Tag Archive: Eurozone Markit Composite PMI

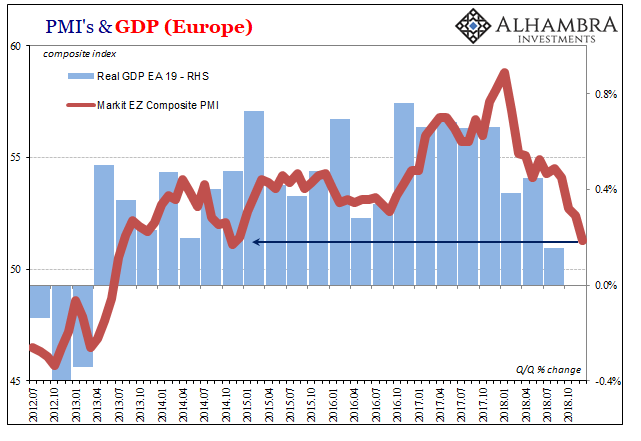

The PMI monthly Composite Reports on Manufacturing and Services are based on surveys of over 300 business executives in private sector manufacturing companies and also 300 private sector services companies. Data is usually released on the third working day of each month. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Replies from larger companies have a greater impact on the final index numbers than those from small companies. Results are presented by question asked, showing the percentage of respondents reporting an improvement, deterioration or no change since the previous month. From these percentages, an index is derived: a level of 50.0 signals no change since the previous month, above 50.0 signals an increase (or improvement), below 50.0 a decrease.

Europe’s Woes Multiply

The Markit group that provides many of the PMI surveys noted with today's reports that the eurozone outlook has "darkened dramatically." This makes for a poor backdrop for the ECB, which meets next week. However, with price pressures recovering from the Easter-related distortions, the ECB is still on track to finish its asset purchases at the end of the year. This seems largely taken for granted.

Read More »

Read More »

FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

The British pound is benefiting from the stronger than expected service and composite PMI readings, which among other things are serving as a distraction from the government's seemingly tortured approach to Brexit and the sales of part of its stake in RBS for a GBP2 bln loss. Financials are a drag on the FTSE 100 today (~-0.5% while other major bourses are higher).

Read More »

Read More »

The Currency of PMI’s

Markit Economics released the flash results from several of its key surveys. Included is manufacturing in Japan (lower), as well as composites (manufacturing plus services) for the United States and Europe. Within the EU, Markit offers details for France and Germany.

Read More »

Read More »

FX Daily, May 23: Dollar and Yen Surge, European Data Disappoints

The US dollar has extended its gains against most of the major currencies. Momentum, positioning, and divergence continue to drive it. The euro briefly traded a little below $1.17, an important technical area and has enjoyed a bounce in late morning turnover in Europe.

Read More »

Read More »

FX Daily, May 04: US Jobs-Not the Driver it Once Was

The US dollar fell last month in response to the disappointing non-farm payroll report. However, in general, the jobs report is not the market mover that it was in the past. With unemployment is at cyclical lows of 4.1% and poised to fall further. Weekly jobless claims and continuing claims at or near lows in a generation, though over qualification is more difficult than previously.

Read More »

Read More »

FX Daily, April 23: Rising Rates Help Extend Dollar Gains

The new week has begun much like last week ended, with rising rates helping to extend the dollar's recent gains. The US 10-year yield is flirting with the 3.0% threshold. The two-year yield is firmer, and, like in the second half of last week, the US curve is becoming a little less flat. The market, as we had anticipated, was not so impressed with North Korea's measures, and Korea's Kospi edged lowed, and the region-leading KOSDAQ fell a little...

Read More »

Read More »

FX Daily, April 05: Investors Find Comfort in Brinkmanship Blinks

Global equity markets are higher, following the stunning recovery in the US yesterday, where the S&P 500 rallied 76 points or 3% from its lows to it highs, near where it finished. The outside up day is seeing following through today. Without China and Hong Kong, which are on holiday, the MSCI Asia Pacific Index snapped a three-day down draft and closed 0.55% higher.

Read More »

Read More »

FX Daily, March 22: Dollar Trades Off

The US dollar has not recovered from the judgment that yesterday's that Fed was not as hawkish as many had anticipated. There was no indication that officials thought they were behind the curve or prepared to accelerate the pace of hikes. Powell is comfortable with the broad policy framework that has been established but seemed to have little time for the summing up of the individual forecasts (dot plot).

Read More »

Read More »

FX Daily, March 05: Italian Election Weighs on Italian Assets, but Little Systemic Risk Seen

The US dollar is narrowly mixed. The Japanese yen remains firm. The dollar appears stuck in a narrow range. Near JPY105.20 the seems to be some short-covering pressure in front of JPY105. On the top side, the greenback is encountering offers in front of JPY105.80. Sterling is firm against the dollar as it recovers against the euro. Before the weekend, the euro reached GBP0.8950, its best levels since last November. The euro is testing GBP0.8900...

Read More »

Read More »

FX Daily, February 21: Markets Mark Time

The economic data stream is picking up, but there is an uneasy calm in the markets. It is almost as if the dramatic drop in stocks has left many with a sense of incompleteness, like waiting for another shoe to drop. The price action has not clarified the situation very much. The equity markets are stalling in front of important chart points as are yields and the dollar.

Read More »

Read More »

FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past nine sessions. The notable exception in Asia was the Shanghai Composite. The 0.75% was led by the financial sector amid talk that a report later this week will show a strong jump in yuan lending from banks, which...

Read More »

Read More »

FX Daily, January 24: Dollar Takes Another Leg Lower

North American session sold into the dollar's upticks and Asia followed suit, taking the greenback to new multi-year lows against the euro and sterling while pushing it below the JPY110 level for the first time since last September. US trade action has become latest element of the narrative the seeks to explain the dollar's slide and the decoupling of the greenback from interest rates.

Read More »

Read More »

FX Daily, January 04: Greenback Continues to Consolidate Recent Losses

The US dollar is sporting a softer profile across the board, though remaining largely in the ranges seen over the past couple of sessions. At the same time, the news stream suggests that the global synchronized growth cycle strengthened late last year and is bound to carry over into the New Year.

Read More »

Read More »

FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment forecasts. Yet its interest rate trajectory and inflation forecasts were largely unchanged. Yellen, as her recent predecessors have done, played down the implications of the flattening of the yield curve.

Read More »

Read More »

FX Daily, December 05: Sterling Sold on Negotiating Snafu, Aussie Bounces on Retail Sales and RBA

The US dollar is confined to narrow ranges against the euro and yen, straddling unchanged levels in the Asian session and the European morning. The action in elsewhere. The British pound is the weakest of the majors, paring 0.4% against the greenback, though around $1.3425, it can hardly be considered weak. A month ago, sterling was a few cents lower. Still, its gains reflected two things: broader dollar weakness and optimism on Brexit talks.

Read More »

Read More »

FX Daily, October 24: Dollar Treads Water as 10-year Yield Knocks on 2.40percent

The US dollar is narrowly mixed in mostly uneventful turnover in the foreign exchange market. There is a palpable sense of anticipation. Anticipation for the ECB meeting on Thursday, which is expected to see a six or nine-month extension of asset purchases at a pace half of the current 60 bln a month. Anticipation of the new Fed Chair, which President Trump says will be announced: "very, very soon."

Read More »

Read More »

FX Daily, October 04: Consolidative Tone in FX Continues

The US dollar has a softer tone today, and it was that way even for the European PMI. The greenback eased further after the upside momentum faded yesterday. The heavier tone in Asia seemed spurred by a hedge fund manager's call that Minneapolis Fed President, and among the most dovish members of the FOMC, Kashkari would be the next Fed chair.

Read More »

Read More »

FX Daily, September 22: Markets Limp into the Weekend

The cycle of sanctions, recriminations, and provocative actives continues as the Trump Administration leads a confrontation with North Korea. The US announced yesterday new round of sanctions on North Korea. Reuters reported that the PBOC has instructed its banks not to take on new North Korean clients and to begin unwinding existing relationships.

Read More »

Read More »

FX Daily, September 5: Greenback Mixed, North Korea and PMIs in Focus

Reports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new sanctions, keep investors on edge. Risk assets are mixed. Gold is slightly lower. While the yen is stronger, the Swiss franc is heavier. Asia equities slipped, and European shares are recouping much of yesterday's 0.5% loss.

Read More »

Read More »

FX Daily, August 23: Consolidation in Capital Markets Conceals Coming Turbulence

A mixed US dollar will greet the North American participants today. It is softer against the euro and yen, but firmer against the dollar-bloc currencies. Among the emerging market currencies, the eastern and central European currencies are moving higher in the euro's draft.

Read More »

Read More »