Tag Archive: Deflation

Lost In Translation

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish.

Read More »

Read More »

Fear Or Reflation Gold?

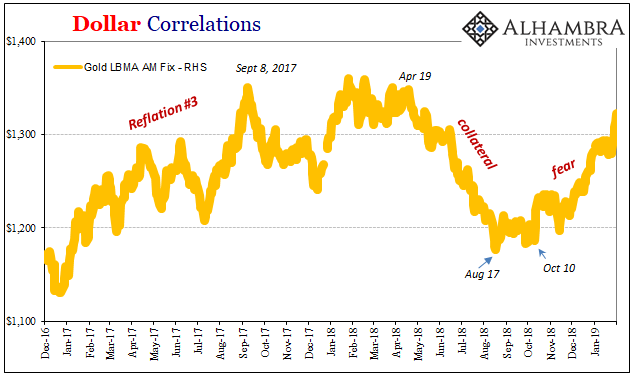

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way.

Read More »

Read More »

Insight Japan

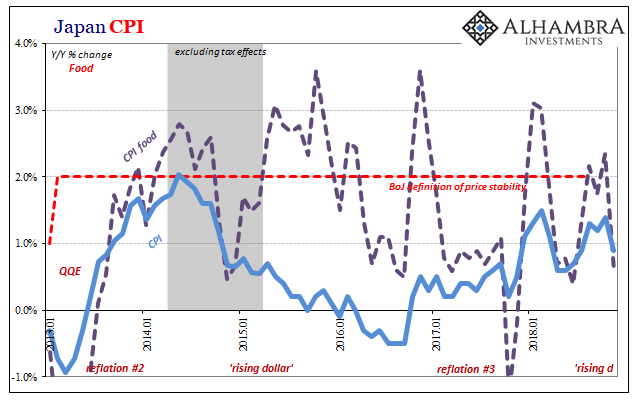

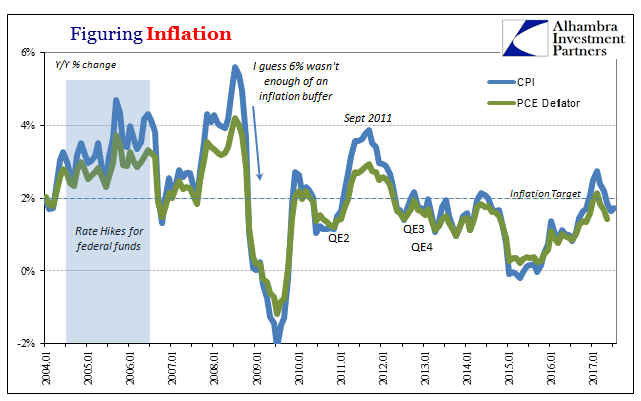

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost.

Read More »

Read More »

Rate of Change

We’ve got to change our ornithological nomenclature. Hawks become doves because they are chickens underneath. Doves became hawks for reasons they don’t really understand. A fingers-crossed policy isn’t a robust one, so there really was no reason to expect the economy to be that way.

Read More »

Read More »

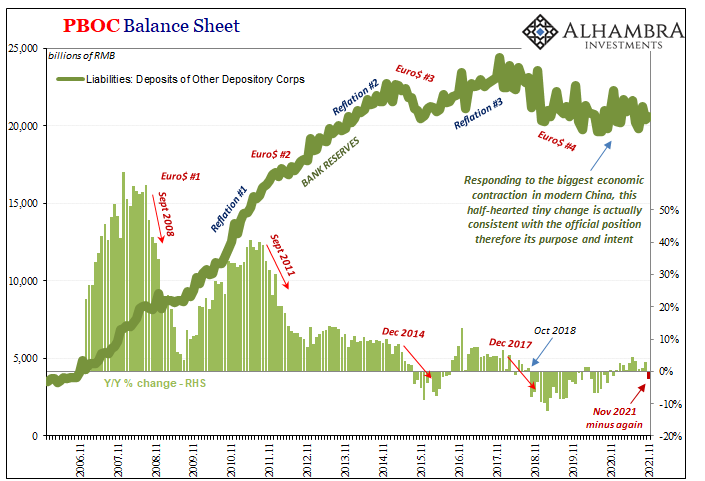

China Going Back To 2011

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of one US investment “bank”) the...

Read More »

Read More »

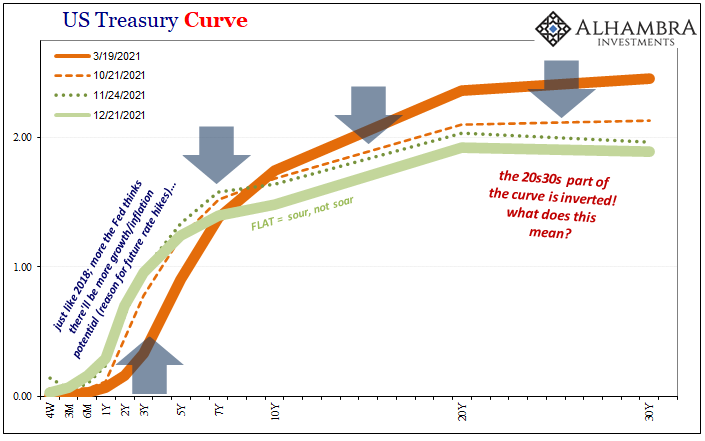

‘Mispriced’ Bonds Are Everywhere

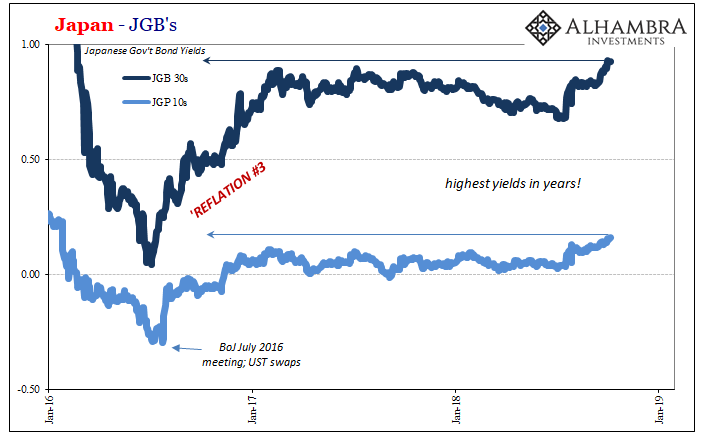

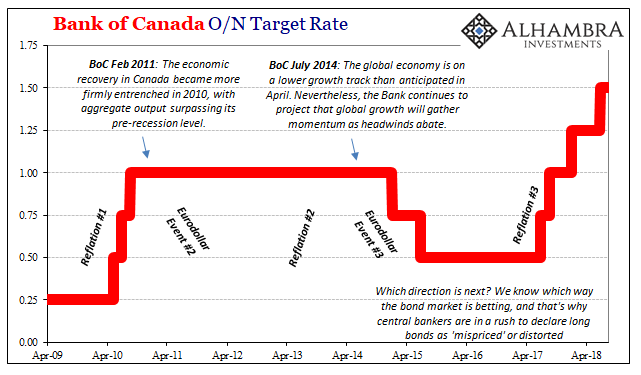

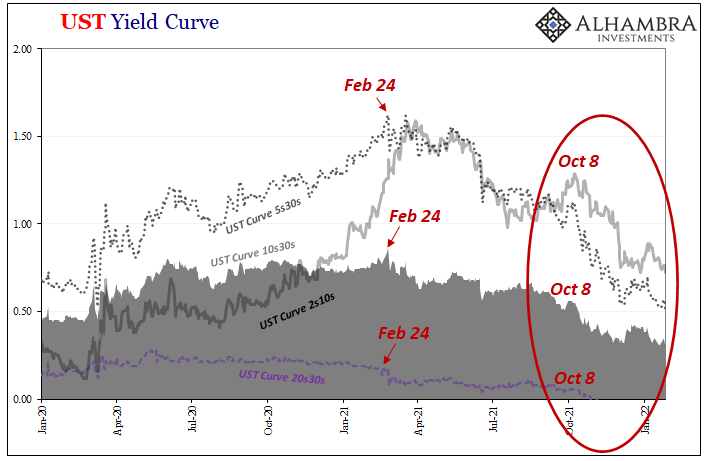

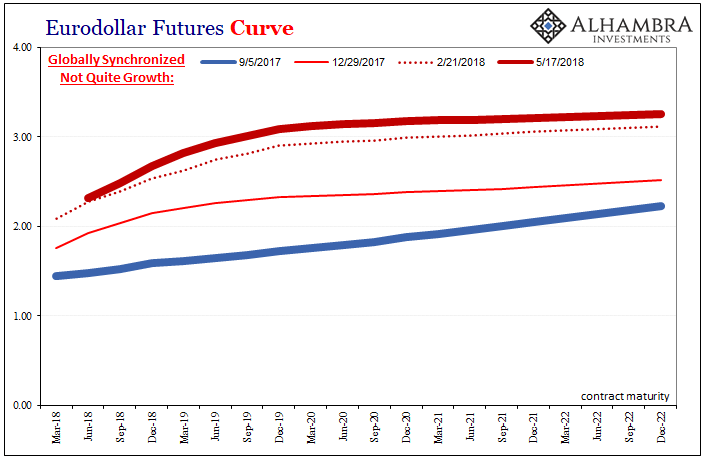

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are.

Read More »

Read More »

What China’s Trade Conditions Say About The Right Side Of ‘L’

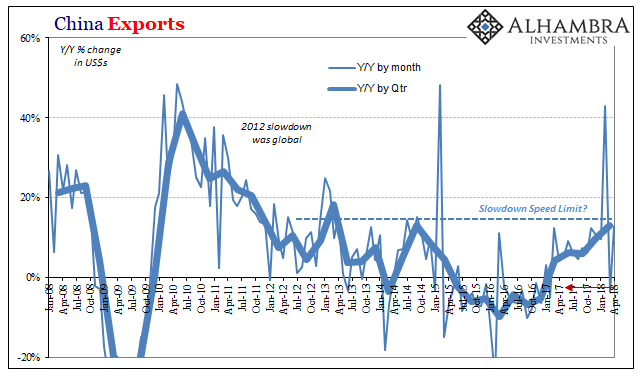

Chinese exports rose 12.9% year-over-year in April 2018. Imports were up 20.9%. As always, both numbers sound impressive but they are far short of rates consistent with a growing global economy. China’s participation in global growth, synchronized or not, is a must. The lack of acceleration on the export side tells us a lot about what to expect on the import side.

Read More »

Read More »

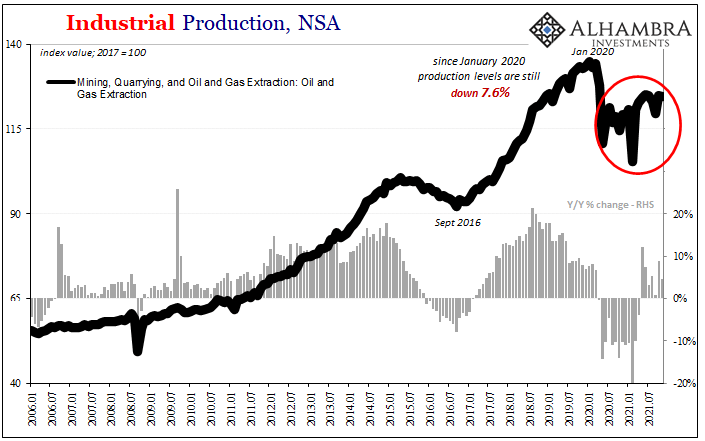

Oil Prices, CPI: Why Not Zero?

In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its notes on September 19 that year the Swedish...

Read More »

Read More »

The Internet Helped Kill Inflation In America, Says Credit Suisse

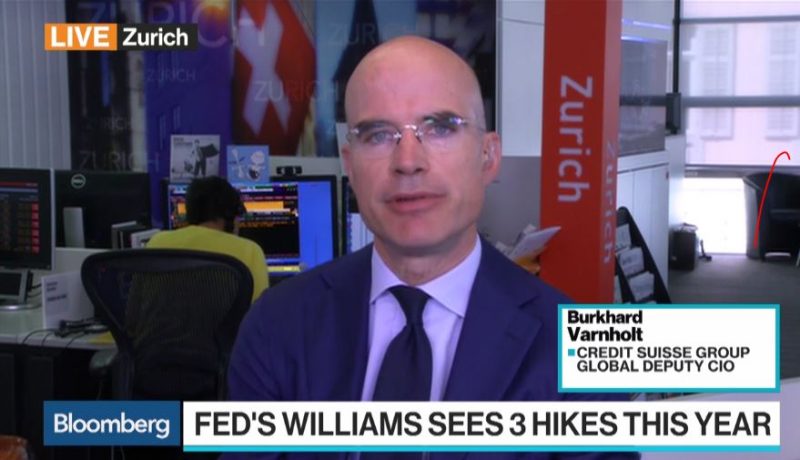

Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen - as he told CNBC two days ago - is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt.

Read More »

Read More »

A New Frame Of Reference Is Really All That Is Necessary To Start With

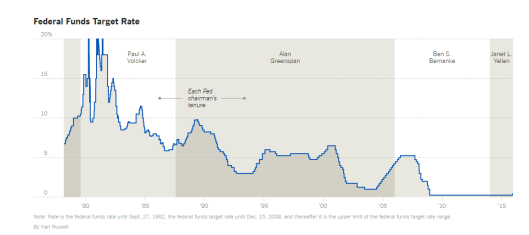

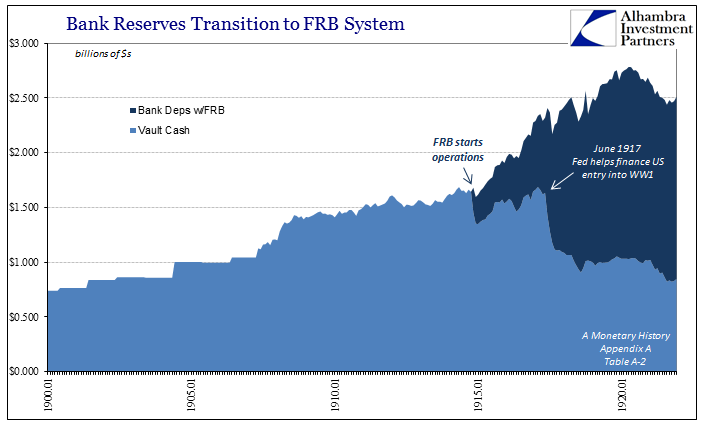

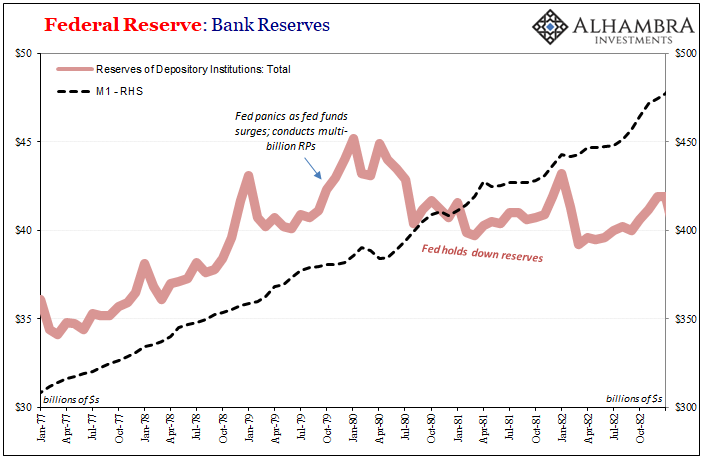

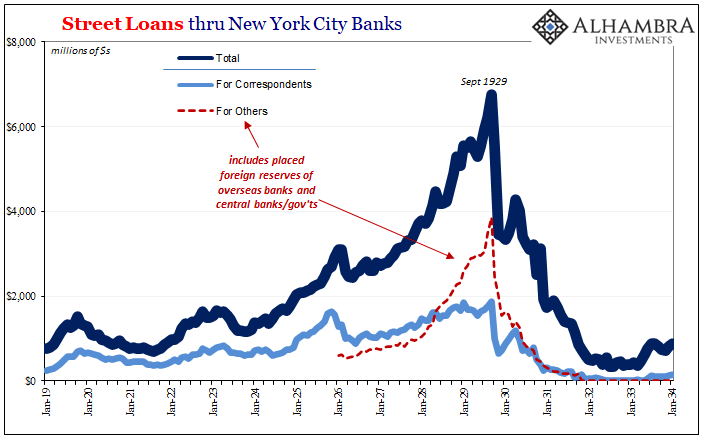

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it.

Read More »

Read More »

China in Continuous PPI Deflation and No Depression In Sight?

Both Chinese PMI and the producer price index (PPI) are in deflation since 2012. This opens a lot of questions about the sustainability of Chinese economic growth, but also about the certain economic theories that consider deflation as a precursor of depression, as it did in the early 1930s. China's speed of economic growth simply slows, recently to 7%, according to China statistics "China’s Economy Showed Moderate but Steady Growth".

Read More »

Read More »

Keith Weiner: Inflation Caused the Greek Tragedy

By inflation, I don’t refer to rising consumer prices in Athens. My Greek friends tell me that prices have been steady there in recent years. The focus on prices is the greatest sleight of hand ever perpetrated. It diverts your attention away from the real action.

Inflation is the counterfeiting of credit. It is borrowing, when you can’t pay and you know it. Inflation is taking money under false pretenses, and issuing fraudulent bonds.

This...

Read More »

Read More »

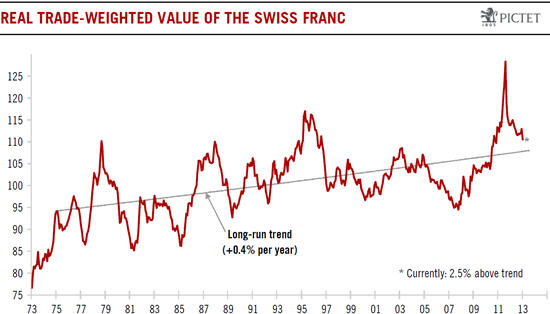

Swiss Franc and Swiss Economy: The Overview Questions

Before the upcoming SNB monetary policy assessment meeting on June 19th, rumors started the SNB could follow the ECB and set negative rates on banks' excess reserves. We would like to deliver the whole background, starting with the question why Swiss inflation has been so low in the past and why CHF always appreciated.

Read More »

Read More »

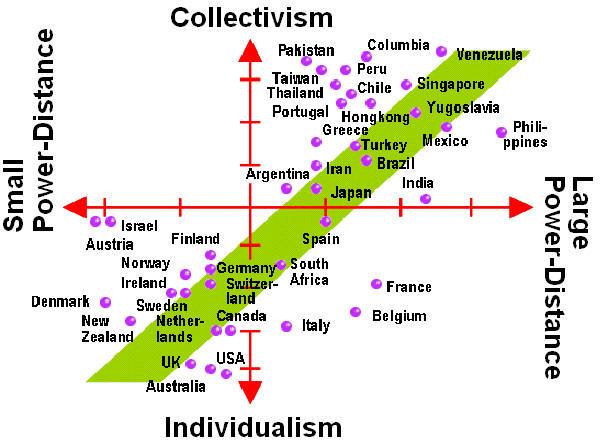

Cultural Reasons for Japan’s Deflation: Can the U.S. Go into a Balance Sheet Recession?

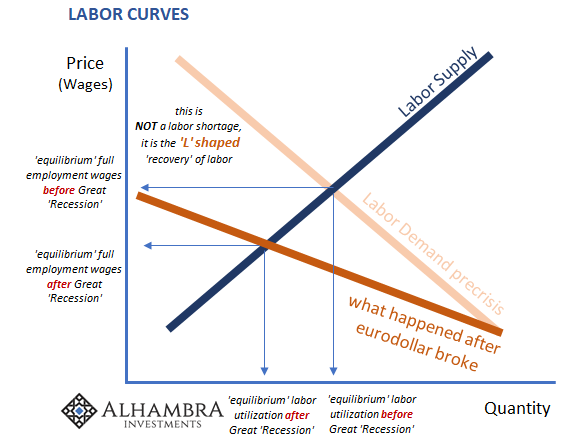

The power distance between employer and employee enforces the importance of the leader, the entrepreneur. Moreover, the collectivite Asian society does not want unemployment, employees prefer to renounce to salary hikes in favor of the collective. These cultural reasons can qualify as drivers of the Japanese balance sheet recession.

Read More »

Read More »

Adam Smith Institute: Could Deflation Be Salvation?

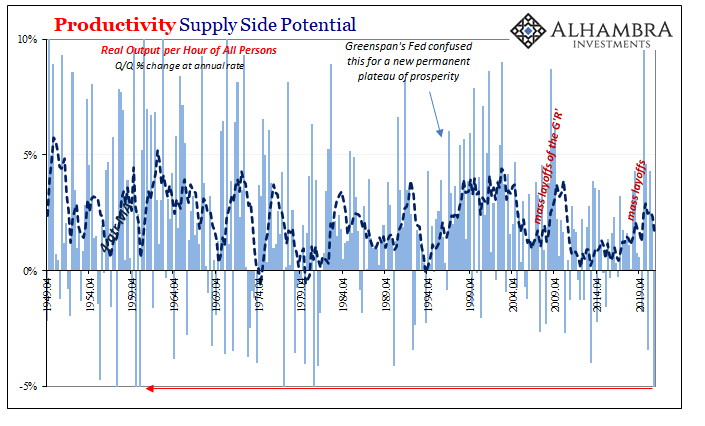

Imagine wages and factor prices are stable. Hence deflation means productivity growth: Higher quantities bought for a lower price. Low inflation or even deflation is the Swiss success story for decades and the success story for the United States recently. The Pigou effect seems to be saving the US economy, just as it did in …

Read More »

Read More »

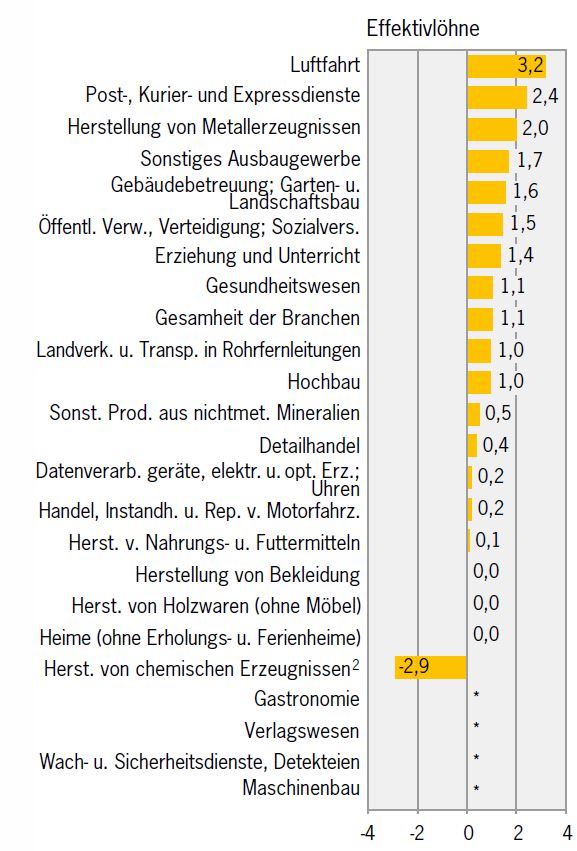

Swiss Wages Keep on Rising: No Signs of Deflationary Pressures

No signs of the so often mentioned "deflationary pressures" by the SNB. According to Swiss statistics hourly wages rose by 1.1% in the year 2012, while they went up by 1.0% in 2011. More details

Read More »

Read More »

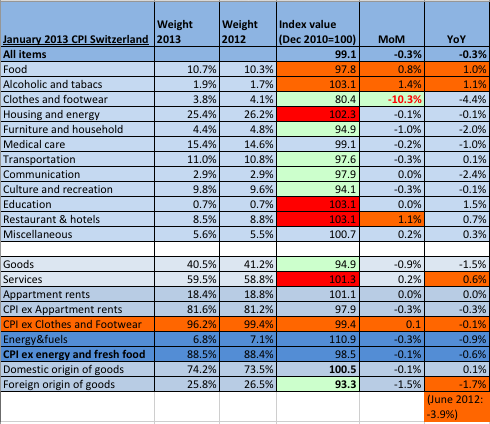

Switzerland’s Slow Way to Inflation

UPDATE February 2013 inflation data: The inflation figures for February showed the upwards movement we expected. On monthly basis inflation rose by 0.3%. The Swiss CPI is getting closer and closer to the one of the euro zone. We explain the January 2013 data on Swiss inflation and indicate which components drive the consumer …

Read More »

Read More »

Is a Liquidity Trap Really a Problem? Yen Debasement Part3 by Noah Smith

Thoughts on the Japanese Currency Debasement (part 3) In previous posts we looked on the following aspects of the recent Japanese currency debasement: Overview: What different leading economists – Paul Krugman, Richard Koo, Adam Posen, Kyle Bass – think about the Japanese currency debasement and the way to more private spending and investing instead of …

Read More »

Read More »