Tag Archive: Brazil

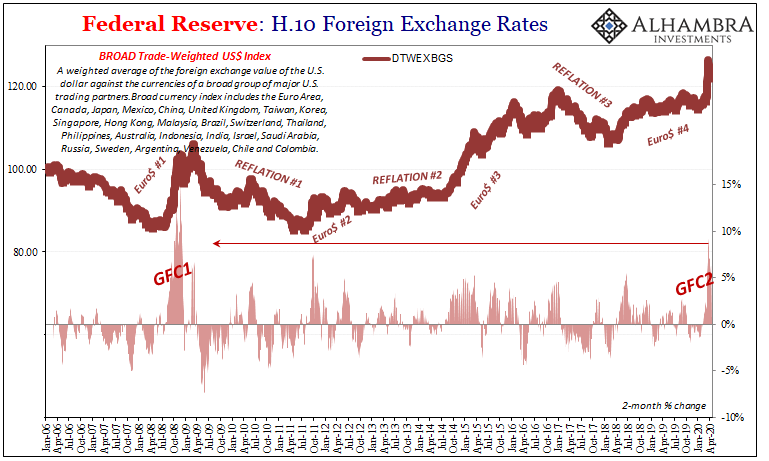

Why Aren’t Bond Yields Flyin’ Upward? Bidin’ Bond Time Trumps Jay

It’s always something. There’s forever some mystery factor standing in the way. On the topic of inflation, for years it was one “transitory” issue after another. The media, on behalf of the central bankers it holds up as a technocratic ideal, would report these at face value. The more obvious explanation, the argument with all the evidence, just couldn’t be true otherwise it’d collapse the technocracy right down to the ground.And so it was also in...

Read More »

Read More »

FX Daily, September 17: Powell Lets Steam Out of Equities and Spurs Dollar Short-Covering

Profit-taking after the FOMC meeting saw US equities and gold sell-off. The high degree of uncertainty without fresh stimulus did not win investors' confidence. The Fed signaled rates would likely not be hiked for the next three years, and without additional measures, that appears to be the essence of the switch to an average inflation target.

Read More »

Read More »

FX Daily, September 3: Corrective Forces Maintain Grip

The US dollar is continuing to recover after hitting new lows earlier in the week. It is lower against all the major currencies and most of the emerging markets. A report in the Financial Times suggesting that there is a concern about the euro's recent strength at the ECB has added a bit more fuel to the move, and the euro, which had pushed above $1.20 earlier in the week, briefly traded below $1.18.

Read More »

Read More »

FX Daily, August 31: Month-End Gyrations and the Fed’s Ad Hocery

Markets are searching for direction at month-end. Asia Pacific shares outside of Japan lower. Berkshire Hathaway confirmed taking a $6 bln stake in Japanese trading companies over the past year, and the pullback in the yen helped lift shares. The MSCI Asia Pacific Index rose 2% last week.

Read More »

Read More »

FX Daily, August 18: Canada Shrugs Off Loss of Morneau and Gold Reclaims $2000 Threshold

The NASDAQ rallied 1% yesterday to record highs as the Dow Industrials struggled, and the S&P 500 was able to eke out a small gain. The coattails were short, and the strength of the yen may have contributed to a 0.2% loss of the Nikkei. Still, its 6.2% advance this month is the best among the G10.

Read More »

Read More »

FX Daily, August 11: Gold and the Dollar are Sold while Stocks March Higher

A rotation of sorts seems to be unfolding. The euro posted its second back-to-back loss in over a month. The Canadian dollar, which has been an under-performer among the major currencies for the past six weeks, gained, while most fell.

Read More »

Read More »

FX Daily, August 06: Markets Consolidate

The Australian dollar powered to marginal news highs for the year as the move against the US dollar continued yesterday. The euro stopped a few hundredths of a cent below the high seen at the end of last week. However, neither sustained the upside momentum and have come back offered today.

Read More »

Read More »

FX Daily, August 5: Corrective Pressures in the FX Market Prove Short-Lived

The drop in US yields to new lows amid paralysis in Washington, except apparently over a lip-syncing app's threat to US national security, sent the dollar back to its lows after a modest recovery in early North American trading yesterday.

Read More »

Read More »

FX Daily, July 23: Powerful Momentum is Still Evident in the Foreign Exchange Market

The powerful momentum moves in the capital markets continues unabated by escalating US-China tensions and continued spread of the virus. Asia Pacific equities were mixed. Tokyo was closed for a holiday, but several other large markets in the region, like China, South Korea, and Taiwan markets slipped lower, while Hong Kong, Australia, and India advanced.

Read More »

Read More »

FX Daily, July 14: Turn Around Tuesday Began Yesterday

Overview: Turn around Tuesday began yesterday with a key reversal in the high-flying NASDAQ. It soared to new record highs before selling off and settling below the previous low. The S&P 500 saw new four-month highs and then sold-off and ended on its lows with a loss of nearly 1% on the session. Asia Pacific shares fell, led by declines in Hong Kong and India.

Read More »

Read More »

FX Daily, July 1: Second Verse Can’t be Worse than the First, Can it?

The resurgence of the contagion in the US has stopped or reversed an estimated 40% of the re-openings, but the appetite for risk has begun the second half on a firm note, helped by manufacturing PMIs that were above preliminary estimates or better than expected. Except for Tokyo and Seoul, equities in the Asia Pacific region rose. The MSCI Asia Pacific Index rose almost 15.5% in Q2.

Read More »

Read More »

FX Daily, May 20: Fed Funds Futures No Longer Imply Negative Rates

Overview: Another late sell-off of US equities, ostensibly on questions over Moderna's progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little changed, but reflects a split.

Read More »

Read More »

FX Daily, May 18: Yuan Slumps as US-Chinese Tensions Rise

Overview: Despite somber warnings that the US economic recovery can stretch to the end of next year, investors have begun the new week by taking on new risks. Most equity markets in the Asia Pacific region rose, with Australia leading the large bourses with a 1% gain. India was an outlier, suffering a 2.4% loss, and Taiwan's semiconductor sector was hit, and the Taiex fell 0.6%.

Read More »

Read More »

FX Daily, May 13: Will Powell have any more Luck Pushing against Negative Rate Expectations in the US?

Overview: Another late sell-off in US shares, this one perhaps related to the sobering assessment by the leading medical adviser for the Trump Administration about the risks of opening too early, failed to deter investors in the Asia Pacific region. Although Japanese shares slipped, most other markets rose. India led the way (~2%) after a fiscal stimulus program was announced.

Read More »

Read More »

FX Daily, May 7: China Reports an Unexpected Jump in Exports, While Norway Surprises with a Rate Cut

Overview: There is a sense of indecision in the air today. There have been several developments, but investors seem mostly reluctant to extend positions. China reported a surge in exports in April and an increase in the value of reserves. Australia reported a rise in exports in March. The Bank of England left policy steady, but clearly signaled it was prepared to boost its asset purchases.

Read More »

Read More »

FX Daily, May 6: The Euro is Knocked Back Further

Overview: The late sell-off in US stocks yesterday has not prevented gains in Asia and Europe. Most of the equity markets, including the re-opening of China, gain more than 1%. Australia was a notable exception, falling about 0.4%, and Taiwan was virtually flat. European bourses opened higher but made little headway before some profit-taking set in, while US shares are trading higher.

Read More »

Read More »

FX Daily, April 27: Equities Rally and the Dollar Eases to Start the Week

Overview: Global equities are beginning the new week on an upbeat note. All the markets in the Asia Pacific region rallied, led by more than 2% gains in the Nikkei and Taiwan. European bourses are higher. All the industry groups are participating and financials and consumer discretionary leading the way.

Read More »

Read More »

An International Puppet Show

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount.

Read More »

Read More »

FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today. Japan and Australia are exceptions to the generalization.

Read More »

Read More »

FX Daily, March 18: Bonds Join Equities in the Carnage

Overview: A new phase of the market turmoil is at hand. Bonds are no longer proving to be the safe haven for investors fleeing stocks. The tremendous fiscal and monetary efforts, with more likely to come, have sparked a dramatic rise in yields. Meanwhile, equities are getting crushed again.

Read More »

Read More »