Tag Archive: ECB

European Central Bank likely to stick to script

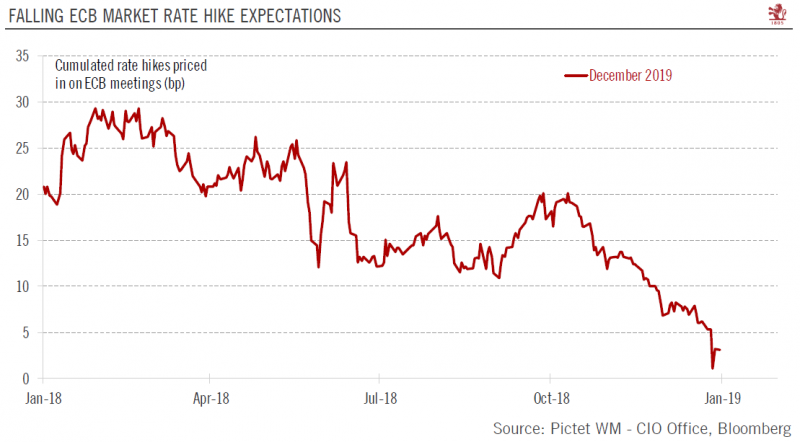

The ECB is comfortable with current market expectations for rate hikes.At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside.

Read More »

Read More »

That’s A Big Minus

Goods require money to finance both their production as well as their movements. They need oil and energy for the same reasons. If oil and money markets were drastically awful for a few months before December, and then purely chaotic during December, Mario Draghi of all people should’ve been paying attention.

Read More »

Read More »

Two Takeaways from ECB Record

The record of the ECB's December meeting was released, and there are two takeaways. The first is that officials may have been more concerned with the deteriorating situation than they let on at the time. Apparently, paring near-term growth forecasts was seen as a sufficient signal that risks were increasing. This allowed Draghi to maintain the "broadly balanced" risk assessment.

Read More »

Read More »

Technical Musings about the Euro and Dollar Anchored by Macro

The $1.1475-$1.1550 is an important area for the euro. Many bulls see a rounded bottom being carved and a break above it would be embraced as a confirmation. The lower-end corresponds to the 100-day moving average. Such a bottom pattern, if confirmed, would project toward $1.1800 the high in H2 18. On the downside, the low from H2 18 was near $1.1200. This is just above a key (61.8%) retracement of the January 2017-February 2018 rally.

Read More »

Read More »

Core Euro Sovereign Bonds 2019 Outlook

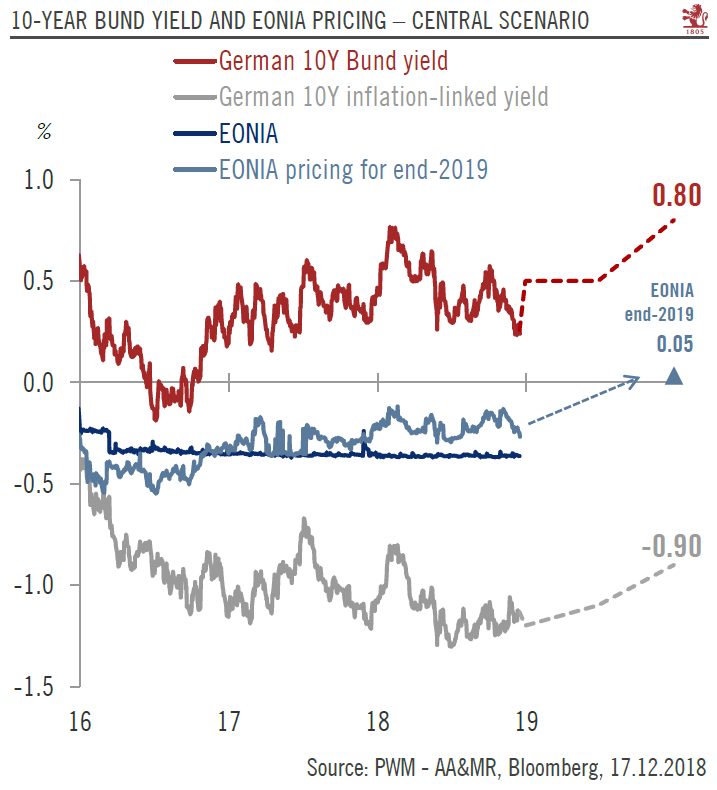

In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.

Read More »

Read More »

‘Paris’ Technocrats Face Another Drop

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts.

Read More »

Read More »

FX Weekly Preview: The Week Ahead: Don’t Skip Steps on Escalation Ladders

The drop in US yields and disappointing economic data weighed on sentiment and the dollar last week. Even weakness in equities, which had seemed to lend the greenback support, failed to do so at the end of last week. With the real Fed funds rate (adjusted for inflation) below zero, employment at 50-year lows, and some fiscal stimulus still in the pipeline, the doom and gloom cant of a recession next year seems misplaced.

Read More »

Read More »

FX Weekly Preview: Powell and Draghi, Xi and Trump

The investment climate will be shaped by three events next week. ECB President Draghi's testimony before the European Parliament to kick-off the week. Fed Chairman Powell speaks to the NY Economic Club in the middle of the week. Presidents Trump and Xi are to meet at the G20 meeting to end the week in hopes of dialing back the escalating trade conflict. Also at the G20 summit, the NAFTA2.0 is expected to be signed, and the steel and aluminum...

Read More »

Read More »

Harmful Modern Myths And Legends

Loreley Rock near Sankt Goarshausen sits at a narrow curve on the Rhine River in Germany. The shape of the bluff produces a faint echo in the wind, supposedly the last whispers of a beautiful maiden who threw herself from it in despair once spurned by her paramour. She was transformed into a siren, legend says, a tantalizing wail which cries out and lures fishermen and tradesmen on the great river to their death.

Read More »

Read More »

FX Daily, October 25: ECB Overshadowed by Equity Market Drama

The Dollar Index broke above 96.00 yesterday and is consolidating today. Provided the 96.00 area holds, the next target is the year's high near 97.00. The euro has been confined to a little more than a quarter of a cent. Players seem reluctant to sell it below $1.14 and note there is a 570 mln euro option at $1.1420 that expires today.

Read More »

Read More »

FX Weekly Preview: What Can Bite You This Week?

Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets.

Read More »

Read More »

Europe Starting To Reckon Eurodollar Curve

We’ve been here before. Economists and central bankers become giddy about the prospects for success, meaning actual recovery. For that to happen, reflation must first attain enough momentum. If it does, as is always forecast, reflation becomes recovery. The world then moves off this darkening path toward the unknown crazy.

Read More »

Read More »

Merkel, European Autonomy, and the ECB

Merkel has again shown herself to be more wily than most. While pundits, investors, and politicians anticipated she would push hard for a German to replace Draghi as ECB President when his term ends next October. After all, it is German's turn at the helm, and its interests were ridden roughshod over by the extraordinary and prolonged monetary policy.

Read More »

Read More »

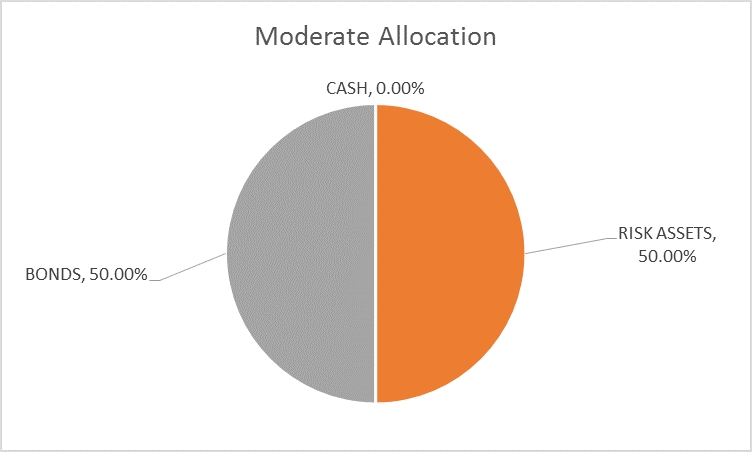

Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month.

Read More »

Read More »

FX Daily, July 26: Equities like EU-US Trade Truce more than the Euro

The markets generated a collective sigh when Juncker and Trump announced that there would be no new tariffs while new trade negotiations took place. This was particularly important because Trump reportedly wanted to press ahead with a 25% tariff on car imports. It was also announced that the EU would buy more soy and liquid natural gas from the US.

Read More »

Read More »

Brent’s Back In A Big Way, Still ‘Something’ Missing

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status.

Read More »

Read More »

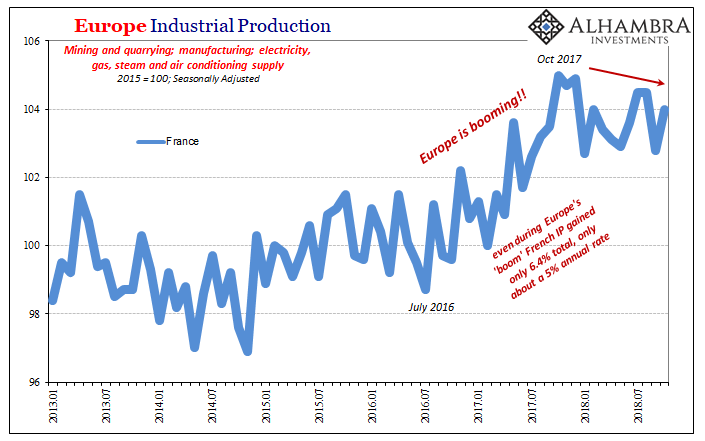

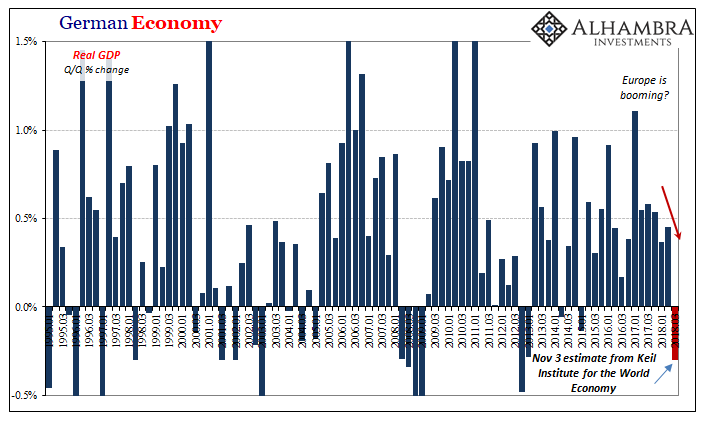

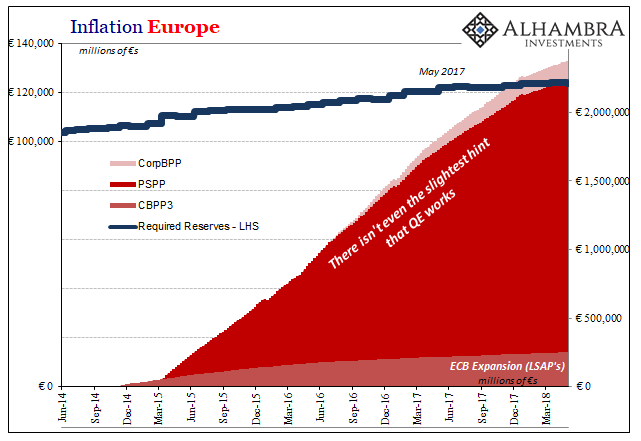

What Really Happened In Europe

The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say.

Read More »

Read More »

FX Weekly Preview: Next Week in Context

A year ago, the Dutch and French elections signaled that UK referendum to leave the EU and the US election of Trump did not usher in a populist-nationalist epoch, such as the one that proceeded the last great financial crisis. The euro gapped higher and did not look back.

Read More »

Read More »

Great Graphic: EMU Inflation Not Making it Easy for ECB

The Reserve Bank of New Zealand is credited with being the first central bank to adopt a formal inflation target. Following last year's election, the central bank's mandate has been modified to include full employment. To be sure this was a political decision, and one that initially saw the New Zealand dollar retreat.

Read More »

Read More »

FX Weekly Preview: The Fed and More

The most significant event in the coming week is the first FOMC meeting under the Chair Powell. At ECB President Draghi’s first meeting he cut interest rates. He cuts rates at his second meeting as well, underwinding the two hikes the ECB approved under Trichet. At BOJ Governor Kuroda’s first meeting, an aggressive monetary policy was announced that was notable not only in its size, but also in the range of assets to be purchased under the...

Read More »

Read More »