Tag Archive: Chart Update

US Money Supply – The Pandemic Moonshot

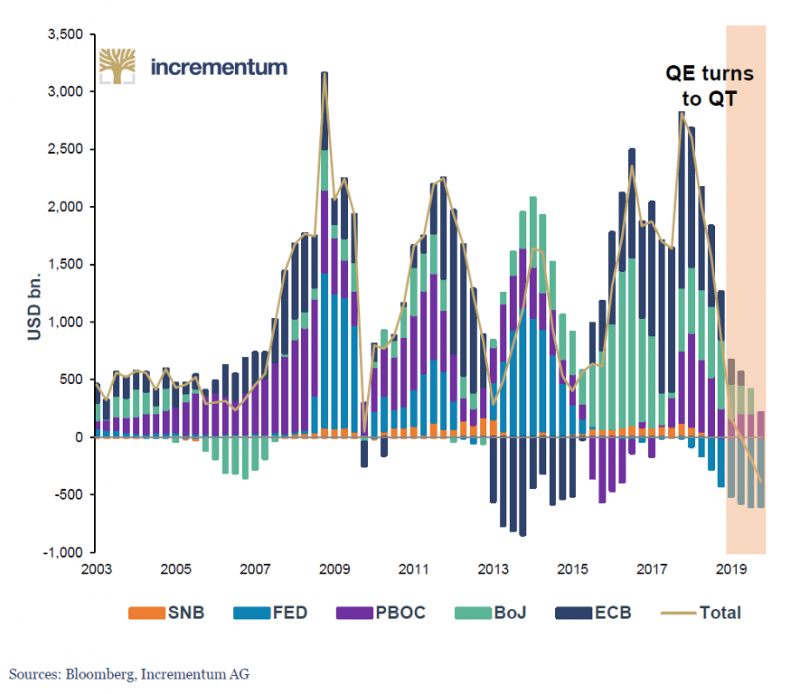

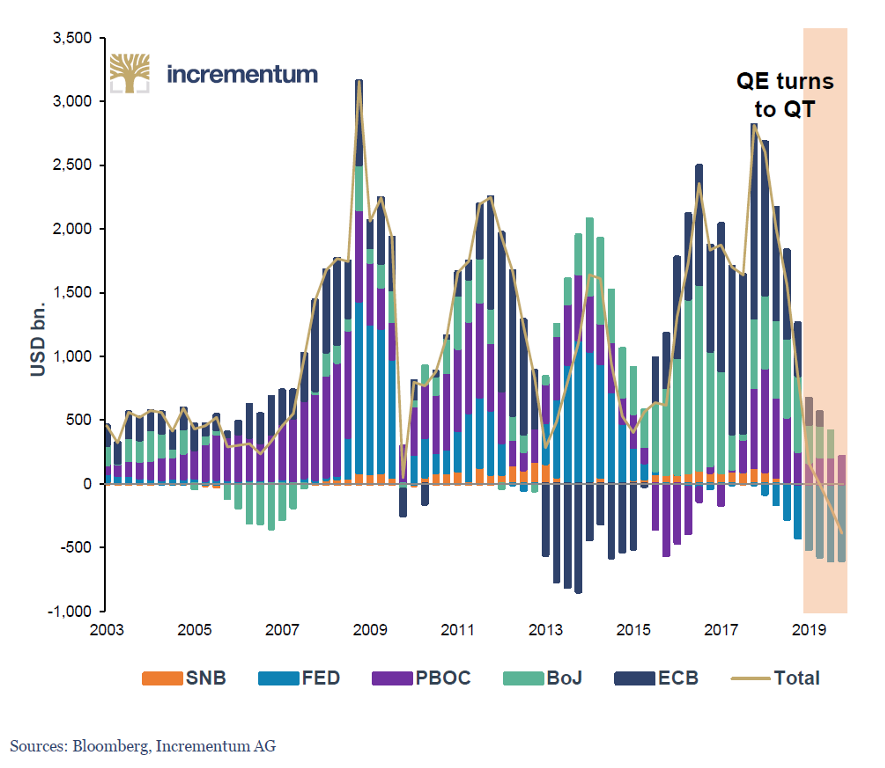

Printing Until the Cows Come Home… It started out with Jay Powell planting a happy little money tree in 2019 to keep the repo market from suffering a terminal seizure. This essentially led to a restoration of the status quo ante “QT” (the mythical beast known as “quantitative tightening” that was briefly glimpsed in 2018/19). Thus the roach motel theory of QE was confirmed: once a central bank resorts to QE, a return to “standard monetary policy”...

Read More »

Read More »

The Recline and Flail of Western Civilization and Other 2019 Predictions

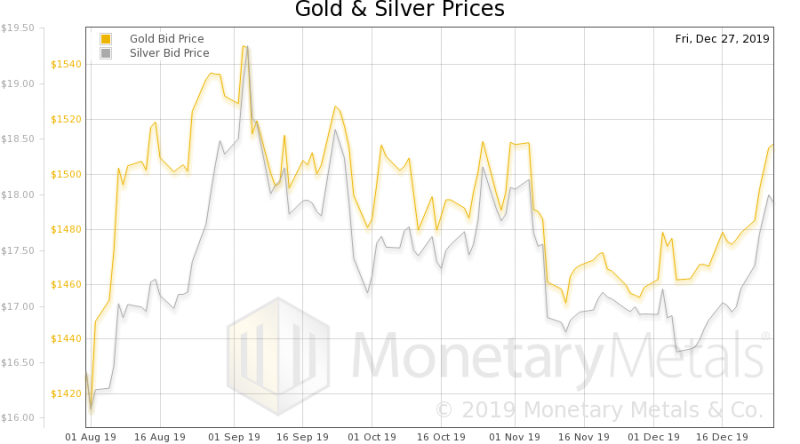

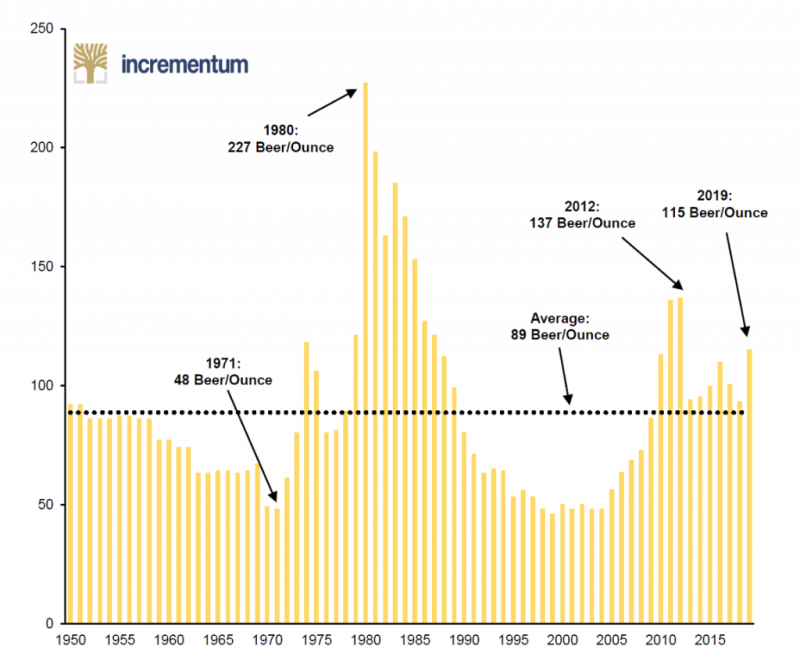

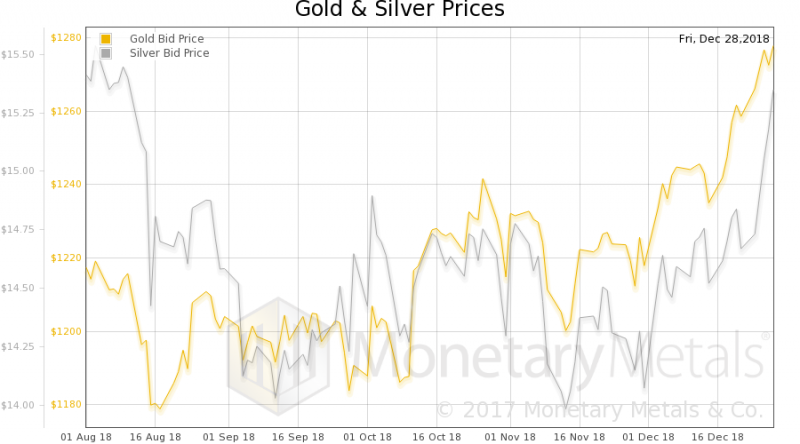

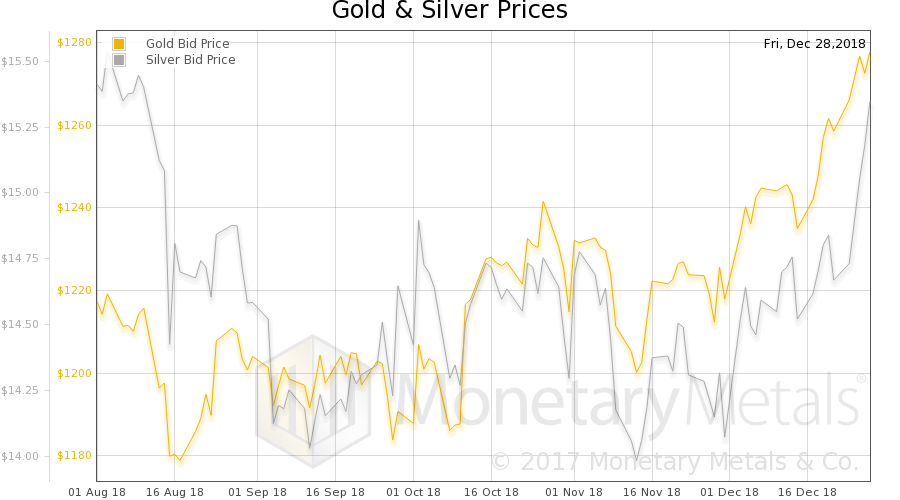

The Recline and Flail of Western Civilization and Other 2019 Predictions. “I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.” – President Donald Trump, Christmas Day 2018. Darts in a Blizzard. Today, as we prepare to close out the old, we offer a vast array of tidings.

Read More »

Read More »

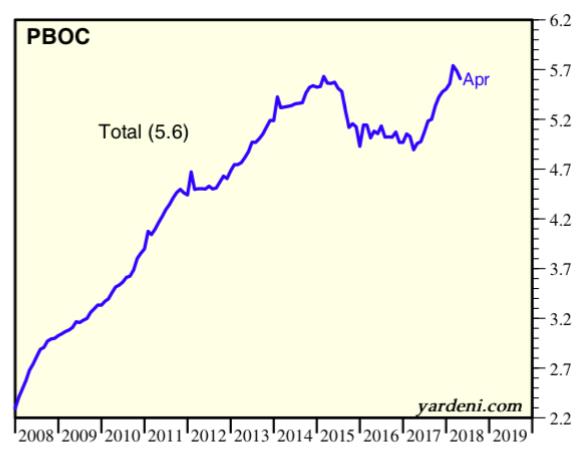

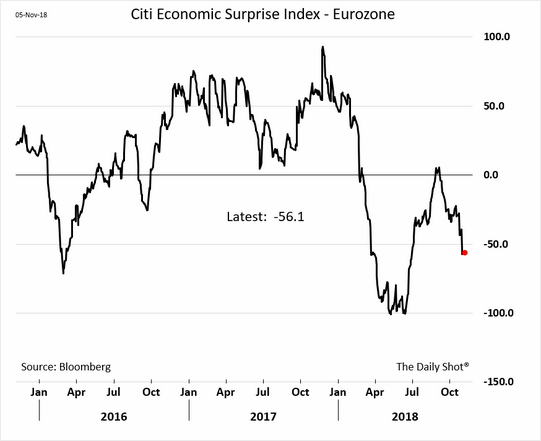

A Global Dearth of Liquidity

Worldwide Liquidity Drought – Money Supply Growth Slows Everywhere

This is a brief update on money supply growth trends in the most important currency areas outside the US (namely the euro area, Japan and China) as announced in in our recent update on US money supply growth (see “Federal Punch Bowl Removal Agency” for the details).

Nobody likes a drought. This collage illustrates why.

The liquidity drought is not confined to the US – it...

Read More »

Read More »

Eastern Monetary Drought

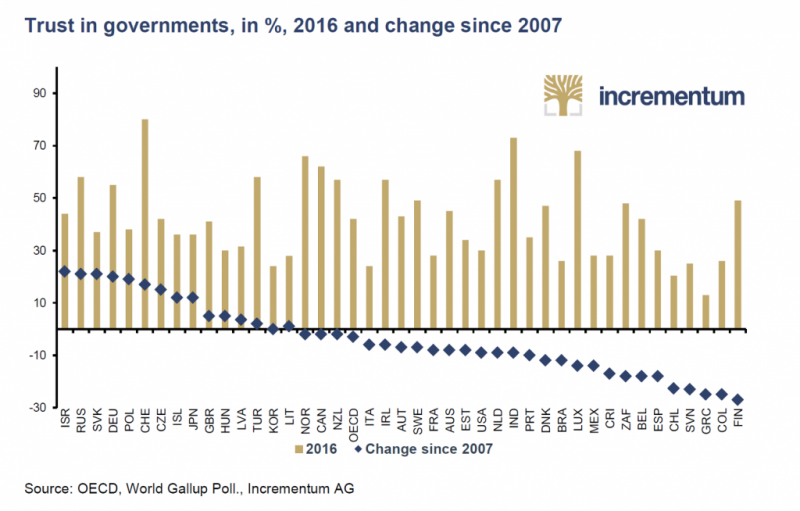

Looking back at the past decade, it would be easy to conclude that central planners have good reason to be smug. After all, the Earth is still turning. The “GFC” did not sink us, instead we were promptly gifted the biggest bubble of all time – in everything, to boot. We like to refer to it as the GBEB (“Great Bernanke Echo Bubble”) in order to make sure its chief architect is not forgotten.

Read More »

Read More »

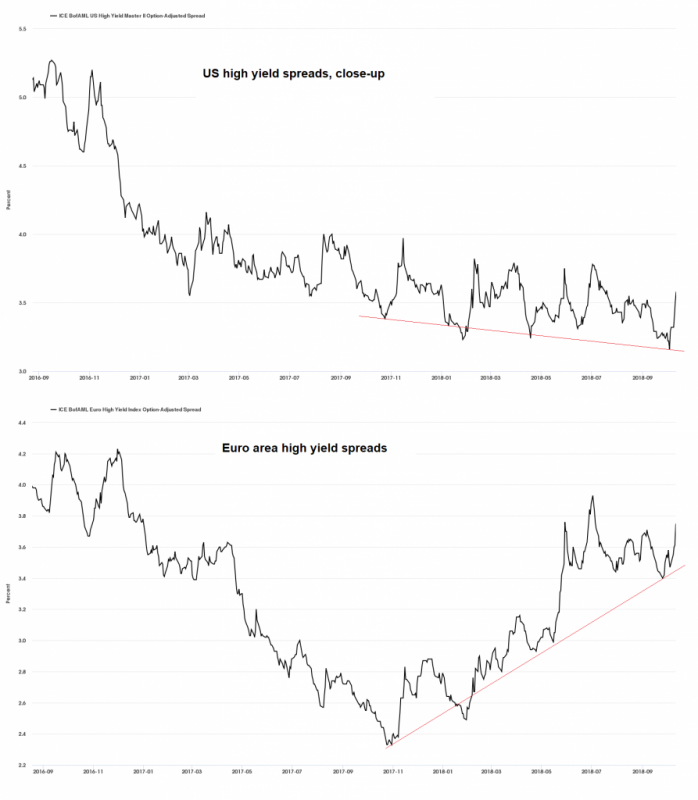

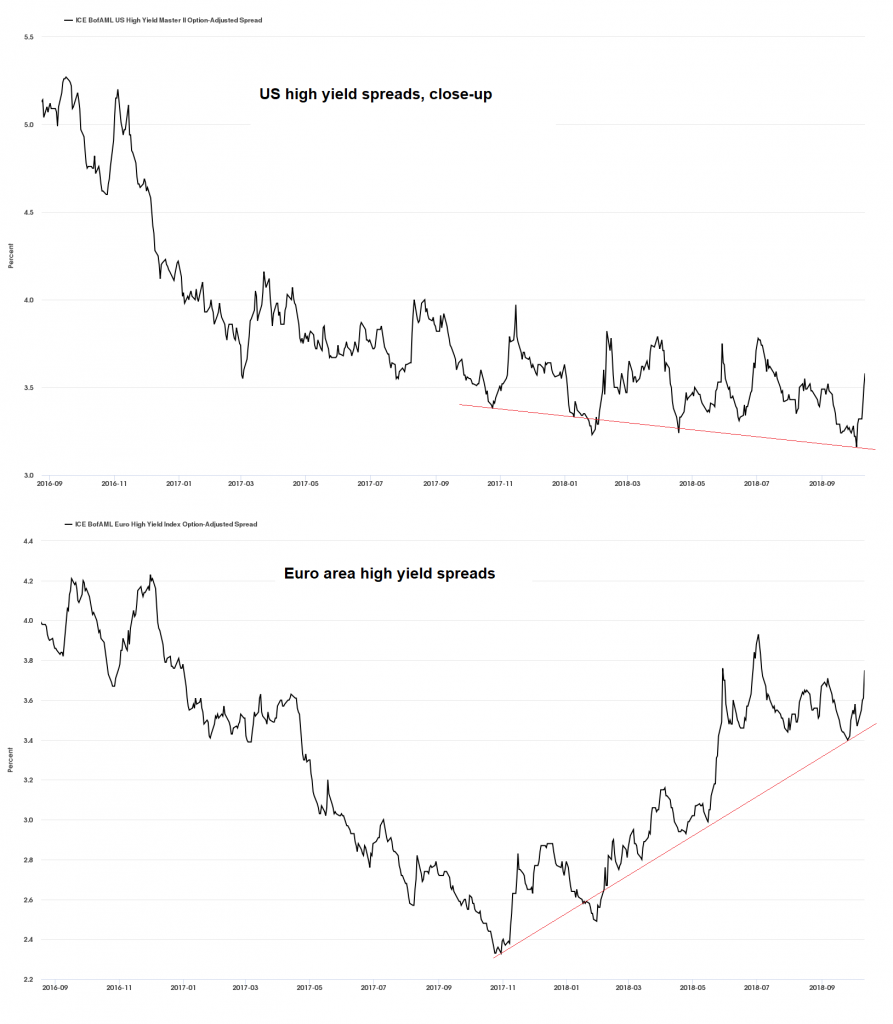

Are Credit Spreads Still a Leading Indicator for the Stock Market?

Seemingly out of the blue, equities suffered a few bad hair days recently. As regular readers know, we have long argued that one should expect corrections in the form of mini-crashes to strike with very little advance warning, due to issues related to market structure and the unique post “QE” environment.

Read More »

Read More »

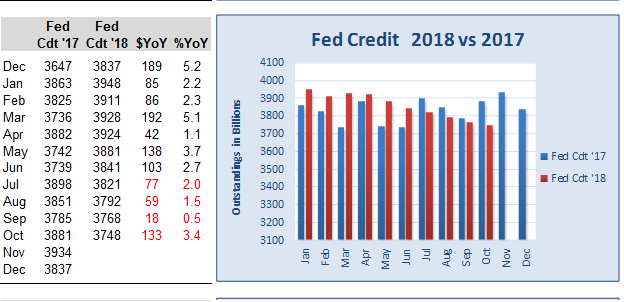

Fed Credit and the US Money Supply – The Liquidity Drain Accelerates

Federal Reserve Credit Contracts Further. We last wrote in July about the beginning contraction in outstanding Fed credit, repatriation inflows, reverse repos, and commercial and industrial lending growth, and how the interplay between these drivers has affected the growth rate of the true broad US money supply TMS-2 (the details can be seen here: “The Liquidity Drain Becomes Serious” and “A Scramble for Capital”).

Read More »

Read More »