Tag Archive: Euro

FX Weekly Review, October 24-28: October Surprise Pushes Open Door

The Swiss Franc Index could recover some of the losses as compared to the US dollar index. Still the USD/CHF remains above 0.99. The US dollar rose against most of the major currencies last week, but the upside momentum appeared to be dissipating, even before the FBI's announcement about new Clinton emails. There are a few exceptions like the greenback's performance against the Japanese yen, Canadian dollar, and Swedish krona. The dollar made new...

Read More »

Read More »

FX Weekly Review, October 17-21: Golden Cross in Dollar Index and Deadman’s Cross in the Euro

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

FX Weekly Review, October 10-14: Rates Still Key to Dollar’s Outlook

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

FX Weekly Review, October 03-07: Dollar Profits on Strong ISM Index

The Franc index lost considerably in the last week, in particularly in comparison to the dollar index. Reason was the exceptionally strong U.S. ISM Non-Manufacturing Index.

Read More »

Read More »

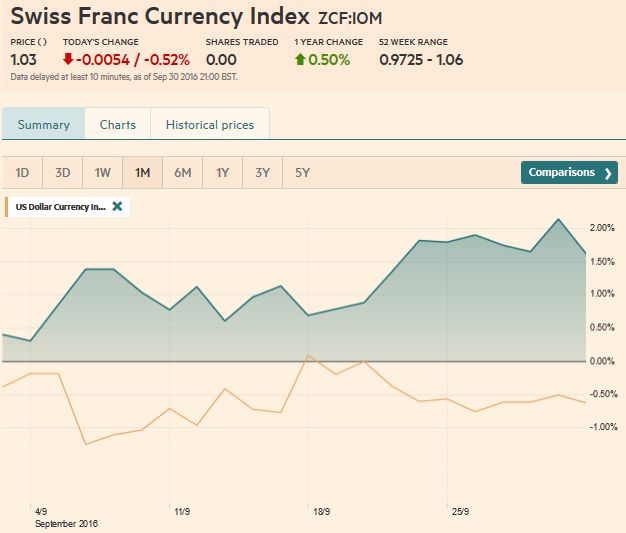

FX Weekly Review, September 26-30: Dollar vulnerable at the Start of Q4, CHF collapses at Quarter End

The US dollar fell against most of the major currencies in Q3. The Norwegian krone was the best performer, gaining 4.4% against the greenback, followed by Aussie and Kiwi. The Swiss Franc collapsed on Friday at quarter end.

Read More »

Read More »

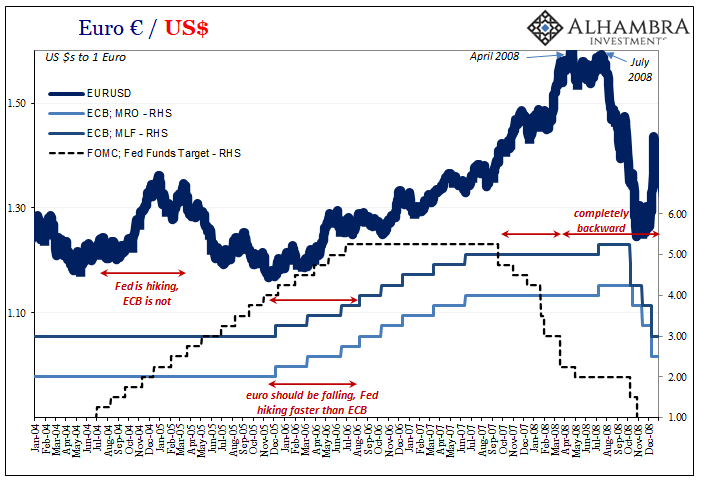

FX Weekly Review, September 12 – 16: U.S. Dollar Resilience Despite Hawkish ECB and bad ISM

The dollar was surprisingly strong this week. This despite a more hawkish ECB, bad U.S. economic data in the ISM surveys.

Read More »

Read More »

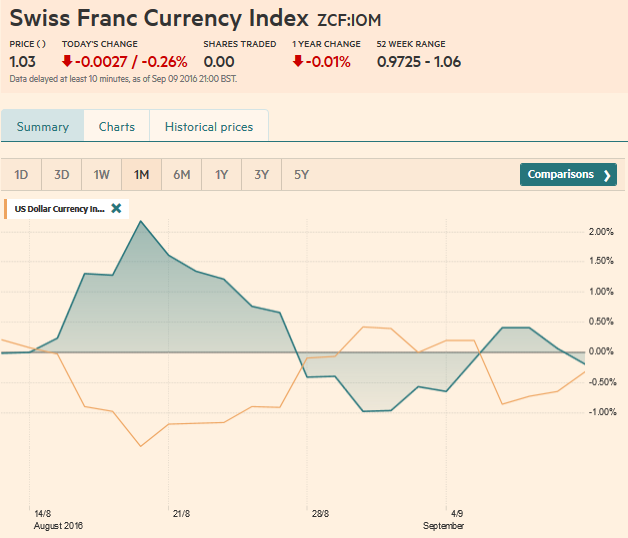

FX Weekly Review, September 05 – September 09: Dollar Proves Resilient as Market Rates Rise

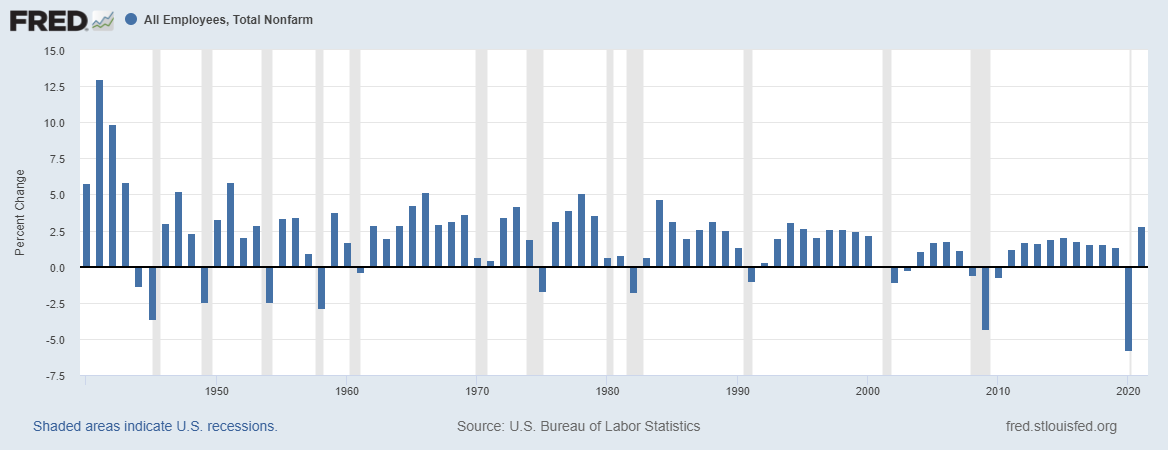

It took the market a few days to overcome the shockingly poor non-manufacturing ISM (51.4 vs. 55.5). However, by the end of the week, the US dollar bulls had regained the upper end.

Read More »

Read More »

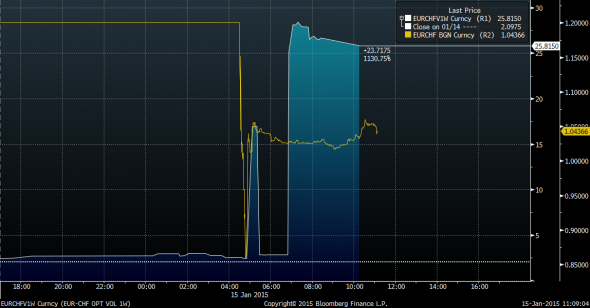

What did the SNB do to EURCHF options markets?

The Swiss National Bank made G10 FX a lot more fun to watch today. One interesting thing is how the options markets responded. Via Jared Woodard of BGC, here’s a chart comparing the move in one-week implied volatility in the exchange rate between the...

Read More »

Read More »

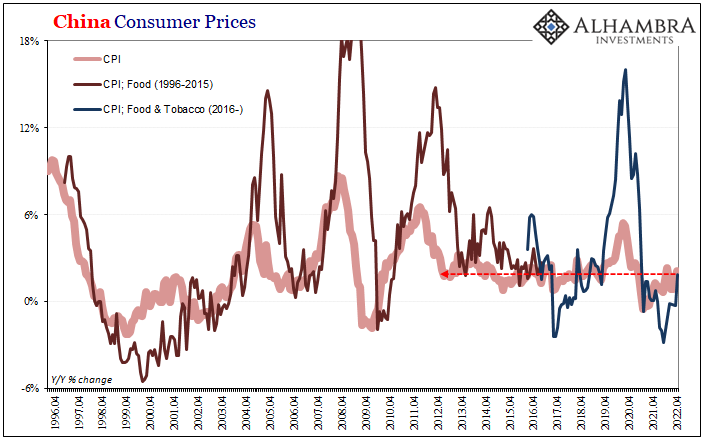

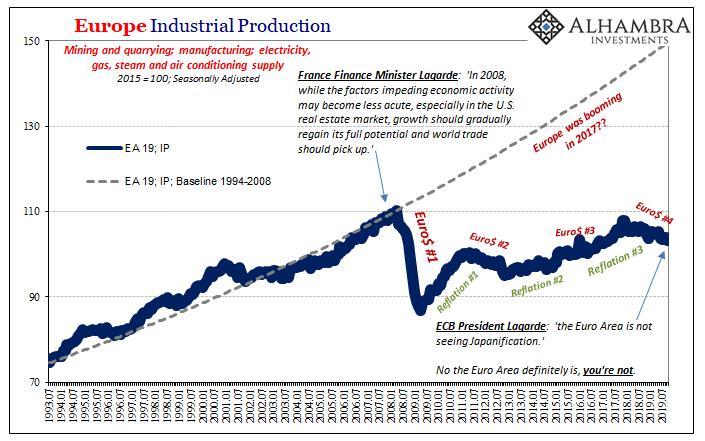

When FX wars become negative interest wars

Beat Siegenthaler, FX strategist at UBS, has been wondering about what the Swiss National Bank may do if the ECB’s measures to weaken the euro begin to test its 1.20 EURCHF floor. He notes, for example, that there has already been a marked divergence...

Read More »

Read More »