Tag Archive: Brazil

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday on a week note and capped of another generally negative week. Worst performers last week were ARS, BRL, and TRY while the best were ZAR, RUB, and KRW. We remain negative on EM FX and look for losses to continue. US retail sales data Tuesday pose further downside risks to EM FX.

Read More »

Read More »

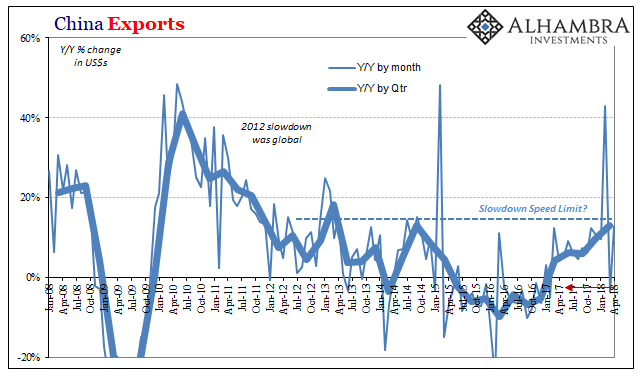

What China’s Trade Conditions Say About The Right Side Of ‘L’

Chinese exports rose 12.9% year-over-year in April 2018. Imports were up 20.9%. As always, both numbers sound impressive but they are far short of rates consistent with a growing global economy. China’s participation in global growth, synchronized or not, is a must. The lack of acceleration on the export side tells us a lot about what to expect on the import side.

Read More »

Read More »

Emerging Markets Preview: The Week Ahead

EM FX came under intense selling pressures last week. The worst performers were ARS, TRY, and MXN while the best were PHP, KRW, and TWD. US rates are likely to remain the key driver for EM FX, and so PPI and CPI data will be closely watched this week. We believe EM FX will remain under pressure.

Read More »

Read More »

Emerging Markets: What Changed

Reserve Bank of India cut its inflation forecast for the first half of FY2018/19 to 4.7-5.1%. Former South Korean President Park was sentenced to 24 years in prison. Malaysia Prime Minister Razak has called for early elections. Bahrain discovered its biggest oil field since it started producing crude in 1932. Local press reports Turkey’s Deputy Prime Minister Simsek tendered his resignation.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM.

Read More »

Read More »

Emerging Markets: Preview Week Ahead

EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note and capped off a soft week overall. Best performers last week were ZAR, CLP, and PHP while the worst were TRY, ARS, and IDR. Fed Chief Powell’s testimony to Congress will likely draw market attention back to Fed policy.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended on a mixed note Friday, but capped off a very strong week overall. Best performers over the past week were RUB, ZAR, and COP, while the worst were PHP, CNY, and TWD. There is not much happening this week that could disrupt the weak dollar narrative, and so EM FX should continue to rally.

Read More »

Read More »

Emerging Markets: What Changed

The National Stock Exchange of India will end all licensing agreements and stop offering live prices overseas. Philippine central bank cut reserve requirements for commercial banks. Egypt cut rates for the first time since 2015. Israeli police recommended that Prime Minister Netanyahu be charged. South Africa President Zuma resigned before a no confidence vote was held.

Read More »

Read More »

Emerging Markets: The Week Ahead, February 12

EM FX ended Friday on a mixed note, as risk assets recovered a bit from broad-based selling pressures. Best EM performers on the week were ZAR, PHP, and CNY while the worst were COP, RUB, and ARS. Besides the risk-off impulses still reverberating through global markets, we think lower commodity prices are another headwind on EM.

Read More »

Read More »

Emerging Markets: What Changed

Korea policymakers have asked state-owned banks and companies to limit the issuance of global bonds. Malaysia's central bank hiked rates for the first time in four years. Pakistan’s central bank unexpectedly hiked rates for the first time in over four years. Moody’s raised its outlook on Russia’s Ba1 rating from stable to positive. Argentina’s central bank surprised markets with its second straight 75 bp rate cut.

Read More »

Read More »

Emerging Markets: What Changed

China State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. Korean officials warned that it will take stern steps to prevent one-sided currency moves. Bulgaria is talking “intensively” with the ECB and other EU representatives about entering the Exchange Rate Mechanism by mid-year.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX was mostly firmer last week, but ended on a mixed note Friday. Best performers on the week for COP, MXN, and BRL while the worst were ARS, PHP, and CNY. We continue to warn investors against blindly buying into this broad-based EM rally, as we believe divergences will once again assert themselves in the coming weeks.

Read More »

Read More »

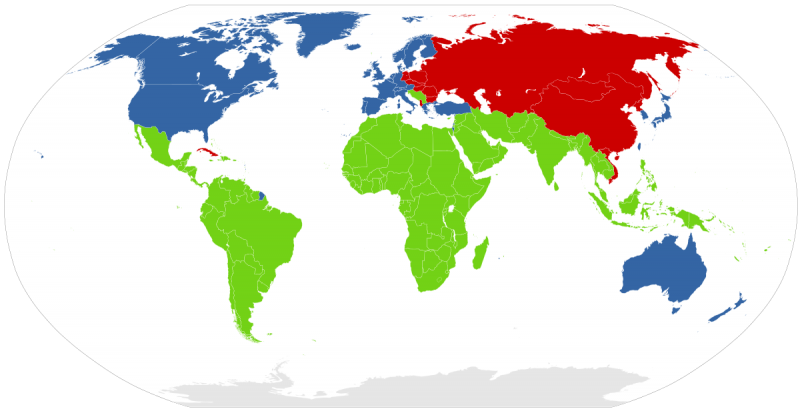

One-Tenth Of Global GDP Is Now Held In Offshore Tax Havens

Accurately measuring the scope of global wealth inequality is a notoriously difficult undertaking – a fact that was brought to light last year when the International Consortium of Investigative Journalists published the Panama Papers, exposing clients of Panamanian law firm Mossack Fonseca.

Read More »

Read More »

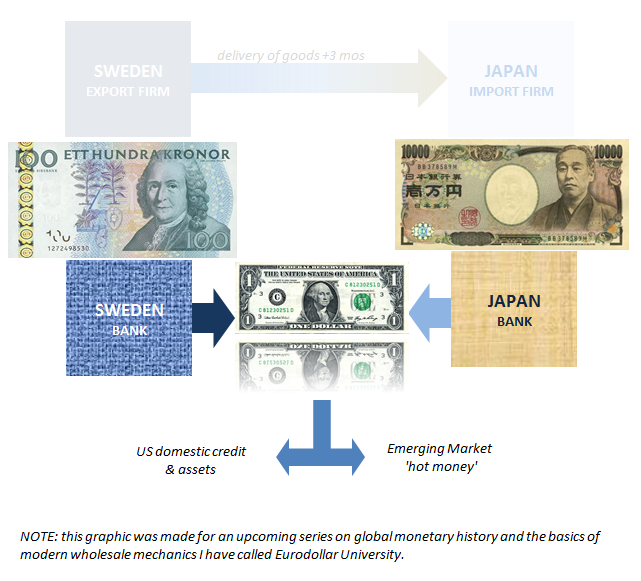

Brazil’s Reasons

Brazil is another one of those topics which doesn’t seem to merit much scrutiny apart from morbid curiosity. Like swap spreads or Japanese bank currency redistribution tendencies, it is sometimes hard to see the connection for US-based or just generically DM investors. Unless you set out to buy an emerging market ETF heavily weighted in the direction of South America, Brazil’s problems can seem a world away.

Read More »

Read More »

FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

Yesterday's dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI's investigation into Russia's attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump Administrations economic program is back the front burners, but it is sufficient to stem the time for the moment.

Read More »

Read More »

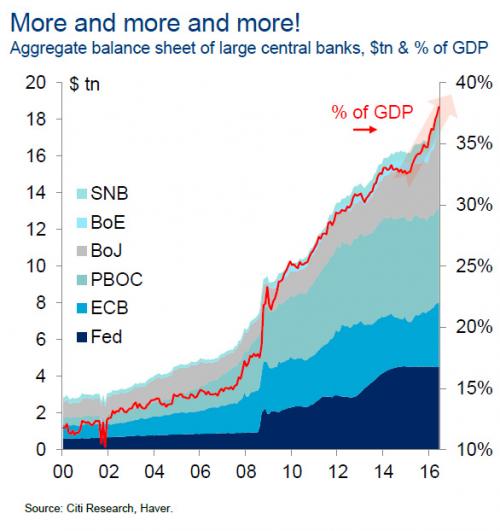

A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, "the largest CB buying on record."

Read More »

Read More »