Tag Archive: India

FX Daily, April 26: Big Week Begins Quietly, with the Greenback Still Under Pressure

Overview: What promises to be a notable week has begun off quietly: the US, EMU, and South Korea report Q1 GDP. The eurozone also provides its first estimate of April inflation. Corporate earnings feature tech and financial firms. Equities are mostly firmer in the Asia Pacific region and Europe.

Read More »

Read More »

FX Daily, February 05: Position Squaring Weighs on the Dollar Ahead of the Jobs Report

Overview: While equities continue to march higher, the dollar is softer amid position squaring ahead of the US jobs data. Gold has stabilized after yesterday's shellacking. Estimates for US nonfarm payrolls appear to have been creeping higher, encouraged by the ADP, PMI, and weekly initial jobless claims.

Read More »

Read More »

FX Daily, August 06: Markets Consolidate

The Australian dollar powered to marginal news highs for the year as the move against the US dollar continued yesterday. The euro stopped a few hundredths of a cent below the high seen at the end of last week. However, neither sustained the upside momentum and have come back offered today.

Read More »

Read More »

FX Daily, July 28: Dollar Bounces, Gold Slips, while Equities Hold Their Own

The main development in the capital markets today is the firmer dollar against nearly all the major and emerging market currencies. Among the majors, the New Zealand dollar and Swedish krona are the heaviest (~-0.4%), while the Swiss franc and yen are marginally lower.

Read More »

Read More »

FX Daily, June 24: Risk Appetites Satiated for the Moment

Overview: The rally in risk assets in North America yesterday is failing to carry over into today's activity. Asia Pacific equities were mixed. Korea and Indonesia led the advances with more than 1% gain. China and Taiwan also gained. Japan and Hong Kong. Europe's Dow Jone's Stoxx 600 is giving back yesterday's gains (~1.3%) plus some and US stocks are heavy.

Read More »

Read More »

FX Daily, June 17: Correction Phase does not Appear Over

Overview: Investors have not yet completely shaken off the angst that saw equities slide last week. All equity markets in the Asia Pacific region, but Japan, edged higher today, including China, India, and South Korea, where political/military tensions are elevated. Europe followed suit, and the Dow Jones Stoxx 600 is firm near yesterday's highs. It has entered but not yet filled the gap created by the sharply lower opening on June 11.

Read More »

Read More »

FX Daily, June 2: Greenback’s Slide Continues

Overview: Liquidity trumps everything else. US equities shrugged off the national guard being called into action in nearly a third of US states, and the S&P 500 closed yesterday at nearly three-month highs. Asia Pacific markets followed suit. Most markets in the region rose by more than 1%. The notable exceptions were Australia and China, where benchmarks rose by 0.2%-0.3%. The Dow Jones Stoxx 600 is up more than 1% in the European morning.

Read More »

Read More »

FX Daily, May 22: US-China Escalation Sinks Hong Kong and Hits Risk Appetites

Overview: The US has ratcheted up pressure on China on several fronts and has sapped risk appetites ahead of the weekend. Equity markets are lower across the world. Even in India, where the central bank unexpectedly cut the repo rate 40 bp, shares fell 0.7%. It was Hong Kong's 5.5% that led the region lower. Europe's Dow Jones Stoxx 600 is off around 1% in late morning turnover to pare this week's gain to about 2.5%.

Read More »

Read More »

FX Daily, May 13: Will Powell have any more Luck Pushing against Negative Rate Expectations in the US?

Overview: Another late sell-off in US shares, this one perhaps related to the sobering assessment by the leading medical adviser for the Trump Administration about the risks of opening too early, failed to deter investors in the Asia Pacific region. Although Japanese shares slipped, most other markets rose. India led the way (~2%) after a fiscal stimulus program was announced.

Read More »

Read More »

FX Daily, April 27: Equities Rally and the Dollar Eases to Start the Week

Overview: Global equities are beginning the new week on an upbeat note. All the markets in the Asia Pacific region rallied, led by more than 2% gains in the Nikkei and Taiwan. European bourses are higher. All the industry groups are participating and financials and consumer discretionary leading the way.

Read More »

Read More »

An International Puppet Show

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount.

Read More »

Read More »

(No) Dollars And (No) Sense: Eighty Argentinas

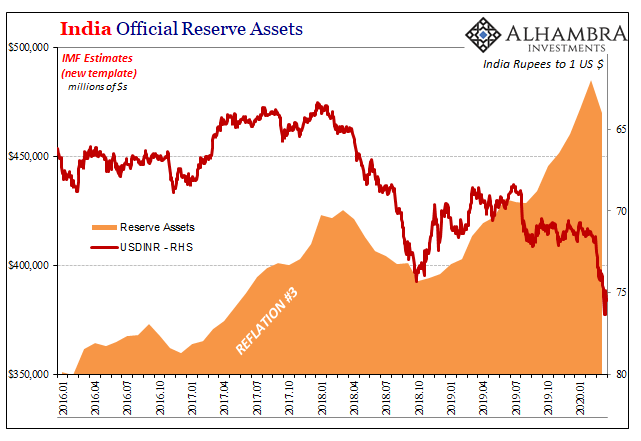

India like many emerging market countries around the world holds an enormous stockpile of foreign exchange reserves. According to the latest weekly calculation published by the Reserve Bank of India (RBI), the country’s central bank, that total was a bit less than half a trillion. While it sounds impressive, when the month began the balance was much closer to that mark.

Read More »

Read More »

FX Daily, March 27: Nervousness Ahead of the Weekend

Overview: Officials appear to have persuaded investors that they have put into place measures that will cushion the economic blow and ensure that the financial system continues to function. After seemingly goading officials into action, investors are choosing not to resist. Moreover, there is a recognition that many programs are scalable.

Read More »

Read More »

FX Daily, February 6: Stocks Push Higher but more Cautious Tone may be Emerging

Overview: The bullish enthusiasm that carried the S&P 500 to new closing highs yesterday is helping Asia Pacific and European shares today. The MSCI Asia Pacific Index rose for the third session with Tokyo, Hong Kong, and Korea jumping two percent. Europe's Dow Jones Stoxx 600 gapped to new record highs before stabilizing in mid-morning turnover. US shares are mostly firmer.

Read More »

Read More »

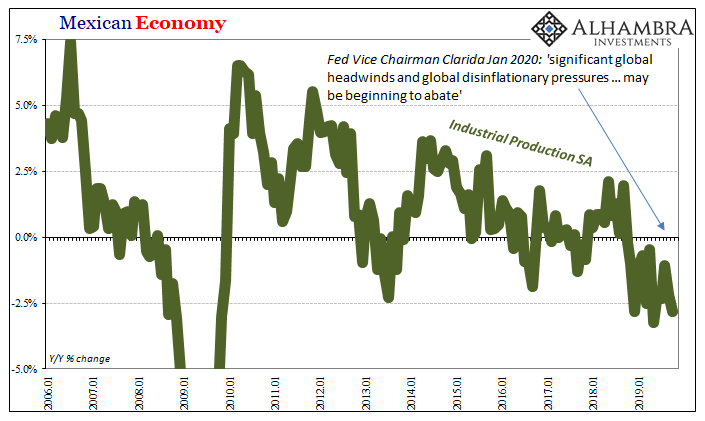

Global Headwinds and Disinflationary Pressures

I’m going to go back to Mexico for the third day in a row. First it was imports (meaning Mexico’s exports) then automobile manufacturing and now Industrial Production. I’ll probably come back to this tomorrow when INEGI updates that last number for November 2019. For now, through October will do just fine, especially in light of where automobile production is headed (ICYMI, off the bottom of the charts).

Read More »

Read More »

FX Daily, December 12: Enguard Lagarde

With the FOMC meeting delivered no surprises, attention turns to the ECB meeting as the UK go to the polls. Lagarde will hold her first press conference as ECB president today, and it will naturally command attention. Equities are advancing today, and tech appears to be leading the way. In Asia Pacific, Taiwan and South Korea rallied more than 1%, while the Hang Seng gapped higher to almost its best level in three weeks.

Read More »

Read More »

FX Daily, December 5: Sterling Sent Higher as Market Discounts Next Week’s Election

Overview: Global equity markets have resumed their climb after a wobble at the end of last week and earlier this week. A strong recovery in the S&P 500 on Tuesday signaled yesterday's strong advance that left a bullish one-day island low in its wake. MSCI Asia Pacific Index snapped a two-day decline today with nearly all the market with the notable exception of South Korea advanced.

Read More »

Read More »

The Risen (euro)Dollar

Back in April, while she was quietly jockeying to make sure her name was placed at the top of the list to succeed Mario Draghi at the ECB, Christine Lagarde detoured into the topic of central bank independence. At a joint press conference held with the Governor of the Reserve Bank of South Africa, Lesetja Kganyago, as the Managing Director of the IMF Lagarde was asked specifically about President Trump’s habit of tweeting disdain in the direction...

Read More »

Read More »

FX Daily, December 4: Hope Springs Eternal

Overview: The prospect of not just the failure of the US and China to resolve its trade dispute but a new escalation has sapped the confidence that had lifted equity benchmarks and the greenback. Led by more than a 1% decline in Tokyo (Nikkei), Hong Kong, and Australia, all the major markets in the Asia Pacific region fell. European shares, perhaps encouraged by an upward revision to the flash composite PMI, are snapping a four-day 2.75% slide.

Read More »

Read More »

FX Daily, November 8: Risk Appetites Satiated Ahead of the Weekend

The capital markets are consolidating the recent moves ahead of the weekend. Equities are paring this week's gains, though the Nikkei, which was closed on Monday, extended its advance for the fourth consecutive session. Despite the profit-taking today, the MSCI Asia Pacific Index rose for the fifth week. Europe's Dow Jones Stoxx 600 is snapping a five-day rally, but it is closing in on the fifth consecutive weekly advance.

Read More »

Read More »