Tag Archive: EUR/CHF

EUR/JPY rallies the hardest vs EUR/CHF as CHF/JPY spikes following ECB

EUR/JPY rallies hard following hawkish ECB cut and trade war optimism. EUR/JPY tracking positive sentiment in financial and commodity markets. While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today.

Read More »

Read More »

FX Daily, September 13: Bonds and the Dollar Remain Heavy Ahead of the Weekend

Overview: The markets are digesting ECB's actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July spilled over to lift Asian markets. Chinese and Korean markets were closed for a mid-autumn holiday.

Read More »

Read More »

FX Daily, September 12: Focus on the ECB, while the Dollar Slips below CNY7.09

Overview: Some gestures in the US-China trade spat have given the market the reason to do what it had been doing, and that is taking on more risk. Equities are higher in Asia Pacific and opened in Europe higher before slipping. The MSCI Asia Pacific and the Dow Jones Stoxx 600 are advancing for the fourth consecutive week.

Read More »

Read More »

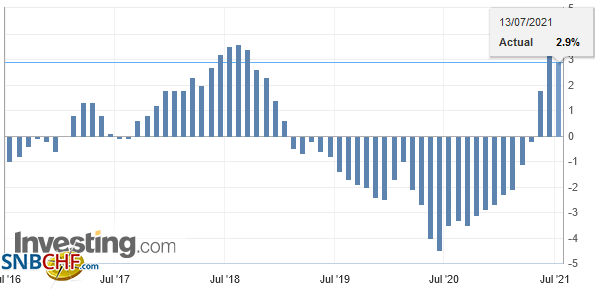

CHF is ‘not strong in real terms’ – no need for SNB intervention

A note from Standard Chartered on the Swiss National Bank and the Swiss franc. The SNB monetary policy meeting is next week, September 19.In brief, Stan Chart argue the franc is not strong in real termsadjusting EUR/CHF for inflation leaves CHF around 10% weaker than (non-adjusted) current spotno need for SNB to intervene to try to weaken ittherefore the SNB is not likely to cut rates at their meeting, nor intervene in forex markets in the near...

Read More »

Read More »

FX Daily, September 11: Dollar is Firm as ECB is Awaited

Overview: Global equities are extending their recent gains while bonds remain on the defensive. The dollar is firm. There is a degree of optimism that is prevailing. There are some more overtures in terms of US-Chinese trade. In Hong Kong, developers and banks led an equity rally on ideas that the political tensions may ease. South Korea reported better trade data for the first ten days of September.

Read More »

Read More »

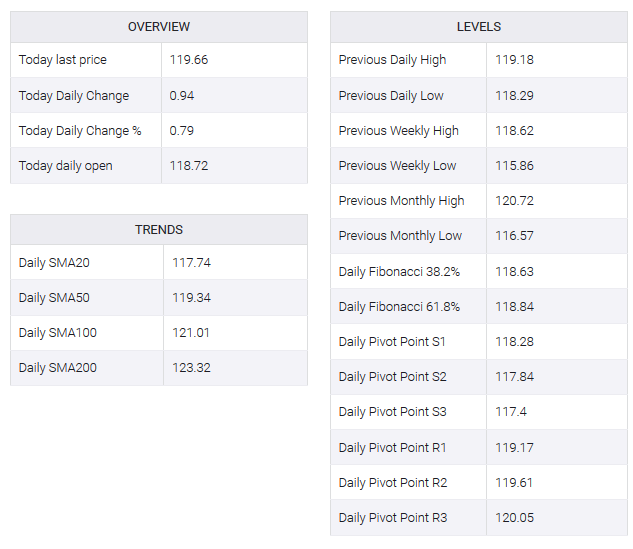

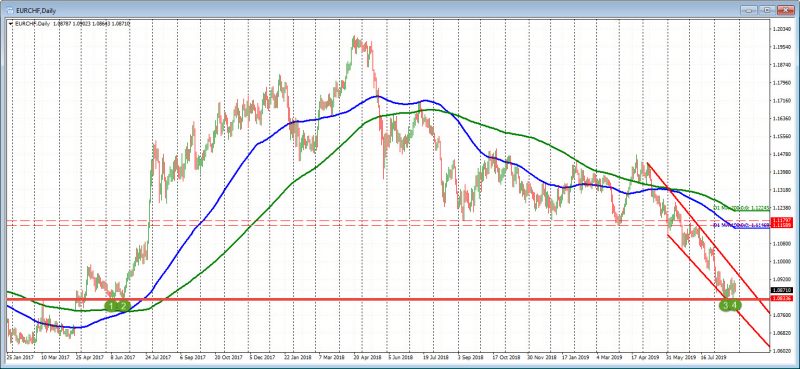

EUR/CHF technical analysis: Break out or fake out?

The cross needs to hold above the 1.0970s and beyond the 25th July swing lows. To the downside, a break back below the prior descending resistance will spell bad news for the bulls. EUR/CHF has been running higher of late, despite the onset of the European Central Bank - a possible buy the rumour sell the fact scenario as the less committed euro shorts are squeezed.

Read More »

Read More »

FX Daily, September 10: Turn Around Tuesday

Overview: The momentum from the end of last week carried into yesterday's activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at the open.

Read More »

Read More »

FX Daily, September 9: Market Sentiment Still Constructive

Overview: The improvement of investor sentiment seen last week is carrying over into the start of the new weeks. Global equities are firm as are benchmark yields. Asia Pacific equities advanced, except in Hong Kong, where Chief Executive Lam's promise to formally withdraw the controversial extradition bill failed to deter protests.

Read More »

Read More »

SNB’s Maechler: Reaffirms Pledges on FX and Intervention, Negative Rates

SNB jawboning CHF lower as concerns mount over global growth fears and a flight to safety. EUR/CHF is already trading close to the lows of the year. The Swiss National Bank's Andréa M Maechler, Member of the Governing Board, has crossed the wires saying that ‘any intervention’ requires an analysis of cost/benefits - plenty of jawboning going on here.

Read More »

Read More »

More SNB Maechler: Right now we still have plenty of room for forex intervention

Right now is still plenty of room for forex intervention. As to negative rates are working, SNB's Maechler says "absolutely". Looking at the EURCHF, the pair is trading near the lowest levels since June 2017. The lows this month tested the lows from back then. The test has stalled the fall.

Read More »

Read More »

FX Daily, August 23: Market has Second Thoughts on Magnitude of Fed Cuts Ahead of Powell

Powell speech at Jackson Hole stands before the weekend. Equities in Asia and Europe are finishing the week on a firm tone. Most markets in the Asia Pacific region closed higher today, and the MSCI Asia Pacific Index snapped a four-week slide. European bourses are edging higher, and the Dow Jones Stoxx 600 is poised to end its three-week air pocket.

Read More »

Read More »

FX Daily, August 22: Tick Up in EMU PMI Does Little, Waiting for Powell

Overview: Soft data in Asia and the continued decline in the yuan (six days and counting) prevented Asian equities from following the US lead from yesterday when the S&P 500 advanced by 0.8%. European shares are paring yesterday's 1.2% advance despite an unexpected gain in the EMU flash PMI. US shares are little changed in the European morning.

Read More »

Read More »

FX Daily, August 21: European Stocks Snap Back, Market Hopeful Italian Election can be Delayed

The end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday's losses and more. It was led higher by consumer discretionary, energy, and industrials.

Read More »

Read More »

FX Daily, August 20: Marking Time Ahead of PMI and Powell

Overview: Global equities and bonds are firmer in quiet turnover, and the dollar is narrowing mixed in narrow ranges. The big events of the week, the eurozone flash PMI and Powell's speech at Jackson Hole still lie ahead. The MSCI Asia Pacific Index rose for the third consecutive session, led by Korea and Australia's 1%+ gains.

Read More »

Read More »

FX Daily, August 19: China’s Rate Reform Helps Markets Extend End of Last Week Recovery

Overview: China announced some changes in its interest rate framework that is expected to lead to lower rates. This helped lift equity markets, which were already recovering at the end of last week from the earlier drubbing. Chinese and Hong Kong shares led the regional rally with 2-3% gains. The Nikkei gapped higher for the third time in six sessions, and the first two were followed by lower gaps.

Read More »

Read More »

FX Daily, August 16: Markets Take Collective Breath Ahead of the Weekend

Overview: The global capital markets are ending the tumultuous week calmly, but it is far from clear that is will hold long. Next week's flash PMIs have potential to disappoint, and there is risk of new escalation in the US-China trade conflict as the PRC threatens to take action to countermeasures to the new US tariffs.

Read More »

Read More »

FX Daily, August 15: Animal Spirits Lick Wounds

Overview: It took some time for investors to recognize that the scaling back of US tariff plans was not part of a de-escalation agreement. There was an explicit acknowledgment by US Commerce Secretary Ross that there was no quid pro quo. The US tariff split was more about the US than an overture to China.

Read More »

Read More »

FX Daily, August 14: Markets Paring Exaggerated Response to US Blink

The US cut its list of Chinese goods that will be hit with a 10% tariff at the start of next month by a little roe than half, delaying the others until the mid-December. This spurred a near-euphoric response by market participants throughout the capital markets. However, as the news was digested, it did not seem as much of a game-changer as it may have initially.

Read More »

Read More »

FX Daily, August 13: Investors Remain on Edge

Overview: The confrontation in Hong Kong and the fallout from the Argentine primary over the weekend join concerns the conflict between the two largest economies and slower growth to force the animal spirits into hibernation. Global equities remain under pressure. Japan's Topix joined several other markets in the region to have given up its year-to-date gain.

Read More »

Read More »

FX Daily, August 12: Yen Remains Bid, While Macri’s Loss in Argentina Weighs on Struggling Mexican Peso

Overview: China again tried to temper the downside pressure on the yuan, and this appears to be helping the risk-taking attitude. Many centers in Asia were closed today, including Japan and India, though most of the other equity markets advanced modestly, including China, Korea, and Australia. Europe's Dow Jones Stoxx 600 opened firmer but is staddling little changed levels unable to stain any upside momentum.

Read More »

Read More »