stärken, schwächen? All das erfährst du in diesem kurzen Video.

----------

? DR. JULIAN HOSP's Special Insights: https://newsletter.julianhosp.com

? Kostenlose DeFi Academy: https://academy.julianhosp.com/de

? Kostenlose Crypto Quiz: https://academy.julianhosp.com/quiz

-----------

? Möchtest du in Julian‘s Inner Circle? Dann...

Read More »

Read More »

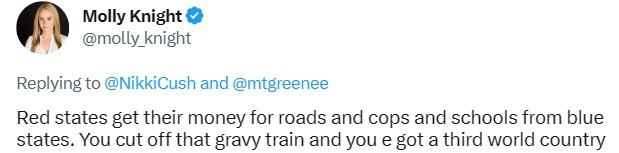

No, Red State Economies Don’t Depend on a “Gravy Train” from Blue States

When Congresswoman Marjorie Taylor Greene called (again) for "national divorce" this week, a common retort among her detractors on Twitter was to claim that so-called red states are heavily dependent on so-called blue states to pay for pretty much everything. Reporter Molly Knight claimed, for example, that "Red states get their money for roads and cops and schools from blue states. You cut off that gravy train and you e [sic] got a...

Read More »

Read More »