Tag Archive: Gold

Ne conservez pas votre or dans une banque. Egon Von Greyerz

Ne détenez pas d’or dans une banque suisse ou dans n’importe quelle autre banque. Nous voyons régulièrement des exemples dans des banques suisses de taille moyenne et de grande taille qui devraient fortement inquiéter les clients. En voici quelques-uns : Un client entrepose de l’or physique dans une banque, mais lorsqu’il souhaite le transférer vers des coffres privés, l’or n’y est plus et la banque doit s’en procurer.

Read More »

Read More »

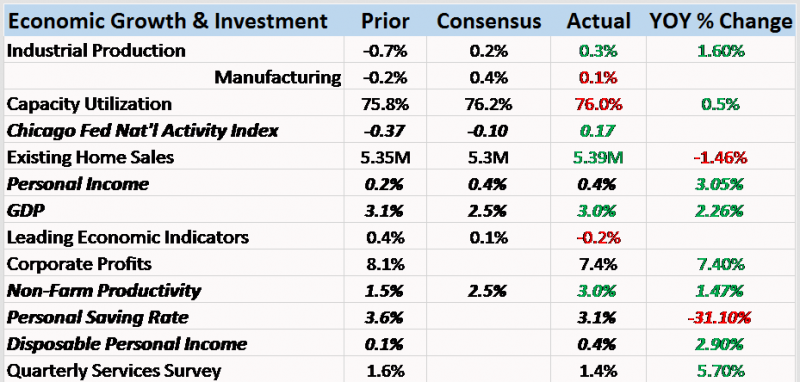

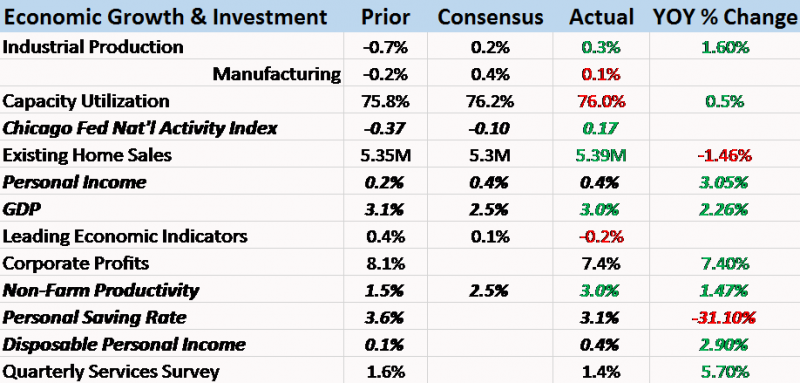

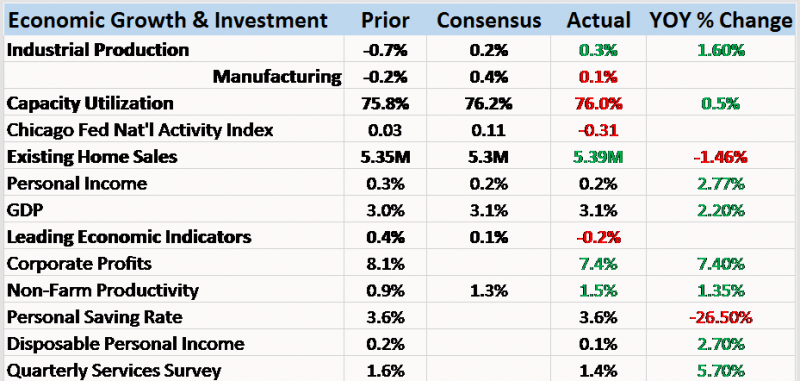

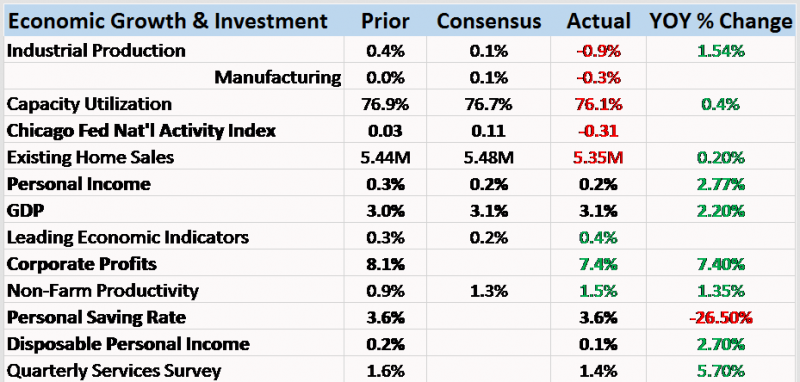

Bi-Weekly Economic Review: A Whirlwind of Data

The economic data of the last two weeks was generally better than expected, the Citigroup Economic Surprise index near the highs of the year. Still, as I’ve warned repeatedly over the last few years, better than expected should not be confused with good. We go through mini-cycles all the time, the economy ebbing and flowing through the course of a business cycle.

Read More »

Read More »

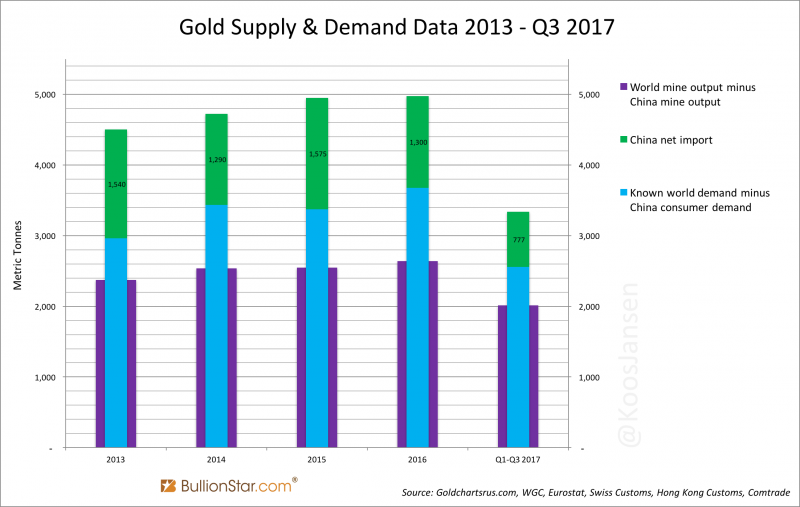

China Gold Import Jan-Sep 777t. Who’s Supplying?

While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day.

Read More »

Read More »

Bi-Weekly Economic Review: Gridlock & The Status Quo

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017.

Read More »

Read More »

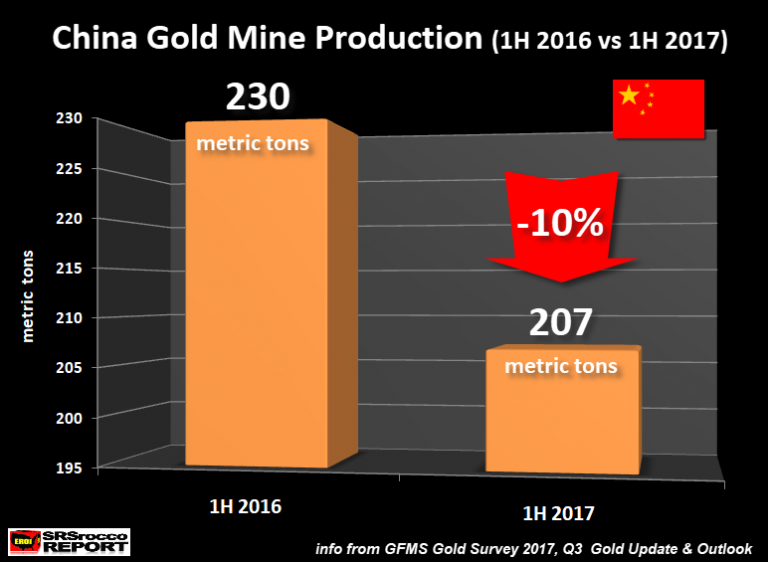

World’s Largest Gold Producer China Sees Production Fall 10 percent

Gold mining production in China fell by 9.8% in H1 2017. Decreasing mine supply in world’s largest gold producer and across the globe. GFMS World Gold Survey predicts mine production to contract year-on-year.

Peak gold production being seen in Australia, world’s no 2 producer. Peak gold production globally while global gold demand remains robust.

Read More »

Read More »

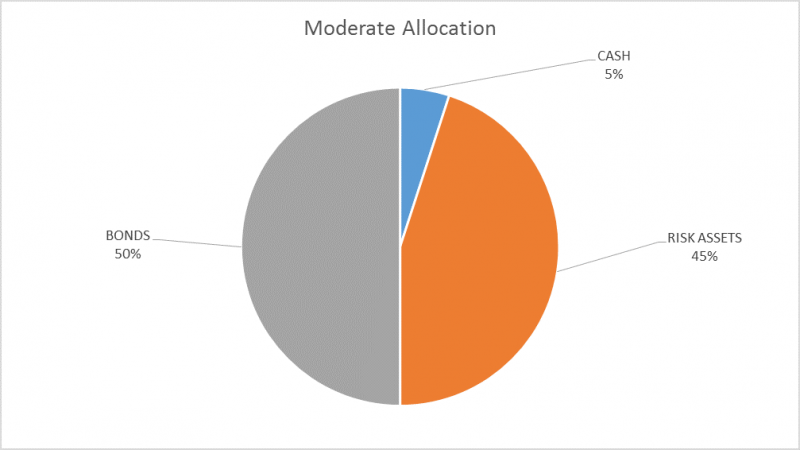

Global Asset Allocation Update

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise.

Read More »

Read More »

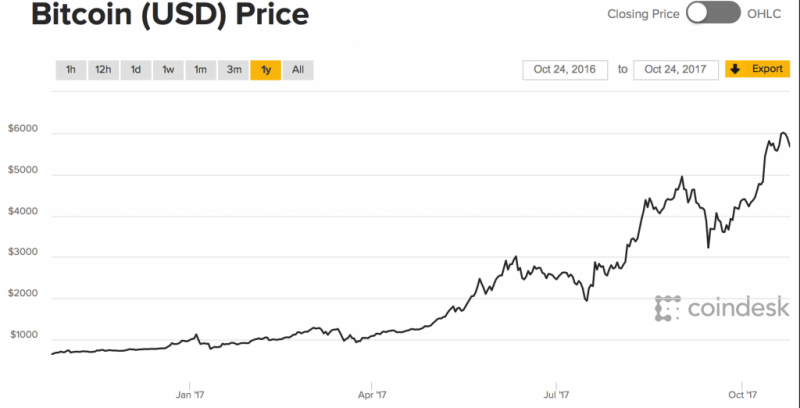

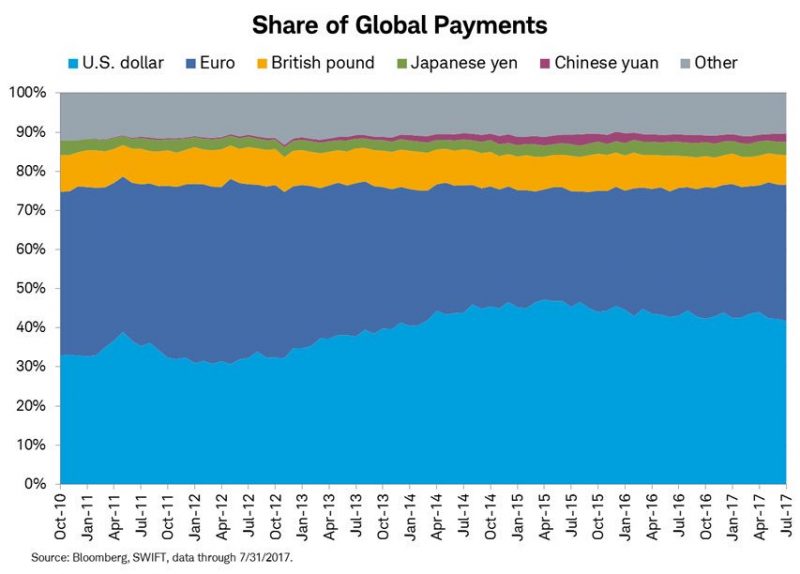

Wozniak and Thiel Fuel Bitcoin-Gold Debate: Gold Comes Out On Top

Gold versus bitcoin debate makes further headlines as tech experts weigh in. Peter Thiel tells Saudi conference he believes bitcoin is underestimated and compares to gold. Steve Wozniak tells Money 20/20 that bitcoin is a better standard of value than gold and U.S. dollar. Both men recognise that the US dollar has little value and there are worthy competitors to its crown as reserve currency. Gold continues to hold its value and has multiple uses,...

Read More »

Read More »

Le vol de l’or de Chine.

L’histoire de la Chine et de son obsession pour l’or a été ravivée cette année, comme nous le prouvent les chiffres des importations effectuées via de Hong Kong et négociées sur le Shanghai Gold Exchange. Mais au vu des articles que nous, commentateurs du marché de l’or, écrivons au sujet de l’amour de la Chine pour l’or, il est surprenant de constater qu’il y a moins de cent ans, le pays perdait l’équivalent de milliers d’années de...

Read More »

Read More »

Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

Gold is better store of value than bitcoin – Goldman Sachs report. Gold will continue to perform well thanks to uncertainty and wealth demand. Bitcoin’s volatility continues to impact its role as money. Gold up 12% in 2017, bitcoin over 600%. BTC is six times more volatile than gold – see chart.

Read More »

Read More »

Bi-Weekly Economic Review: Yawn

When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky.

Read More »

Read More »

The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece was released ‘the story’ was...

Read More »

Read More »

Swiss Flush $3 Million In Gold And Silver Down The Drain Every Year

When it comes to flushing valuables down the toilet, the Swiss are hardly "Austrians", and appear to be equity-opportunity dumpers, whether it is fiat or hard money. Last month we reported that Switzerland was gripped in a mystery, after it was discovered that someone tried to flush $120,000 in €500 bills down the toilet in a bathroom close to a UBS bank vault as well as three nearby restaurants, which in turn clogged the local toilets requiring...

Read More »

Read More »

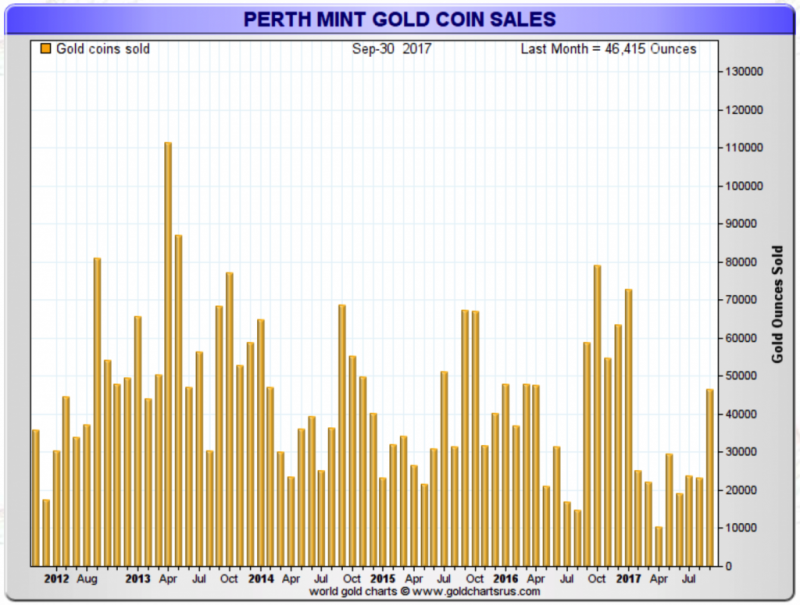

Perth Mint Gold Coins Sales Double In September

Perth Mint gold coins see sales double on month in September. Perth Mint silver bullion coin sales surge 78% in September. Perth Mint sold 46,415 ounces of gold in September. Nearly six times more gold coins sold at Perth Mint than U.S. Mint in September. Sales surge at Perth Mint from low base; could indicate trend change and higher demand in coming months

Read More »

Read More »

Bi-Weekly Economic Review: Maximum Optimism?

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady stream of all time highs, bond...

Read More »

Read More »

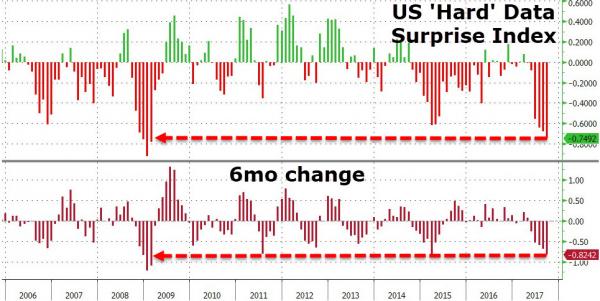

Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown - the 4th-longest streak since 1928... So everything is awesome...BUT...US 'hard' economic data has not been this weak (and seen the biggest drop) since Feb 2009...Q3 Was a Roller-Coaster...Q3 was the 8th straight quarterly gain in a row for The Dow - the longest streak since Q3 1997.

Read More »

Read More »