Tag Archive: Eurozone Services PMI

The Service PMI release is published monthly by Markit Economics. The data are based on surveys of over 400 executives in private sector service companies. The surveys cover transport and communication, financial intermediaries, business and personal services, computing & IT, hotels and restaurants.

FX Daily, May 23: Greenback Remains Soft

The US dollar cannot get out of its own way, it seems. With a light economic schedule, there is little to offset the continued drumbeat of troubling political developments. The latest turn, as reported first in the Washington Post, that President Trump asked heads of intelligence groups to also publicly deny collusion with Russia.

Read More »

Read More »

FX Daily, May 04: Greenback Struggles to Sustain Upticks, Though Odds of June Hike Rise

The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation estimates the market is discounting around 70%-75% chance of a hike.

Read More »

Read More »

FX Daily, April 21: Markets Enter Consolidative Mode Ahead of Weekend

Neither the terrorist attack in Paris nor the strong eurozone flash PMI has managed to shake investors. Judging from the social media, many suspect that the terrorist attack plays into Le Pen's hands, but investors do not seem particularly concerned. The French interest rate premium over Germany has narrowed, and gold is flat. UK retail sales fell sharply, yet sterling is holding on to the bulk of this week's gains, which are the most here in 2017.

Read More »

Read More »

FX Daily, April 05: Dialing it Up on Hump Day

he dollar is practically unchanged against the euro and yen in the first two sessions of the week. The pace can be expected to pick up starting Wednesday. Although the euro slipped through $1.0650, it was not sustained, and on Monday and Tuesday, the euro finished near its highs.

Read More »

Read More »

FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

The US dollar has been stabilizing over the past couple of sessions. This broad stability of the dollar is impressive because of the questions of the prospects of US President Trump's economic agenda. Expectations for tax reform and infrastructure spending have bolstered investor confidence and helped boost equity prices despite what appears to be stretched valuation.

Read More »

Read More »

FX Daily, March 03: Yellen and Jobs Report Last Two Hurdles to US Hike

The US dollar is narrowly mixed as Yellen's speech in Chicago is awaited. The greenback's three-day advance against the euro and four-day advance against the yen is at risk. The dollar-bloc currencies, where speculators in the futures market had gone net long, continue to underperform.

Read More »

Read More »

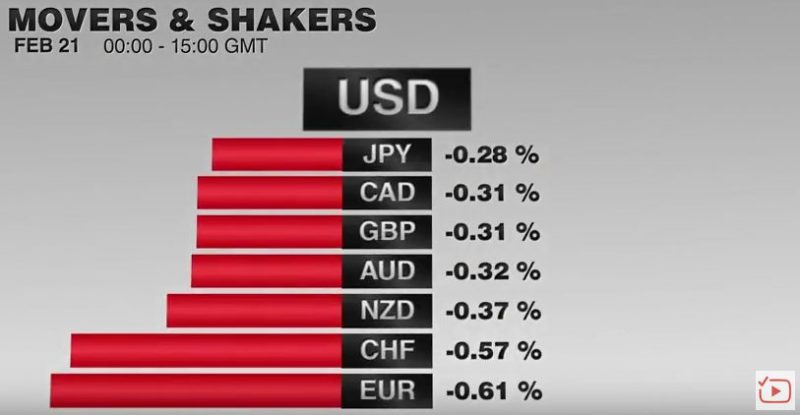

FX Daily, February 21: Dollar Bounces Back

Some profit-taking in the middle of last week pushed the dollar lower and gave rise in some quarters that the run was over. However, the greenback has come back the bid. It is gaining against all the major currencies today and most of the emerging market currencies.

Read More »

Read More »

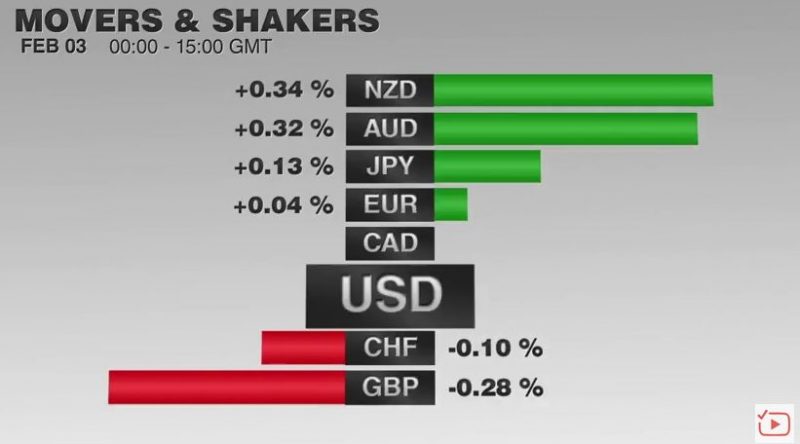

FX Daily, February 03: US Jobs Trump Europe’s Service PMIs

Ahead of the weekend, there are two series of economic reports. The first are Europe's service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

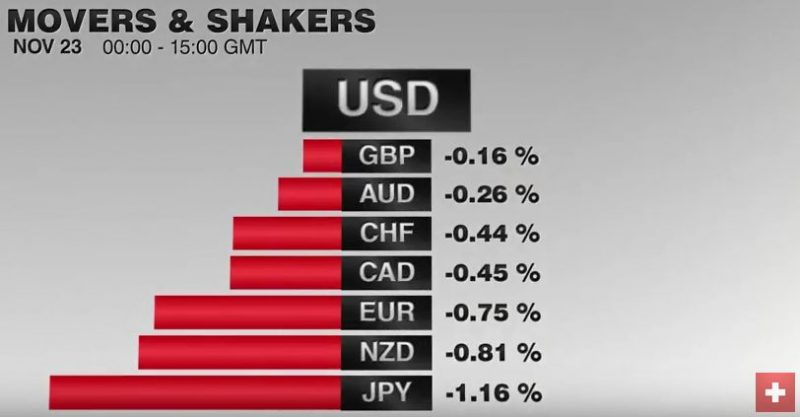

FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

The US dollar is trading inside yesterday's ranges against the euro and yen. The dollar's tone matches the consolidation in the debt market ahead of today's slew of US data and tomorrow's holiday. Tokyo markets were on holiday.

Read More »

Read More »

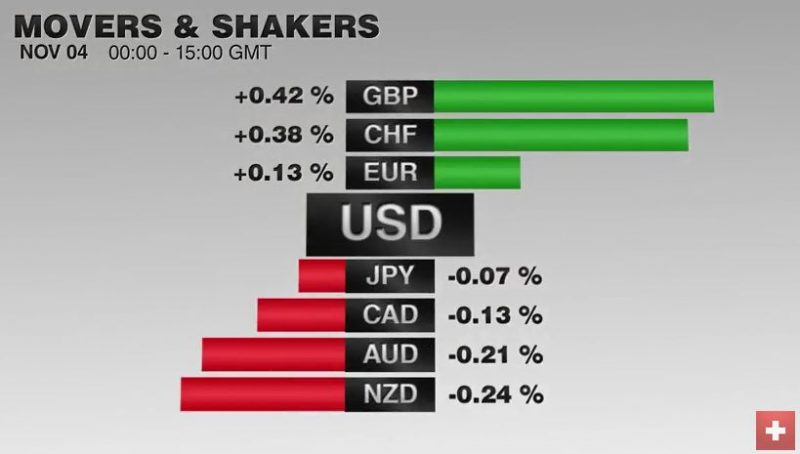

FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions

Read More »

Read More »

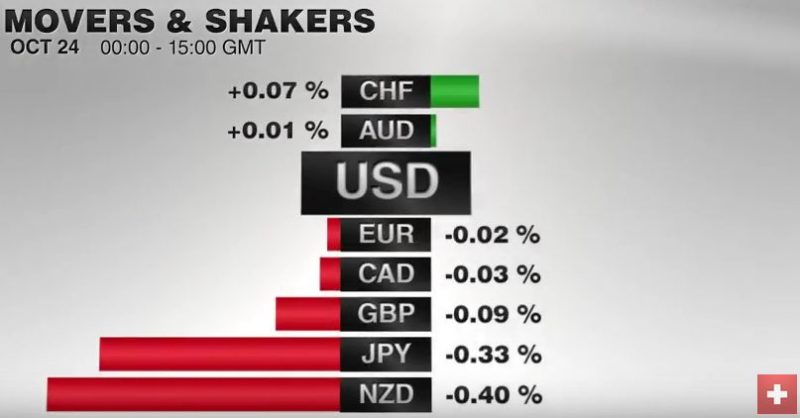

FX Daily, October 24: Dollar Begins Mostly Slightly Lower, and Risk is On to Start the Week

Sterling vs the Swiss Franc has remained close to its lowest level in history caused by the aftermath of the Brexit vote back in June and more recently the announcement that Article 50 will be triggered by March 2017. Confidence in Sterling exchange rates has plummeted recently and until we get some form of assurances as to how the talks may go with the European Union we could see Sterling fall even further against the Swiss Franc than its current...

Read More »

Read More »

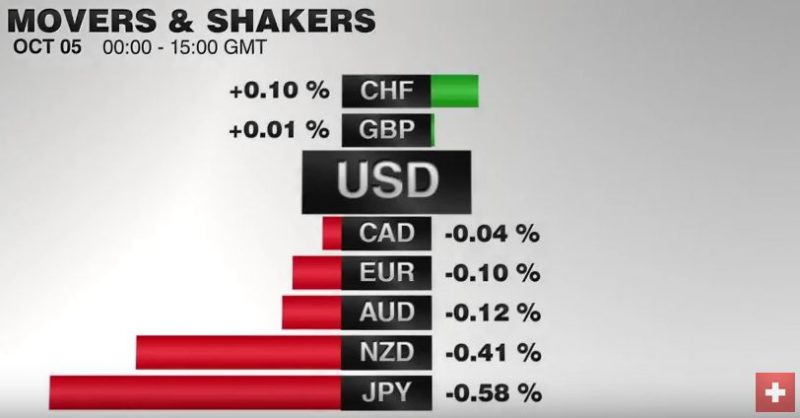

FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

After the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. Traders that moved with the SNB Window Dressing for Q3 are closing their shorts again.

Read More »

Read More »

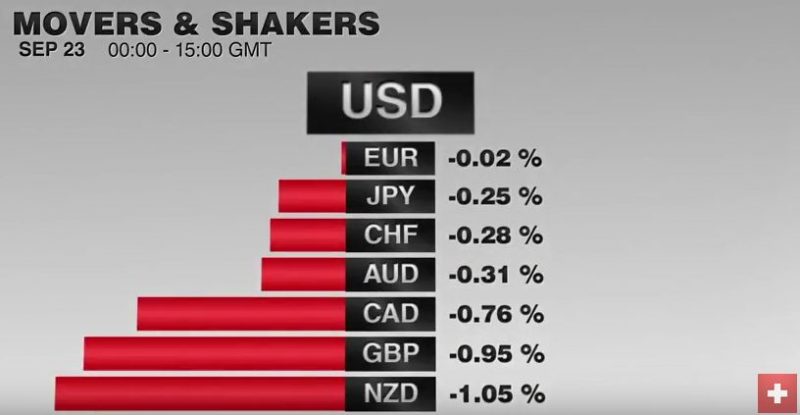

FX Daily, September 23: It is Friday and the Dollar is Firmer Again

As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged.

Read More »

Read More »

FX Daily, September 5: While Americans were Celebrating Labor Day

There were several developments that took place while US markets were closed for its Labor Day holiday. Most of the economic news was favorable. This included a strong snap back in the UK service PMI, more evidence that the moral suasion campaign to lift wages in Japan is yielding some success and a rise in the Caixin's China's service PMI.

Read More »

Read More »

FX Daily, August 03: Consolidation Featured

The US dollar is consolidating yesterday's losses. The greenback's upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week's RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week.

Read More »

Read More »

FX Daily, July 05: Sterling Hammered to New Lows, Yen Pops, SNB intervenes

The British pound has been hammered to fresh lows just above $1.3115. The euro is moving toward GBP0.8500. The immediate catalyst is three-fold. First, one of the UK's largest property funds has moved to prevent retail liquidation. Second, the BOE reversed an earlier decision on the capital buffer for banks, which is tantamount to easing policy by boosting the banks' lending capability by as much as GBP150 bln.

Read More »

Read More »

FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK's referendum is underway. The capital markets are

continuing the move that began last week with the murder of UK MP Cox.

The tragedy seemed to mark a shift in investor sentiment. Sterling

bottomed on June 17 just ahead...

Read More »

Read More »