Tag Archive: Gold

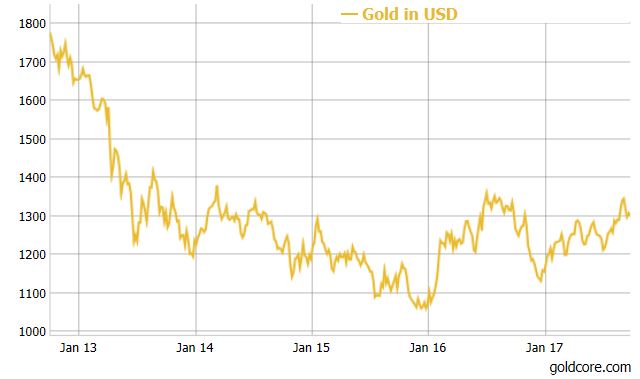

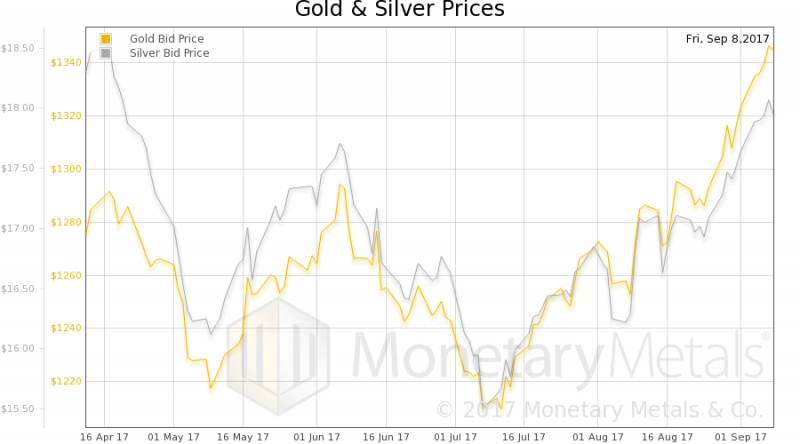

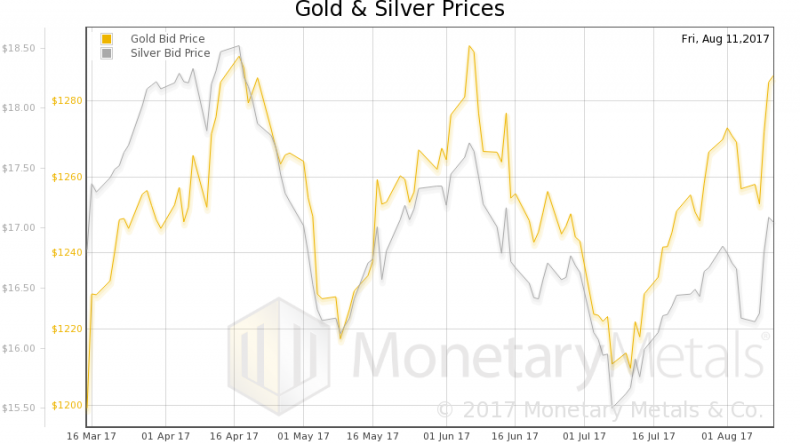

“Backdrop For Gold Today Is As Bullish As It Has Been In A Long Time” – GoldCore Dublin

Gold finished sharply higher on Monday, recouping roughly half of last week’s loss, as declines in the U.S. stock market and growing tensions between the U.S. and North Korea lifted prices for the yellow metal to the highest settlement in more than a week.

Read More »

Read More »

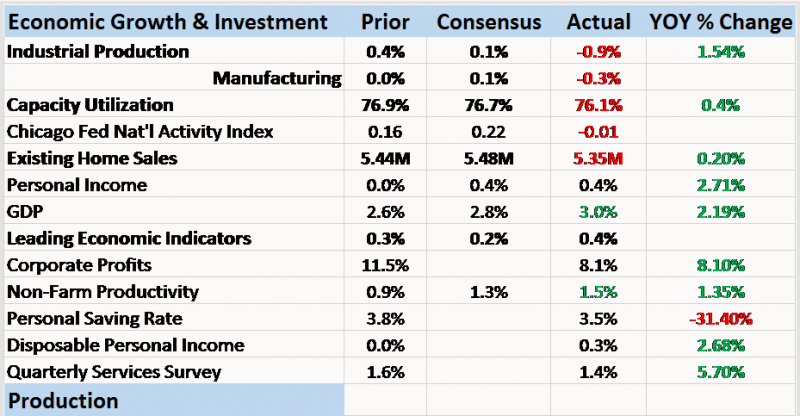

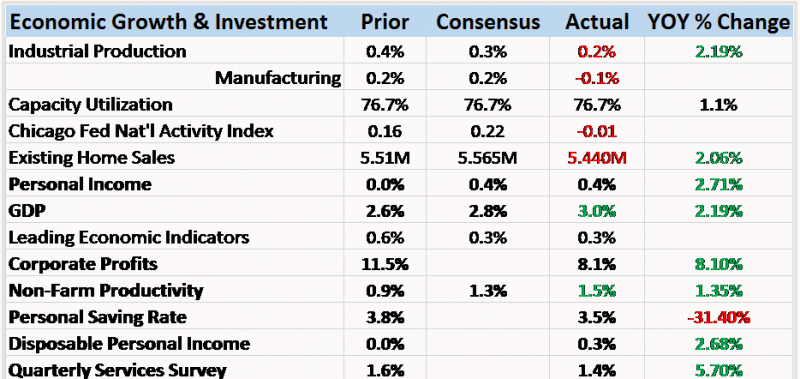

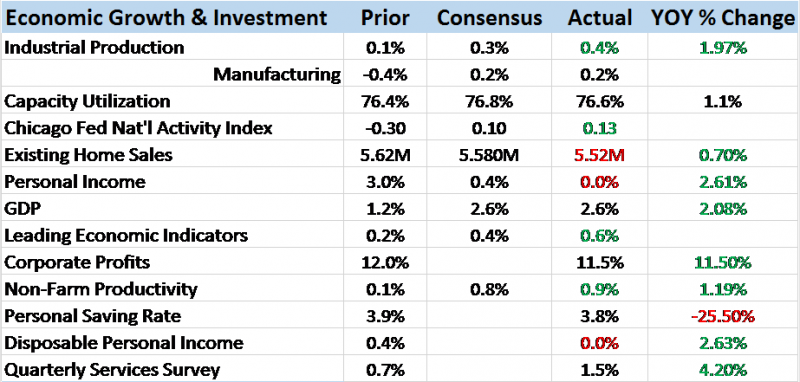

Bi-Weekly Economic Review: As Good As It Gets

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble papered over the annoying lack of...

Read More »

Read More »

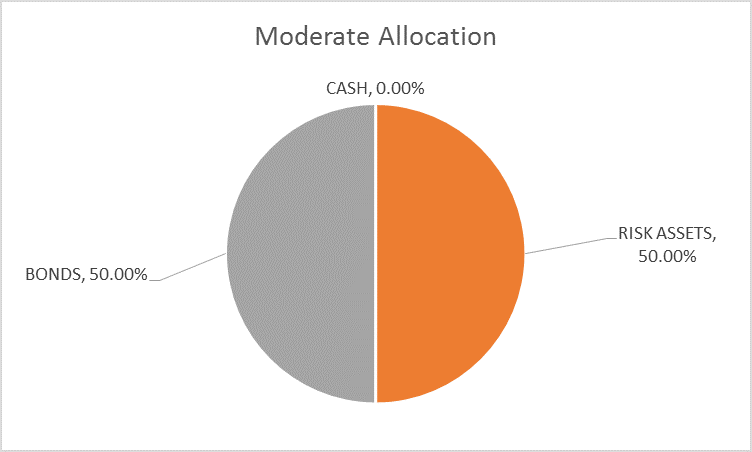

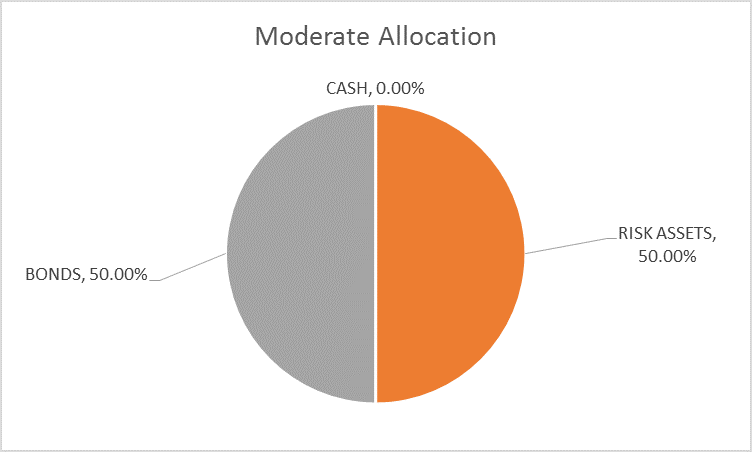

Global Asset Allocation Update: Step Away From The Portfolio

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a different hymnal.

Read More »

Read More »

Buy Gold for Long Term as “Fiat Money Is Doomed”

Buy gold for long term as fiat money is doomed warns Frisby. Gold’s “winning streak” will continue in long term. September is traditionally a good month for gold, as we head into the Indian wedding season. “It’s just a matter of time before gold comes good again…” by Dominic Frisby, Money Week. Today folks, by popular demand, we’re talking gold.. It’s had a nice summer run. What now?

Read More »

Read More »

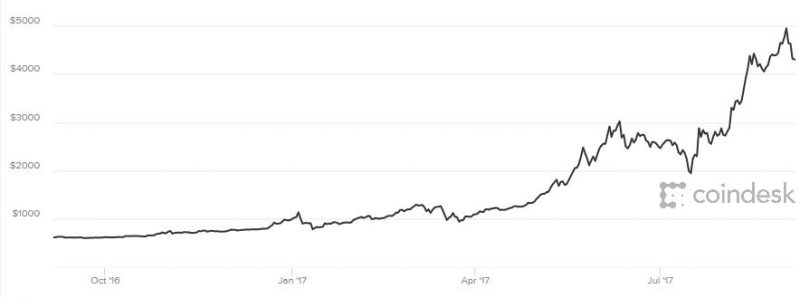

“Things Have Been Going Up For Too Long” – Goldman CEO

“Things have been going up for too long…” – Goldman Sachs’ CEO. Lloyd Blankfein, Goldman CEO “unnerved by market” (see video). Bitcoin bubble is no outlier says Bank of America Merrill Lynch. Bubbles are everywhere including London property. $14 trillion of monetary stimulus has pushed investors to take more risks. We are now in a new era of bigger booms and bigger busts – BAML. “Seeing signs of bubbles in more and more parts of the capital market”...

Read More »

Read More »

Bi-Weekly Economic Review: Waiting For Irma

This update will be a bit shorter than usual. I’m in Miami awaiting Hurricane Irma. As of now, it looks like the eye of the storm will make landfall near Key West and continue west of us with the Naples/Ft. Myers area at risk. Or at least that’s the way it looks right now. I’ve done a lot of these storms though – I lost a house in Andrew in ’92 – and you never know what these things will do. We are secure in a house that survived Andrew with barely...

Read More »

Read More »

Bitcoin Falls 20 percent as Mobius and Chinese Regulators Warn

Bitcoin falls 20% as Mobius and Chinese regulators warn. “Cryptocurrencies are beginning to get out of control” – warns respected investor Mark Mobius. Mobius believes governments will begin to clamp down on cryptocurrencies sparking rush to gold. Yesterday China’s PBOC ruled Initial Coin Offerings (ICOs) are illegal and all related activity to halt. China is home to majority of bitcoin miners.

Read More »

Read More »

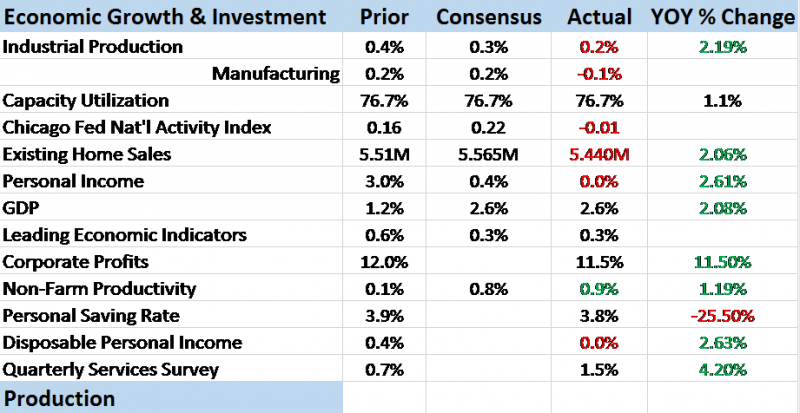

Bi-Weekly Economic Review: Don’t Underestimate Gridlock

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index probably says it all, coming...

Read More »

Read More »

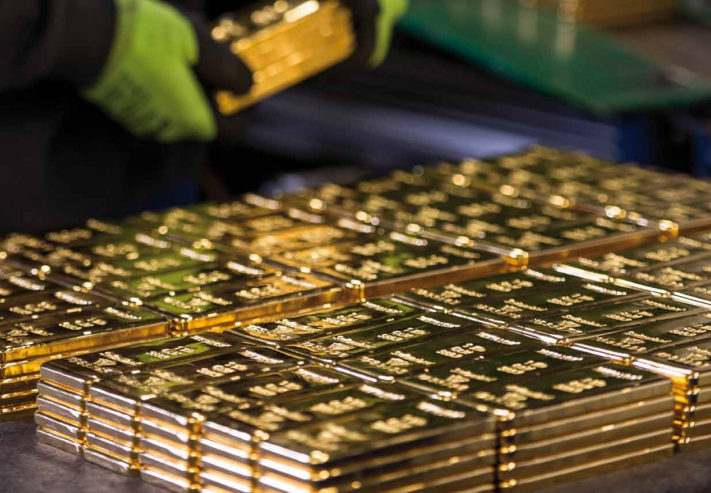

The Truth About Bundesbank Repatriation of Gold From U.S.

Bundesbank has completed a transfer of gold worth €24B from France and U.S. Germany has completed domestic gold storage plan 3 years ahead of schedule. In the €7.7 million plan, 54,000 gold bars were shipped and audited.

Read More »

Read More »

U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There

US Treasury Secretary Steve Mnuchin visits Fort Knox Gold

Later tweeted ‘Glad gold is safe!’

Only the third Treasury Secretary to visit the fortified vault, last visit was 1948

Read More »

Read More »

Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand.

Read More »

Read More »

FX Weekly Preview: Transitioning to a New Phase

Jackson Hole marks the end of the investors' summer and a beginning of a challenging several weeks. The abandonment of national business leaders from Trump's advisory board and strong words by Republican Senator Corker, followed by the dismissal of the controversial Bannon, could be a turning point. Neither Yellen nor Draghi may not even address the current policy stance as they discuss the topic at hand, "Fostering Dynamic Global Economy", which...

Read More »

Read More »

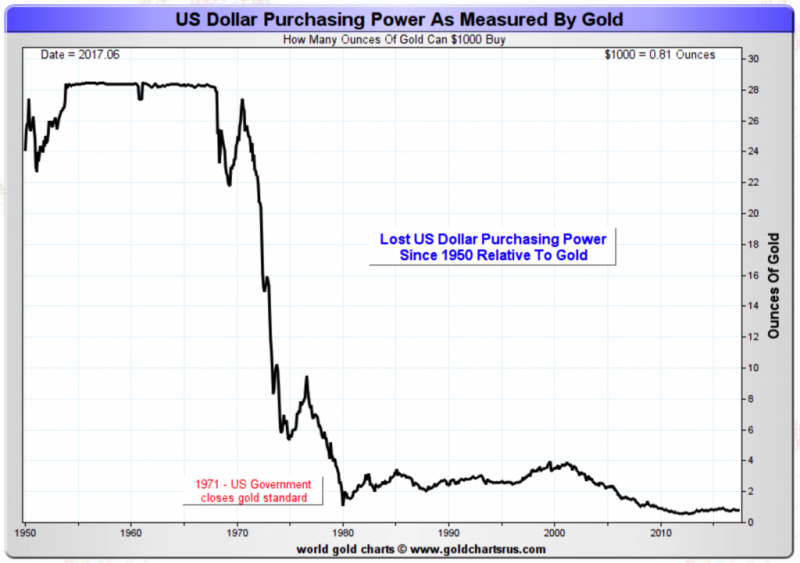

Gold Hedges USD Devaluation, Rise in Oil, Food and Cost of Living Since 1971 – Must See Charts

Gold hedges massive ongoing devaluation of U.S. Dollar. 46th anniversary of ‘Tricky Dicky’ ending Gold Standard (see video). Savings destroyed by currency creation and now negative interest rates. Long-term inflation figures show gold a hedge against rising cost of fuel, food and cost of living. $20 food and beverages basket of 1971 cost $120.17 in 2017.

Read More »

Read More »

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »