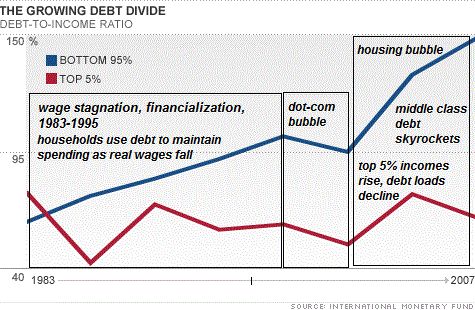

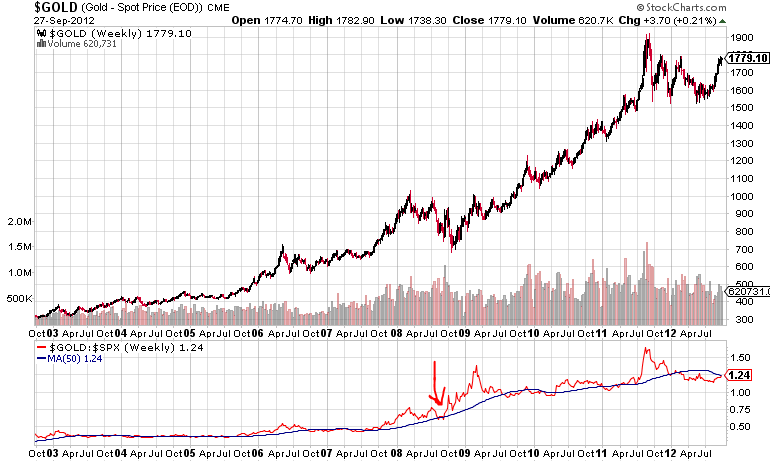

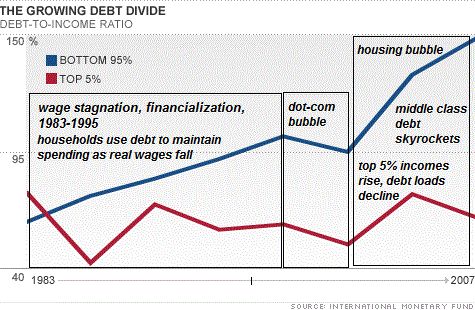

In our manifesto we criticized that central banks created inequality. They provided cheap interest rates and pushed asset prices upwards. At these elevated levels only the rich informed investor could take profit, but the middle class was left with an over-indebted home.

In our manifesto we criticized that central banks created inequality. They provided cheap interest rates and pushed asset prices upwards. At these elevated levels only the rich informed investor could take profit, but the middle class was left with an over-indebted home.

With the recent end of this Joseph cycle in 2011 (including the QE2 induced asset bubble in the Emerging Markets), a new seven to ten years long Joseph cycle has started during which the rich in developed markets are not able to increase their wealth significantly because the poor and the middle class are not able to pay a lot more for rents and/or stop spending. House prices might decrease despite record-low rates, taxes on the wealthy increase. Our logic has become mainstream: Income equality hampers growth: Harvard Business Review.

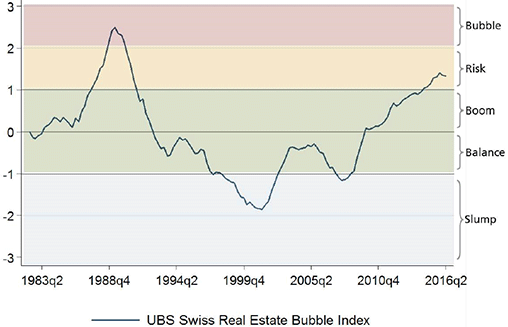

The current cycle is represented by the bubble of holding cash and most secure securities, e.g. treasuries and German Bunds. 30 year US Treasuries yield 2.6%, a complete absurdity, given that historically inflationary and deflationary periods have interchanged. Risk-averseness, wealthy immigrants and qualified labor that escape the high-tax states, drive the demand of currencies like the Swiss franc , the Singapore dollar and the assets in these countries.

The next, very dangerous Joseph cycle has not happened yet; we think it will come after the current “cash and treasuries bubble” cycle. Similarly as Bill Gross recently explained, this dangerous cycle will see rising wage inflation in China and other Emerging Markets, which will affect developed economies via the back-door. Qualified labour will become scarce with the aging phenomena. The poor and the middle-class in developed economies will require more income given that their wealth in form of houses has fallen in value with the back-door inflation from China. The consequence of this inflationary cycle are collapses of developed economies and huge losses of central banks like the SNB. Greece is just a very tiny beginning.

Tags: asset prices,home prices