Tag Archive: #GBP

FX Daily, December 14: Markets Quietly Edge into FOMC Meeting

The Pound is entering mid-December in the same fashion it begun the month after having a very strong November as well. After being buoyed by Donald Trump’s victory and the High Courts ruling that parliamentary approval is needed before invoking Article 50, the Pound has been boosted further after economic data has also impressed, with yesterday being a good example of this.

Read More »

Read More »

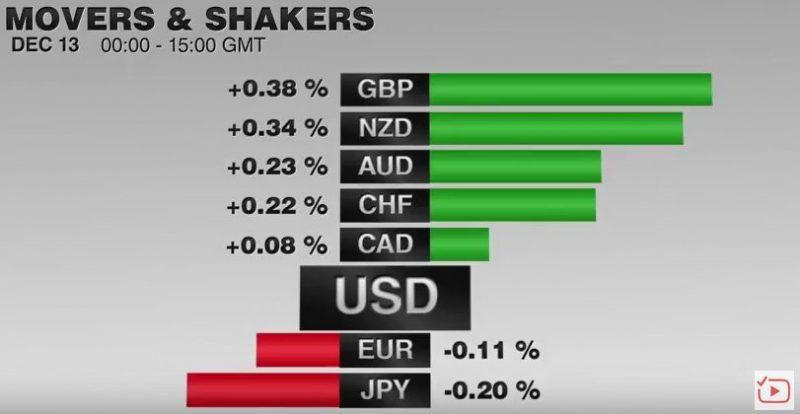

FX Daily, December 13: Narrowly Mixed Dollar Conceals Resilience

The US dollar is little changed against most of the major currencies. The dollar finished yesterday's North American session on a soft note, but follow through selling has been limited. After rallying to near 10-month high above JPY116 yesterday, the greenback finished on session lows near JPY115.00. Initial potential seemed to extend toward JPY114.30, but dollar buyers reemerged near JPY114.75, and it rose back the middle of the two-day range...

Read More »

Read More »

Busy Week for the UK

The UK reports inflation, employment and retail sales this week. The BOE meets but will keep rates steady. The US 2-year premium over the UK is the highest since at least 1992 today.

Read More »

Read More »

FX Daily, December 12: Dollar and Yen Trade Lower to Start the Week

The US dollar and Japanese yen are trading lower. The tone is largely consolidative, and the foreign exchange market is not main focus today. Instead, the OPEC-non-OPEC agreement before the weekend is arguably the key driver today. Oil prices are up 4.5%-4.8%, lifting bond yields and supporting oil producers' currencies, like the Norwegian krone, Canadian dollar, the Russian ruble and Mexican peso.

Read More »

Read More »

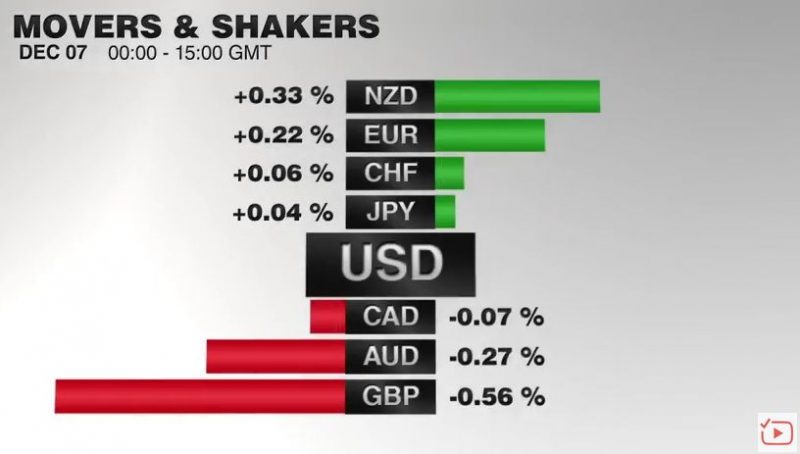

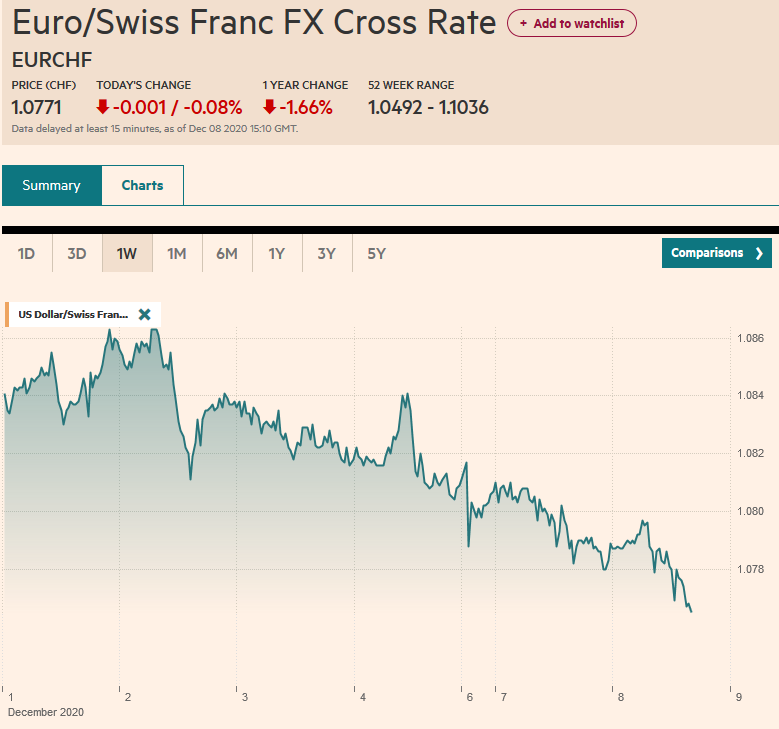

FX Daily, December 07: Greenback is Broadly Steady While Sterling Slides

The US dollar is little changed against most of the major currencies. Sterling is the notable exception, losing about 0.75% to trade at three-day lows. It was on the defensive in early European turnover but got the run pulled from beneath by the unexpectedly poor data. UK industrial output fell by 1.3% in October. The median forecast was for a small increase.

Read More »

Read More »

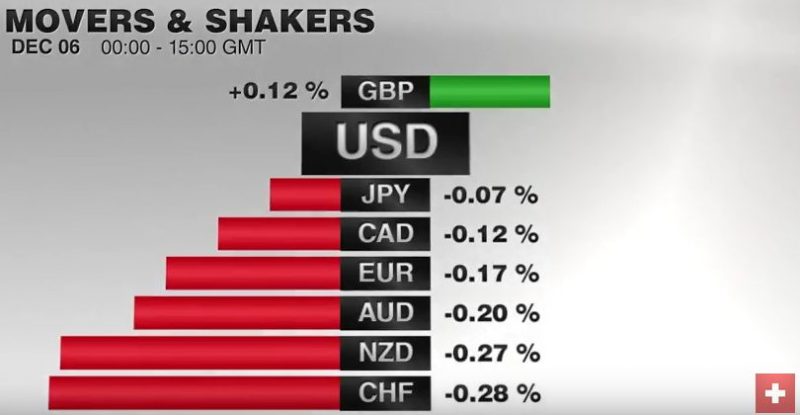

FX Daily, December 06: You Can Almost Hear a Pin Drop

The foreign exchange market is quiet. Ranges are narrow, with the US dollar mostly consolidating against the major currencies. Given the push lower yesterday, the shallowness of its recovery warns of the greenback's downside correction after strong gains last month may not be complete.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

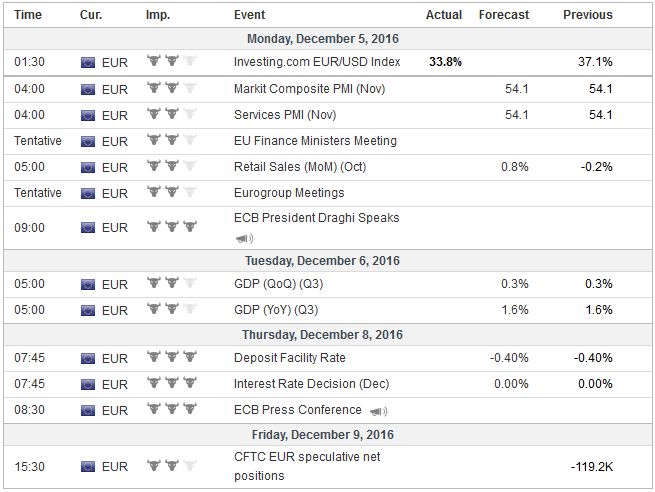

FX Weekly Preview: Focus Shifts toward Europe

US developments have driven the dollar rally and bond market decline over the past three weeks. Attention shifts to European politics and the ECB meeting. Bank of Canada and the Reserve Bank of Australia meet but are unlikely to change policy.

Read More »

Read More »

Brexit Minister Sends Sterling Higher

UK could pay for single market access. UK's position still seems fluid. The Supreme Court will hear the government's appeal next week.

Read More »

Read More »

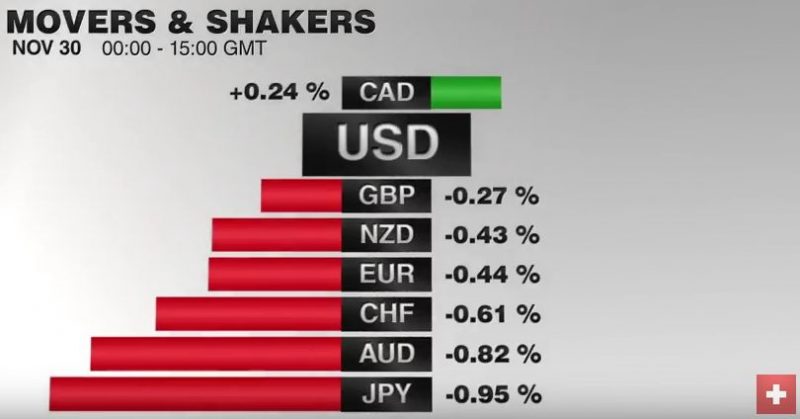

FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked government document titled Have cake and eat it, the markets and sterling were largely unphased.

Read More »

Read More »

FX Daily, November 29: Dollar Comes Back Mostly Firmer, but Focus is Elsewhere

The US dollar correctly lowered yesterday, but most of the selling was over by the end of the Asian session, and the greenback steadied in Europe and North America. The dollar is firm against the euro and yen but within yesterday's broad trading ranges. The Australian and Canadian dollar's gains from yesterday are being pared.

Read More »

Read More »

FX Daily, November 28: Corrective Forces Seen in Asia, Subside in Europe

As soon as markets opened in Asia, the greenback was sold, and corrective forces that had been nipping below the surface took hold. The euro, which had finished last week below $1.0590, rallied nearly a cent. Before the weekend, the greenback had pushed to almost JPY114, an eight-month high, before closed near JPY113.20. It was sold to almost JPY111.35 in early Asia. Sterling extended last week's gains and briefly poked through $1.2530, to reach...

Read More »

Read More »

Short Summary on US Thanksgiving

Euro fell to new 20-month lows before steadying. The dollar extended its recovery against the yen. Emerging markets remained under pressure, and Turkey's central bank surprised with a 50 bp hike in the repo rate.

Read More »

Read More »

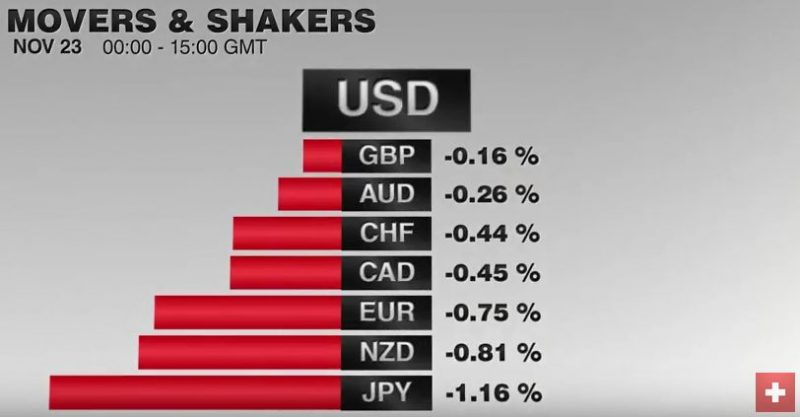

FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

The US dollar is trading inside yesterday's ranges against the euro and yen. The dollar's tone matches the consolidation in the debt market ahead of today's slew of US data and tomorrow's holiday. Tokyo markets were on holiday.

Read More »

Read More »

FX Daily, November 21: Flattish Consolidation Hides Dollar Strength

The news over the weekend is primarily political in nature. Sarkozy is going to retire (again) after taking a drubbing in the Republican Party primary in France. Fillon, the self-styled French Thatcher unexpected beat Juppe, but without 50% and therefore the results set up the run-off this coming weekend. It is as if, knowing their candidate will likely face Le Pen in the final round next spring, the Republican Party might as well chose the most...

Read More »

Read More »

FX Daily, November 17: Consolidation Gives Dollar Heavier Tone

The US dollar is trading with a heavier bias today as its recent run is consolidated. The euro is trying to snap the eight-day slide that brought it to nearly $1.0665 yesterday, the lows for the year. It is almost as if participant saw the proximity of last year's lows ($1.0460-$1.0525) and decided to pause, perhaps to wait for additional developments, such a Fed Chief's Yellen's testimony before the Joint Economic Committee of Congress.

Read More »

Read More »

FX Daily, November 16: The Greenback Remains Resilient

The US dollar remains bid. It is at its year high against the euro and five-month highs against the Japanese yen. Sterling, which has performed better recently, remains in the trough around 30-year lows. It surge since the election reflects three considerations. The first is December Fed hike. Prior to the election, the market was assessing around a two-thirds chance. Now both the CME and Bloomberg's WIRP estimate the odds above 90%....

Read More »

Read More »

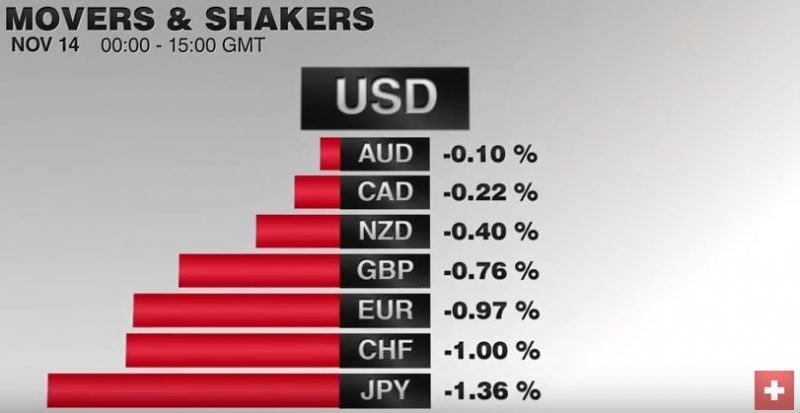

FX Daily, November 14: Dollar Steps Up to Start Week

The US dollar rally that moved into a higher gear in the second half of last week has begun the new week with a bang. It is up against nearly all the major and emerging market currencies. Even sterling, which last week, managed to eke out modest gains against the greenback is under pressure today.

Read More »

Read More »

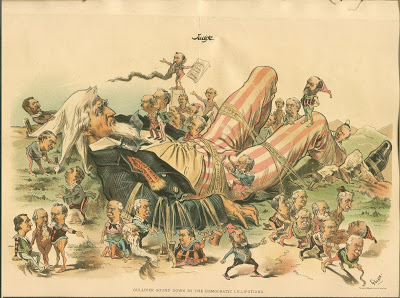

An English Breakfast Causes Less Indigestion than the British Brexit

Prime Minister May is appealing the High Court decision and preparing to present broad guidelines of her strategy. An early election; even if it could be arranged, it is not clear which wing of the Tories would win. May missed the opportunity to provide strong leadership when it was most needed.

Read More »

Read More »

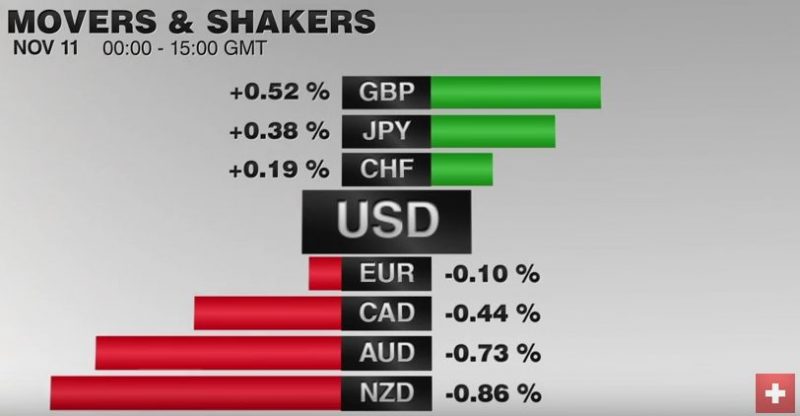

FX Daily, November 11: Ramifications of Trump’s Election Continue to Drive Markets

The forces unleashed by the US election results continue to drive the capitals markets. The combination of nationalism, reflation and deregulation are seen as good for US equities and the US dollar. It has not been so kind to US Treasuries, where the 10- and 30-year yield has risen about 32 bp this week coming into today's federal holiday that closes the bond market, while the stock market is open.

Read More »

Read More »