Tag Archive: EUR/USD

FX Weekly Review, October 17-21: Golden Cross in Dollar Index and Deadman’s Cross in the Euro

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

FX Weekly Review, October 10-14: Rates Still Key to Dollar’s Outlook

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

FX Weekly Review, October 03-07: Dollar Profits on Strong ISM Index

The Franc index lost considerably in the last week, in particularly in comparison to the dollar index. Reason was the exceptionally strong U.S. ISM Non-Manufacturing Index.

Read More »

Read More »

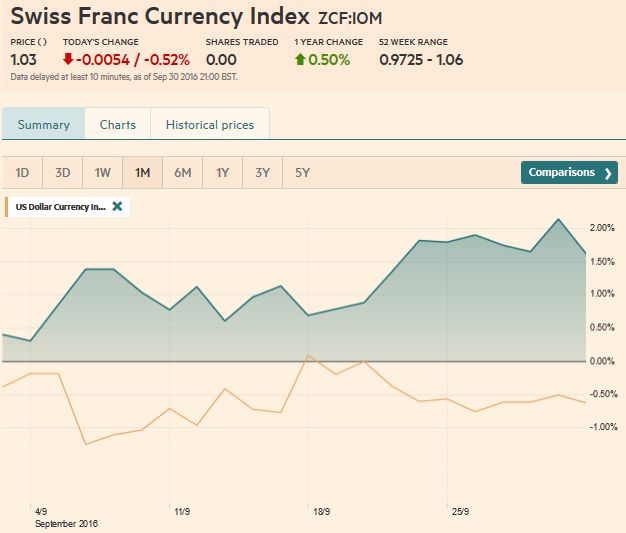

FX Weekly Review, September 26-30: Dollar vulnerable at the Start of Q4, CHF collapses at Quarter End

The US dollar fell against most of the major currencies in Q3. The Norwegian krone was the best performer, gaining 4.4% against the greenback, followed by Aussie and Kiwi. The Swiss Franc collapsed on Friday at quarter end.

Read More »

Read More »

FX Weekly Review, September 12 – 16: U.S. Dollar Resilience Despite Hawkish ECB and bad ISM

The dollar was surprisingly strong this week. This despite a more hawkish ECB, bad U.S. economic data in the ISM surveys.

Read More »

Read More »

FX Weekly Review, September 05 – September 09: Dollar Proves Resilient as Market Rates Rise

It took the market a few days to overcome the shockingly poor non-manufacturing ISM (51.4 vs. 55.5). However, by the end of the week, the US dollar bulls had regained the upper end.

Read More »

Read More »

FX Weekly Review, August 29 – September 2: Disappointing Jobs Data Doesn’t Break the Buck

During this week the Swiss Franc index lost against both dollar and euro. The CHF index ended one percent down. Despite not convincing US jobs, the dollar index ended in positive territory.

Read More »

Read More »

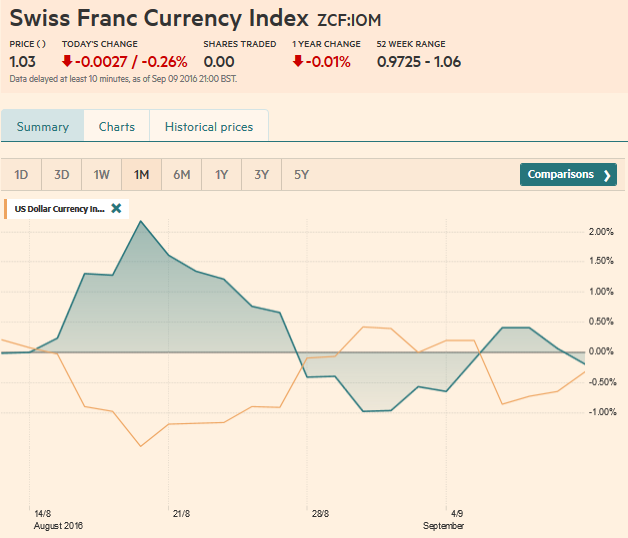

FX Weekly Review, August 22 – August 26: Swiss Franc Loses Most Gains Again

After winning 5% against the dollar index last week, the Swiss Franc index lost 3% again. CHF lost against both USD and EUR. Reason: An increased probability of a rate hike in the U.S.

Read More »

Read More »

FX Weekly Review, August 15 – August 19: Swiss Franc index improves 5% compared to dollar index

The US dollar lost ground against nearly all the major currencies last week. The sole exceptions were the Australian dollar, where Moody's decision to cut the outlook for five Australian banks wiped out the previous small gain. The Swiss Franc index gained nearly 5% compared to the dollar index.

Read More »

Read More »

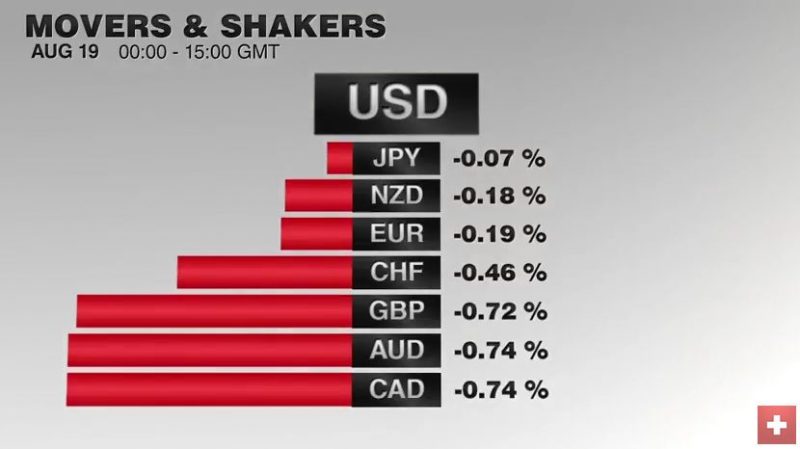

FX Daily, August 19: Dollar Recovers into the Weekend

The US dollar is trading firmly ahead of the weekend as part of this week's losses are recouped. The euro is trading within yesterday's range, holding to a little more than a half-cent above $1.13. However, as we have noted, the Asia and European participants appear more dollar-friendly than Americans

Read More »

Read More »

FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting.

Read More »

Read More »

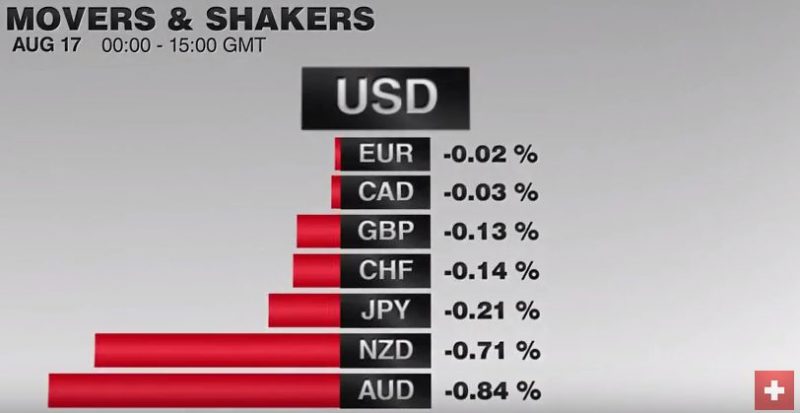

FX Daily, August 17: Dollar Snaps Back

The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley's comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent.

Read More »

Read More »

FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think.

Read More »

Read More »

FX Daily, August 15: Dollar Eases to Start the New Week

The US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable exceptions are the Scandi-bloc, which are consolidating last week's gains, and sterling, which remains pinned near $1.29.

Read More »

Read More »

FX Weekly Preview: Thoughts on the Significance of Ten Developments

The GDP deflator may be just as important as overall growth for BOJ considerations and the possibility of fresh action next month. Falling UK rates and a weaker pound are desirable from a policy point of view.

Dudley's press conference may be more important than FOMC minutes.

Two German state elections that will be held next month comes as Merkel's popularity has waned.

Read More »

Read More »

Weekly Speculative Positions: Switch to Small Net Long CHF

Speculators shifted to a 0.1 long Swiss Franc position in the week of August 9. Speculators reduced their exposure on Euro, CHF and Peso, increased it for NZD, CAD and GBP.

Read More »

Read More »

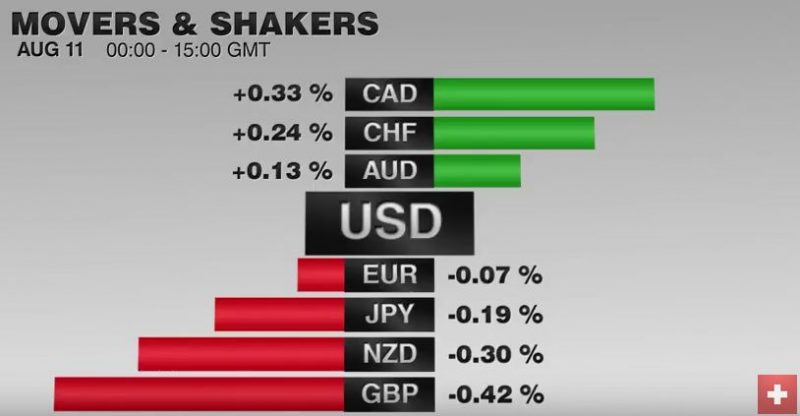

FX Weekly Review, August 08 – August 12: Finally an Improvement of the CHF Index

The CHF index experienced its first good week since many weeks, when we compare it against the dollar index. On a three years interval, the Swiss Franc had a weak performance.

Read More »

Read More »

FX Daily, August 11: Sterling Struggles to Find a Bid, While RBNZ Can’t Knock Kiwi Down

Once again, EUR/CHF reverses in the middle of the week. A part from technical reasons, the weak French CPI (+0.4% YoY) and Italian CPI (-0.2% YoY) exercised downwards pressure on the euro. The US dollar has found steadier footing today after trading heavily yesterday. There are two main themes. The first is sterling’s heavy tone.

Read More »

Read More »

Two Things I Learned Looking for Something Else

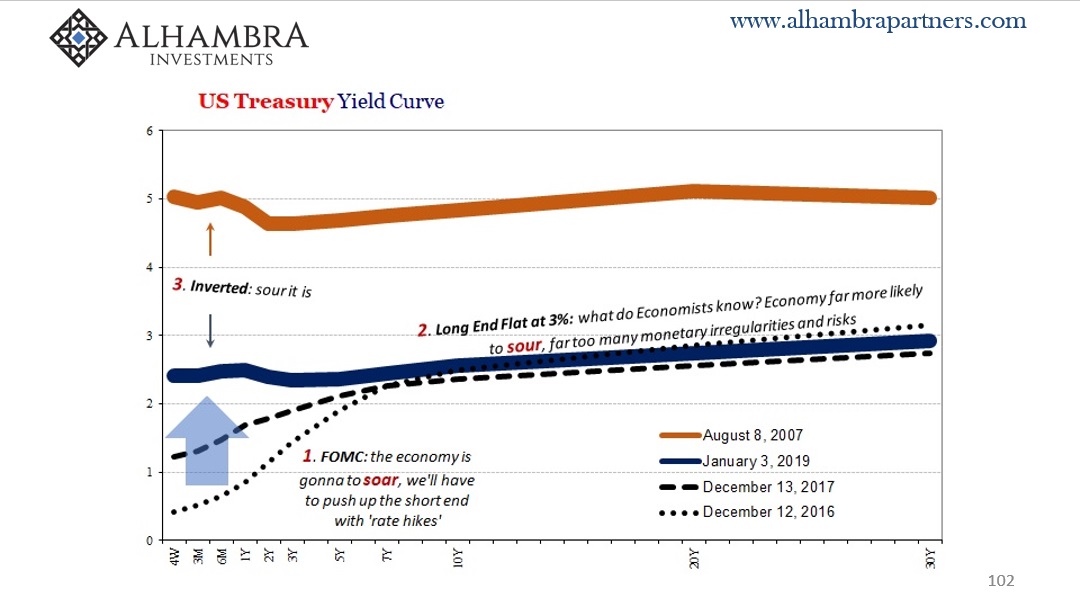

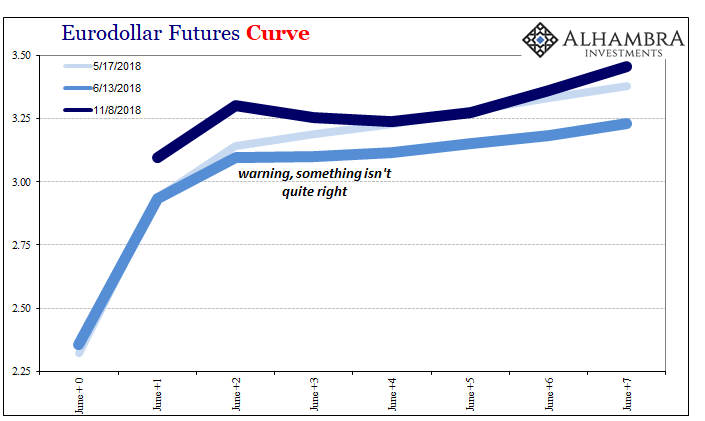

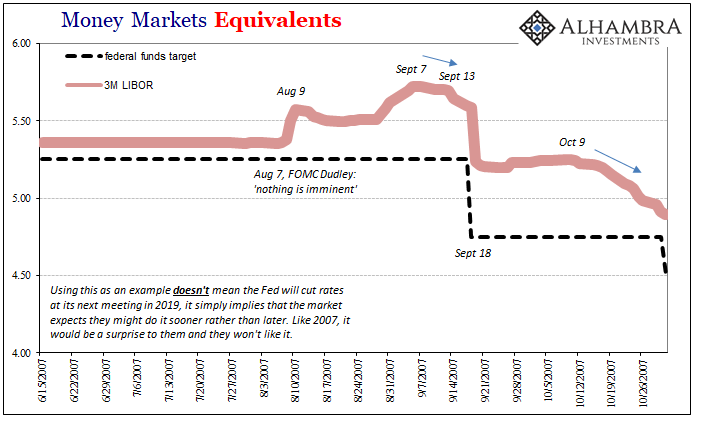

LIBOR continues to rise. The relative calm of the markets will likely end next month. The last four months of the year are jammed with key events that have potential to disrupt the markets.

Read More »

Read More »

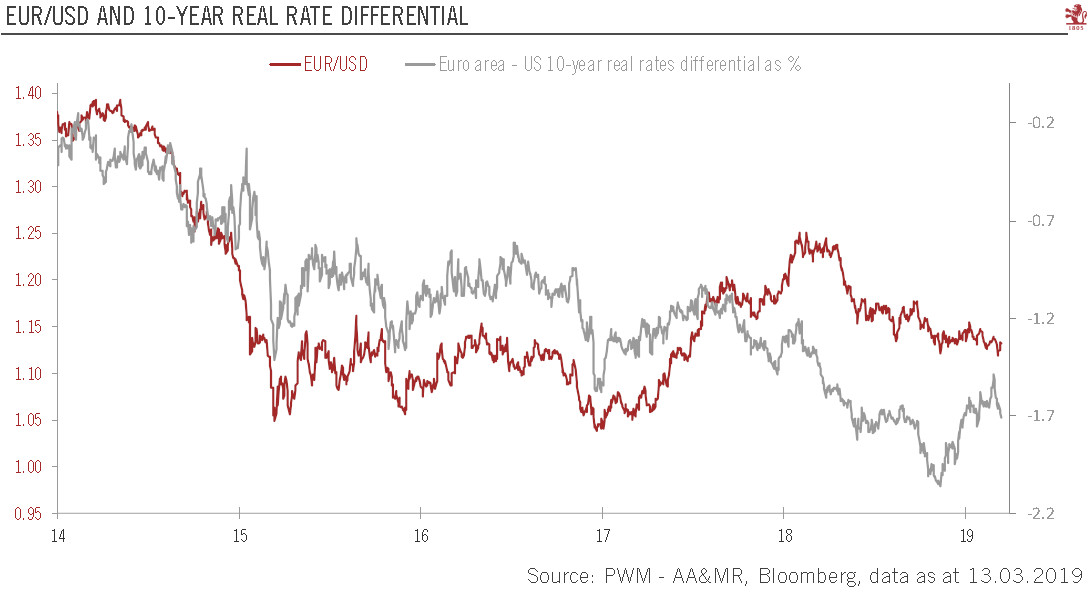

No Fines for Iberia, but Remedial Action Demanded and Possible Loss of Some ESI Funds

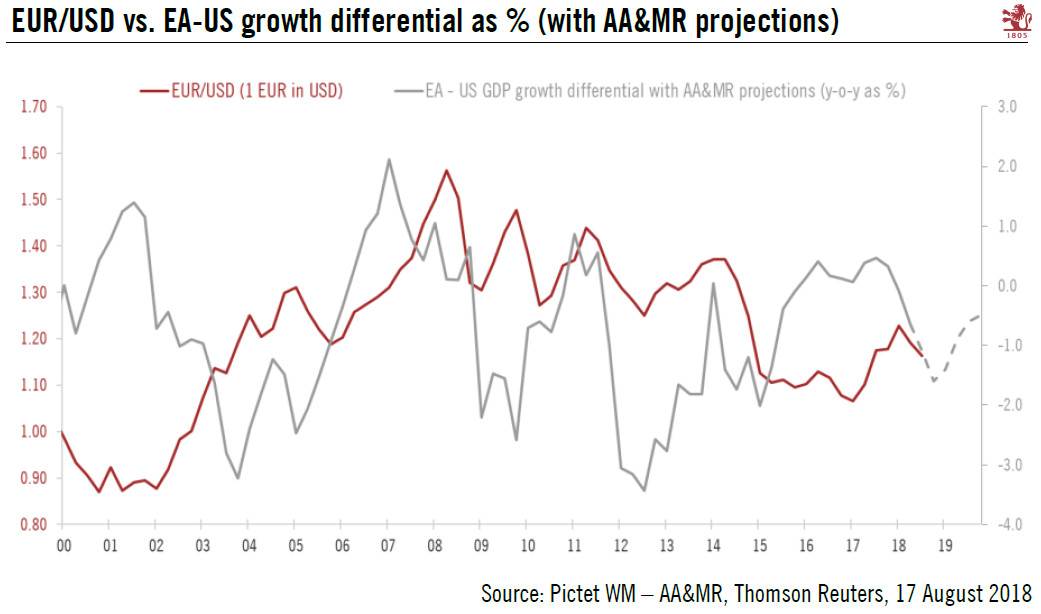

Spain and Portugal need to make some relatively small budget adjustments or will be denied some transfer payments. Spain's political situation is fluid, but another window of opportunity to break the logjam is at hand. The euro seems immune to these fiscal developments; some retracement objectives are in sight.

Read More »

Read More »