Tag Archive: Eurozone

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »

Otmar Issing’s new book on the euro crisis

We well remember when the über-bailouter of the Financial Times Wolfgang Münchau claimed that except some old economy professors like Otmar Issing nobody in Germany would like to abolish the euro. According to Münchau the euro can be saved only via a fiscal and a banking union. The response to Münchau’s post could be … Continue reading...

Read More »

Read More »

How Switzerland Implicitly Joins the Eurozone: SNB Obliges each Swiss to Invest 73% of 2012 income in Euros

The SNB forces each Swiss to invest 73% of each one's yearly income into Euros. Reason enough to join the Euro zone ?

Read More »

Read More »

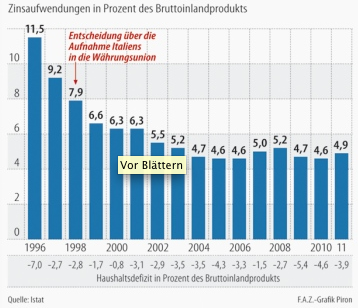

Guest Post: Six Reasons Why Italy May Exit the Euro Before Spain; Ultimate Occupy Movement

Six Reasons Why Italy May Exit Before Spain

1) Rise of the Five Star Movement

2) 44% of Italians view the euro negatively, only 30% favorably. That is biggest negative spread in the eurozone. In Spain more view the euro positively than negative, albeit by a small 4 percentage point spread.

Read More »

Read More »

Wolfgang Münchau, FT: Merkel was the winner of the Euro summit

Wolfgang Münchau endorsed many of our arguments Wolfgang Münchau, Financial Times, has endorsed many of our arguments of our Friday's opinion about the Euro summit where we stated that there was nothing really new. Münchau even claims that "The real victor in Brussels was Merkel."

Read More »

Read More »

At the Euro summit there was nothing really new. What was the party about ?

At the euro summit today there was essentially nothing what was really surprising. We wonder what markets are so excited about.

Read More »

Read More »

Spread Swiss Eidgenossen vs. German Bund to see further gains

The spread between the Swiss government Eidgenossen bond against the Germany 10yrs. Bund will see further gain in the future, after the Euro summit opened the door for ESM direct financing of banks. Differences between EFSF and ESM explained

Read More »

Read More »

Can Merkel stop the Eurobonds ? German “Der Focus” on Eurobonds

The German "Der Focus",one of the most successful weekly magazines, titles "Can Merkel stop the Eurobonds ?" Der Focus claims that Eurobonds have the following issues:

Read More »

Read More »

Eurobonds, fiscal union or banking union are all pure utopia

Eurobonds are light years away.Germany wants the following order: 1) Euro Plus Pact 2) Fiscal Compact 3) ESM 4) Political union 5) Fiscal union 6) Eurobonds

Read More »

Read More »

Is the SNB prepared for the black swan ?

Will the SNB printing policy lead to inflation and a housing bust when Germany leaves the Euro ? Recently the voices for a German euro exit have become louder and louder. The most recent voice comes from Biderman , the FT says that the rise of German Bunds holds the secret how the eurozone crisis will … Continue reading...

Read More »

Read More »

The Northern Euro introduction: A retrospective from the year 2030

A retrospective from the year 2030 on two decades of failed european integration policy and 10 years of successful disintegration policy The following essay shows that currency regimes come and go over the time. Nothing is stable with the time, especially the use of a currency. What has never happened in history is the use …

Read More »

Read More »

Italy: About the Hypocrisy of Politicians and the Blindness of the English-Speaking Financial Papers

Just a little wrap-up of two tweets read in 5 minutes, to which I finally added a bit more out of my recent Tweets. One Tweet: The British finance minister Osborne has emphasized that the euro zone needs to protect its peripheral economies. “The whole of Europe needs to become more competitive and productive. That …

Read More »

Read More »

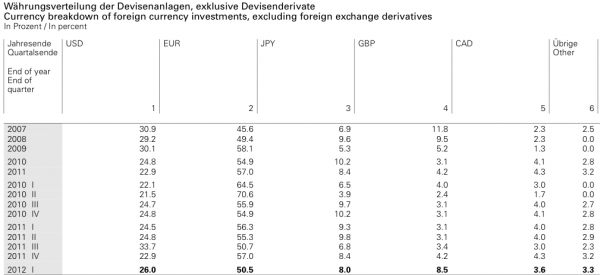

Is the SNB pegging away from the Euro to the SDR currency basket using their FX reserves ?

We reckon that the central bank has introduced an automatic peg mechanism which obliges them to buy euros at exactly 1.2010 and sell euros above this level (reasons and details here). If they sold more euros than they bought, they are happy to have offloaded some items of their overloaded balance sheet. If they bought more euros than they sold, however, there are some "superfluous" euros. Instead putting these euros on their balance sheet, they...

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »