The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate.

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate.

The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely appropriateness of a rate hike this summer. Although the Fed did not rule out a July hike, as we anticipated, by saying that it was “not impossible,” Yellen damned by faint praise. The KC Fed President George, who dissented from the majority decisions in January, March and April, in favor a hike, re-joined the majority this week.

There was a clear softening of the Fed’s position. In March, one of the seventeen Fed officials saw a single rate hike this year. Now six do. In March, seven thought more than two hikes might be appropriate. Now two do.

It is generally appreciated that the Board of Governors is appointment by the President with the approval of the Senate. This explains why there are two vacancies. It is not just the Supreme Court that the Senate has balked, but also with other appointments, including the Board of Governors. What is often lost on observers is how people to become regional Fed Presidents. For the most part, it is through the local banking institutions. There is great variance in the economic, financial and monetary acumen. Reforming how the regional presidents are chosen may be on the agenda under the next Administration.

Consider one of the dots. Apparently, one official sees a rate hike this year as appropriate, but then sees the need for the Fed to be on hold in 2017 and 2018. That seems to beg the question of why hike rates once this year then.

It is in part our appreciation of this, as well as the particular leadership style, that informs our advice to place most emphasis on the comments from the Fed’s leadership, Yellen, Fischer, and Dudley. Many investors who are frustrated with the cacophony of voices, should hone in on the signal from the Troika.

Yellen suggested that some of the headwinds on the economy might last for some time. Although many observers think she was embracing some the secular stagnation hypothesis, popularized by former Treasury Secretary Summers, we are less convinced. Barring a recent conversion, we understand Yellen to be more sympathetic with the position Bernanke has staked out as well. That position is more consistent with the Rogoff and Reinhart thesis of the traditional experience after a credit cycle ends. Also, Yellen cited demographic issues as well.

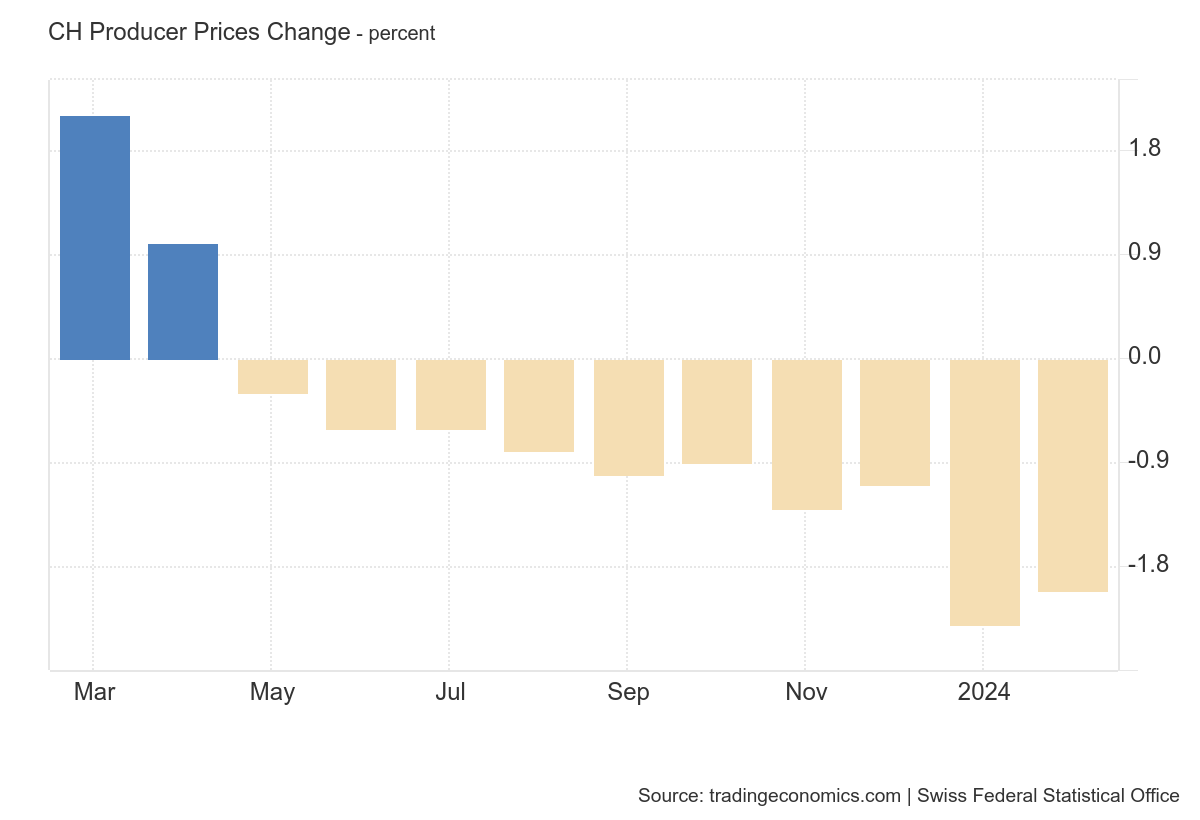

While there is nearly universal agreement that Fed was dovish, the US dollar has strengthened, not a first but within a few hours. The euro and Swiss franc are at new lows for the week today. US Dollar Index is at new highs for the week. Many argue that the Fed needs to be careful about raising rates otherwise risk destabilizing emerging markets. Yet the Fed’s dovish tone failed to help emerging markets. The dollar is higher against most emerging market currencies. MSCI Emerging market equity index is off 1.25% before commodity intensive Latin American market open.

Sterling is being sold through recent lows. The risks of Brexit continues to take a toll on sterling. It is the worst performing major currency and has lost 2.7% here in June. Sterling is nearing psychological support near $1.40. The low for the year was set near $1.3835 on February 29.

What many investors fear is that a UK vote to leave the EU would trigger more than a UK political and economic crisis, but could spur a larger European and EMU crisis. Support for the EU throughout much of Europe has waned. Unbeknownst to many, just yesterday the Swiss Senate approved a motion passed by the lower chamber to withdraw a dormant application to join the EU. The Swiss decision is more symbolic than substantive. There has been no progress on the application in recent years. The government has previously acknowledged that the application was no longer valid.

There is some speculation that if the UK votes to leave the EU, Germany and France would respond with a new initiative for greater integration, perhaps in the security area. The EU appears to have great incentive be stern with the UK if it votes to leave in the negotiations that would follow. It wants to ensure a high barrier to exit.

As I have noted previously, on a recent trip to China, several investors suggested that a Brexit vote would be a sign of US weakness. The US has long favored and used numerous levers of influence to encourage a stronger and more integrated Europe. Most recently Obama urged the UK to stay in the EU. A Brexit vote would mean the US was unable to secure its interest. That defeat is the more bitter because Russia is the one country that clearly benefits from a weaker and divided Europe.

There is an element of truth to this assessment, but the first cut hurts Europe. It is a reflection of the failure of UK and European leadership. Given that Cameron campaigned to remain in the EU, a Brexit vote would be a public vote of no confidence. We have long suspected a vote to leave would spur a political crisis in the UK. The Labour Party itself is torn, partly on the issue and more on the current leadership, which has alienated traditional donors.

Merkel’s support in Germany has weakened over immigrations/refugees, and she has not found a way to correct it. The national election is a little over a year away. The CDU is still the biggest party, but its support has fallen. Together the CDU/CSU and the SPD are polling a little less than 50%, meaning a third party would be needed for the coalition. In France, Hollande is terribly unpopular. One of his ministers may form his own party to run for President. The National Front will celebrate a UK decision to leave the EU. Italy has run-off elections for local offices this weekend. Prime Minister Renzi’s reform momentum may stall ahead of this fall’s referendum on constitutional changes that would remove much power from the Senate.

While the Fed was more dovish than we had anticipated, and we recognize that the bar to a July hike is higher than we had thought, our underlying outlook for the dollar has not changed. It remains the driest towel on the rack, even if it is not quite as dry as we had thought. Yellen sought to reassure investors (and perhaps Congress) that foreign monetary policies do not constrain US monetary policy. She did not sound particularly convincing. Negative rates in Europe and Japan, and with no clear exit strategy, encourage flows into the US.

Full story here Are you the author? Previous post See more for Next post

Tags: Angela Merkel,Dollar Index,Europe,Federal Reserve,Janet Yellen,Kenneth Rogoff,newslettersent