Tag Archive: Crude Oil

Is Another Oil Head-Fake Brewing?

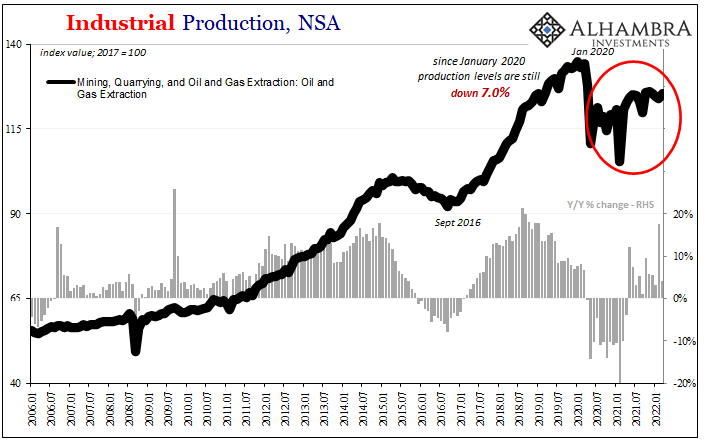

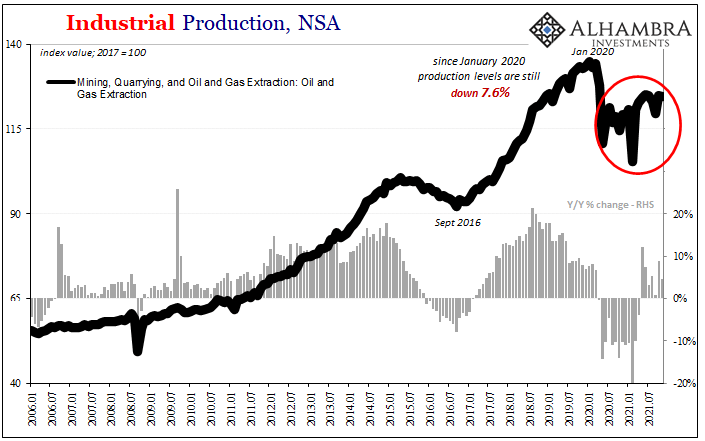

Over the past decade I've addressed what I call Head-Fakes in the cost of oil/fossil fuel: even though we know the cost of extracting and processing oil will rise over time as the easy-to-get oil is depleted, oil occasionally plummets to such low prices that we're fooled into thinking it will remain cheap for a long time to come.

Read More »

Read More »

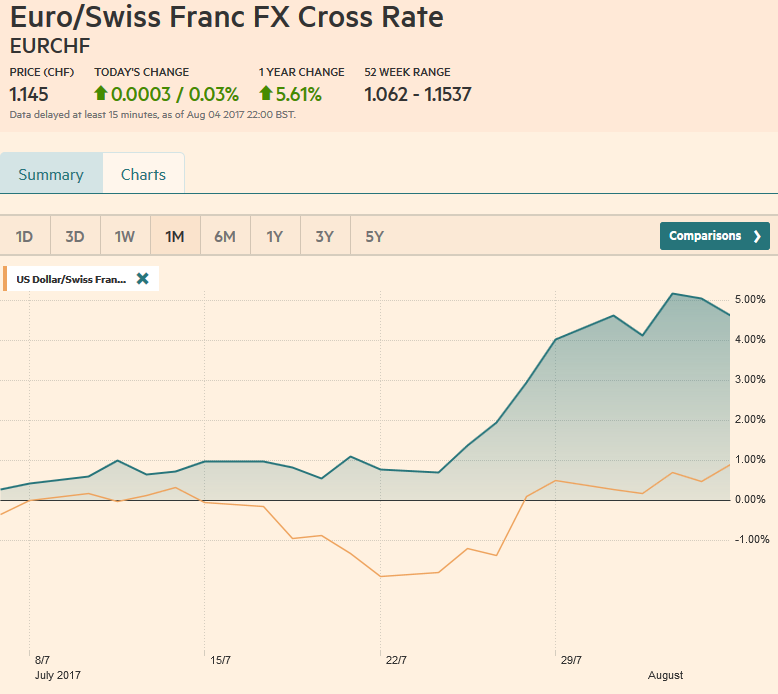

FX Weekly Review, July 31 – August 05: Second Week of Strong CHF Losses

The Swiss Franc entered the second week of stronger losses. While the euro gained 4% last week, the dollar appreciated against the Swiss Franc 2% during this week.

Read More »

Read More »

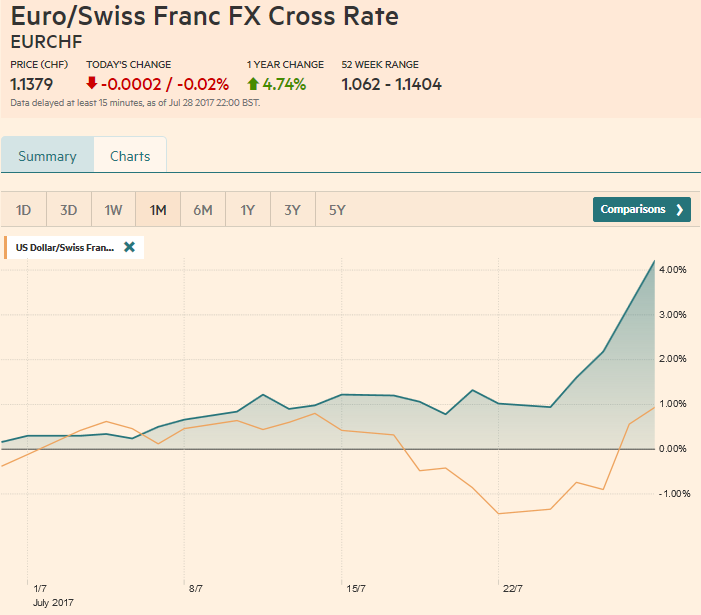

FX Weekly Review, July 24 – July 29: Swiss Franc getting crushed

The Swiss franc was the only major foreign currency that fell against the dollar last week. The 2.6% decline was the largest in two years.

Read More »

Read More »

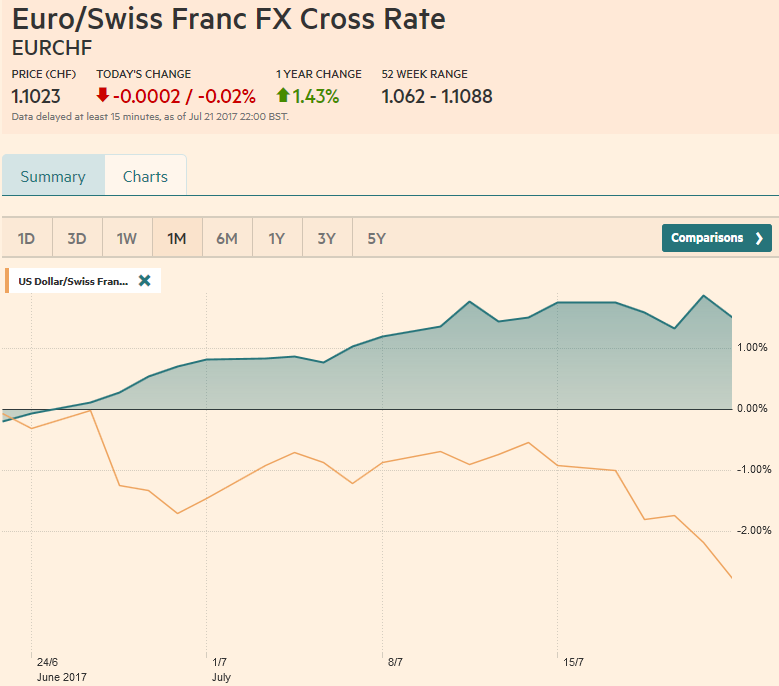

FX Weekly Review, July 17 – July 22: Euro and CHF move upwards against Dollar

Both Swiss Franc and Euro were moving upwards against the dollar. So CHF gained 3% versus the dollar in the last month. CHF losses against the euro are smaller, around 1.3%.

Read More »

Read More »

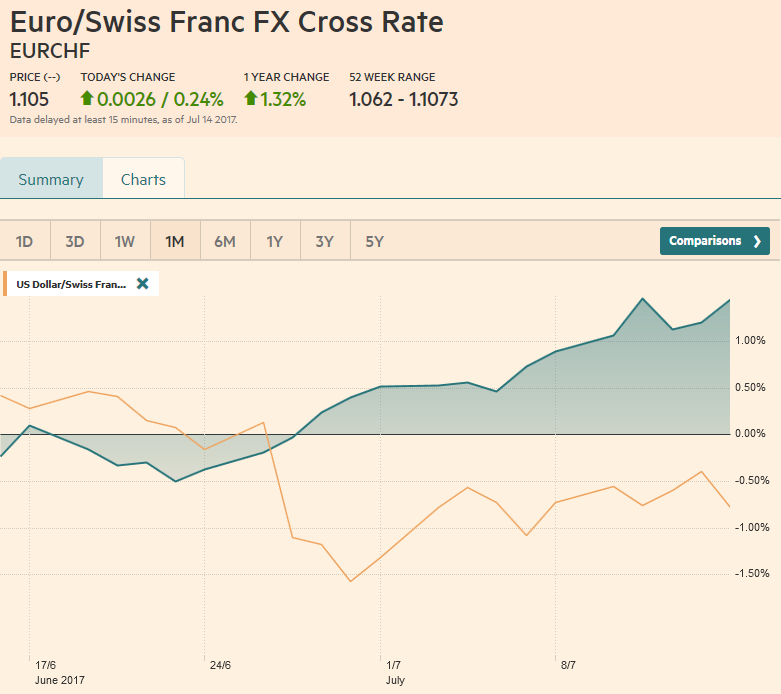

FX Weekly Review, July 10 – July 15: CHF Winning against USD, but losing vs. Euro

The Euro remained the strongest among EUR, CHF and USD during the last month.

The Swiss lost against EUR 1.5%, while it gained versus the dollar 0.75%.

Read More »

Read More »

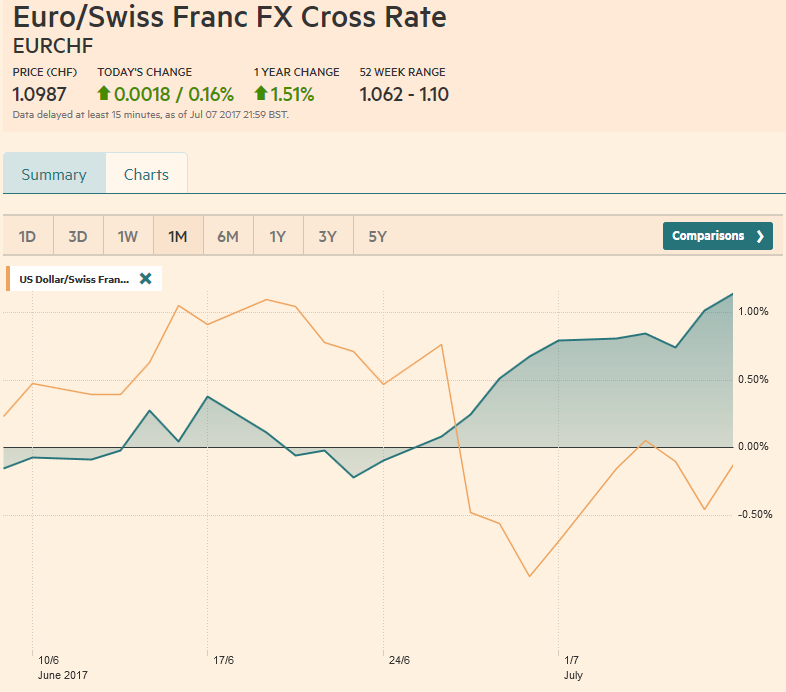

FX Weekly Review, July 03 – July 08: Second Euro appreciation phase

The ECB appears to be preparing investors for a further adjustment of its risk assessment and a reduction of its asset purchases as they are extended into next year.

This assessment has marked a new phase of an appreciating EUR/CHF rate. It followed the previous phase, the one with and after the French elections.

Read More »

Read More »

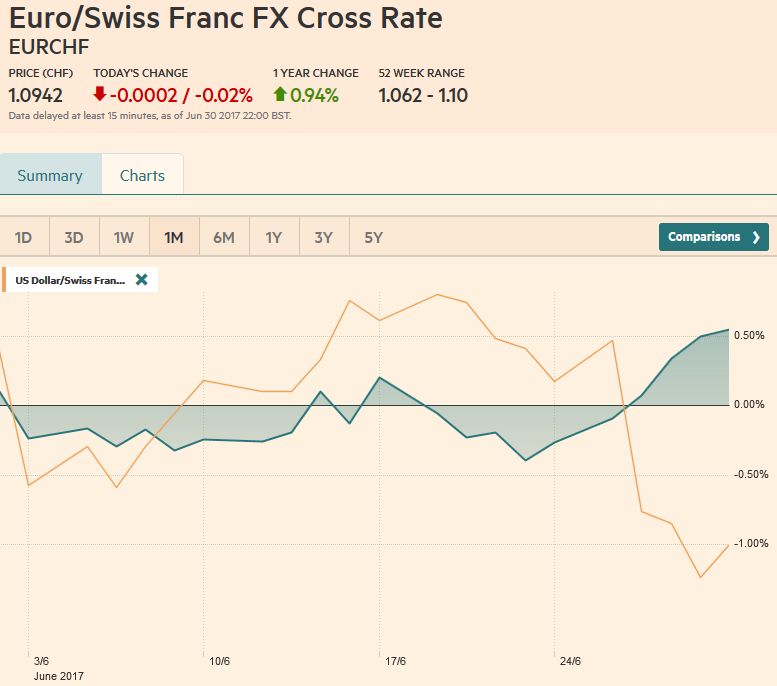

FX Weekly Review, June 26 – July 01: Normalization Ideas Weigh on Greenback

A virus has spread across the markets as the first half drew to a close. Many investors have become giddy. The low vol environment was punctuated by ideas that peak in monetary accommodation is past and that the gradual process of normalization is beginning.

Read More »

Read More »

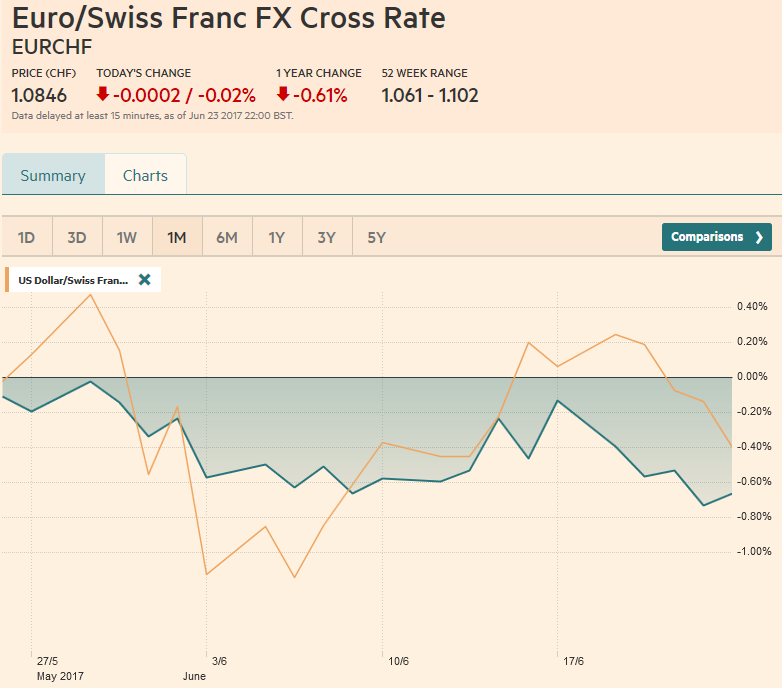

FX Weekly Review, June 19 – June 24: Stronger Franc with Fading Euro Enthusiam

Over the last month, the Swiss franc outpaced both EUR and USD. But the change is only little, the EUR fell by 0.60% and the dollar by 0.40%. The main reason for the stronger CHF is the fading enthusiasm after Macron's victory in the French elections and hence a weaker euro. Consequently SNB interventions are rising again.

Read More »

Read More »

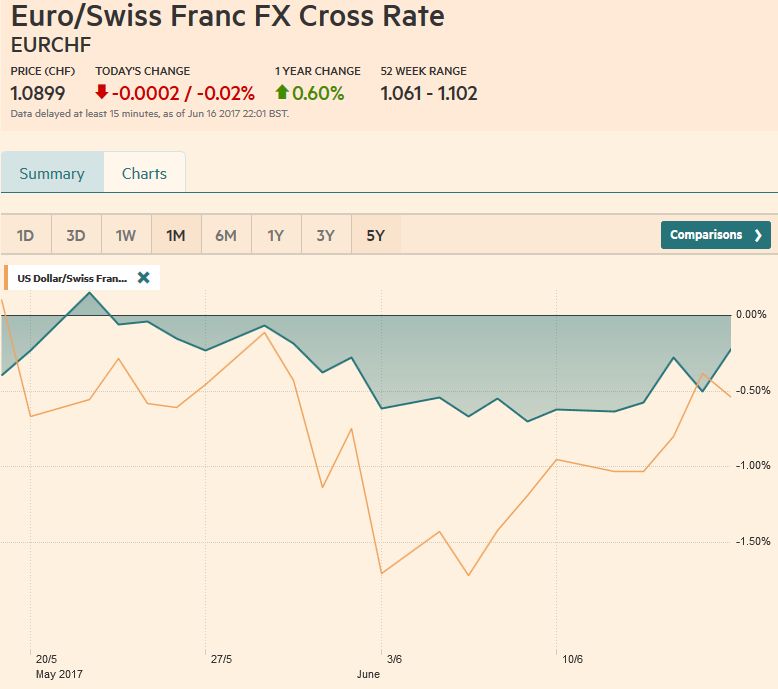

FX Weekly Review, June 12 – June 17: Greenback Still Trying To Turn

Swiss Franc vs USD and EUR Rarely in the foreign exchange market is there a V-shaped extreme. Most of the time, the high or low is a process that is carved over time. Although the explanation of the dollar’s weakness here in H1 vary, we continue to believe that the longer-term cyclical rally, the third since … Continue reading »

Read More »

Read More »

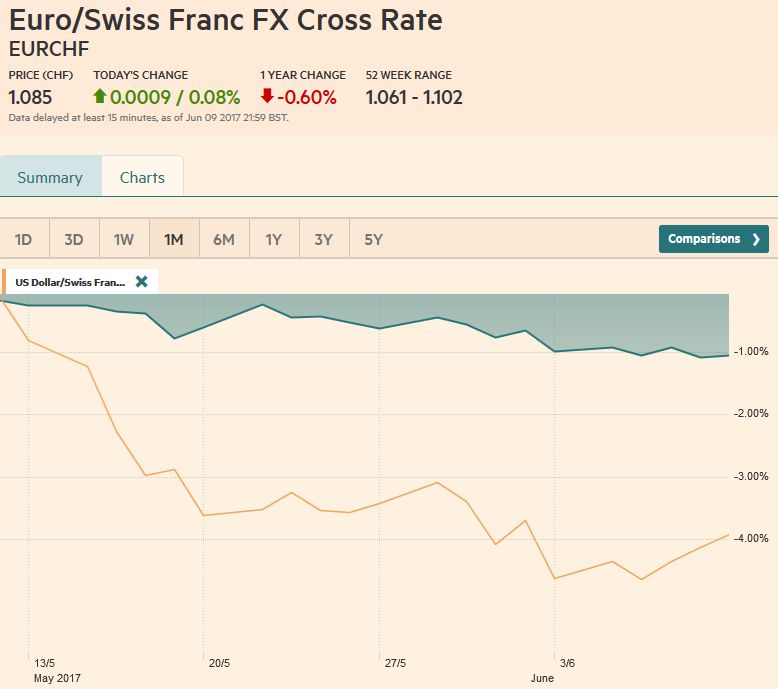

FX Weekly Review, June 05 – June 10: Sterling Leads Dollar Recovery

The US Dollar has lost 4% against the franc since the beginning of May, while the euro is down only 1%. Most important events in this week were the ECB meeting and the UK elections. The inability of the Tory Party to secure a parliamentary majority spurred a sharp decline in sterling.

Read More »

Read More »

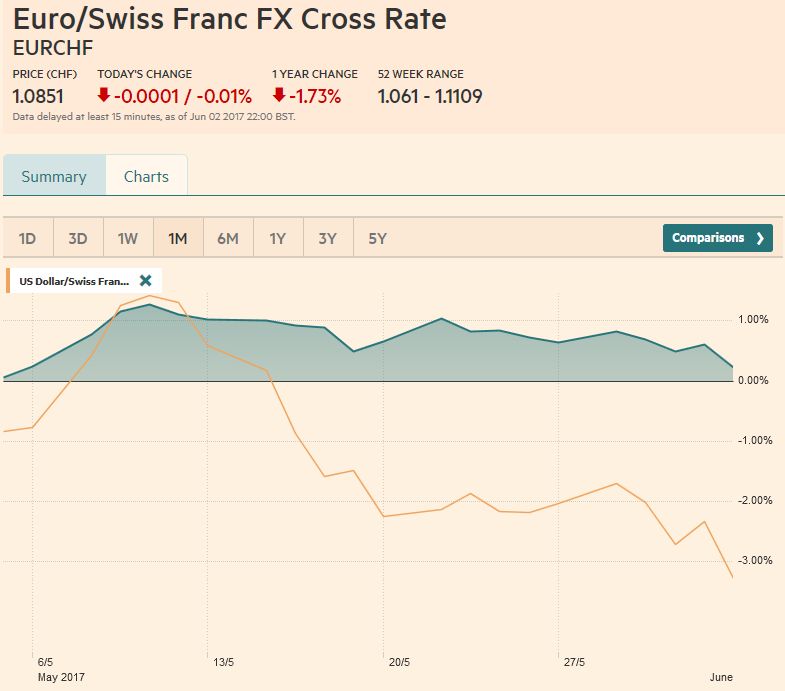

FX Weekly Review, May 29 – June 03: Dollar Dogged by Disappointing Data

While the Euro traded in the range between 1.08 and 1.09, the dollar declined by nearly 3%. The technical indicators warn that the US dollar is stretched, but the combination of disappointing auto sales and jobs report may deny it the interest rate support needed to facilitate a resumption of the bull market.

Read More »

Read More »

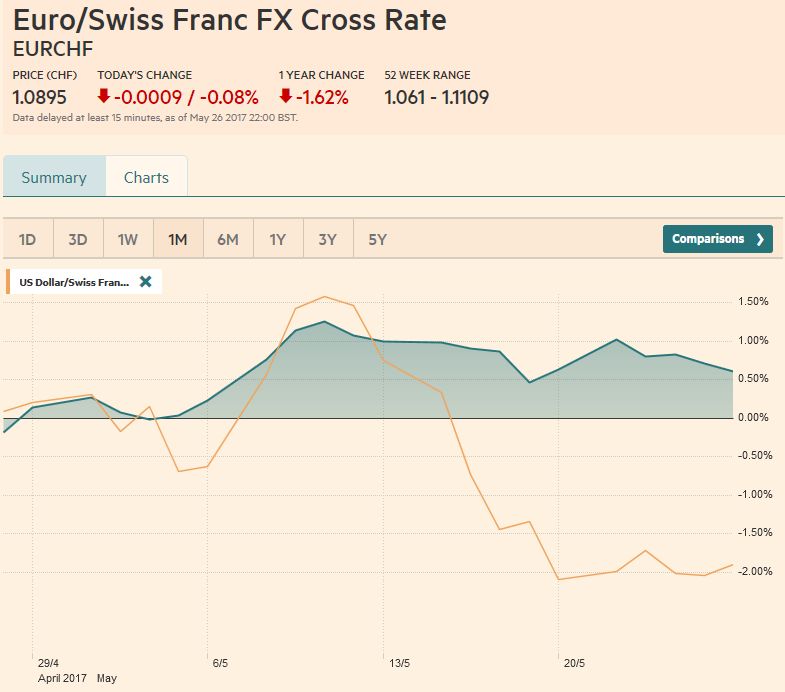

FX Weekly Review, May 22 – 27: Is the Dollar Going To Turn?

The Swiss Franc recovered a lot of the losses that came with the French elections. That political event was mostly driven by speculators that will close their positions. We expected the EUR to trade around 1.07 to 1.0750 CHF in some time.

Read More »

Read More »

Great Graphic: OIl and the S&P 500

The fluctuation of oil prices is often cited as an important factor driving equities. Our work shows that this is not always the case and that the correlation between the price of oil and the S&P 500 continues to ease.

Read More »

Read More »

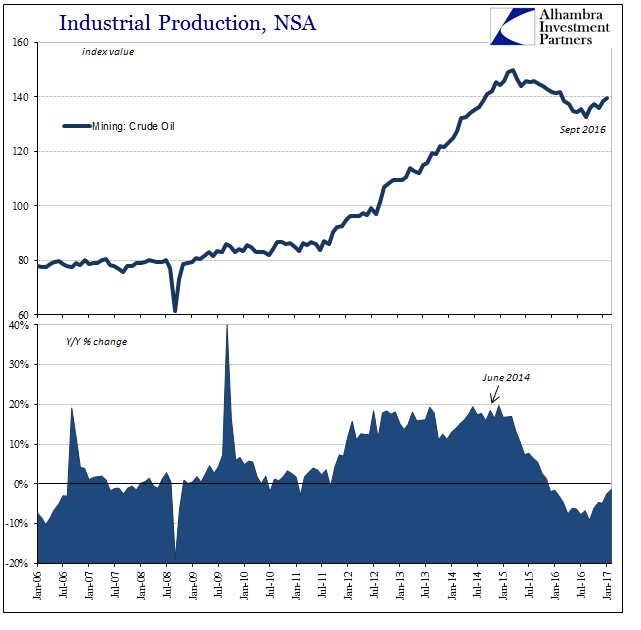

Commodity and Oil Prices: Staying Suck

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their pain.

Read More »

Read More »

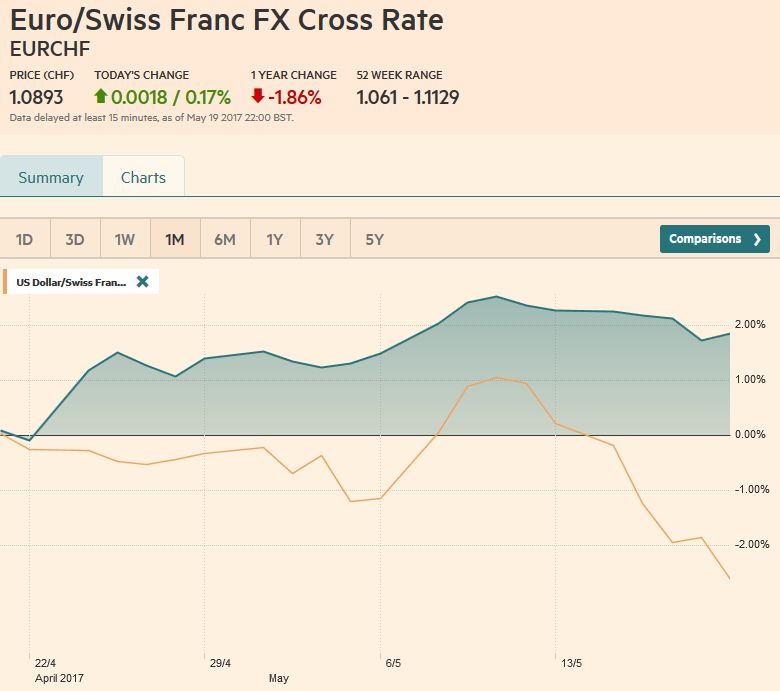

FX Weekly Review, May 15-20: Swiss Franc recovering against EUR

The Swiss Franc recovered a lot of the losses that came with the French elections. That political event was mostly driven by speculators that will close their positions. We expected the EUR to trade around 1.07 to 1.0750 CHF in some time.

Read More »

Read More »

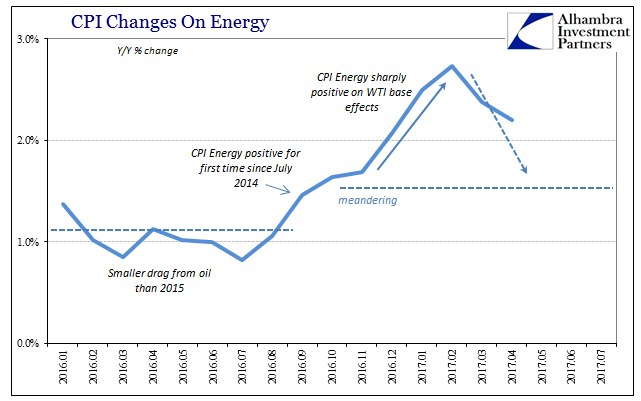

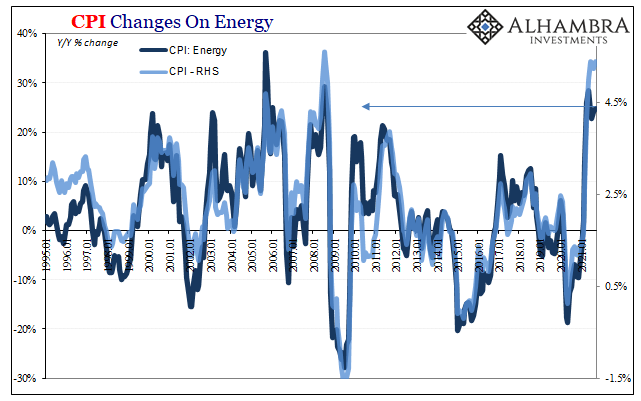

Inflation Is Oil, But Inflation Is Much More Than Consumer Prices

The average annual change in the WTI benchmark price was in April about 25%. That was still a sizable increase year-over-year, and just marginally less than March’s average of 33%. For calculated inflation rates, it represents the last of the base effects that have to this point made it appear as if economic improvement was possibly serious.

Read More »

Read More »

FX Weekly Review, May 08-13: Euro rises far above 1.09 CHF, for how long?

The euro rose up to 1.0980. How long this momentum will last is still the question, given that it is driven by this political event and sustained by SNB interventions.

Read More »

Read More »

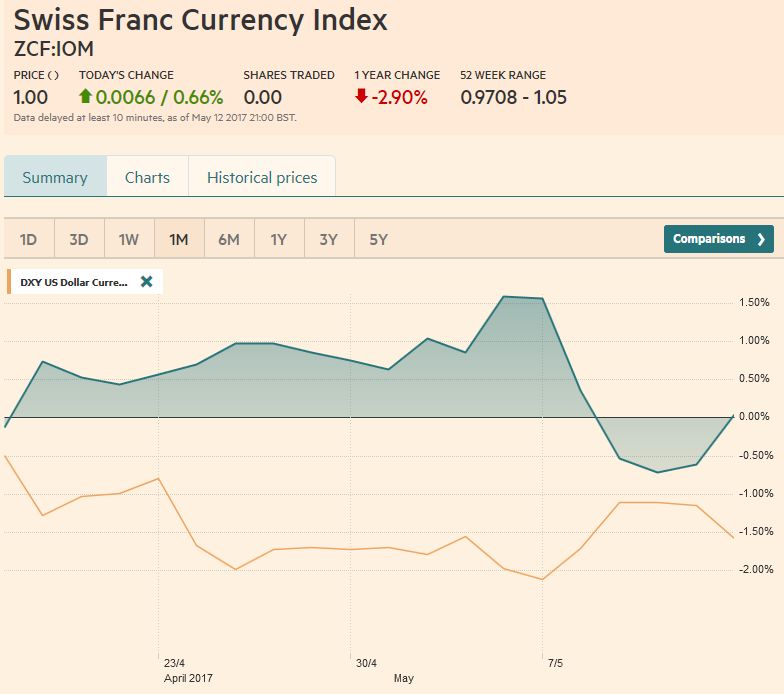

FX Weekly Review, May 01 – 06: Seasonal Patterns and Yen Crosses

The Swiss Franc index gained 1.5% in the last month, the biggest part of it is from the last week. The trade-weighted indices the Fed tracks are updated monthly. The Bank of England calculates the effective exchange rate on a daily basis. It has not fallen since April 24.

Read More »

Read More »

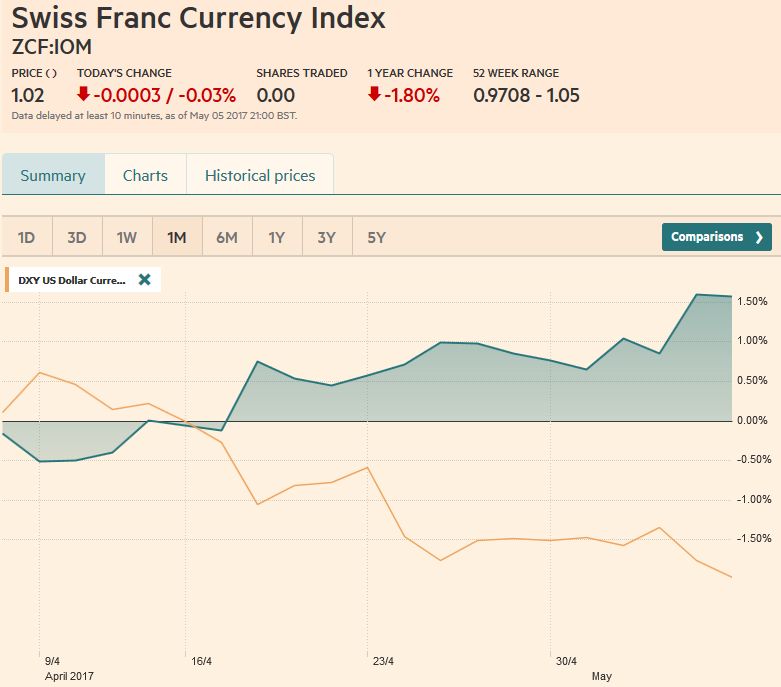

FX Weekly Review, April 24 – 29: Dollar Remains the Fulcrum

Often the US dollar, as the numeraire, seems to be the main actor in the foreign exchange market. Other times, the dollar appears to be at the fulcrum between European currencies on one hand, and the dollar-bloc currencies on the other hand. Another way expressing this is whether there is a dollar-move underway or is it really more about the crosses.

Read More »

Read More »

FX Weekly Review, April 17 – 22: Dollar Technicals Trying to Turn, but…

While the dollar index had another bad week with a 0.75% less, the Swiss Franc currency index could accumulate the corresponding gains. Main reason is that the EUR/CHF rose over 1.07.

Read More »

Read More »