Tag Archive: EMU

FX Daily, January 04: Rising Equities and Slumping Dollar Greet the New Year

Overview: The first day of the New Year, but it feels a lot like last year. The dollar is under pressure, and equities are higher. Outside of Japan and Malaysia, The MSCI Asia Pacific Index extended last week's 3.6% gain. It has not rallied for seven consecutive sessions.

Read More »

Read More »

FX Daily, December 1: No Follow-Through After Month-End Adjustments

The near-record rallies seen in the major equity markets in November may have contributed to the month-end drama yesterday. There has been no follow-through activity. Stocks bounced back, and the US dollar is heavy, with few exceptions.

Read More »

Read More »

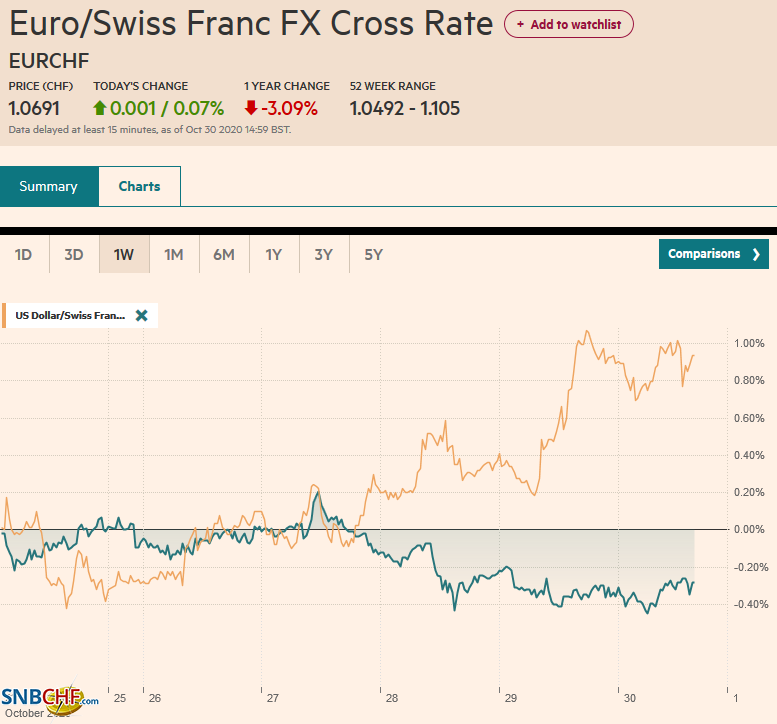

FX Daily, October 30: Investors Scared Before Halloween

Investors punished US tech giants for not delivering perfection as prices apparently had discounted, and the subsequent sell-off coupled with month-end dynamics has rocked global equities. Asia Pacific bourses were a sea of red, led by a 2.5% decline in the tech-heavy South Korean Kospi, but most major markets were off more than 1%.

Read More »

Read More »

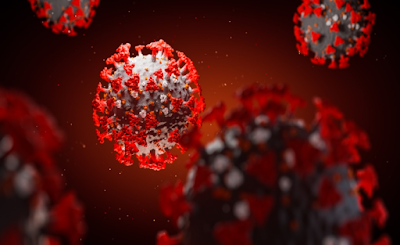

FX Daily, October 2: POTUS Infected: Is this the October Surprise?

Before a US election, there is often speculation of a last-minute game-changing development. News earlier today that the US President and his wife have tested positive for the Covid virus has injected a new unknown into not only the US election but the markets as well.

Read More »

Read More »

FX Daily, October 1: Hope Springs Eternal

Speculation that a new round of fiscal stimulus from the US is possible is encouraging risk-taking today. Many large Asian centers were closed for holidays today, and a technical problem prevented the Tokyo Stock Exchange from opening.

Read More »

Read More »

FX Daily, September 1: Dollar Lurches Lower

The US dollar has been sold-off across the board. The euro approached $1.20, and sterling neared $1.3450. The greenback traded below CAD1.30 for the first time since January. Most emerging market currencies but the Turkish lira, are also advancing today.

Read More »

Read More »

FX Daily, August 21: PMIs Shake Investor Confidence

The second disappointing Fed manufacturing survey report and an unexpected rise in weekly jobless claims helped reverse the disappointment over the FOMC minutes. Bonds and stocks rallied--not on good macroeconomic news, but the opposite, which underscores the likelihood of more support for longer.

Read More »

Read More »

The Ant and the Grasshopper: A Window into Macro Part II

Regardless of the dollar's role and function in the world economy and the halls of finance, in the near and intermediate terms, investors and businesses are more concerned with foreign exchange prices. The greenback has fallen out of favor. Its main supports, like wide interest rate differentials, favorable growth differentials, and political certainty if not stability, have weakened.

Read More »

Read More »

FX Daily, July 27: Dollar Slide Continues, while Gold Soars

The US dollar's dramatic sell-off continues. It is off against nearly all currencies. Among the majors, the Swedish krona and Japanese yen are leading the money, and the euro surged through $1.17. Emerging market currencies are fully participating, with the JP Morgan Emerging Market Currency Index posting its fifth gain in six sessions.

Read More »

Read More »

FX Daily, June 23: Weebles Wobble but they Don’t Fall Down

Overview: After early indecision, investors ramped the demand for risk assets, encouraged perhaps by indications that the Trump Administration going to support at least another trillion-stimulus package. The NASDAQ rallied to new record highs, and the dollar got thumped across the board. However, in early Asia activity, Trump adviser Navarro seemed to have told Fox News that the US-China trade deal was over.

Read More »

Read More »

FX Daily, April 1: Hemorrhaging Resumes

Overview: There is no reprieve for investors. Equities are falling sharply. Nearly all the Asia Pacific markets slumped but Australia. Chinese markets fared better than most, but the Nikkei was off 4.5%, and India was down almost as much in late dealings. Europe's Dow Jones Stoxx 600 is off more than 3% near midday, led by a sell-off in banks that are suspending dividends and share buybacks.

Read More »

Read More »

FX Daily, March 30: Monday Blues

Overview: Risk appetites remain in check as the spread of the coronavirus is leading to more and longer shutdowns. Asia Pacific equities fell with Australia, the notable exception. Its benchmark rallied a record 7%, encouraged by additional stimulus measures.

Read More »

Read More »

FX Daily, February 21: Covid-19 Contagion Outside China Keeps Investors on the Defensive

Overview: The spread of Covid-19 outside of China and early signs of the economic consequences again emerged to weigh on investor sentiment. Poor Japanese and Australian preliminary February PMI reports and some trade indications from South Korea saw most Asia Pacific equities sell-off. China was an exception. The small gain (0.3%), lifted the Shanghai Composite 4.2% on the week.

Read More »

Read More »

FX Daily, February 7: Dollar Rides High as Eurozone Disappoints, and Caution Sets In

Overview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the markets in the region slipping.

Read More »

Read More »

FX Daily, February 3: Inauspicious Start to the Year of the (Flying) Rat

Overview: The Year of the Rat is off to an inauspicious start as apparently a fly rat (a bat) virus has jumped to humans. China's markets re-opening amid much fanfare, and the Shanghai Composite dropped 7.7%, which is about what the futures in Singapore had anticipated. Several other markets in the region (Japan's Nikkei, Australia, Singapore, Taiwan, and Thailand) fell by more than 1%.

Read More »

Read More »

FX Daily, January 31: Stocks Finishing on Poor Note, while the Dollar and Bonds Firm

Overview: It was as if the World Health Organization's recognition of that the new coronavirus is an international health emergency was the catalyst that the markets needed. US equities recovered smartly and managed to close higher on the session. However, the coattails were short, and follow-through buying of US shares fizzled.

Read More »

Read More »

FX Weekly Preview: The Week Ahead and Why the FOMC Meeting may not be the Most Interesting

The week ahead is arguably the most important here at the start of 2020. The Federal Reserve and the Bank of England meet. The US and the eurozone report initial estimates of Q4 19 GDP. The eurozone also reports its preliminary estimate of January CPI. China returns from the extended Lunar New Year celebration and reports its official PMI. Japan will report December retail sales and industrial production.

Read More »

Read More »

FX Daily, January 24: Coronavirus Hits Asia Hardest, Europe and the US Resilient

Overview: The new coronavirus in China has moved into the vacuum left by the US-China trade agreement and clear indications that the Bank of Japan, the European Central Bank, and the Federal Reserve are on hold as investors searched for new drivers. The World Health Organization refrained from calling it a public health emergency even though China has dramatically stepped up its efforts to contain the new virus.

Read More »

Read More »

FX Daily, January 10: Jobs Friday: Asymmetrical Risks?

Overview: The first full week of 2020 is ending on a quiet note, pending the often volatile US jobs report. New record highs US equities on the back of easing geopolitical anxiety is a reflection of greater risk appetite that is evident across the capital markets. Asia Pacific equities mostly rose today, though Chinese shares and a few of the smaller markets saw small losses.

Read More »

Read More »

FX Daily, January 7: Geopolitical Angst Eases, Helps Equities and Underpins the Greenback

Overview: Without fresh escalation, investors cannot maintain a heightened sense of geopolitical anxiety. The recovery of US shares yesterday set the tone for today's rebound in Asia and Europe. All the equity markets in the Asia Pacific region rallied today, led by a 1.6% rally in Japan and a nearly 1.4% advance in Australia, with the exception of Taiwan.

Read More »

Read More »