Category Archive: Feed

How Successful Businesses Minimize Their Fleet Operating Costs

Fleet management is a critical aspect of any business that utilizes multiple vehicles for its operations. It’s an area of business operations that can often seem riddled with complexity and high costs, especially for businesses with a large fleet. However, successful businesses find ways to minimize these costs while maintaining optimal fleet operations. This article …

Read More »

Read More »

AstroPay as a Payment Method for Online Gambling in Australia: Is It Worth?

Year in and year out, online gambling continues to increase in popularity in Australia. With the industry’s growth, there has been a surge in the number of payment methods available to players. With the many payment options available, AstroPay stands out as one of Australia’s most secure and reliable online gambling options. What is AstroPay? …

Read More »

Read More »

Swiss National Bank meet this week – Goldman Sachs says “We are bullish on the CHF”

Goldman Sachs maintains a bullish bias on CHF going into this week's SNB policy meeting.

Read More »

Read More »

Swiss National Bank monetary policy meeting preview

The SNB announcement is due on Thursday at 0730 GMT. -This in brief via Standard Chartered:expect SNB to hike by 100bpStan Chart were at +50bp but have ramped their expectation much higher.

Read More »

Read More »

Newsquawk Week Ahead – Highlights: US jobs report, ISM; China PMIs; EZ inflation

The US jobs report and ISM data will be key in shaping expectations for the September 21st FOMC meeting. MON: EU Defence Ministers Meeting (1/2), UK Summer Bank Holiday; Australian Retail Sales (Jul), Swedish Trade Balance (Jul).

Read More »

Read More »

SNBs Maechler will not hesitate to raise rates if inflation remains outside the target

The SNBs Andrea Maechler in a newspaper article has said:The SNB will not hesitate to increase interest rates if inflation remains outside of the target.

Read More »

Read More »

SNB says remains prepared to intervene in FX market if necessary

Franc is currently sought after as a refuge currency. Franc appreciation also reflects inflation differential between Switzerland and other countries. The franc continues to be highly valued SNB looks at overall currency situationIndividual currency pairs do not play a special role. Some verbal intervention there by the SNB but in typical cases for the franc, actions speak louder than words.

Read More »

Read More »

SNB Jordan: Strong Swiss Franc limits Swiss inflation

SNBs JordanStrong CHF limits swiss inflation

See no sign swiss wage price cycle

Inflation stubbornly above 2% would lead to policy tightening

Difficult to say whether global rates have turned, much still depend on economic development

CHF has remained stable in real termsAsked about real estate prices, Jordan says monetary policy aims primarily at price stabilityThe SNB is not investing in crypto currencies

The USDCHF has moved...

Read More »

Read More »

So spielt man Blackjack

So spielt man Blackjack Im deutschsprachigen Raum auch als „17 und 4“ bekannt, ist Blackjack nach Poker wohl weltweit eines der beliebtesten Kartenspiele in den Casinos. Natürlich hat jedes gute Online-Casino ebenfalls Blackjack im Angebot. Doch nicht jeder kennt die Grundregeln des Spiels. Deshalb haben wir hier für Sie die entsprechenden Basics zusammengestellt. Der Grundaufbau … Continue reading »

Read More »

Read More »

FX Daily, December 03: Euro Rally Stalls while Brexit Concerns Trip Sterling

The selling pressure that drove the dollar lower yesterday has abated, and the greenback is paring yesterday's loss, though the dollar-bloc currencies are showing some resilience. EC negotiator Barnier briefed ministers that the same three issues that have bedeviled the trade talks with the UK remain unresolved (fisheries, level playing field, and a conflict resolution mechanism).

Read More »

Read More »

More (Badly Needed) Curve Comparisons

Even though it was a stunning turn of events, the move was widely celebrated. The Federal Reserve’s Open Market Committee, the FOMC, hadn’t been scheduled to meet until the end of that month. And yet, Alan Greenspan didn’t want to wait. The “maestro”, still at the height of his reputation, was being pressured to live up to it.

Read More »

Read More »

Syngenta commits $2 billion to tackle climate change

The Swiss-based agricultural firm has set aside $2 billion (around CHF1.97 billion) over five years to reduce emissions from agricultural practices. The company, which has come under fire for profiting from selling hazardous pesticides abroad, also announced on Tuesday that it will be reducing its carbon footprint by 50% by 2030.

Read More »

Read More »

SNBCHF has changed sending service

Dear readers, SNBCHF has changed sending service. If you are missing the daily newsletters, please look in your spam or quarantine program.

Read More »

Read More »

‘Mature’ Swiss crypto industry demands banking access

Representatives from Switzerland’s growing cryptocurrency and blockchain sector say it has matured into a viable and respectable industry that demands to be taken seriously by banks. “The hype, nonsense and scams have gone away,” says Daniel Haudenschild, President of the Crypto Valley Association (CVA), referring to a “wild west” phase over the last two years that saw several flimsy and phony companies set up and go bust, burning millions in...

Read More »

Read More »

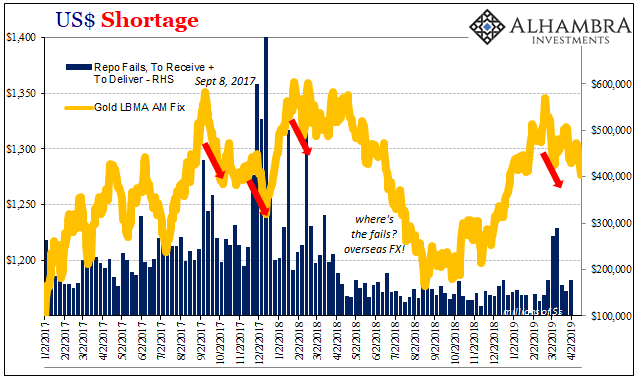

COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge.

Read More »

Read More »

Gold & Basel 3: A Revolution That Once Again No One Noticed

Real revolutions are taking place not on squares, but in the quiet of offices, and that’s why nobody noticed the world revolution that took place on March 29th 2019. Only a small wave passed across the periphery of the information field, and the momentum faded away because the situation was described in terms unclear to the masses.

Read More »

Read More »

Swiss-German venture aims to build blockchain trading marketplace

A consortium of Swiss firms has joined forces with Germany’s main stock exchange to create a distributed ledger technology (DLT) trading system that would rival one being built by the Swiss stock exchange. The alliance is between Deutsche Börse, Switzerland’s state-owned telecoms company Swisscom, budding Swiss crypto bank Sygnum, the Daura platform for listing tokenised company shares and financial services start-up Custodigit.

Read More »

Read More »

What’s Up With Australia’s 80 Tonnes Of Gold At The Bank Of England?

Recently, news network RT.com asked for comments on the question of the 80 tonnes of the Reserve Bank of Australia's (RBA) gold reserves and their supposed storage location at the Bank of England's gold vaults in London. Based on some of those comments I made, RT has now published an article in its English language news website at www.rt.com about this Australian gold that the RBA claims is held in London.

Read More »

Read More »