Tag Archive: Gold

Wozniak and Thiel Fuel Bitcoin-Gold Debate: Gold Comes Out On Top

Gold versus bitcoin debate makes further headlines as tech experts weigh in. Peter Thiel tells Saudi conference he believes bitcoin is underestimated and compares to gold. Steve Wozniak tells Money 20/20 that bitcoin is a better standard of value than gold and U.S. dollar. Both men recognise that the US dollar has little value and there are worthy competitors to its crown as reserve currency. Gold continues to hold its value and has multiple uses,...

Read More »

Read More »

Le vol de l’or de Chine.

L’histoire de la Chine et de son obsession pour l’or a été ravivée cette année, comme nous le prouvent les chiffres des importations effectuées via de Hong Kong et négociées sur le Shanghai Gold Exchange. Mais au vu des articles que nous, commentateurs du marché de l’or, écrivons au sujet de l’amour de la Chine pour l’or, il est surprenant de constater qu’il y a moins de cent ans, le pays perdait l’équivalent de milliers d’années de...

Read More »

Read More »

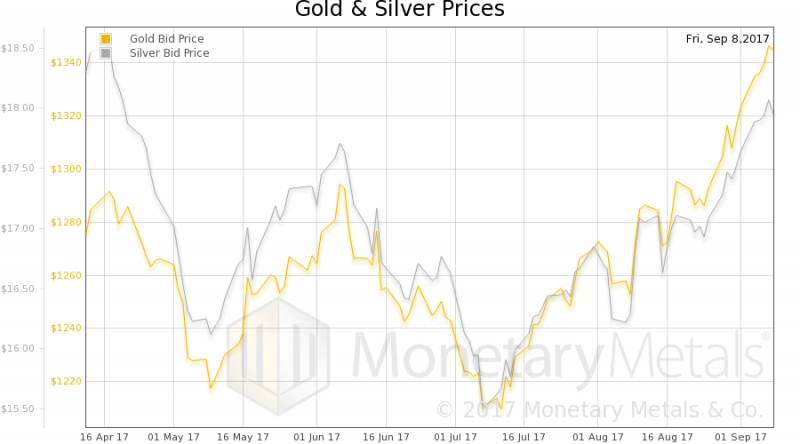

Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

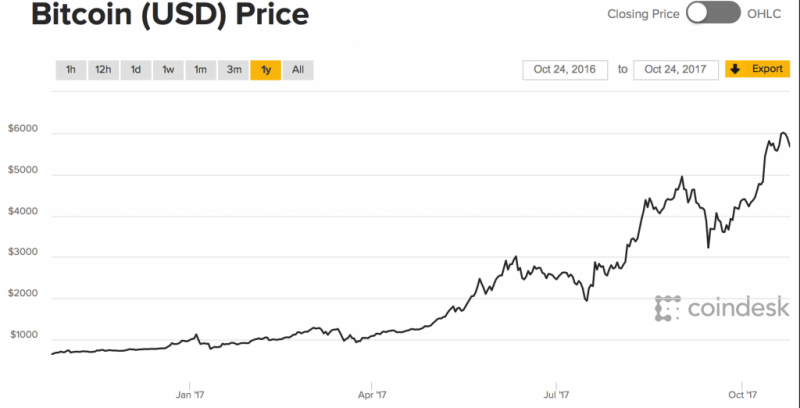

Gold is better store of value than bitcoin – Goldman Sachs report. Gold will continue to perform well thanks to uncertainty and wealth demand. Bitcoin’s volatility continues to impact its role as money. Gold up 12% in 2017, bitcoin over 600%. BTC is six times more volatile than gold – see chart.

Read More »

Read More »

Bi-Weekly Economic Review: Yawn

When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky.

Read More »

Read More »

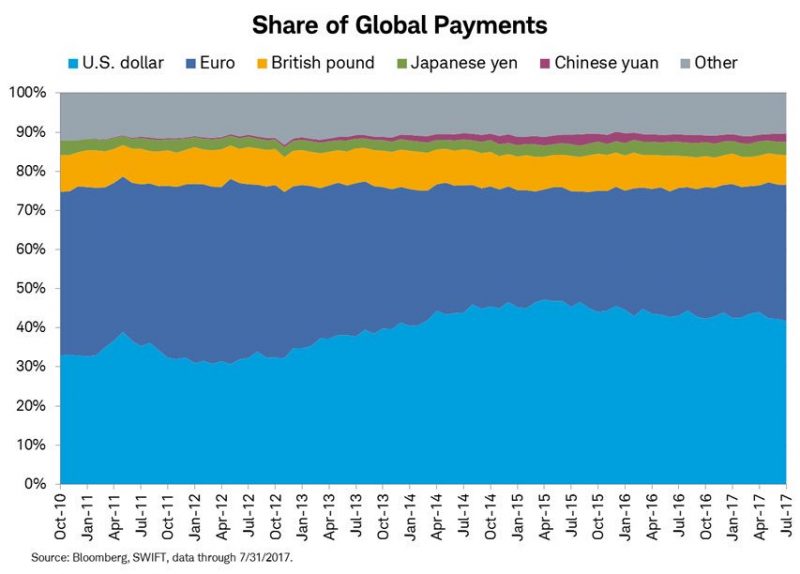

The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece was released ‘the story’ was...

Read More »

Read More »

Swiss Flush $3 Million In Gold And Silver Down The Drain Every Year

When it comes to flushing valuables down the toilet, the Swiss are hardly "Austrians", and appear to be equity-opportunity dumpers, whether it is fiat or hard money. Last month we reported that Switzerland was gripped in a mystery, after it was discovered that someone tried to flush $120,000 in €500 bills down the toilet in a bathroom close to a UBS bank vault as well as three nearby restaurants, which in turn clogged the local toilets requiring...

Read More »

Read More »

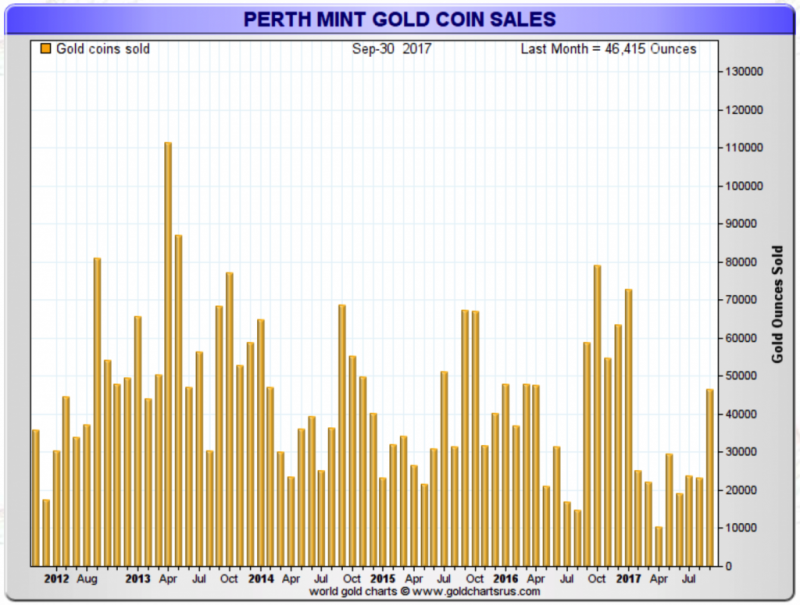

Perth Mint Gold Coins Sales Double In September

Perth Mint gold coins see sales double on month in September. Perth Mint silver bullion coin sales surge 78% in September. Perth Mint sold 46,415 ounces of gold in September. Nearly six times more gold coins sold at Perth Mint than U.S. Mint in September. Sales surge at Perth Mint from low base; could indicate trend change and higher demand in coming months

Read More »

Read More »

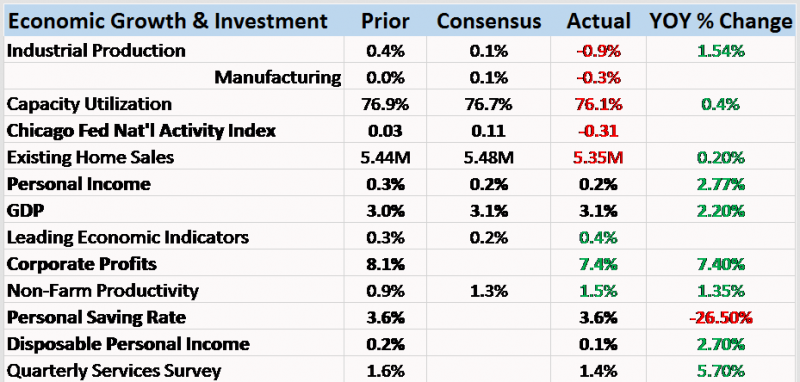

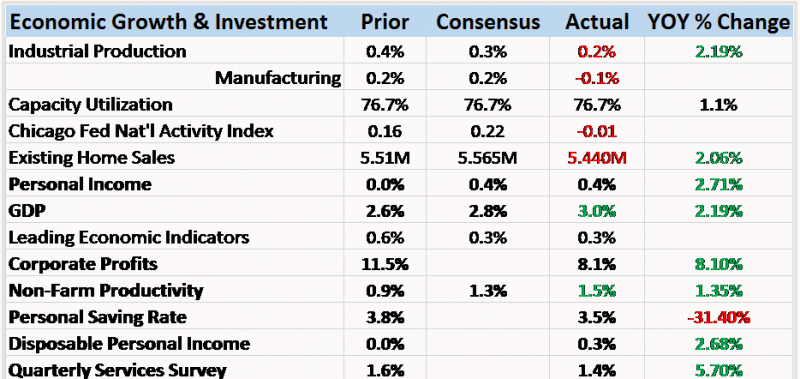

Bi-Weekly Economic Review: Maximum Optimism?

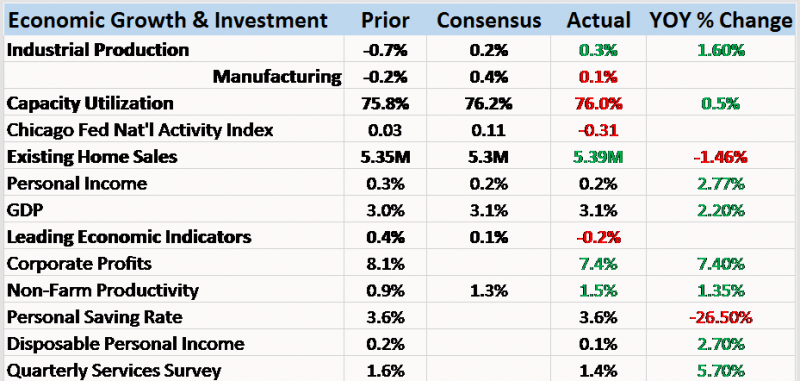

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady stream of all time highs, bond...

Read More »

Read More »

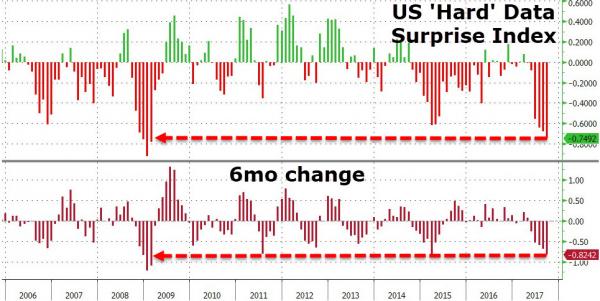

Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown - the 4th-longest streak since 1928... So everything is awesome...BUT...US 'hard' economic data has not been this weak (and seen the biggest drop) since Feb 2009...Q3 Was a Roller-Coaster...Q3 was the 8th straight quarterly gain in a row for The Dow - the longest streak since Q3 1997.

Read More »

Read More »

“Backdrop For Gold Today Is As Bullish As It Has Been In A Long Time” – GoldCore Dublin

Gold finished sharply higher on Monday, recouping roughly half of last week’s loss, as declines in the U.S. stock market and growing tensions between the U.S. and North Korea lifted prices for the yellow metal to the highest settlement in more than a week.

Read More »

Read More »

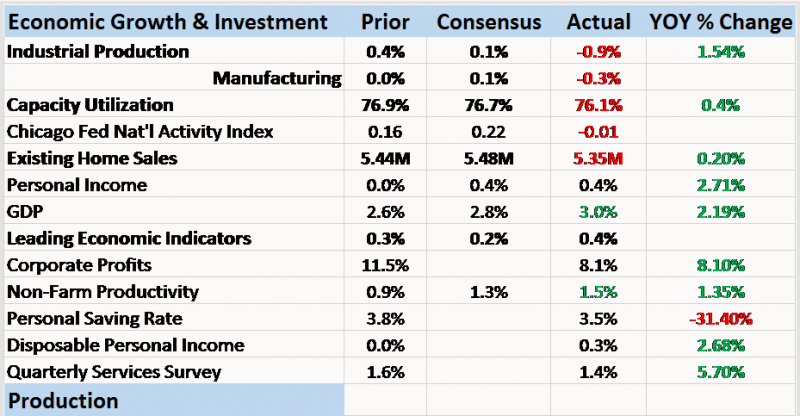

Bi-Weekly Economic Review: As Good As It Gets

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble papered over the annoying lack of...

Read More »

Read More »

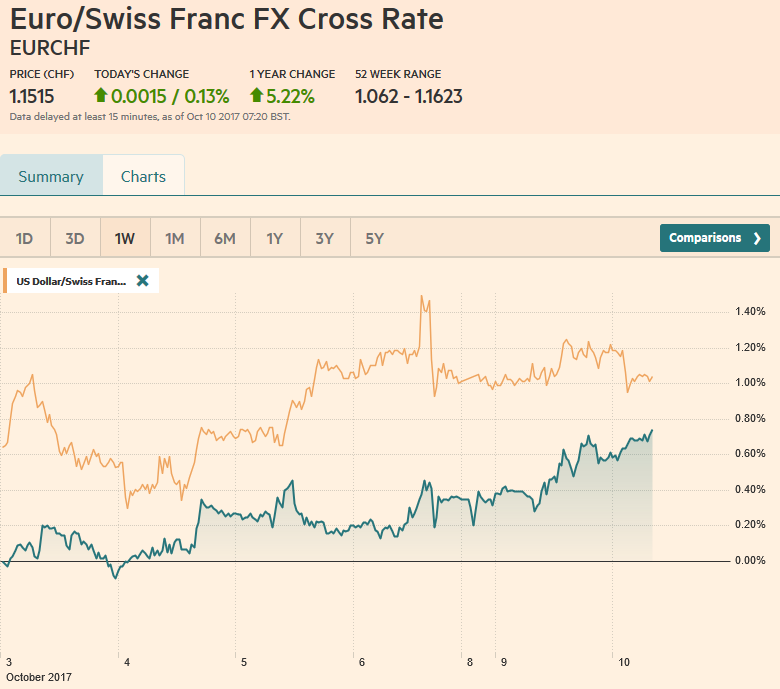

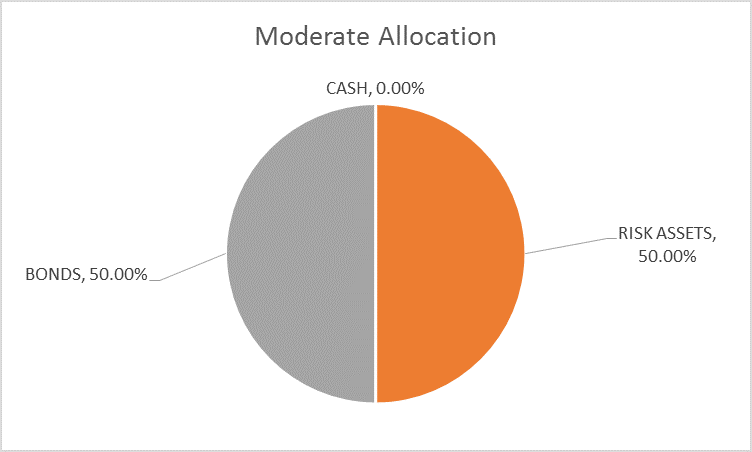

Global Asset Allocation Update: Step Away From The Portfolio

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a different hymnal.

Read More »

Read More »

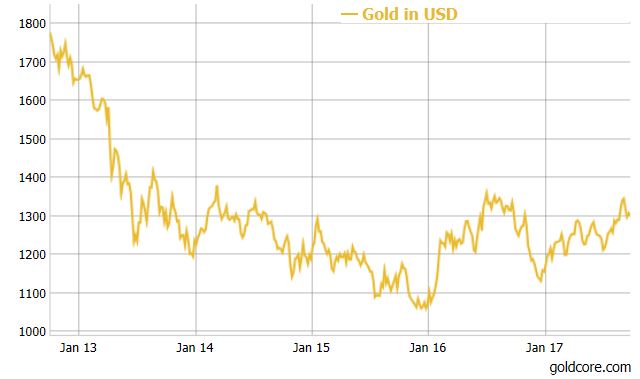

Buy Gold for Long Term as “Fiat Money Is Doomed”

Buy gold for long term as fiat money is doomed warns Frisby. Gold’s “winning streak” will continue in long term. September is traditionally a good month for gold, as we head into the Indian wedding season. “It’s just a matter of time before gold comes good again…” by Dominic Frisby, Money Week. Today folks, by popular demand, we’re talking gold.. It’s had a nice summer run. What now?

Read More »

Read More »

“Things Have Been Going Up For Too Long” – Goldman CEO

“Things have been going up for too long…” – Goldman Sachs’ CEO. Lloyd Blankfein, Goldman CEO “unnerved by market” (see video). Bitcoin bubble is no outlier says Bank of America Merrill Lynch. Bubbles are everywhere including London property. $14 trillion of monetary stimulus has pushed investors to take more risks. We are now in a new era of bigger booms and bigger busts – BAML. “Seeing signs of bubbles in more and more parts of the capital market”...

Read More »

Read More »

Bi-Weekly Economic Review: Waiting For Irma

This update will be a bit shorter than usual. I’m in Miami awaiting Hurricane Irma. As of now, it looks like the eye of the storm will make landfall near Key West and continue west of us with the Naples/Ft. Myers area at risk. Or at least that’s the way it looks right now. I’ve done a lot of these storms though – I lost a house in Andrew in ’92 – and you never know what these things will do. We are secure in a house that survived Andrew with barely...

Read More »

Read More »