|

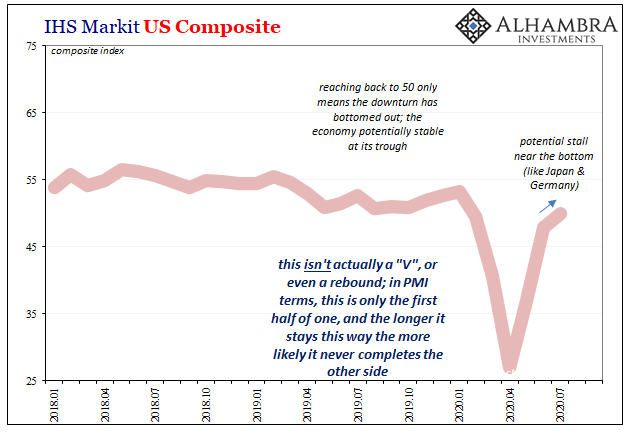

Why only half a “V?” If the latest PMI’s are anywhere close to accurate, and they don’t have to be all that close, then the production side of the economy may have stalled out somewhere nearer the trough of this contraction. The promise of May’s big payroll report surprise has dissipated in more than just the bond market. |

IHS Markit US Composite, 2018-2020 |

| This isn’t quite what people were thinking when they euphorically celebrated that number being published. |

IHS Markit US Composite, 2018-2020 |

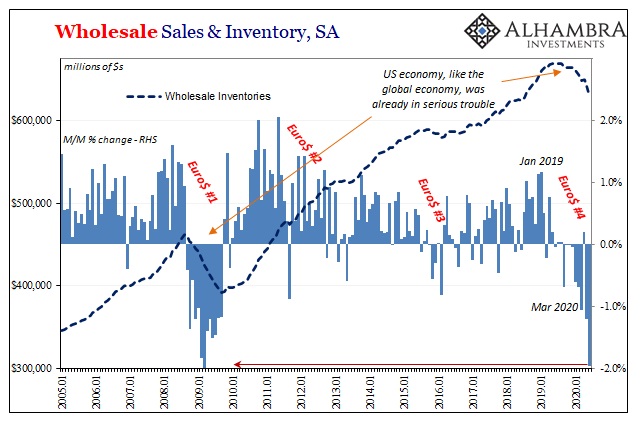

| Though the data is one month behind the sentiment estimates from IHS Markit shown above (and those are for the composite index, which takes into account service sector firms as well as any in manufacturing), the Census Bureau today gives us what is in all likelihood a big part of the answer for why only half the “V.”

The advance survey for wholesale and retail inventory suggests, on the wholesale level, things went from bad to worse in June. Inventory quantities had already dropped by more than 1% in May, seasonally adjusted, from those in April. It was expected that would have been the bottom and inventory like sales began to rebound last month. |

Wholesale Sales & Inventory, SA 2005-2020 |

| Instead, Census figures that not only did wholesale inventories fall further, they did so at just about the worst monthly pace on record – matching the most difficult month for inventory during the Great “Recession.”

In June. Two things to take from this estimate, both of which point to why we pay closer attention to inventory. One, obviously not enough sales and not enough demand in retail to begin restocking even after what were universally hailed as very V-like retail sales estimates. Is the wider supply chain a bit wary about just how sustainable the rebound in retail might be? Was May and June really as good as they were made to be? Initial jobless claims levels seem to fit real nice here. Two, cash and projected cash flow. Liquidity, as in no flood of it. Inventory and working capital in general are cash flow needy processes. Sometimes regardless of demand, looming potential insolvency can cause anyone on the supply chain to purposefully strip out every cash-intensive activity no matter how vital. |

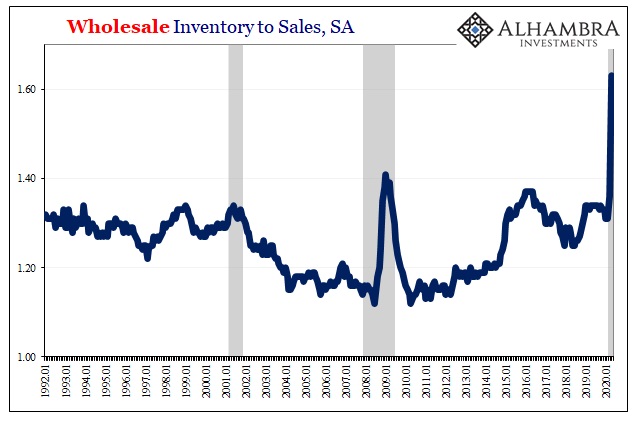

Wholesale Inventory to Sales, SA 1992-2020 |

When you feel the need to hoard liquidity, the last thing you want is to be bloated up with even less-than-normal levels of inventory.

Combine uncertainty (to put it charitably) with regard to demand for goods with survival instincts where cash hoarding and availability are concerned, suddenly June inventory projects the same stall, and the big reason for it, which might have shown up in July sentiment.

Full story here Are you the author? Previous post See more for Next post

Tags: currencies,economy,Featured,Federal Reserve/Monetary Policy,Inventory,Markets,newsletter,wholesale inventory