Tag Archive: EUR/CHF

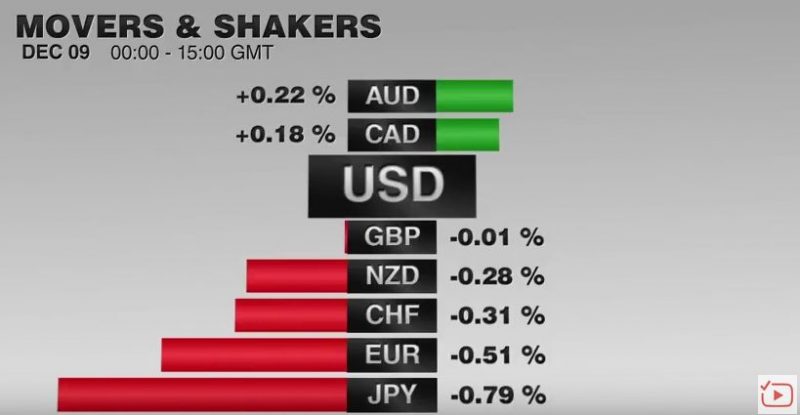

FX Daily, December 09: Euro Chopped Lower before Stabilizing

The euro has stabilized after extending yesterday's ECB-driven losses. The euro's drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week's range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the...

Read More »

Read More »

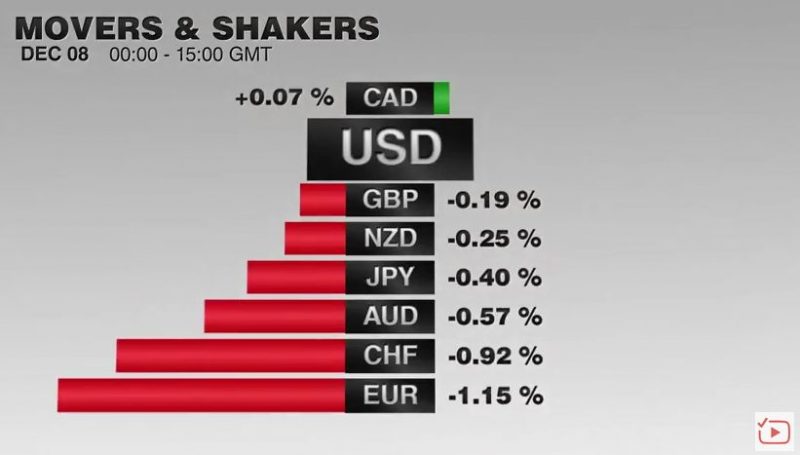

FX Daily, December 08: Dollar Heavy into ECB

The ECB prolonged its bond purchases, which came unexpected for markets. Consequently the EUR/CHF lost nearly half of its big gains that it registered in the beginning of the week. The ECB expects lower inflation for longer, which makes the life for the SNB harder for longer.

Read More »

Read More »

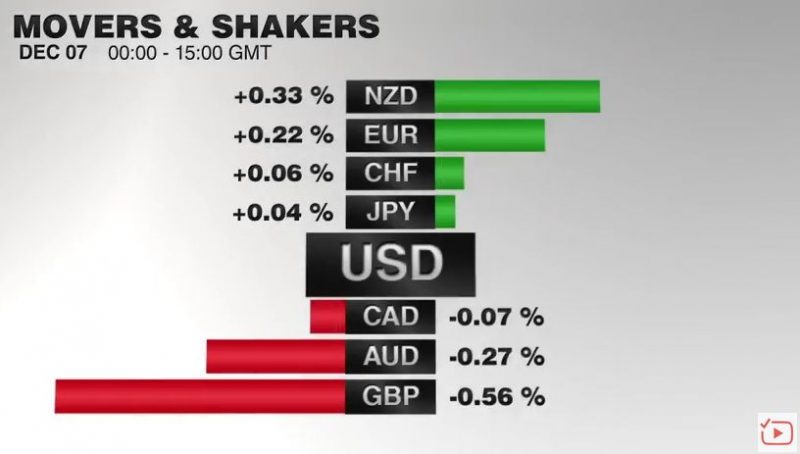

FX Daily, December 07: Greenback is Broadly Steady While Sterling Slides

The US dollar is little changed against most of the major currencies. Sterling is the notable exception, losing about 0.75% to trade at three-day lows. It was on the defensive in early European turnover but got the run pulled from beneath by the unexpectedly poor data. UK industrial output fell by 1.3% in October. The median forecast was for a small increase.

Read More »

Read More »

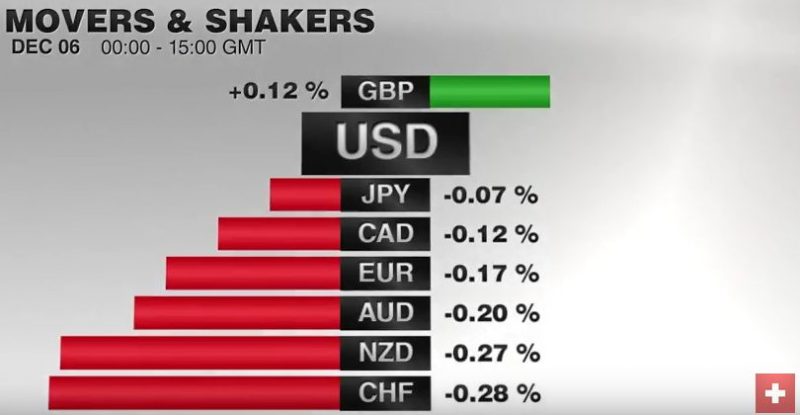

FX Daily, December 06: You Can Almost Hear a Pin Drop

The foreign exchange market is quiet. Ranges are narrow, with the US dollar mostly consolidating against the major currencies. Given the push lower yesterday, the shallowness of its recovery warns of the greenback's downside correction after strong gains last month may not be complete.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

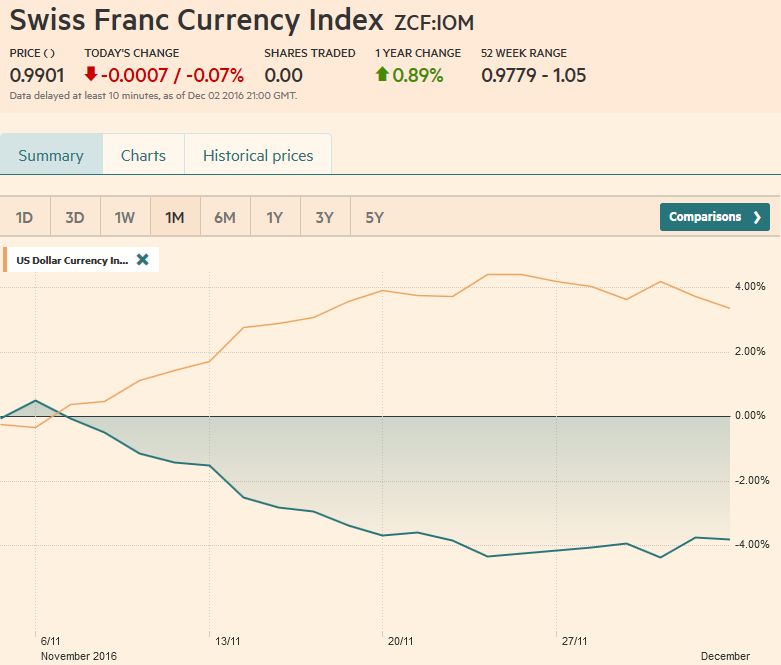

FX Weekly Review, November 28 – December 02: CHF Index still at its 4% loss since U.S. Elections

The Swiss Franc index continued around its 4% loss since the U.S. elections, while the US Dollar index had a 4% increase. The focus shifts to the ECB meeting, where participants are wary of a "hawkish ease".

Read More »

Read More »

FX Daily, December 02: Is it About US Jobs Today?

The capital markets are finishing the week amid speculation that the driving forces of the past three weeks are ebbing. Global equities and the dollar may be snapping three-week advances. The issue is whether it is a consolidation or trend change. The former is a more prudent assumption until proven otherwise. As a rough and ready signal, the 100.60 level in the Dollar Index, which corresponds to the lows November 22 and November 28 is reasonable.

Read More »

Read More »

FX Daily, December 01: Dollar is on the Defensive, though Yields Rise

The US dollar is trading heavily against most of the major currencies, but the general tone appears consolidative in nature. Despite a disappointing UK manufacturing PMI (53.4, a four-month low), sterling is near a three-week high above $1.2600.

Read More »

Read More »

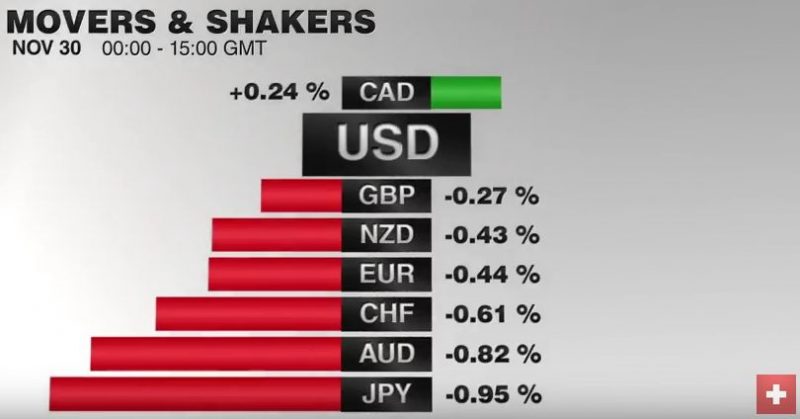

FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked government document titled Have cake and eat it, the markets and sterling were largely unphased.

Read More »

Read More »

FX Daily, November 29: Dollar Comes Back Mostly Firmer, but Focus is Elsewhere

The US dollar correctly lowered yesterday, but most of the selling was over by the end of the Asian session, and the greenback steadied in Europe and North America. The dollar is firm against the euro and yen but within yesterday's broad trading ranges. The Australian and Canadian dollar's gains from yesterday are being pared.

Read More »

Read More »

FX Daily, November 28: Corrective Forces Seen in Asia, Subside in Europe

As soon as markets opened in Asia, the greenback was sold, and corrective forces that had been nipping below the surface took hold. The euro, which had finished last week below $1.0590, rallied nearly a cent. Before the weekend, the greenback had pushed to almost JPY114, an eight-month high, before closed near JPY113.20. It was sold to almost JPY111.35 in early Asia. Sterling extended last week's gains and briefly poked through $1.2530, to reach...

Read More »

Read More »

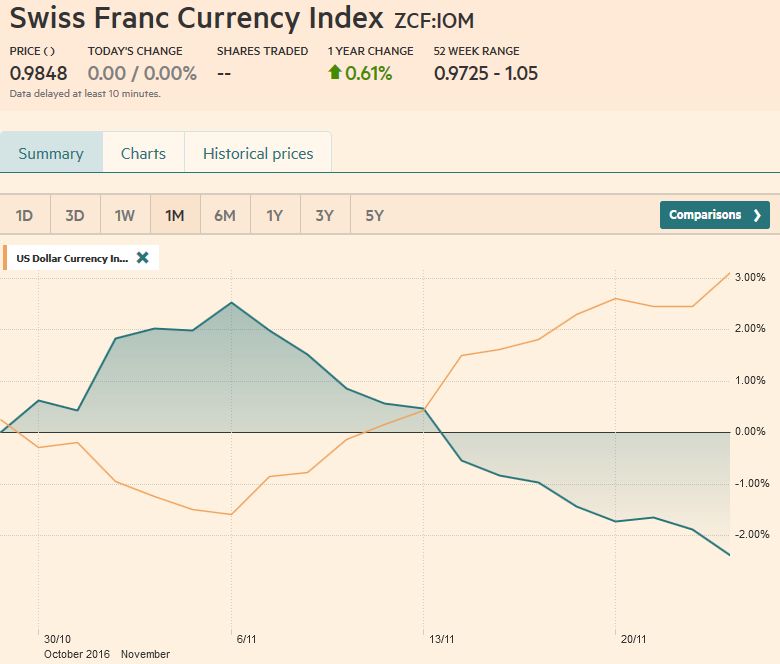

FX Weekly Review, November 21 – November 25: Dollar Strength Losing Steam

After a three-week rally, the dollar bulls finally showed signs of tiring ahead of the weekend. At least against the Swiss Franc index, the dollar index could further advance. We had observed SNB interventions in the previous week that kept the euro mostly above 1.07.

Read More »

Read More »

FX Daily, November 25: Corrective Forces Emerge, but Underlying Trend is Evident

The US dollar's recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today.

Read More »

Read More »

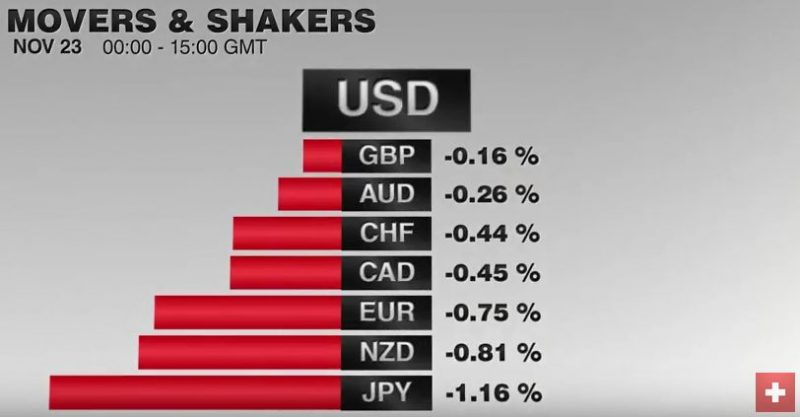

FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

The US dollar is trading inside yesterday's ranges against the euro and yen. The dollar's tone matches the consolidation in the debt market ahead of today's slew of US data and tomorrow's holiday. Tokyo markets were on holiday.

Read More »

Read More »

FX Daily, November 21: Flattish Consolidation Hides Dollar Strength

The news over the weekend is primarily political in nature. Sarkozy is going to retire (again) after taking a drubbing in the Republican Party primary in France. Fillon, the self-styled French Thatcher unexpected beat Juppe, but without 50% and therefore the results set up the run-off this coming weekend. It is as if, knowing their candidate will likely face Le Pen in the final round next spring, the Republican Party might as well chose the most...

Read More »

Read More »

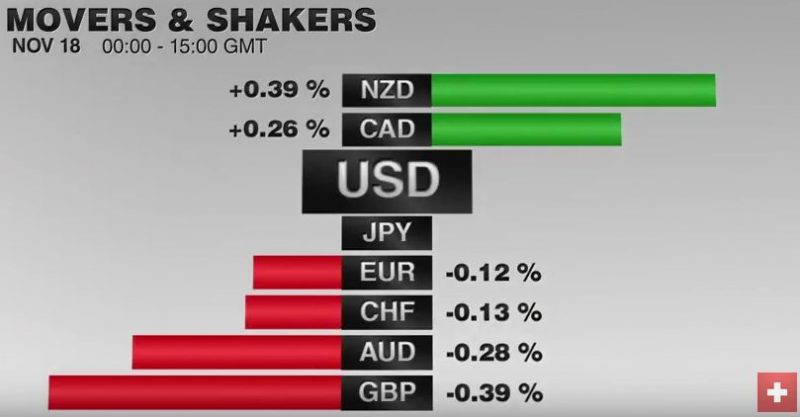

FX Weekly Review, November 14 – November 18: Best Dollar Weeks since Reagan

The US dollar has recorded its best two-week performance since Reagan was President. The weeks after Trump's election continue to see a weakening of the Swiss Franc, while the dollar index is on a steady rise. Still both the euro and the yen have seen worse performance than the Swiss Franc. The euro is currently under 1.07.

Read More »

Read More »

FX Daily, November 18: Revaluation of the Dollar Continues

Since the US election, the dollar has been on a tear. Pullbacks have been brief and shallow. There are powerful trends in place. The euro has fallen nearly five percent over the past ten sessions, during which it is not closed higher once. The dollar rose four days this week against the yen and four days last week.

Read More »

Read More »

FX Daily, November 17: Consolidation Gives Dollar Heavier Tone

The US dollar is trading with a heavier bias today as its recent run is consolidated. The euro is trying to snap the eight-day slide that brought it to nearly $1.0665 yesterday, the lows for the year. It is almost as if participant saw the proximity of last year's lows ($1.0460-$1.0525) and decided to pause, perhaps to wait for additional developments, such a Fed Chief's Yellen's testimony before the Joint Economic Committee of Congress.

Read More »

Read More »

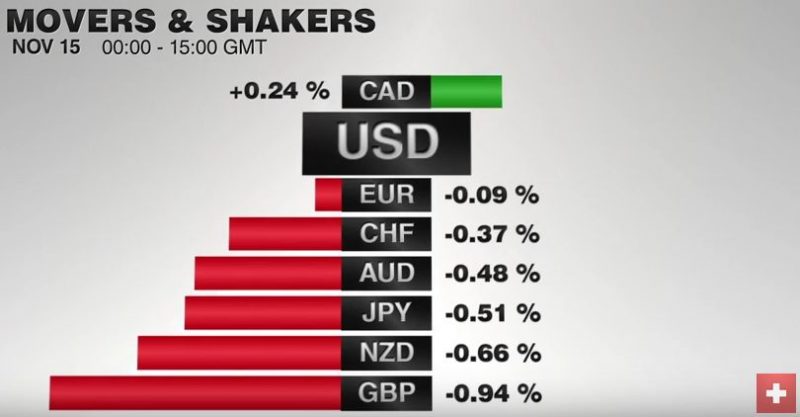

FX Daily, November 15: Investors Catch Breath, Markets Consolidate

After a dramatic run since the US election, the capital markets are consolidating today. It is a bit too restrained to such a Turn Around Tuesday is unfolding. The euro is struggling to sustain corrective upticks through $1.08, and after a pullback is, the greenback pushed back above the JPY108 level like a beach ball held under water.

Read More »

Read More »

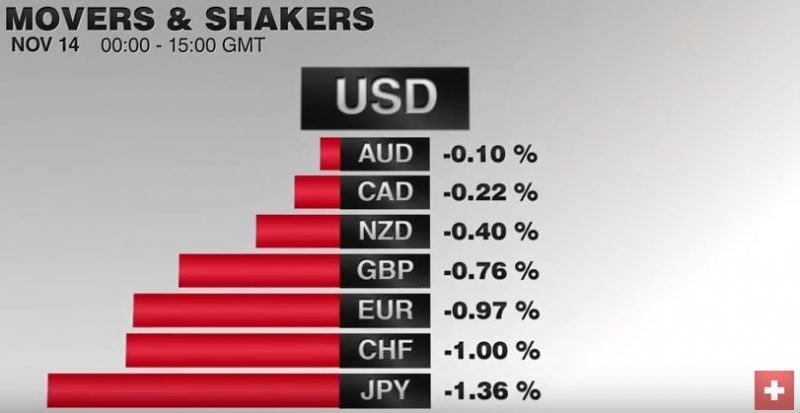

FX Daily, November 14: Dollar Steps Up to Start Week

The US dollar rally that moved into a higher gear in the second half of last week has begun the new week with a bang. It is up against nearly all the major and emerging market currencies. Even sterling, which last week, managed to eke out modest gains against the greenback is under pressure today.

Read More »

Read More »