Tag Archive: British Pound

FX Weekly Review, December 12 – December 16: Fed Lifts Dollar, but Consolidation may be on Tap

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

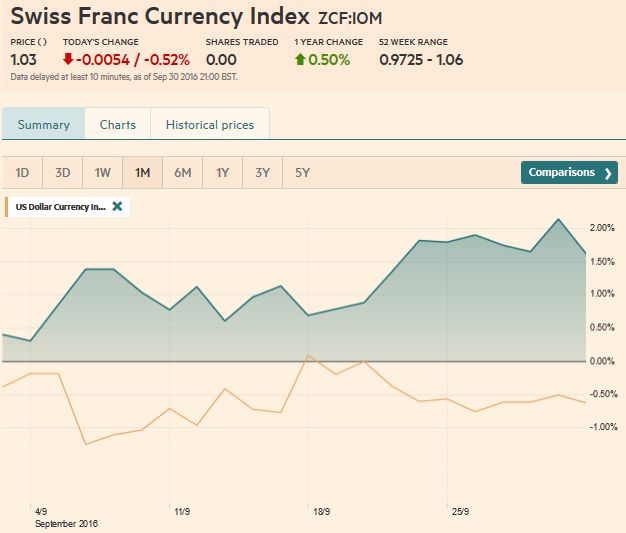

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. USD/CHF The US dollar is finishing the year on a firm note. It rose … Continue reading »

Read More »

Read More »

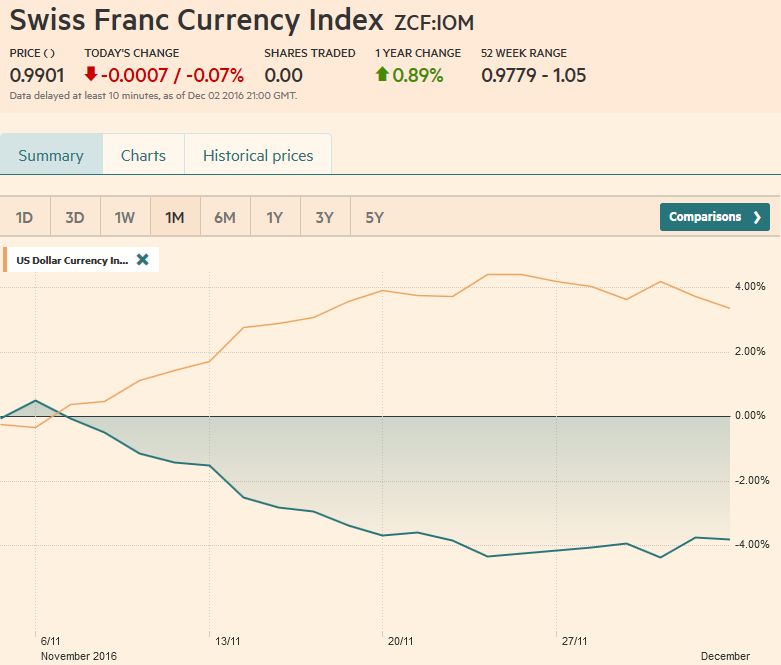

FX Weekly Review, November 28 – December 02: CHF Index still at its 4% loss since U.S. Elections

The Swiss Franc index continued around its 4% loss since the U.S. elections, while the US Dollar index had a 4% increase. The focus shifts to the ECB meeting, where participants are wary of a "hawkish ease".

Read More »

Read More »

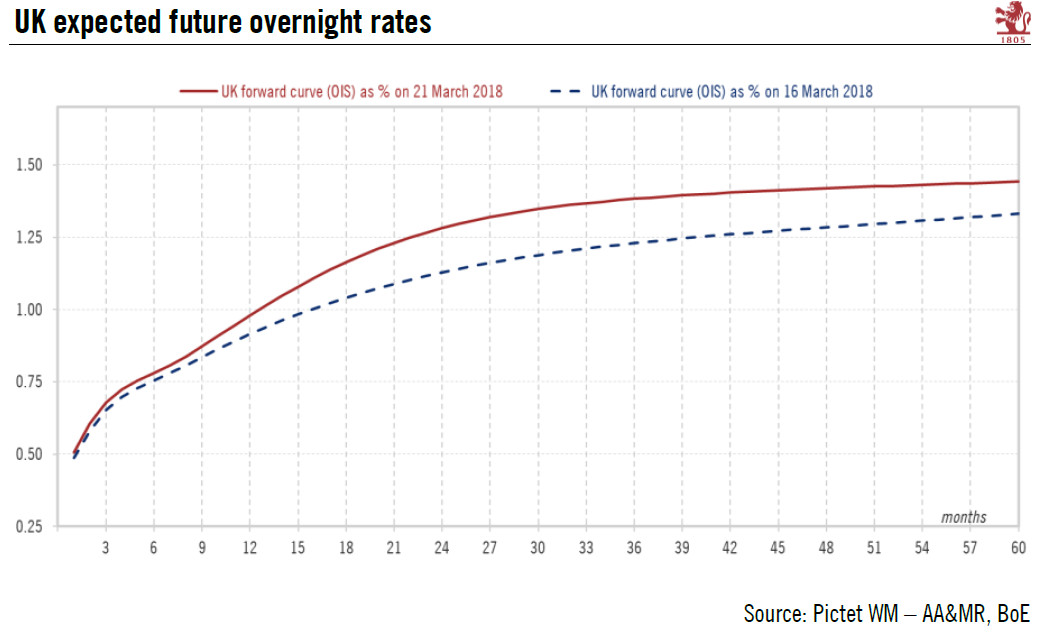

Brexit Minister Sends Sterling Higher

UK could pay for single market access. UK's position still seems fluid. The Supreme Court will hear the government's appeal next week.

Read More »

Read More »

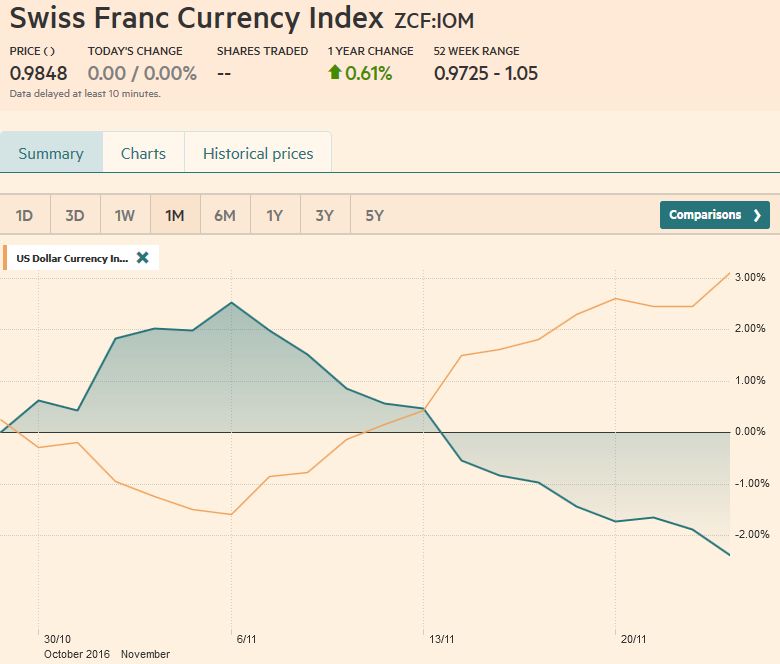

FX Weekly Review, November 21 – November 25: Dollar Strength Losing Steam

After a three-week rally, the dollar bulls finally showed signs of tiring ahead of the weekend. At least against the Swiss Franc index, the dollar index could further advance. We had observed SNB interventions in the previous week that kept the euro mostly above 1.07.

Read More »

Read More »

FX Weekly Review, November 14 – November 18: Best Dollar Weeks since Reagan

The US dollar has recorded its best two-week performance since Reagan was President. The weeks after Trump's election continue to see a weakening of the Swiss Franc, while the dollar index is on a steady rise. Still both the euro and the yen have seen worse performance than the Swiss Franc. The euro is currently under 1.07.

Read More »

Read More »

FX Weekly Review, November 07 – November 11: The Trump Reflation Trade

The Swiss Franc Index rose sharply, shortly after the U.S. elections. But then the Trump reflation trade came. Trump may fulfills the wet dreams of many economists. With tax cuts he might extend the U.S. fiscal deficit up to 10% per year. This resulted in:

Gains on U.S. stocks, inflows in U.S. Bonds, inflation hedges gold and Swiss Francs.

Read More »

Read More »

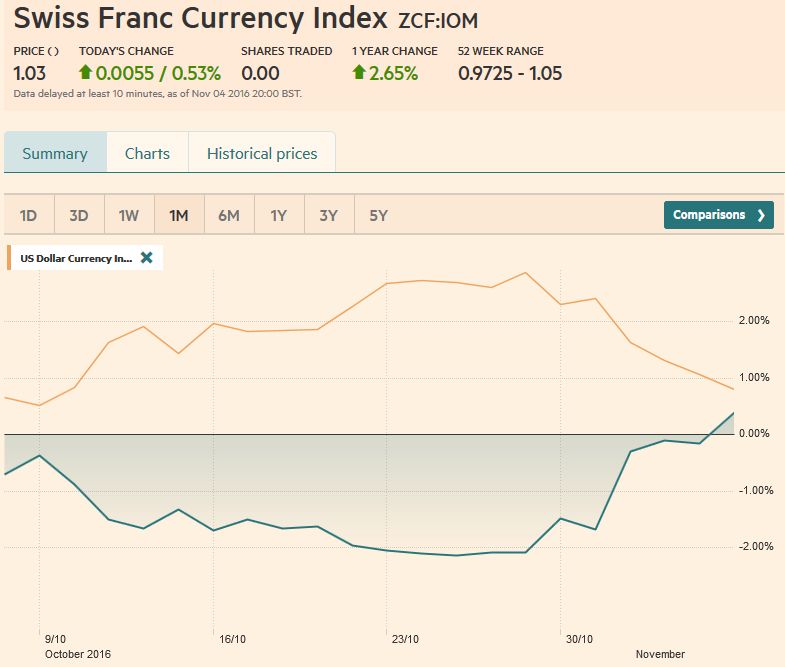

FX Weekly Review, October 31 – November 04: Dollar at Crossroads

Swiss Franc Currency Index As visible in the graph, the Swiss Franc index recovered most of its losses against the US Dollar Index for the last 30 days. In the last 30 days, both the USD currency index and the CHF currency index have had a positive performance.

Read More »

Read More »

Sterling High Court Decision on Parliament’s Right to Vote on Brexit

The UK High Court defends Parliament's right to vote before Article 50 is triggered. The decision will be appealed. Sterling approached an important resistance as it extended its rally for the fifth session.

Read More »

Read More »

FX Weekly Review, October 24-28: October Surprise Pushes Open Door

The Swiss Franc Index could recover some of the losses as compared to the US dollar index. Still the USD/CHF remains above 0.99. The US dollar rose against most of the major currencies last week, but the upside momentum appeared to be dissipating, even before the FBI's announcement about new Clinton emails. There are a few exceptions like the greenback's performance against the Japanese yen, Canadian dollar, and Swedish krona. The dollar made new...

Read More »

Read More »

FX Weekly Review, October 17-21: Golden Cross in Dollar Index and Deadman’s Cross in the Euro

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

FX Weekly Review, October 10-14: Rates Still Key to Dollar’s Outlook

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

FX Weekly Review, October 03-07: Dollar Profits on Strong ISM Index

The Franc index lost considerably in the last week, in particularly in comparison to the dollar index. Reason was the exceptionally strong U.S. ISM Non-Manufacturing Index.

Read More »

Read More »

FX Weekly Review, September 26-30: Dollar vulnerable at the Start of Q4, CHF collapses at Quarter End

The US dollar fell against most of the major currencies in Q3. The Norwegian krone was the best performer, gaining 4.4% against the greenback, followed by Aussie and Kiwi. The Swiss Franc collapsed on Friday at quarter end.

Read More »

Read More »

FX Weekly Review, September 12 – 16: U.S. Dollar Resilience Despite Hawkish ECB and bad ISM

The dollar was surprisingly strong this week. This despite a more hawkish ECB, bad U.S. economic data in the ISM surveys.

Read More »

Read More »

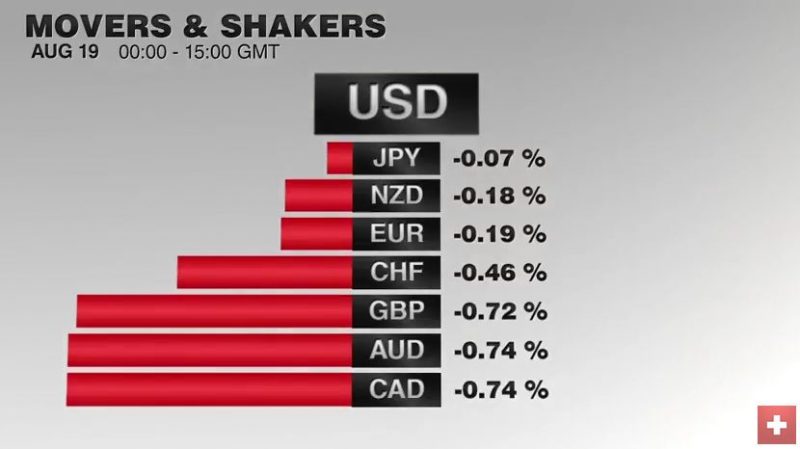

FX Daily, August 19: Dollar Recovers into the Weekend

The US dollar is trading firmly ahead of the weekend as part of this week's losses are recouped. The euro is trading within yesterday's range, holding to a little more than a half-cent above $1.13. However, as we have noted, the Asia and European participants appear more dollar-friendly than Americans

Read More »

Read More »

FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting.

Read More »

Read More »

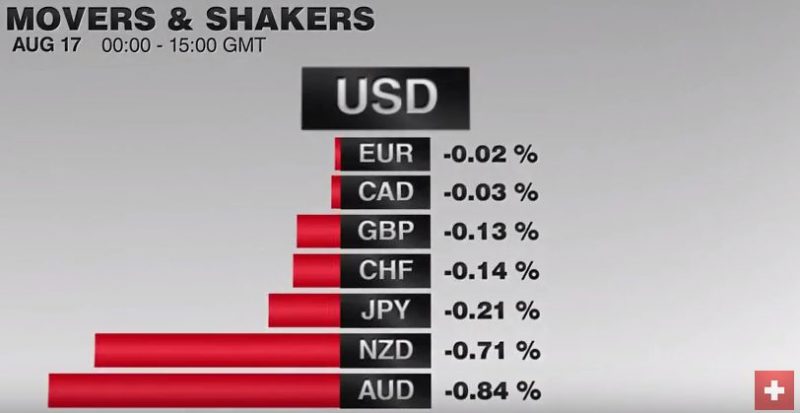

FX Daily, August 17: Dollar Snaps Back

The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley's comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent.

Read More »

Read More »

FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think.

Read More »

Read More »