Tag Archive: Auto Sales

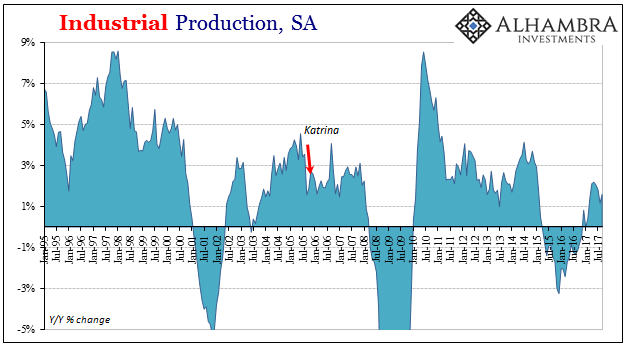

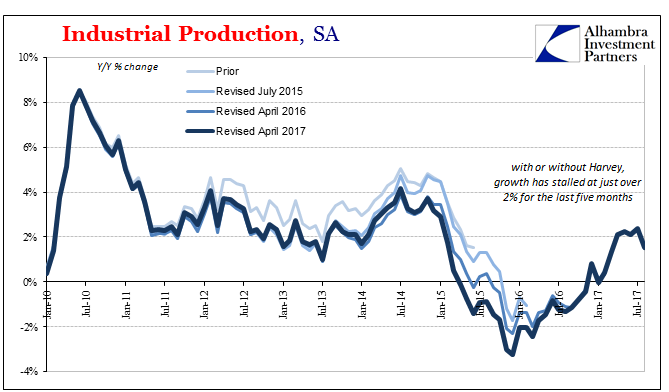

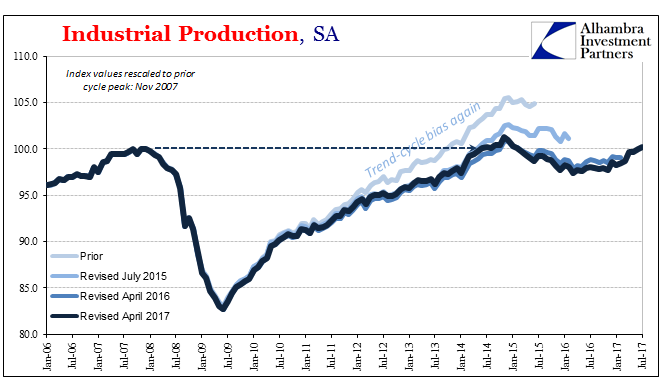

Broader Slowing in Industrial Production

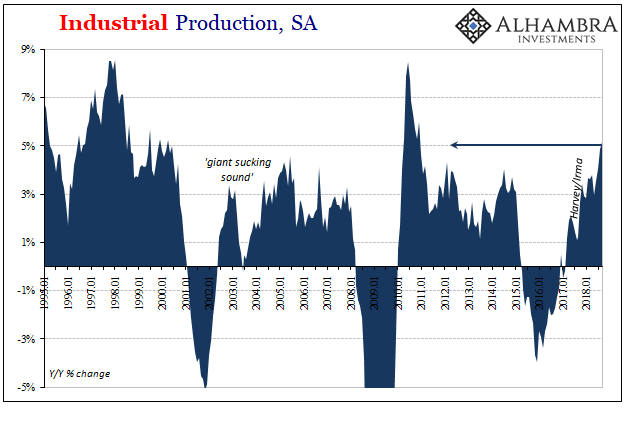

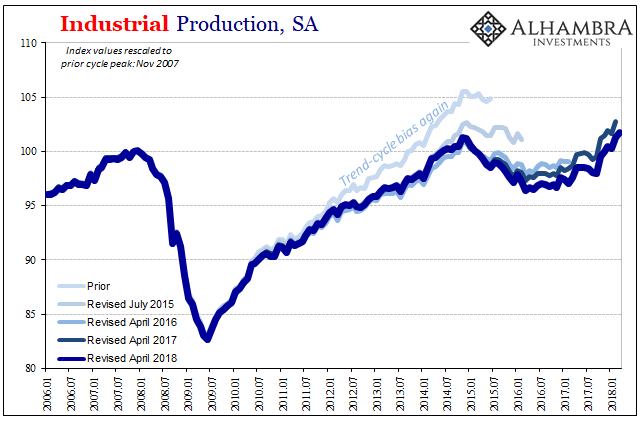

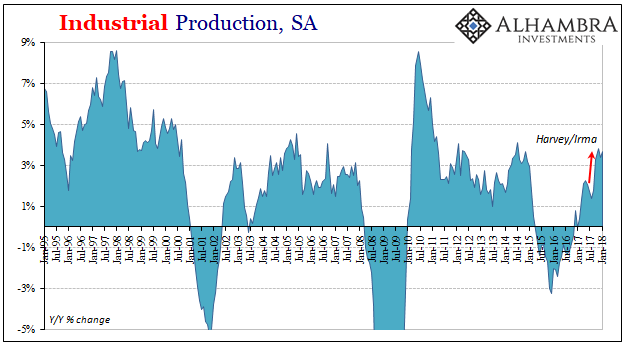

Industrial Production rose 1.6% year-over-year in September 2017. That’s up from 1.2% growth in August, both months perhaps affected to some degree by hurricanes. The lack of growth and momentum, however, clearly predated the storms. The seasonally-adjusted index for IP peaked in April 2017, and has been lower ever since. This pattern, the disappointment this year is one we see replicated nearly everywhere on both sides (supply as well as demand)...

Read More »

Read More »

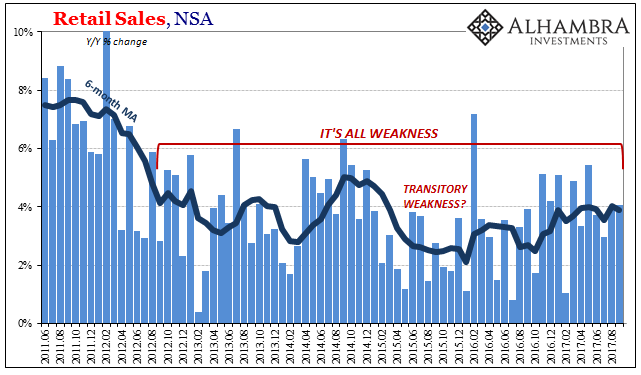

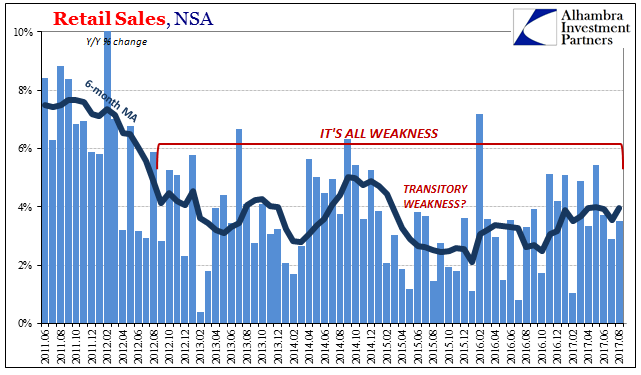

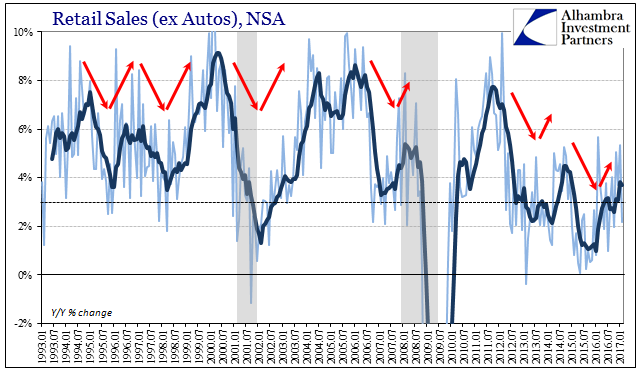

US Retail Sales: Retail Storms

Retail sales were added in September 2017 due to the hurricanes in Texas and Florida (and the other states less directly impacted). On a monthly, seasonally-adjusted basis, retail sales were up a sharp 1.7% from August. The vast majority of the gain, however, was in the shock jump in gasoline prices. Retail sales at gasoline stations rose nearly 6% month-over-month, so excluding those sales retail sales elsewhere gained a far more modest 0.6%.

Read More »

Read More »

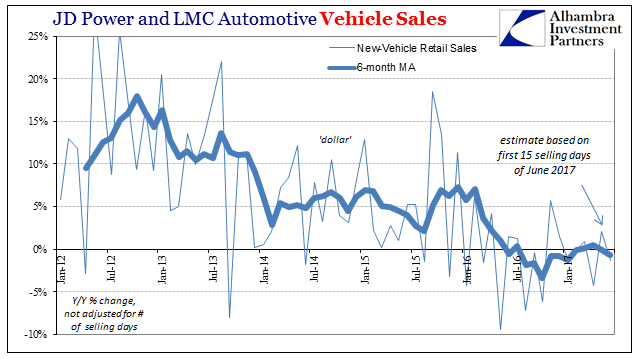

Auto Sales Up Last Month, But Why?

Auto sales rebounded sharply in September, with most major car manufacturers reporting better numbers. Sales at Ford were up 8.9% last month from September 2016; +11.9% at GM; Toyota +14.9%; Nissan +9.5%; Honda +6.8%. The only negatives were reported by FCA (-9.7%) and Mercedes (-1.7%).

Read More »

Read More »

IP Weathers Storms But Not Cars

In late August 2006, ABC News asked more than a dozen prominent economists to evaluate the impacts of hurricane Katrina on the US economy. The cataclysmic storm made landfall on August 29, 2005, devastating the city of New Orleans and the surrounding Gulf coast. The cost in human terms was unthinkable, and many were concerned, as people always are, that in economic terms the country might end up in similar devastation.

Read More »

Read More »

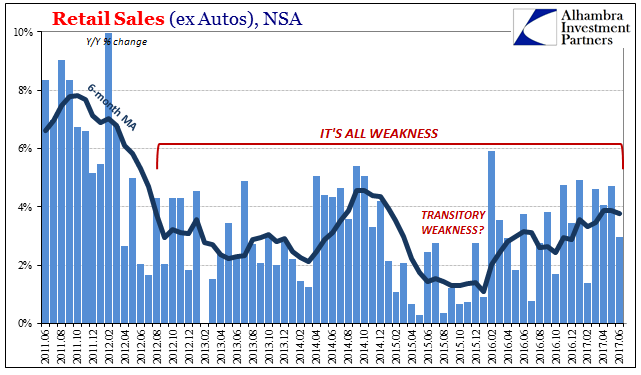

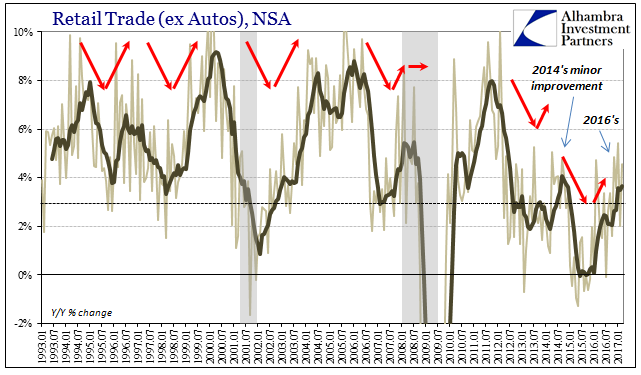

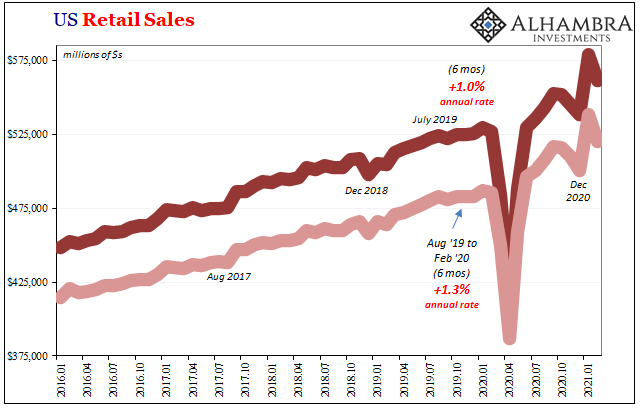

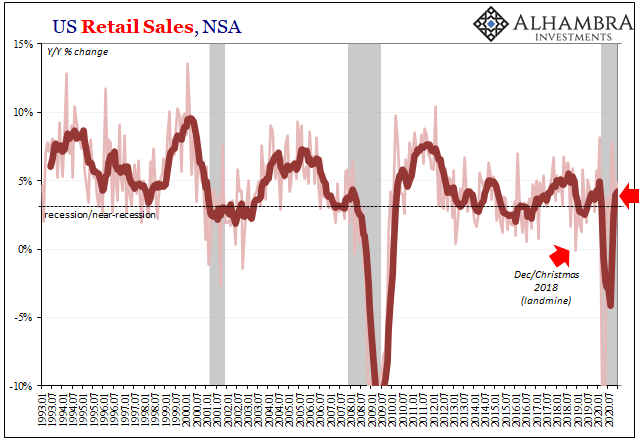

Retail Sales and the End of ‘Reflation’

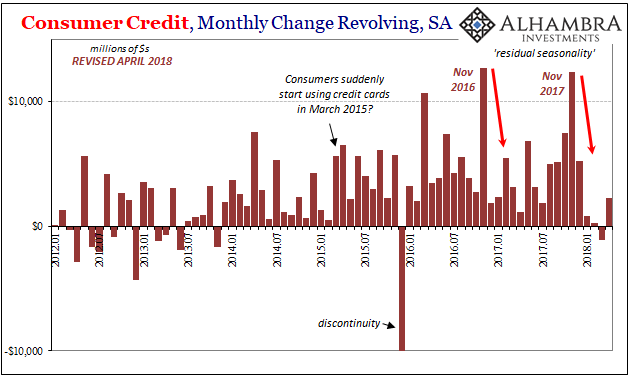

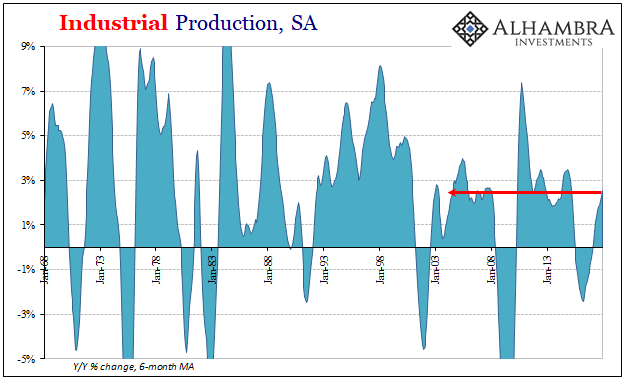

There will be an irresistible urge to the make this about the weather, but more and more data shows it’s not any singular instance. Nor is it transitory. What does prove to be temporary time and again is the upside. The economy gets hit (by “dollar” events), bounces back a little, and then goes right back into the dumps. This, it seems, is the limited extent of cyclicality in these times.

Read More »

Read More »

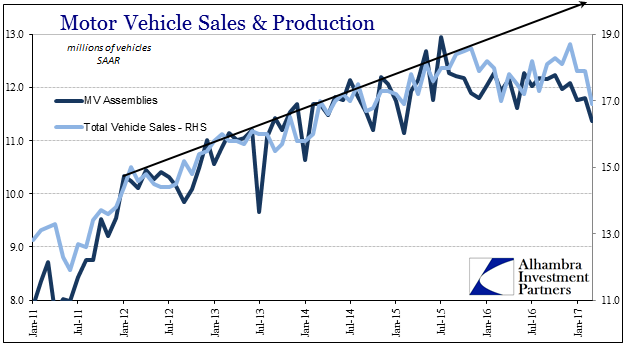

United States: Lack Of Industrial Momentum Is (For Now) Big Auto Problems

Industrial Production disappointed in the US last month, dragged down by auto production. Despite the return of an oil sector tailwind, IP was up just 2.2% year-over-year in July 2017 according to Federal Reserve statistics. It marks the fourth consecutive month stuck around 2% growth. The lack of further acceleration is unusual in the historical context, especially following an extended period of contraction.

Read More »

Read More »

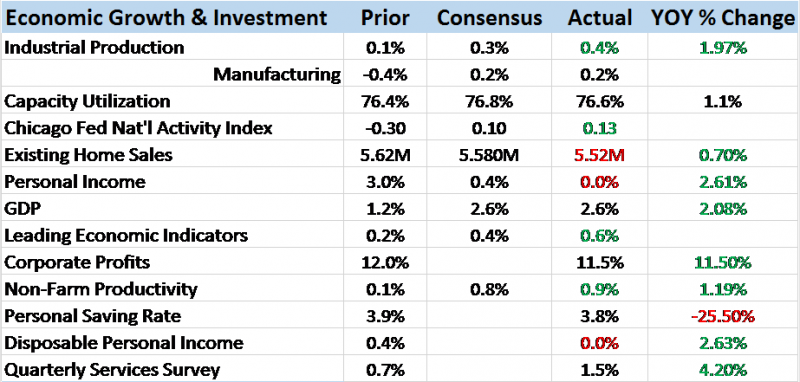

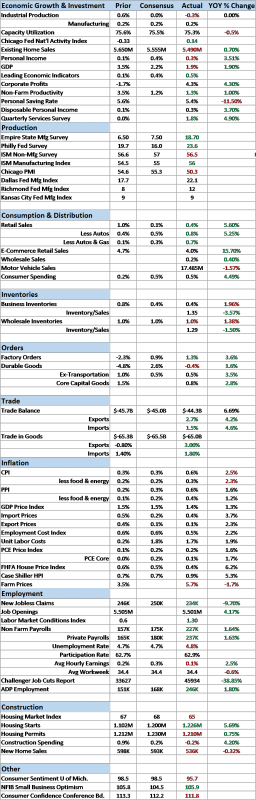

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »

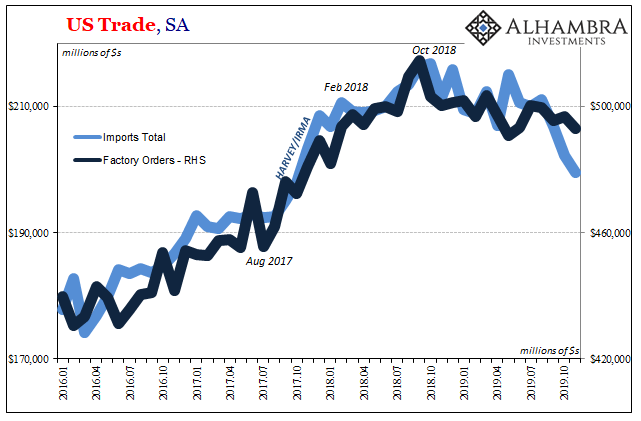

Retail Sales Conundrum

Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January.

Read More »

Read More »

Vehicle Sales, Consumer Price Index and Average Weekly Hours: More Than Minor Auto Potential

According to Edmunds.com, in June 2017 the average length of a new vehicle loan has been stretched to a record 69.3 months. JD Power says that incentives last month were running at more than 10% of MSRP, the eleventh time over the past twelve months where manufacturers have so heavily discounted. And yet, the auto industry would have us believe that the problem is one of fleet sales rather than of consumers.

Read More »

Read More »

Auto Pressure Ramps Up

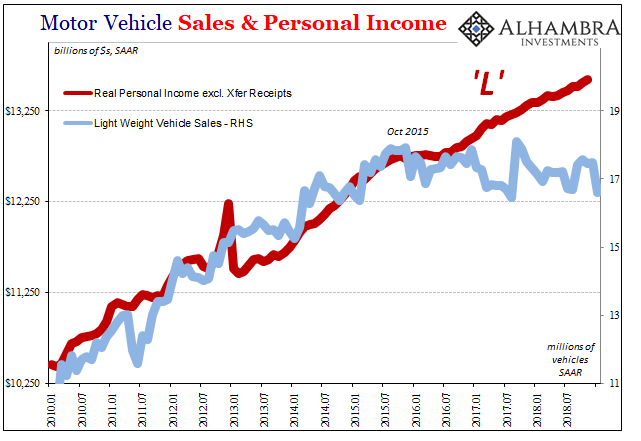

The Los Angeles Times today asked the question only the mainstream would ask. “Wages are growing and surveys show consumer confidence is high. So why are motor vehicle sales taking a hit?” Indeed, the results reported earlier by the auto sector were the kind of sobering figures that might make any optimist wonder.

Read More »

Read More »

The Expanded Retail Sales Gap

Retail sales growth in February 2017 was going to be low by virtue of its comparison to February 2016 and the extra day in that month. The Census Bureau’s autoregressive models are supposed to normalize just these kinds of calendar irregularities so that we can make something close to apples to apples comparisons. The seasonally-adjusted estimate for February, however, was calculated to be less than the one for January 2017, therefore suggesting...

Read More »

Read More »

Retail Sales: Extra Day Likely, no Meaningful Difference

Retail sales comparisons were for February 2017 skewed by the extra day in February 2016. With the leap year February 29th a part of the base effect, the estimated growth rates (NSA) for this February are to some degree better than they appear. Seasonally-adjusted retail sales were in the latest estimates essentially flat when compared to the prior month (January). That leaves too much guesswork to draw any hard conclusions.

Read More »

Read More »

Bi-Weekly Economic Review

The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the last update 3 weeks ago. In other words, there’s no reason...

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »