Tag Archive: Federal Reserve/Monetary Policy

Monthly Macro Monitor – August 2020

One of the advantages we enjoy here at Alhambra is the opportunity to interact with a lot of investors. We talk to hundreds of individual investors on a monthly basis, giving us a front-row seat to everyone’s fear and greed. Economic data tells us about the past, which isn’t particularly useful for investors focused on the future.

Read More »

Read More »

Part 2 of June TIC: The Dollar Why

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

It Was Bad In The Other Sense, So Now What?

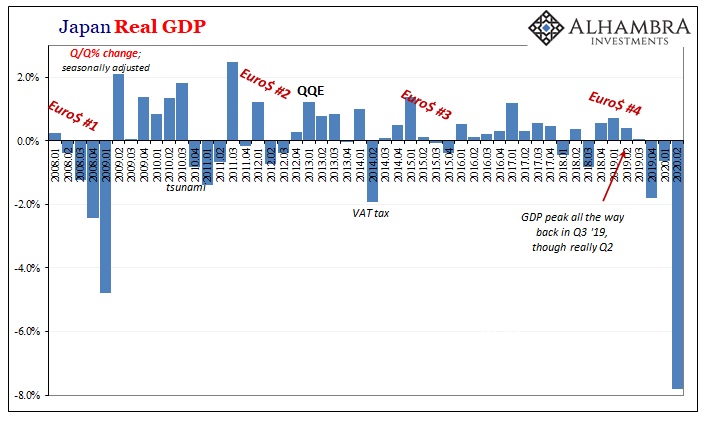

According to the latest figures, Japan has tallied 56,074 total coronavirus cases since the outbreak began, leading to the death of an estimated 1,103 Japanese citizens. Out of a total population north of 125 million, it’s hugely incongruous.

Read More »

Read More »

Fama 2: No Inflation For Old Central Banks

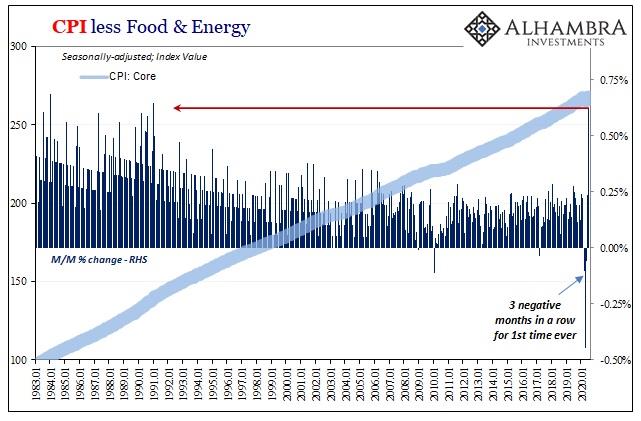

The Bureau of Labor Statistics reported that the core CPI in July 2020 jumped by the most (+0.62%) in almost thirty years. After having dropped month-over-month for three months in a row for the first time in its history, it has posted back to back gains the latest of which pushing the index back above its February level.

Read More »

Read More »

Eugene Fama’s Efficient View of Stimulus Porn

The key word in the whole thing is “bias.” For a very long time, people working in and around the finance industry have sought to gain tremendous advantages. No explanation for the motive is required. Charts, waves, technical (sounding) analysis and so on.

Read More »

Read More »

Science of Sentiment: Zooming Expectations Wonder

It had been an unusually heated gathering, one marked by temper tantrums and often publicly expressed rancor. Slamming tables, undiplomatic rudeness. Europe’s leaders had been brought together by the uncomfortable even dangerous fact that the economic dislocation they’ve put their countries through is going to sustain enormously negative pressures all throughout them. What would a “united” European system do to try and fill in this massive hole?The...

Read More »

Read More »

A Second JOLTS

What happens when we are stunned and dazed? We filter out the noise to focus on the bare basics by getting back to our instincts, acting reflexively based upon our deeply held beliefs and especially training. When faced with a crisis and there’s no time to really think, shorthand will have to suffice.

Read More »

Read More »

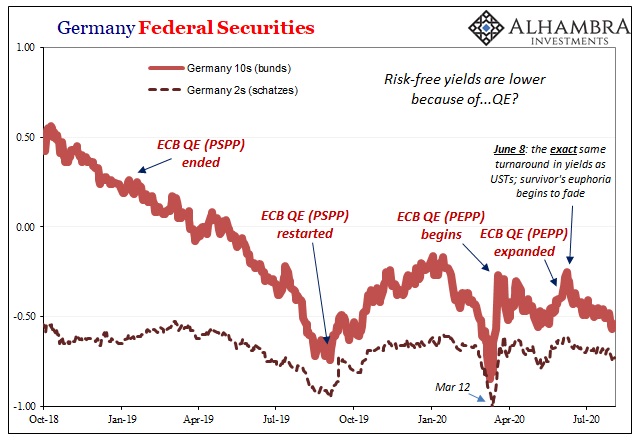

Shoe V arning

It’s no wonder we’re obsessed with shoes these days. Even the V-people, as I’ll call them, keep one wary eye glued looking behind them. Survivor’s euphoria means a lot of potentially bad things, only beginning with a false sense of survivor-hood.

Read More »

Read More »

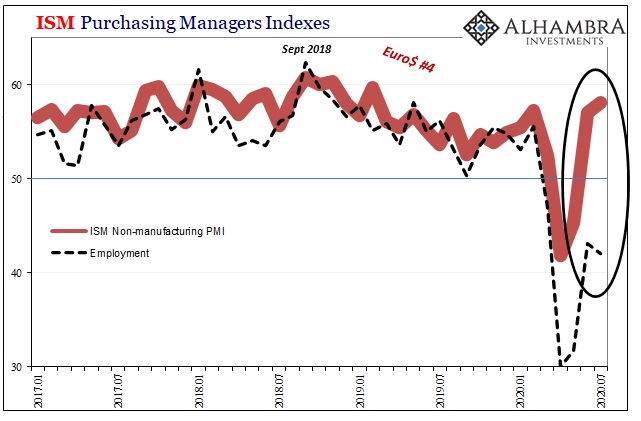

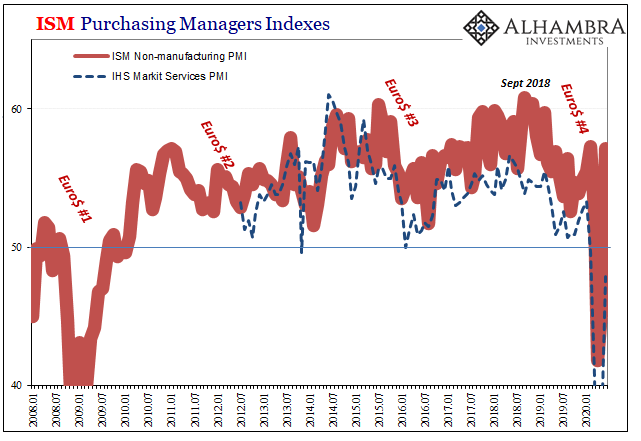

Purchasing Managers Indigestion

There’s already doubt given how the two major series supposedly measuring the same thing seemingly can’t agree. If the rebound was truly robust, it would show up unambiguously everywhere. But IHS Markit’s purchasing managers indices struggled to get back above 50 in July, barely getting there, suggesting the economy might be slowing or even stalling way too close to the bottom.

Read More »

Read More »

Accusing the Accused of Excusing the Mountain of Evidence

Why not let the accused also sit in the jury box? The answer seems rather obvious. While maybe the truly honest man accused of a crime he did commit would vote for his own conviction, the world seems a bit short on supply of those while long and deep offering up practitioners of pure sophistry in their stead.

Read More »

Read More »

That’s Probably Why Only Half a “V”

Why only half a “V?” If the latest PMI’s are anywhere close to accurate, and they don’t have to be all that close, then the production side of the economy may have stalled out somewhere nearer the trough of this contraction. The promise of May’s big payroll report surprise has dissipated in more than just the bond market.

Read More »

Read More »

US Stall? Only Half The Imagined “V” May Indicate One, Too

These are not numbers that are consistent with a robust rebound. In fact, they don’t indicate very much of one at all. IHS Markit’s flash PMI’s for July 2020 instead look way too much like the sentiment indicators in Germany and Japan. Though they are now back near 50, both services and manufacturing, that doesn’t actually indicate what everyone seems to think it does.

Read More »

Read More »

The (Other) Shoe Of Unemployment

After raising the specter of a rebound stall, the idea before limited to Japan and Germany was abruptly given further weight today by US jobless claims numbers. For the first time since the peak at the end of March, the weekly tally of initial filings increased from the prior week.

Read More »

Read More »

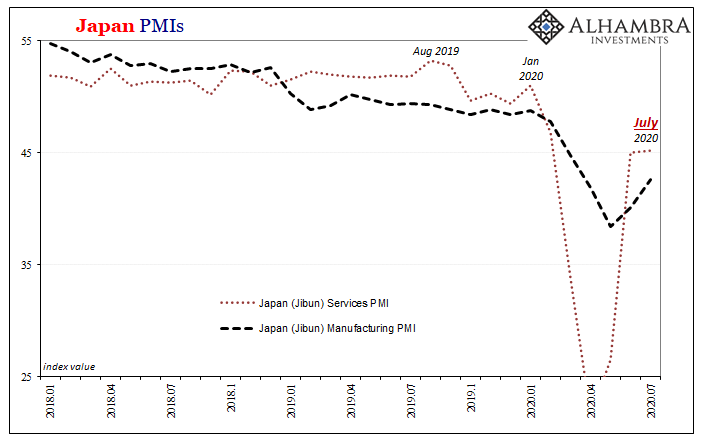

A Japanese Stall?

In sharp contrast to the sentimental deference towards central bank stimulus exhibited by Germany’s ZEW, for example, similar Japanese surveys are starting to describe potential trouble developing. Like Germany, Japan is a bellwether country and a pretty reliable indicator of global economy performance.

Read More »

Read More »

Of Incomplete Plans and Recoveries

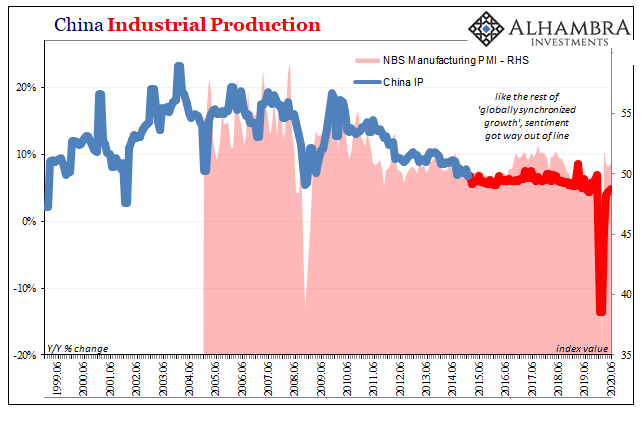

At the monthly press conference China’s National Bureau of Statistics (NBS) now regularly gives whenever the Big Three economic accounts are updated (this time along with quarterly GDP), spokesman Liu Aihua was asked by a reporter from Reuters to comment on how the global economic recession might impact the Communist government’s long range goal of reaching its assigned GDP target.

Read More »

Read More »

Transitory, The Other Way

After a record three straight months of decline for the seasonally-adjusted core CPI March through May 2020, it turned upward again in June. Buoyed by a partially reopened economy, the price discounting (prerequisite to the Big D) took at least one month off.

Read More »

Read More »

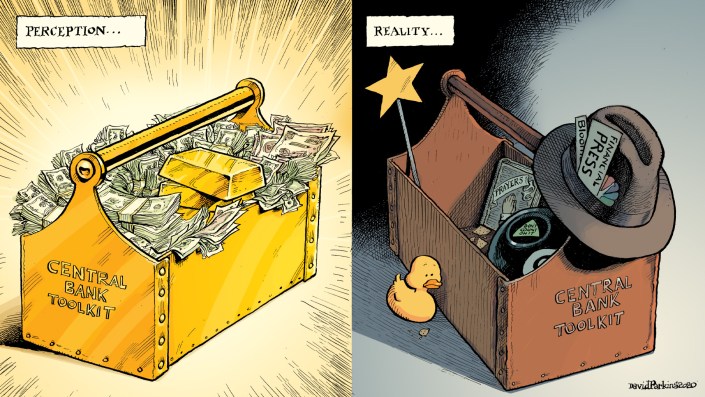

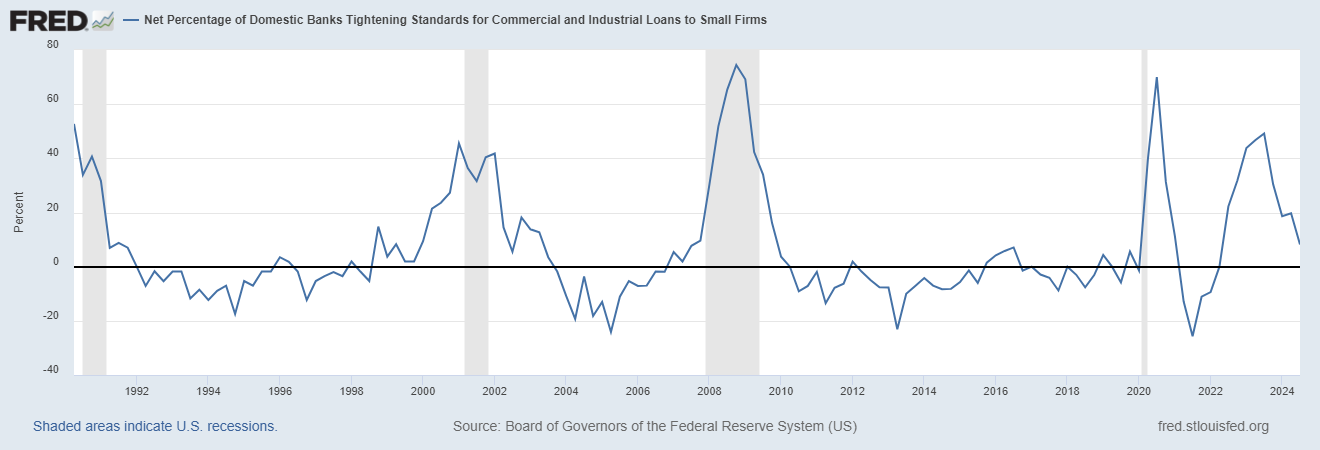

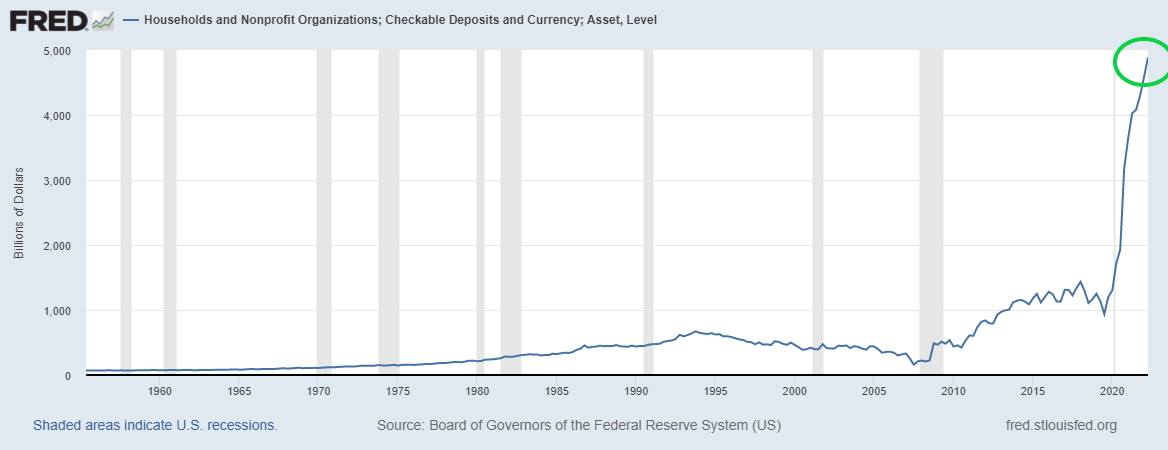

Wait A Minute, The Dollar And The Fed’s Bank Reserves Are Directly Not Inversely Related

One small silver lining to the current situation, while Jay Powell is busily trying to sell you his inflation fantasy, he’s actually undermining it at the very same time. No mere challenge to his own “money printing” fiction, either, the Fed’s Chairman is actively disproving the entire enterprise. While he says what he says, pay close attention instead to what he’s done.

Read More »

Read More »

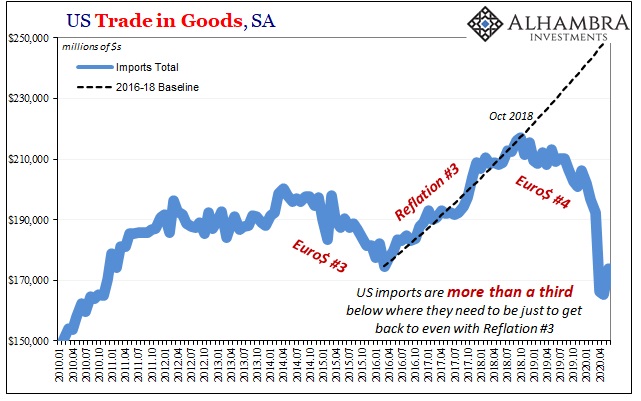

Second Wave Global Trade

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting.

Read More »

Read More »

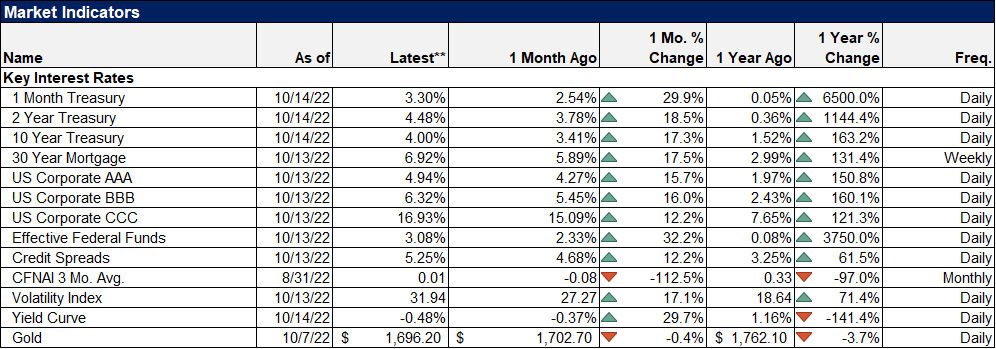

Monthly Market Monitor – July 2020

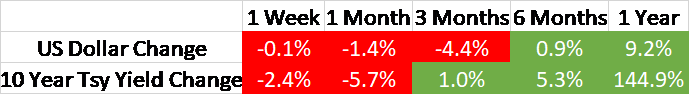

Most Long-Term Trends Have Not Changed. A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime.

Read More »

Read More »

Gratuitously Impatient (For a) Rebound

Jay Powell’s 2018 case for his economic “boom”, the one which was presumably behind his hawkish aggression, rested largely upon the unemployment rate alone. A curiously thin roster for a period of purported economic acceleration, one of the few sets joining that particular headline statistic in its optimism resides in the lower tiers of all statistics.

Read More »

Read More »