Tag Archive: federal-reserve

FX Daily, November 26: Some Are More Equal Than Others

Overview: Neither optimistic comments from Federal Reserve Chairman, that the economic glass is more than half full, nor a seemingly positive spin on the weekend fall calendar between Chinese and US officials have succeeded in deterring some profit-taking today.

Read More »

Read More »

FX Weekly Preview: Is Conventional Wisdom Too Optimistic?

There have been three general issues that the macro-fundamental picture has revolved around this year: trade, growth, and Brexit. On all three counts, conventional wisdom seems unduly optimistic, and this may have helped dampen volatility. A series of signals suggest that the US and China remain far apart in trade negotiations.

Read More »

Read More »

FX Daily, November 19: Hong Kong Stocks Rally as Stand-Off Continues

Overview: The run-up in equities continues to be the dominant development in the capital markets. Although the Japanese and South Korean bourses fell, the rise in Australia, China, Hong Kong, and Taiwan underpin the MSCI Asia Pacific Index. The Hang Seng's gains (1.5% on top of yesterday's 1.3% rise) is notable as the situation on the ground remains intense and unresolved.

Read More »

Read More »

Congressman Prods Attorney General on Gold, Silver Trading Questions Ignored by CFTC

A U.S. representative who has been pressing the Treasury Department, Federal Reserve, and Commodity Futures Trading Commission (CFTC) with questions about the gold and silver markets has asked Attorney General William P. Barr to try intervene and get answers from the commission. In a letter dated November 1 and made public today, the U.S. representative, Alex W. Mooney, Republican of West Virginia, commends Barr for the Justice Department's recent...

Read More »

Read More »

FX Daily, November 14: Unexpected German Growth Fails to Buoy the Euro

Overview: Rising trade anxiety and disappointing economic reports from the Asia Pacific region helped unpin the profit-taking mood in equities, while bond yields continued to pullback. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 are in the red for the fourth time in the last five sessions. Germany reported a surprise 0.1% expansion in Q3, but it has done little for the DAX or the euro.

Read More »

Read More »

FX Daily, November 13: Investors Temper Euphoria

Overview: The recent rise in equity markets and backing up in yields spurred many observers to upgrade their macroeconomic outlooks rather than the other way around. Yet we continue to see may worrisome signs. It is not just trade, though, of course, that is part of it. Sentiment itself is fragile and will likely follow prices.

Read More »

Read More »

FX Weekly Preview: Synchonized Emergence from Soft Patch?

There have been plenty of developments warning of a global economic slowdown. Yet, seemingly to justify the continued advance in equity prices, there has begun to be talk of possible cyclical and global rebound. That is the new constellation, connecting the better than expected Japanese, South Korean, and Chinese September industrial output figures, a slightly stronger than expected Q3 GDP reports from the US and the eurozone.

Read More »

Read More »

FX Daily, October 30: All About Perspective

Overview: The global capital markets are mostly treading water ahead of the Federal Reserve meeting. Asia Pacific and European equities drifted lower. The MSCI Asia Pacific Index appears to have snapped a four-day advance, while the Dow Jones Stoxx 600 was trading slightly lower for the second consecutive session following a six-day rally.

Read More »

Read More »

Cool Video: Dollar and Fed

I joined Tom Keene and Marty Schenker (chief content officer) on the set of Bloomberg TV this morning. Schenker discussed some of the geopolitical issues in the Middle East, and Keene asked about the impact on the dollar. I expressed my concern that the chief threat to the dollar's role in the world economy is the several administrations have increasing weaponized access to the dollar and the dollar funding market.

Read More »

Read More »

FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU.

Read More »

Read More »

FX Daily, October 24: Flash PMIs Disappoint Despite Negative Interest Rates

Overview: As the UK awaits the EU's decision on its request, disappointing flash PMI readings Japan, Australia, and Germany have filled the news vacuum. Sweden's Riksbank retained a hawkish tone while keeping rates on hold, and Norway's Norges Bank also stood pat. The market expects Turkey to deliver a rate cut, while the ECB meeting is Draghi's last at the helm.

Read More »

Read More »

FX Weekly Preview: Same Three Drivers in the Week Ahead but Changing Tones

Three themes have dominated the investment climate: US-China tensions, Brexit, and the policy response to the disinflationary forces. None have been resolved, which contributes to the uncertainty for businesses, households, and investors. However, the negativity that has prevailed is receding a little.

Read More »

Read More »

FX Daily, October 9: Hope is Trying to Supplant Pessimism Today

Overview: The 1.5% drop in the S&P 500 and the deterioration of US-China relations and the prospects of a no-deal Brexit failed did not carry over much into today's activity. Asia Pacific equities were mostly a little lower, though China and India bucked the regional trend, while Korea was closed for a national holiday. Taiwan led the losses amid a sell-off in semiconductor stocks.

Read More »

Read More »

FX Weekly Preview: China Returns, ECB Record, Fed Minutes and the Week Ahead

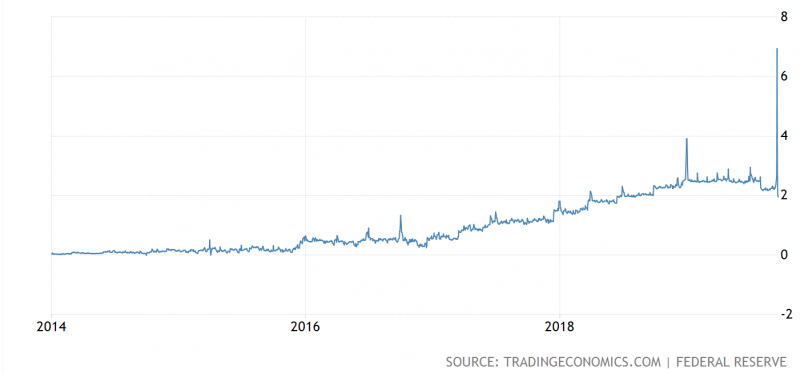

Many high-income countries experienced little growth but strong price pressures in the 1970s. Since the mainstream economics said the two were mutually exclusive, a new term had to be created, hence stagflation. Fast forward almost half a century later, and mainstream economists are still having a problem deciphering the linkages between prices and economic activity, such as inflation and employment.

Read More »

Read More »

FX Daily, October 2: Greenback Shows Resiliency, Stocks Don’t

Shockingly poor ISM data sent shivers through the market on Tuesday and hand the S&P 500 its biggest loss in five weeks and took the shine off the greenback. The S&P 500 reached a five-day high before reversing course and cast a pall over today's activity. All the markets were lower in Asia Pacific, with China and India closed for holidays.

Read More »

Read More »

FX Weekly Preview: Forces of Movement at the Start of Q4 19

The world's largest economy appears to have grown by about 2% in Q3 at an annualized pace, the same as in Q2, and in line with what many Fed officials understand to be trend growth. The strength of the US labor market underpins consumption, the powerful engine of the US economy. The latest readings of both the labor market and consumption will highlight the economic data in the week ahead.

Read More »

Read More »

FX Daily, September 20: UK and India Provide Excitement Ahead of the Weekend

Overview: A word of optimism on a Brexit deal has sent sterling to its best level in two months. Corporate tax cuts sparked a more than 5% rally in Indian stocks as the week draws to a close. The MSCI Asia Pacific Index snapped a four-day losing streak to pare this week's decline. Europe's Dow Jones Stoxx 600 was flat for the week coming into today, and its four-week advance is at stake.

Read More »

Read More »

FX Daily, September 19: Investors Looking for New Focus

Overview: Central bank activity is still very much the flavor of the day, but investors are looking for the next focus. The Bank of Japan and the Swiss National Bank stood pat, while Indonesia cut for the third consecutive time and the Hong Kong Monetary Authority and Saudi Arabia quickly followed the Fed. Brazil cut its Selic rate yesterday by 50 bp as widely expected.

Read More »

Read More »

FX Daily, September 18: FOMC Meets Amid Money Market Pressures

Overview: News that Saudi Arabia was able to restore 40%-50% of the oil capacity lost by the weekend strike coupled with the Fed's efforts to offset the squeeze in the money markets are allowing the global capital markets to trade quietly ahead of the conclusion of the FOMC meeting. Equities are little changed with a lower bias that has been seen in the first few sessions this week.

Read More »

Read More »