Tag Archive: British Pound

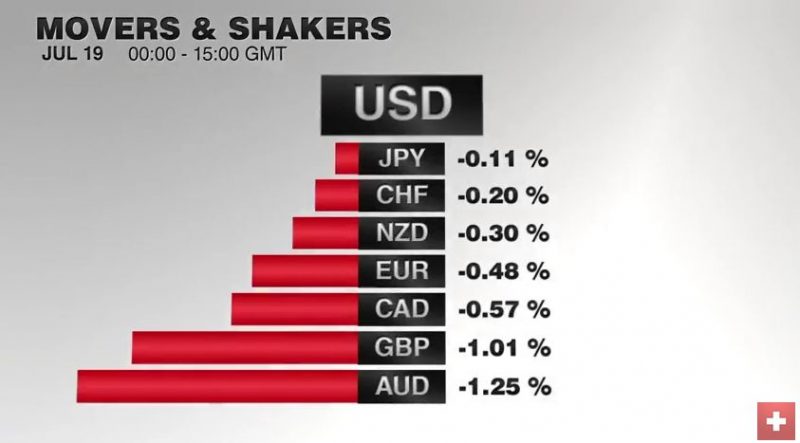

FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today.

Read More »

Read More »

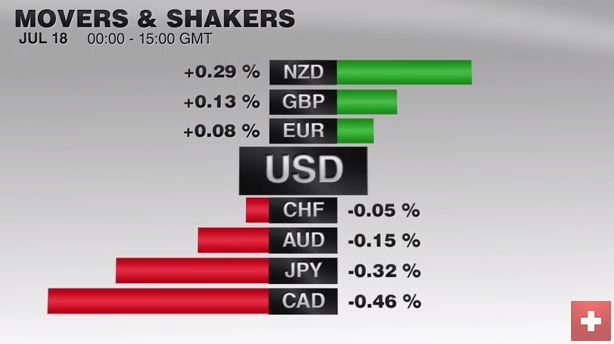

FX Daily, July 18: Coup in Turkey Repulsed, Risk-Appetites Return

The US dollar and the yen are trading heavy, while risk assets, including emerging markets, and the Turkish lira, have jumped. Sterling is the strongest of the majors. It is up about 0.5% (~$1.6365), helped by the opportunity of GBP23.4 bln foreign direct investment and comments from a hawkish member of the MPC suggesting not everyone is onboard necessarily for a rate cut next month.

Read More »

Read More »

Squaring the Circle: Can Article 7 be Used to Force Article 50?

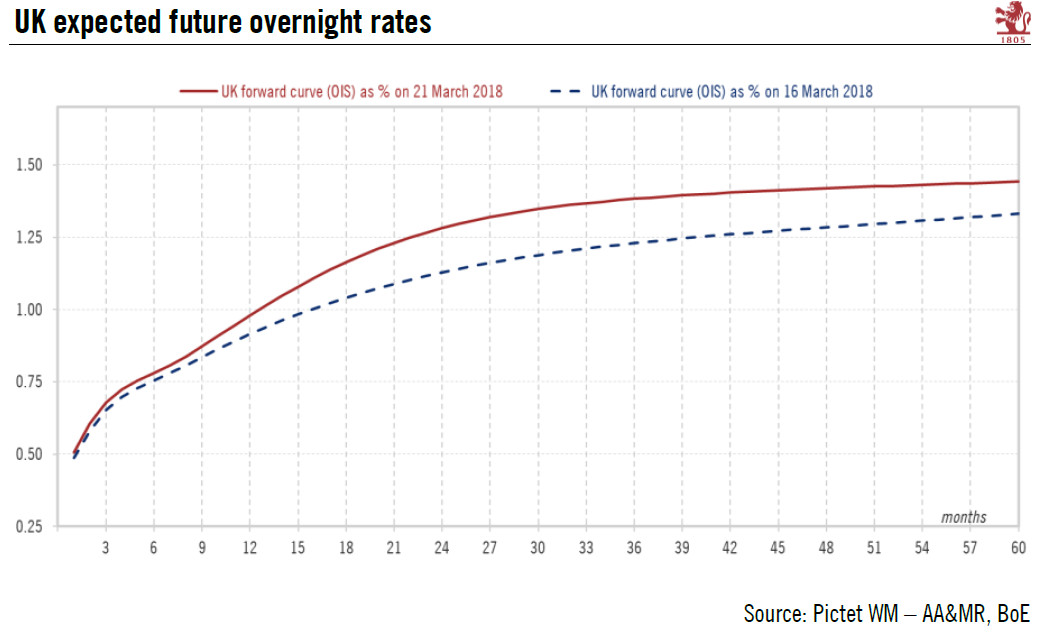

Article 7 would suspend the UK's EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what "is" means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not.

Read More »

Read More »

FX Daily, July 12: Easing Political Uncertainty Encourages Animal Spirits

Further risk appetite means rising euro and weaker CHF. The SNB typically sustains such risk appetite phases with smaller FX interventions of around 300 million per day. Sterling is leading the new appetite for risk as one element of political uncertainty has been lifted. It is moving higher for the third consecutive session today; advancing by more than 1.5 cents to reach $1.3180.

Read More »

Read More »

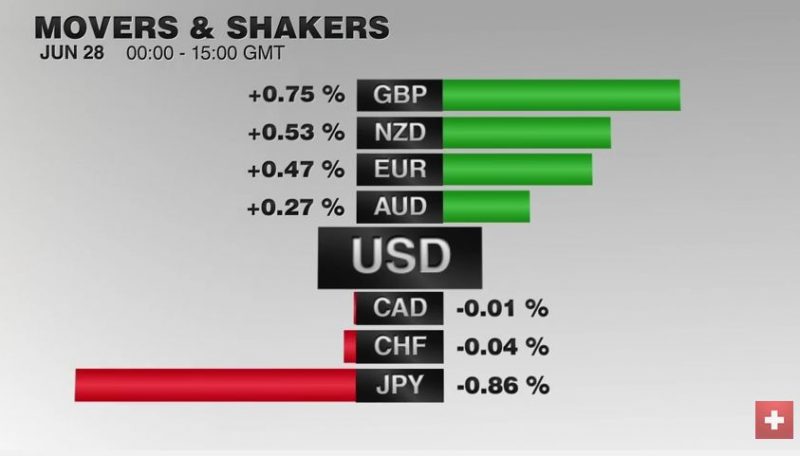

FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday's; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today.

Read More »

Read More »

Rule Britannia

What a glorious day for Britain and anyone among you who continues to believe in the ideas of liberty, freedom, and sovereign democratic rule. Against all expectations, the leave camp somehow managed to push the referendum across the center line, with 51.9% of voters counted electing to leave the European Union.

Read More »

Read More »

The EU Begins to Splinter, a new Tsunami for Kuroda

Early this morning one might have been forgiven for thinking that Japan had probably just been hit by another tsunami. The Nikkei was down 1,300 points, the yen briefly soared above par.

Read More »

Read More »

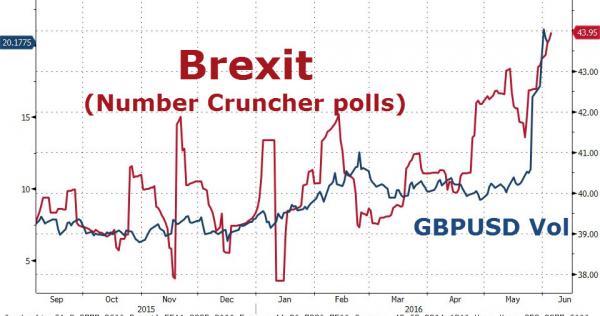

Moving Closer to BREXIT

Polls Show Growing Support for a Break with the EU In the UK as elsewhere, the political elites may have underestimated the strength of the trend change in social mood across Europe. The most recent “You-Gov” and ICM pools show a widening lead in f...

Read More »

Read More »

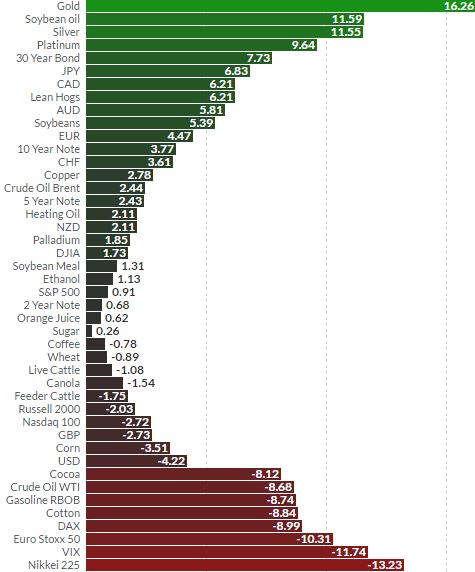

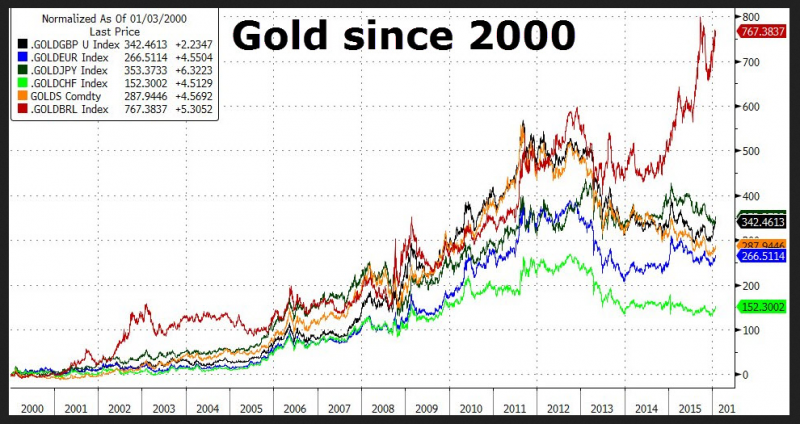

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

– Gold prices gained 16% in Q1 – best quarterly performance since 1986– Gains due to increasing global financial, macroeconomic and monetary risk– Stocks come under pressure – Flat in U.S.; Falls ...

Read More »

Read More »

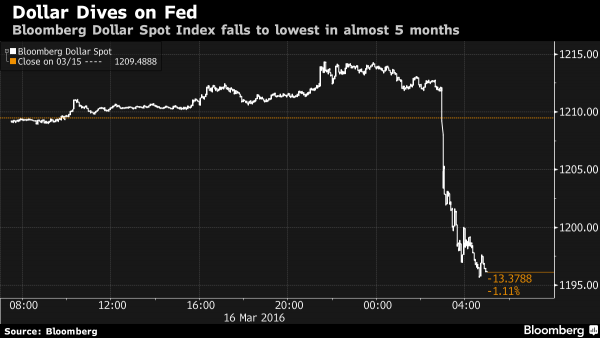

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »