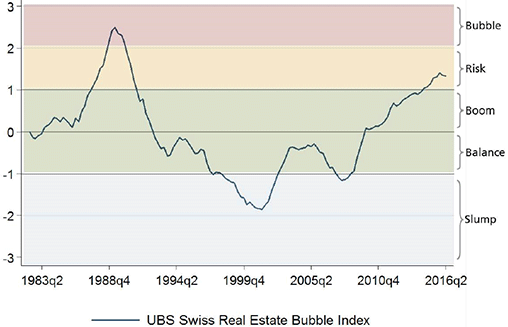

The UBS Swiss Real Estate Bubble Index nudged down in 2Q 2016 to 1.32 points and thus remains in the risk zone. This second drop in a row was due to house prices falling in real terms and the declining momentum of mortgage growth. Investments in real estate remain popular due to low interest rates.

Read More »

Tag Archive: home prices

China’s Rolling Boom-Bust Cycle

Pater Tenebrarum looks on the most important China charts that indicate a boom-bust cycle: annual rate of growth of M1 and M2, China fixed asset investment, China Money Supply M1, Shanghai Stock Exchange, China commodity futures, Steel Rebar futures, China residential real estate prices

Read More »

Read More »

Who the Heck Consumes Capital?!

I have been writing about consumption of capital, using the example of a farmer who sells off his farm to buy groceries. It’s a striking story, because people don’t normally act like this. Of course, there are self-destructive people in every society, but, not many. Most people know not to spend themselves into poverty.

To make people hurt themselves, we need to add the essential element: a perverse incentive. Consider a parlor game called...

Read More »

Read More »

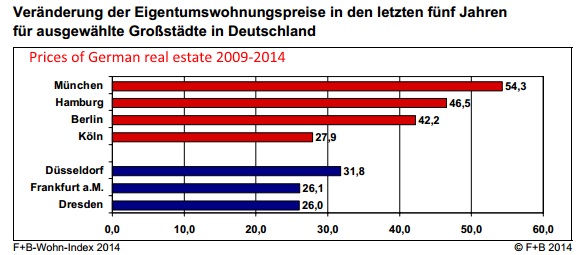

German Home Prices Quickly Narrowing Gap against France – 2014 Update

European national central banks released European household wealth reports in Spring 2013. According to that data, "median" German households were far poorer than many of their European counterparts. Based on 2012/2013 data we compared apartment prices and discovered that French prices were strongly overvalued or German ones undervalued.

We wanted to know if this is still the case in 2014 and integrated our 2012/2013 data with the one of 2014. We...

Read More »

Read More »

Swiss Housing Bubble: Thirteen Reasons Why It Will Continue for another Decade

The Bubble Bubble is produced by economic analyst and Forbes columnist Jesse Colombo, who was called one of the "Ten People Who Predicted the Financial Meltdown" in 2008 by the London Times.

Read More »

Read More »

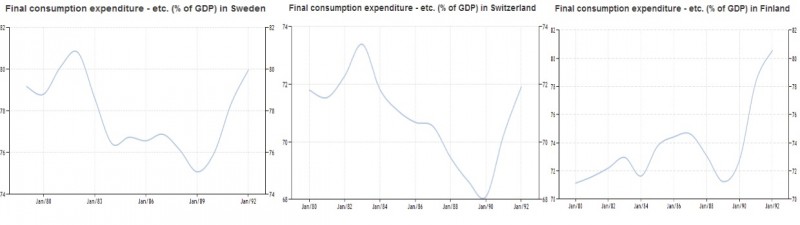

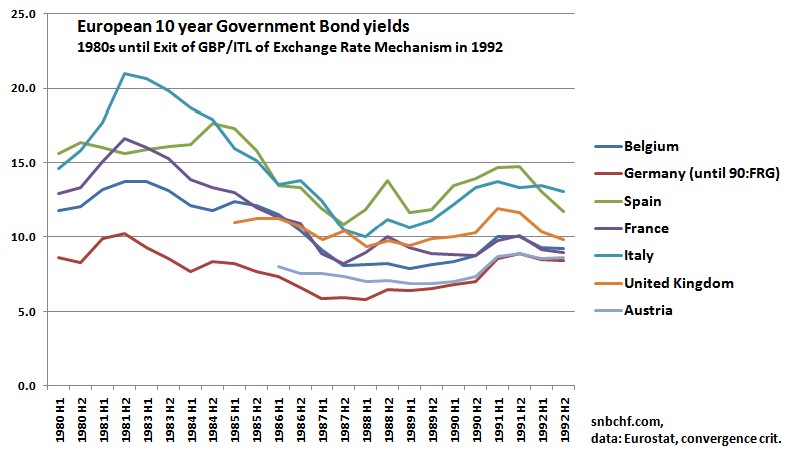

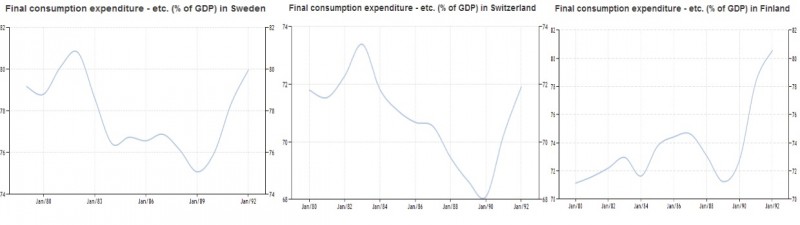

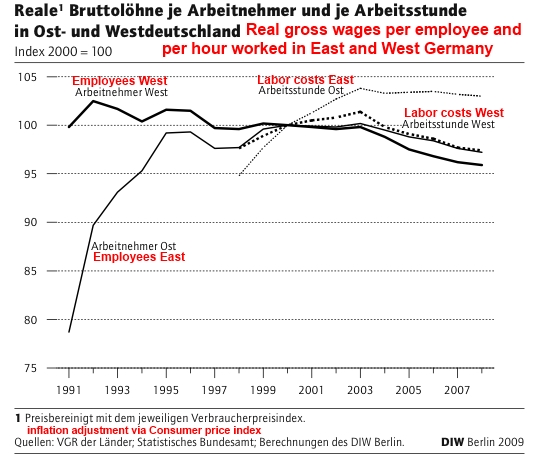

Financial Cycles History, 1991-1998: Overspending in Germany, Asia and former communist countries, Housing Busts in Japan and Northern Europe

In this post we present financial and credit cycles in the history: Due a weak credit cycle, Germany was a weak economy under many other weak ones.

Read More »

Read More »

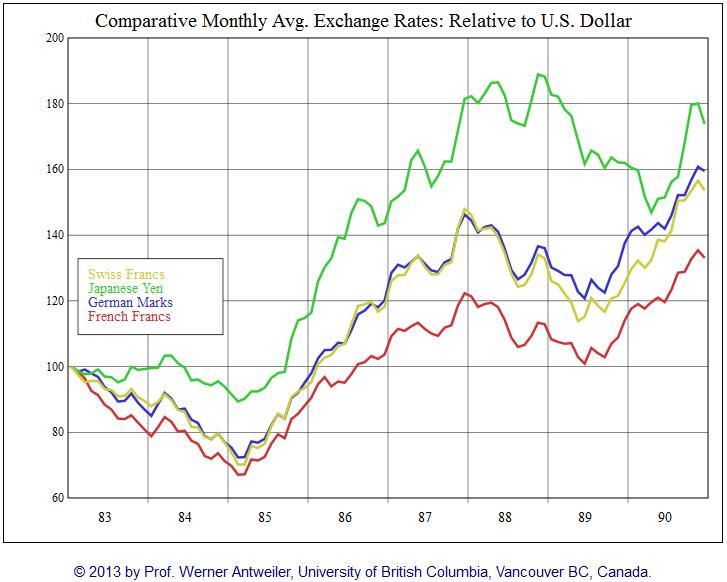

Financial Cycles History, 1978-1985: Oil Glut, Strong Dollar and the Lost Decade in Latin America

The next financial cycle takes from 1981 to 1990: The dollar was strong, Latin America lost a decade and the Japanese created their bubble.

Read More »

Read More »

Swiss Franc History: Weak German and Swiss growth between 1996 and 2004

A critical Swiss Franc History: Between 1996 and 2004 Switzerland and its main trading partner and FX proxy Germany saw slower growth compared to other European countries. We explain the reasons

Read More »

Read More »

Swiss Franc History 1986-1996: Swiss real estate Boom and Bust

A critical Swiss franc history: This chapter describes the most controversial episode in the Swiss monetary history: How the Swiss National Bank helped to wreck the Swiss real estate market in the 1990s.

Read More »

Read More »

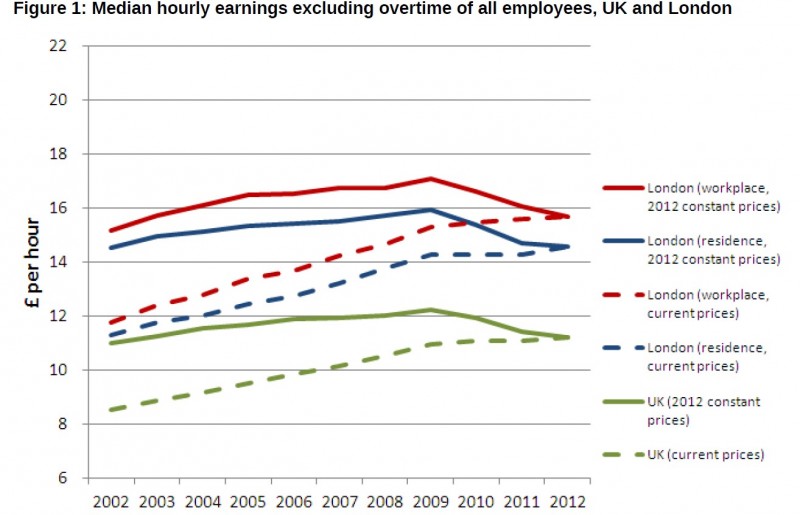

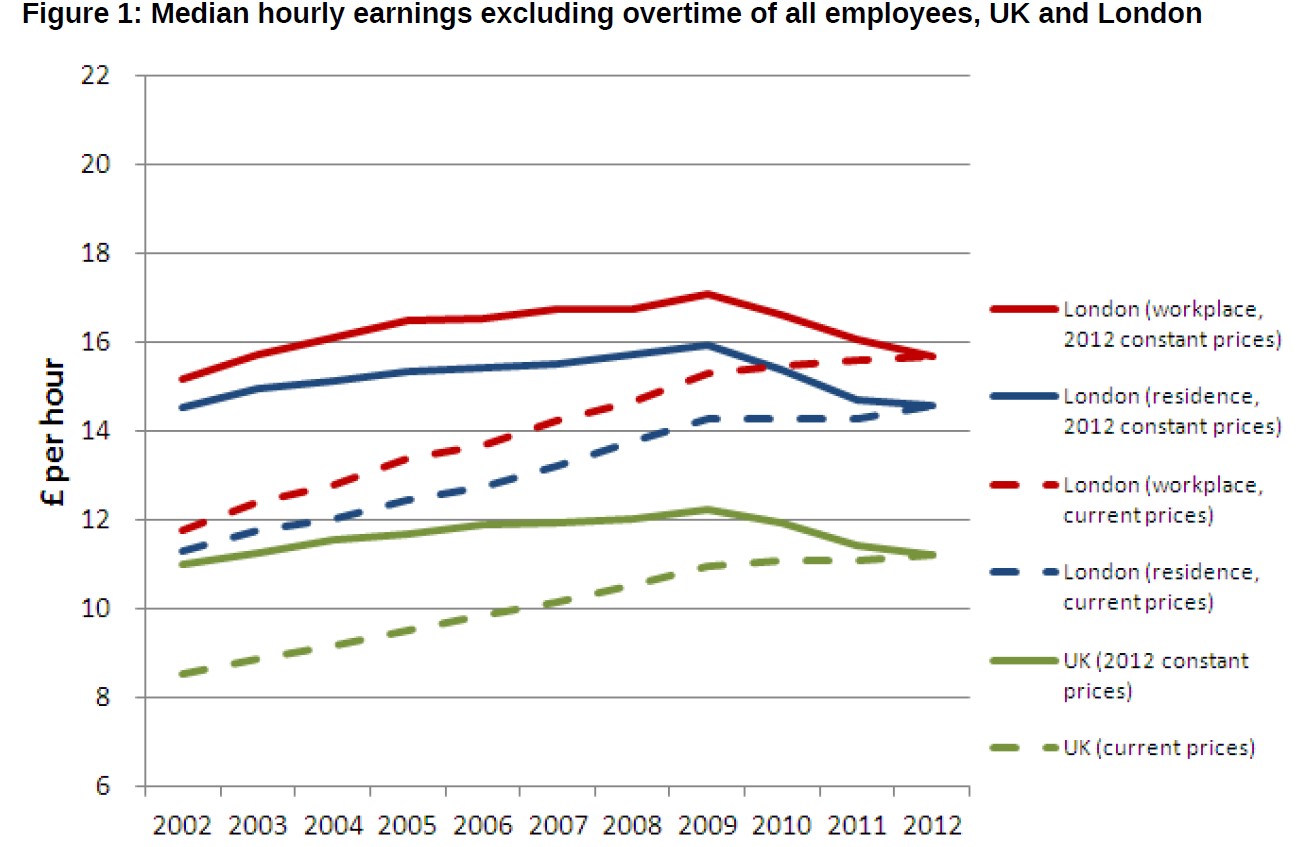

Stagnating Salaries as Main Reason for the British Home Price Boom

The major reason for rising British and American home prices is for us the relatively new phenomenon that they are to able to finance at cheap rates. Swiss or Germans have seen relatively low mortgage rates for more than three decades (with a short exception in the mid 1990s after the German reunification). The main driver of low rates …

Read More »

Read More »

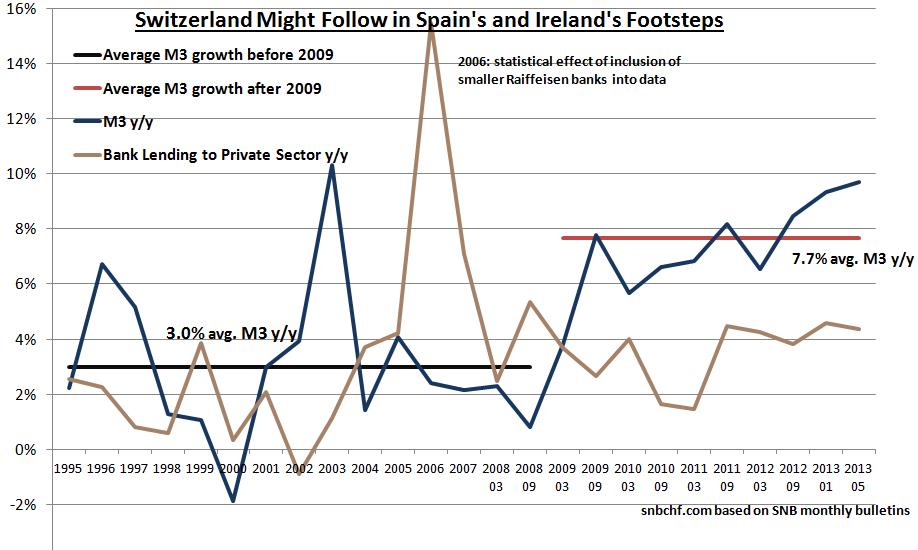

Excessive Money Supply: Switzerland Could Follow in Spain’s and Ireland’s Footsteps

In the Euro zone bank lending is contracting, M3 is rising very slowly. As opposed to that, Swiss bank lending is currently rising by 4.4% per year, M3 is increasing by 10% per year.

Read More »

Read More »

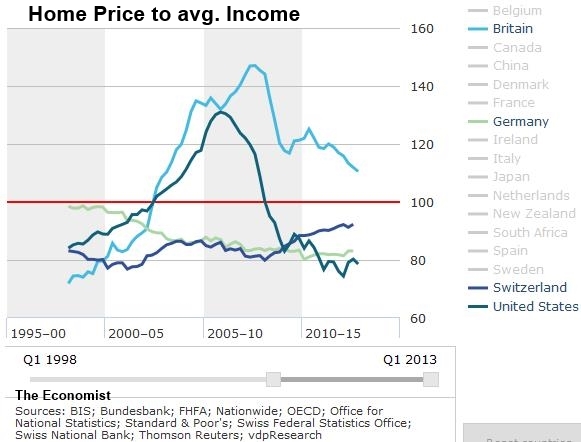

Swiss home price to income ratio small in historic and global comparison

Based on four different data source, we find out that Swiss home price to income ratio is small in global comparison. Therefore we wonder why the SNB must contain home price rises, but the Fed must artificially increase them.

Read More »

Read More »

Zillow CEO: If You Can, Sell Your U.S. Home Now

Via CNBC Against the backdrop of increasing home prices and the prospect of much higher mortgage rates, it’s a “great time” to sell, Spencer Rascoff, CEO of online real estate marketplace Zillow, told CNBC on Thursday. That is, if you can find a place to buy, he added. “As mortgage rates inevitably come from …

Read More »

Read More »

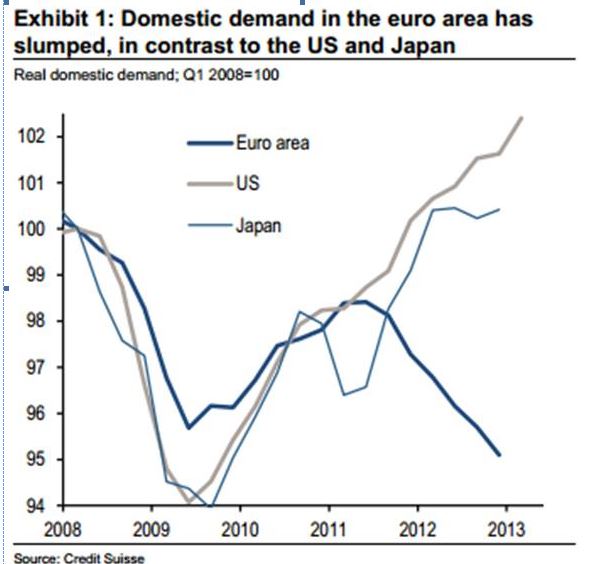

Balance of Payments Crisis: Did the Fed Cause the Euro Crisis with Excessive Monetary Easing?

The Fed's excessive monetary easing QE2 caused an inflationary period, that created a balance of payments crisis during which the Eurozone members were obliged to introduce excessive austerity measures.

Read More »

Read More »

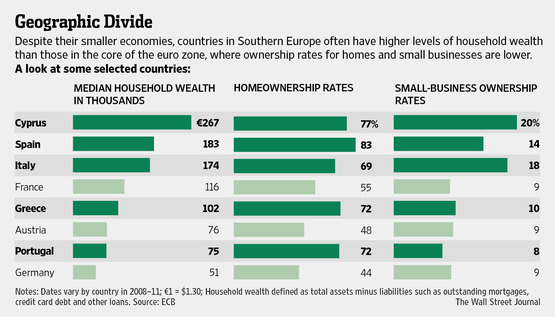

The European Transfer Union From North To South and from Poor to Rich between 1999 and 2007

Cheap ECB rates and rising home prices helped to enrich Southern Europeans between 1999 and 2007. Germany's middle-class and poor, most of them not owning a home, were the ones that financed it.

Read More »

Read More »

The Transfer Union from South to North since 2008: Wolfgang Schäuble, the Evil Genius of the Euro Crisis

Wolfgang Schäuble has become the evil genius of the euro crisis. He has understood that the Cyprus crisis won't lead to a bank-run and collapse of capital markets. We all know that the US is now recovering.

Read More »

Read More »

Is U.S. Housing Really Recovering? Pros and Cons

The U.S. housing market is the main driver for risk on/off movements and therewith implicitly of the gold price. We state charts, e.g. Shiller Home Price Index and U.S. New Home Sales statistics, arguments in favour of a housing recovery and the counter-arguments.

Read More »

Read More »

Is U.S. Housing Really Recovering? A Discussion

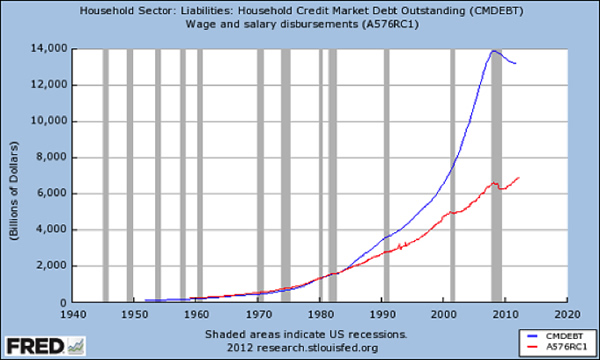

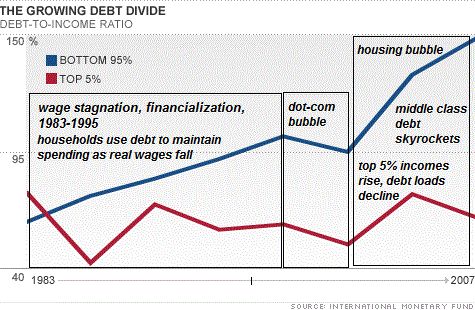

Collection of 6 sources showing: Housing Market Index,Home Inventory, S&P/C-Shiller, New Home Sales&Prices and Ratio to Population, MBS Purchases by the Fed, Household Liabilities and Dependency Ratio.

Read More »

Read More »

Swiss Public Discussion Switched from Floor to Housing Bubble

Why there is no real estate bubble in Switzerland yet and why the SNB will help to create one With the current recovery in the United States the discussion in Switzerland switched from a discussion about the EUR/CHF floor to the Swiss real estate boom, the so-called “housing bubble”. It seems that the Swiss …

Read More »

Read More »