Tag Archive: ECB

FX Weekly Preview: Three Central Banks Dominate the Week Ahead

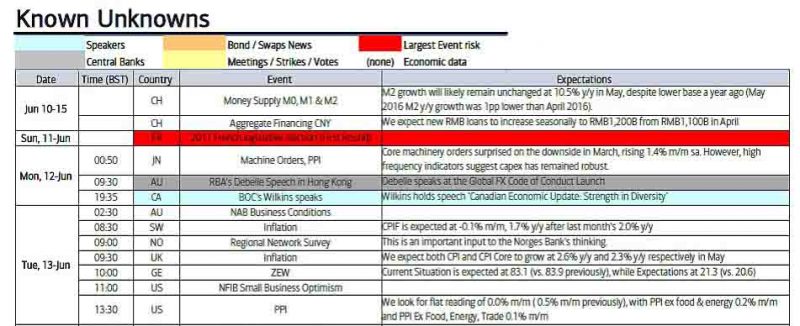

Following strong Q2 GDP figures, risk is that Bank of Canada's rate hike anticipated for October is brought forward. ECB's guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley's comments are the most important.

Read More »

Read More »

Two Overlooked Takeaways from Draghi at Jackson Hole

The consensus narrative from the Jackson Hole Symposium was the Yellen and Draghi used their speeches to argue against dismantling financial regulation and the drift toward protectionism. Many cast this as a push against US President Trump, but this may be too narrow understanding.

Read More »

Read More »

Markets Exaggerate, That is what They Do

FOMC minutes were not as dovish as spins suggest. ECB record was not as dovish as market response appears. Divergence is still intact.

Read More »

Read More »

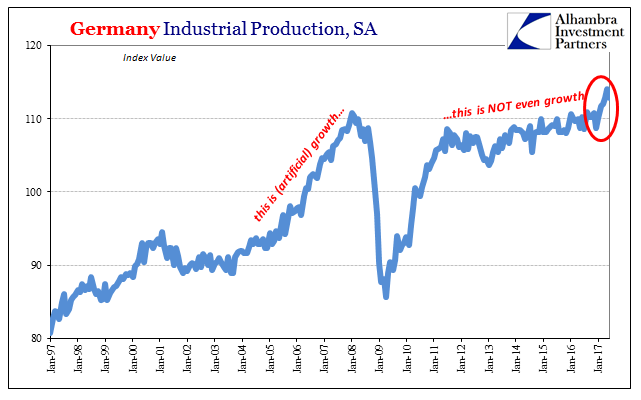

Industrial Production: Irreführende Statistiken

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year.

Read More »

Read More »

Cool Video: Dollar Drivers on Bloomberg

There were three talking points. First was the observation that while the President took credit for the record stock market, the strength of the economy, the low unemployment rate, and business confidence, there was no mention of the dollar, which poised to close lower for its seventh consecutive month.

Read More »

Read More »

FX Daily, July 17: Markets Mark Time, Dollar Consolidates Losses

After falling to new lows for the year against several major currencies in response to disappointing retail sales and uninspiring CPI before the weekend, the US dollar has begun the new week on a more stable note. It is firmer against nearly all the major currencies, though is mixed against the emerging market currencies.

Read More »

Read More »

Global Manufacturing PMI’s, Inflation and CPI: Some Global Odd & Ends

When it comes to central bank experimentation, Japan is always at the forefront. If something new is being done, Bank of Japan is where it happens. In May for the first time in human history, that central bank’s balance sheet passed the half quadrillion mark.

Read More »

Read More »

Weird Obsessions

People often ask why I care so much about China. In some ways the answer is obvious, meaning that China is the world’s second largest economy (the largest under certain methods of measurement). Therefore, marginal changes in the Chinese economy are important to understanding our own global situation.

Read More »

Read More »

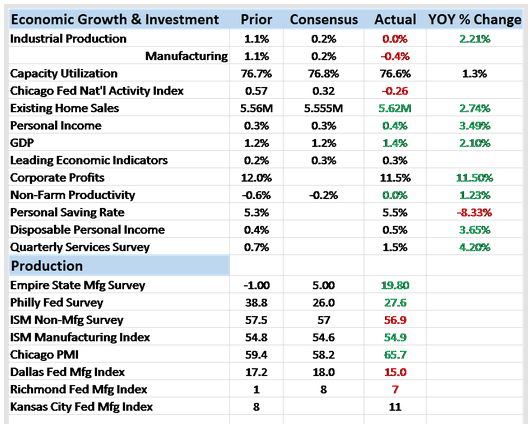

Bi-Weekly Economic Review: Draghi Moves Markets

In my last update two weeks ago I commented on the continued weakness in the economic data. The economic surprises were overwhelmingly negative and our market based indicators confirmed that weakness. This week the surprises are not in the economic data but in the indicators. And surprising as well is the source of the outbreak of optimism in the bond market and the yield curve.

Read More »

Read More »

FX Daily, June 28: Draghi’s Sparks Mini Taper Tantrum, Euro Chief Beneficiary

Sounding confident, ECB President Draghi seemed prepared to reduce the asset purchases, and this overshadowed his explicit recognition that substantial accommodation is still necessary. This is very much in line with what many, including ourselves, anticipate: At the September ECB meeting, an extension of the asset purchases into the first part of next year, coupled with a reduction in the amounts being purchased.

Read More »

Read More »

“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside.

Read More »

Read More »

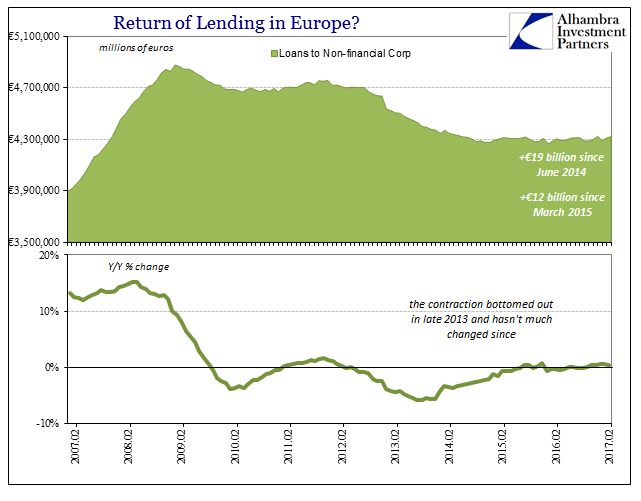

Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant.

Read More »

Read More »

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

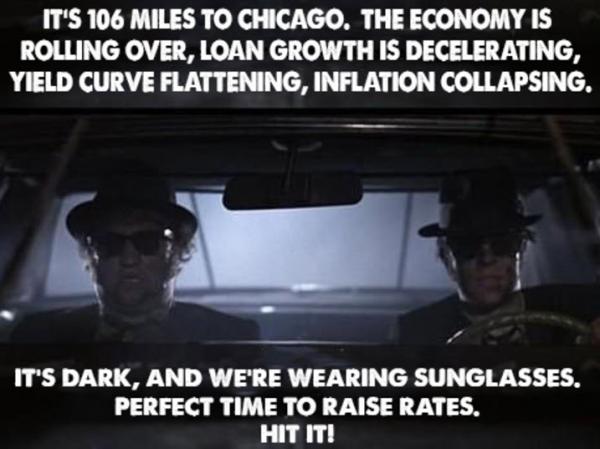

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

Merkel Sends Euro Higher

Markel said the euro was too weak, so it rallied. This is not a new position for Germany. Merkel may now tack to the left since the AfD appears to have been dispatched. Look for Weidmann to begin moderating views or becoming less antagonistic.

Read More »

Read More »

Euro Drivers

Correlation between the change in the US-German two-year differential and euro remains robust. The German two-year yield has jumped in recent weeks but looks poised to slip back lower. US two-year yield has eased but is knocking on 1.30%, an important level.

Read More »

Read More »

FX Daily, April 27: Several Developments ahead of the ECB meeting

The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday.

Read More »

Read More »

Draghi Does Nothing and Talks about It

Draghi confirms rate on hold and maintains easing bias. Growth risks are becoming more balanced. Inflation has yet to get on a sustained upward path.

Read More »

Read More »

FX Daily, April 26: Dollar Stabilizes Ahead of Trump and ECB

The US dollar was marked down in response to the French election and saw some follow through selling yesterday, but the momentum had slowed, and now it is stalled. The greenback is posting upticks against nearly all the major currencies. There is a good reason to be cautious.

Read More »

Read More »

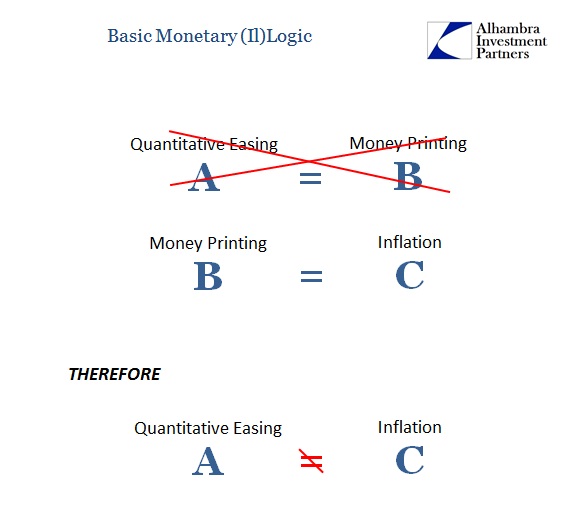

Ultra-Loose Terminology, Not Policy

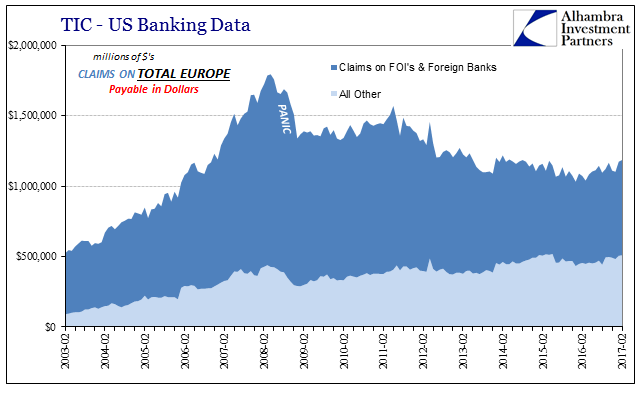

As world “leaders” gathered in Davos in January 2016, they did so among financial turmoil that was creating more economic havoc than at any time since the Great “Recession.” Having seen especially US QE as the equivalent of money printing, their focus was drawn elsewhere to at least attempt an explanation for the contradiction.

Read More »

Read More »

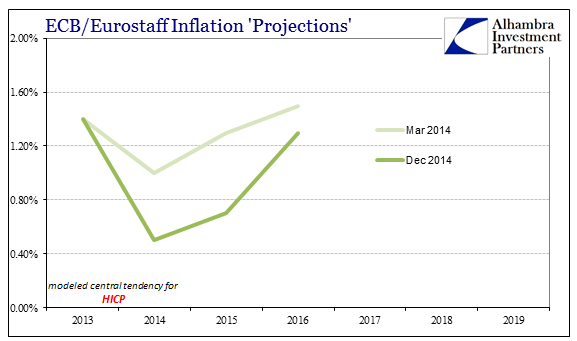

Consensus Inflation (Again)

Why did Mario Draghi appeal to NIRP in June 2014? After all, expectations at the time were for a strengthening recovery not just in Europe but all over the world. There were some concerns lingering over currency “irregularities” in 2013 but primarily related to EM’s and not the EU which had emerged from re-recession. The consensus at that time was full recovery not additional “stimulus.” From Bloomberg in January 2014:

Read More »

Read More »