Tag Archive: Dollar Index

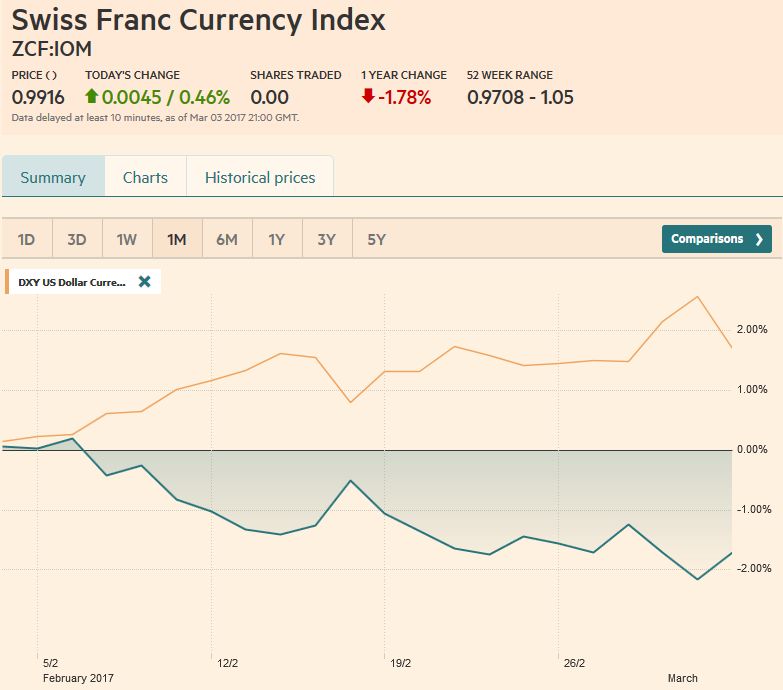

FX Weekly Review, August 22 – August 26: Swiss Franc Loses Most Gains Again

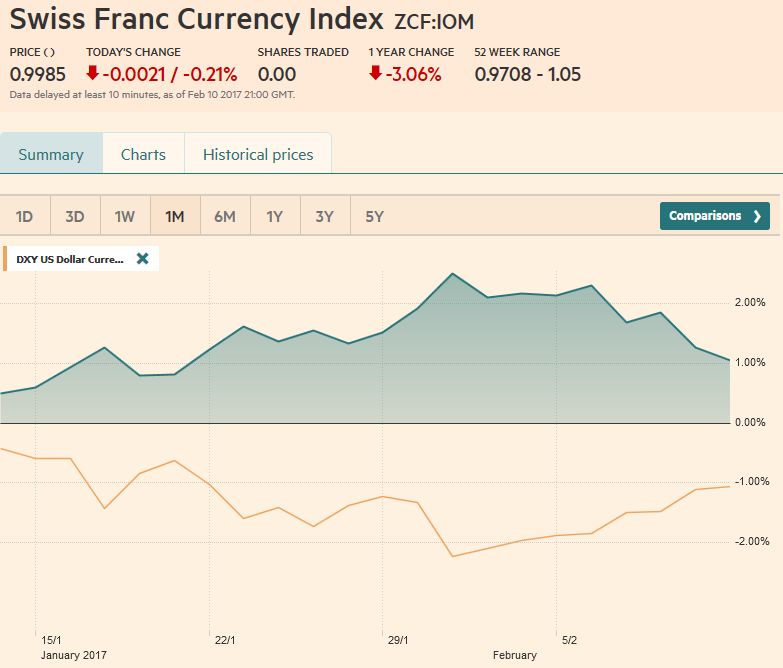

After winning 5% against the dollar index last week, the Swiss Franc index lost 3% again. CHF lost against both USD and EUR. Reason: An increased probability of a rate hike in the U.S.

Read More »

Read More »

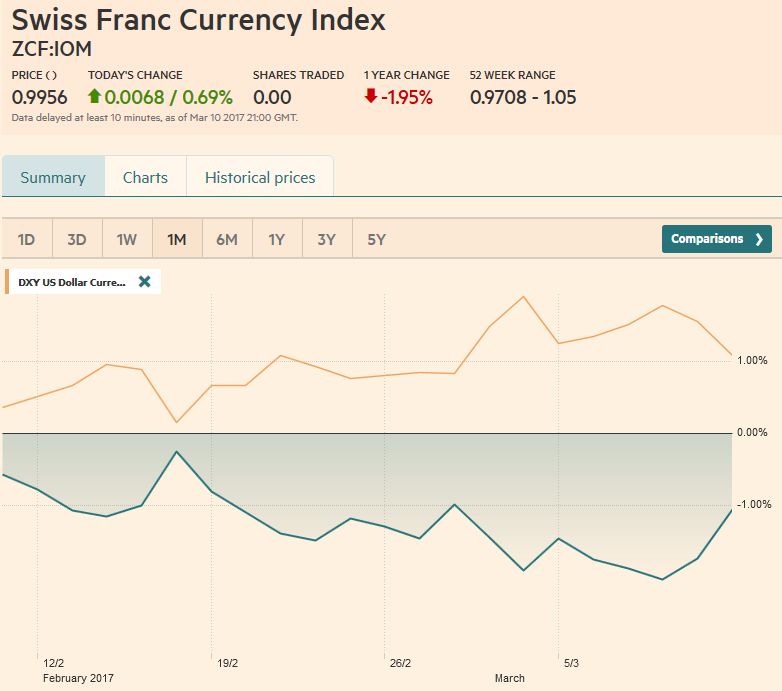

FX Weekly Review, August 15 – August 19: Swiss Franc index improves 5% compared to dollar index

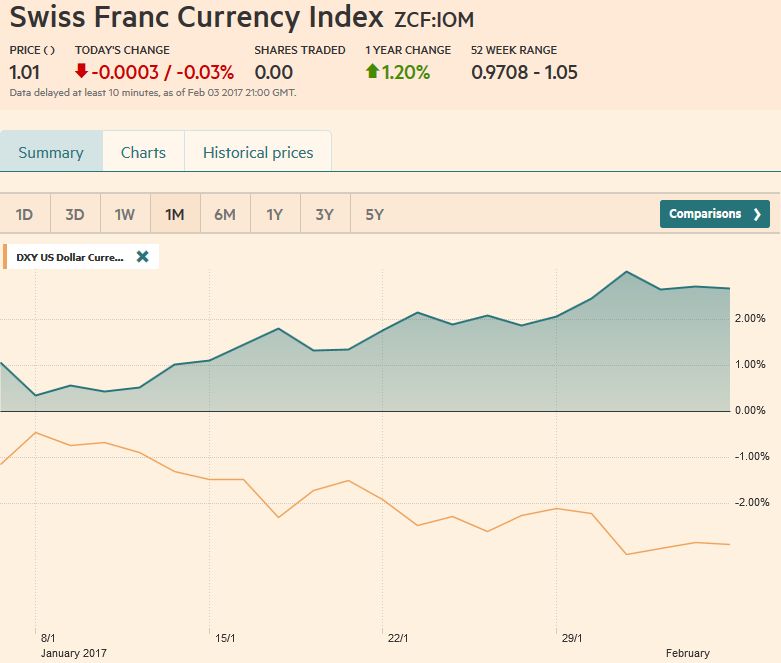

The US dollar lost ground against nearly all the major currencies last week. The sole exceptions were the Australian dollar, where Moody's decision to cut the outlook for five Australian banks wiped out the previous small gain. The Swiss Franc index gained nearly 5% compared to the dollar index.

Read More »

Read More »

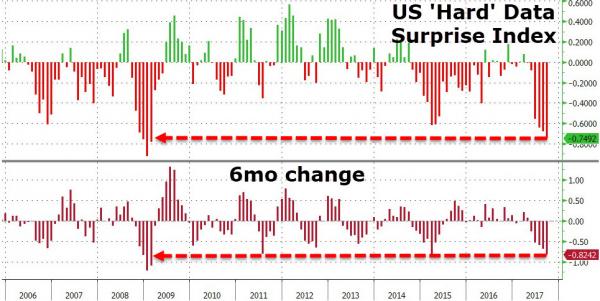

FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think.

Read More »

Read More »

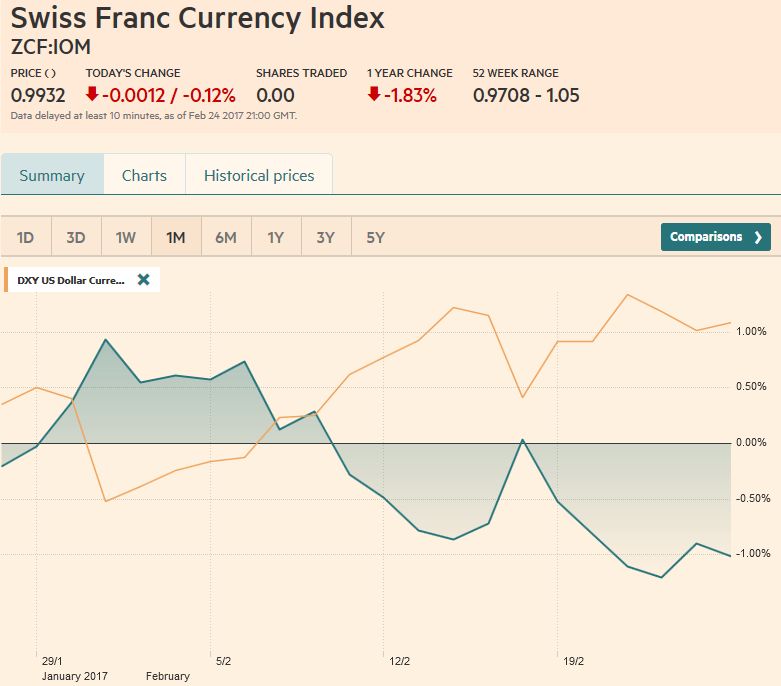

FX Weekly Review, August 08 – August 12: Finally an Improvement of the CHF Index

The CHF index experienced its first good week since many weeks, when we compare it against the dollar index. On a three years interval, the Swiss Franc had a weak performance.

Read More »

Read More »

FX Weekly Review, August 01 – August 05: Does the Jobs Report Give the Greenback Legs?

The robust US employment report before the weekend allowed the dollar to recoup the losses it experienced earlier in the

week against most of the major currencies. The Australian dollar and Japanese yen managed to hold onto minor gains for the

week.

Read More »

Read More »

FX Weekly Review, July 25 – July 29: Dollar Hobbled; Technicals Warn of More Losses

The US dollar advance was stopped in its tracks by the

disappointingly weak Q2 GDP figures. The 1.2% annualized growth rate was

roughly half of the pace expected. The FOMC statement earlier in the week did not leave the impression that a September hike was likely, and with the poor growth numbers, the odds were downgraded

further.

Read More »

Read More »

FX Weekly Review, July 18 – July 22: Will the FOMC Halt the Dollar’s Advance?

The US dollar gained against all the major currencies over the past week. It also rose against many emerging market currencies. A notable exception was the Chinese yuan.

Read More »

Read More »

FX Weekly Review, July 11 – July 15: It is not About the Dollar, but About Other Currencies

Our weekly review of currency movements, with focus on the Swiss franc. This week: The US dollar is easily the most traded currency, and despite the plethora of other currencies, it is on one side of nearly 90% of all trades. Yet the movement in the foreign exchange market presently is not so much driven by the dollar as it is by other currencies.

Read More »

Read More »

FX Weekly Review, July 04 – July 08: Further SNB Interventions, Good Dollar Week

In the Brexit month, the Swiss franc index clearly underperformed the dollar index. The major reason is that the dollar is seen as a better safe-haven than the Swiss Franc, possibly because Swiss sales are affected more when British demand falls.

Read More »

Read More »

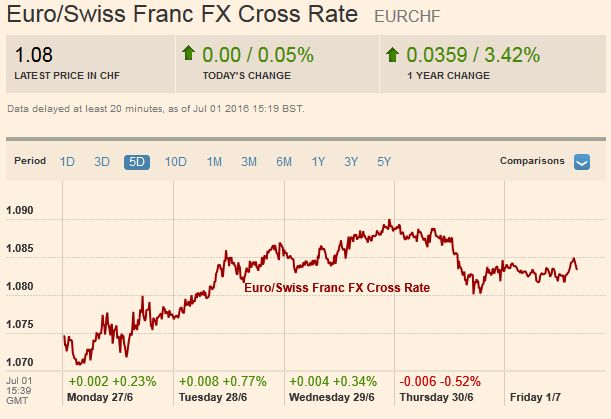

FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Week after Brexit.: The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers, as so-called safe haven buying was reversed.

But the Swiss Franc index is still stronger in the last month than the dollar index.

Read More »

Read More »

Why the Fed Will Talk Down the Dollar

And right now, in the wake of Brexit, tighter monetary policy is clearly not an option. Plus, a stronger dollar (by virtue of the “peg”) strengthens the Chinese Yuan and the Saudi Riyal… something neither country will tolerate.

Read More »

Read More »

FX Weekly Review: June 20 – June 24: Dollar Appreciates with Brexit

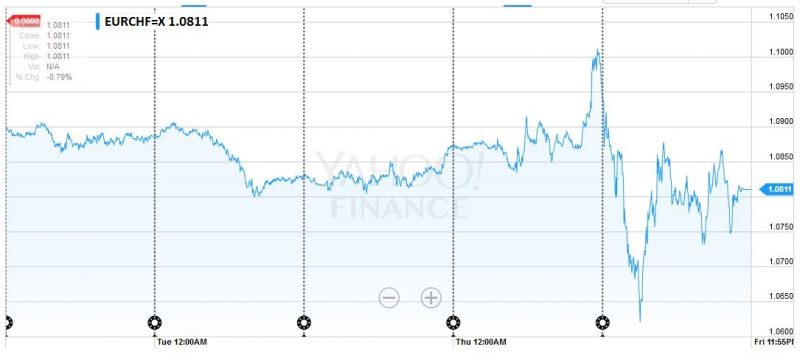

The dramatic reaction to the UK decision to leave the European Union has changed the technical condition in the foreign exchange market. The EUR/CHF peaked shortly before the Brexit referendum, when traders were anticipating a yes. It found its trough when the No was published. Then the SNB intervened.

Read More »

Read More »

FX Review Week till June 17: Jo Cox’s death supports Sterling, negative for CHF

Two main events that drove the foreign exchange market. The first iare some post-FOMC meeting movements and the assassination of Jo Cox, that might be positive for the Anti-Brexit camp . The EUR/CHF has fallen down to 1.0774 and recovered.

Read More »

Read More »

Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely …

Read More »

Read More »

Chart up-date: Stocks, Bonds, Copper, Gold

Well that escalated quickly...All-time highs within reach... everything is awesome...wait what...

Quite a week:

Gold +5.25% in last 2 weeks - best run in 4 months

Silver +5.65% this week - best week since May 2015

Copper -4% this week to lowest week...

Read More »

Read More »

Great Graphic: Gold and the Dollar

Many investors still think about gold as if it were money. Economists identify three functions of money: store of value, means of exchange, and a unit of account.

It can be a store of value, but the price fluctuates compared with other form...

Read More »

Read More »

FX Week Ahead: Evolving Investment Climate

The US dollar’s weakness in recent months, despite negative interest rates in Europe and Japan likely had many contributing factors. These factors include shifting views of Fed policy, weaker US growth, the recovery in commodity prices, including oil, gold and iron ore, and market positioning.

Read More »

Read More »

FX Daily, May 02: New Month, Same Heavy Dollar

In quiet turnover, with China, Hong Kong, Singapore and London markets closed, the US dollar is trading with a heavier bias against all the major currencies. Lower commodity prices, including oil and copper, appears to be taking a toll on some emerging market currencies, including the South African rand. Japanese markets were closed last Friday …

Read More »

Read More »

Dollar’s Technical Tone Improves

It is not that the US dollar had a particularly good week. It was mixed. The best performers were sterling and the Canadian dollar. The pound led with a 1.6% gain, followed closely by the Canadian dollar.

The latest polls suggest that tho...

Read More »

Read More »

FX Daily, 03/19: Greenback Remains Technically Vulnerable

The US dollar had a difficult week. The price action after the ECB meeting had undermined the technical tone, and the dollar took another leg down after the FOMC moved closer to the market expectation by reducing the number of rate hikes the median official thinks will be appropriate this year from four to two. … Continue...

Read More »

Read More »