| For much of 2018, the idea of “overseas turmoil” lived up to its name. At least in economic terms. Market-wise, there was a lot domestically to draw anyone’s honest attention. Warnings were everywhere by the end of the year. And that was what has been at issue. Some said Europe and China are on their own, the US is cocooned in a tax cut-fueled boom. Decoupling, only now the other way around.

The Bureau of Economic Analysis (BEA) is still catching up after the federal government shutdown. The agency has now revised its release schedule for the major economic accounts it is responsible for. Rather than the usual three stabs at GDP, there will now be just two. On February 28, the numbers for Q4 will be published with only a partial update included; meaning, it will incorporate more data than the typical preliminary figure but not as much survey information as the usual second estimate. A final GDP number for the fourth quarter will be released as scheduled on March 28. The other big one is Personal Spending and Income. On March 1, the BEA will deliver two months instead of a single; reporting on December as well as January as scheduled. The data is already three months old, stuck on November. |

U.S Industrial Production Real Personal Income Vehicle Sales, Jan 2010(see more posts on U.S. Industrial Production, ) |

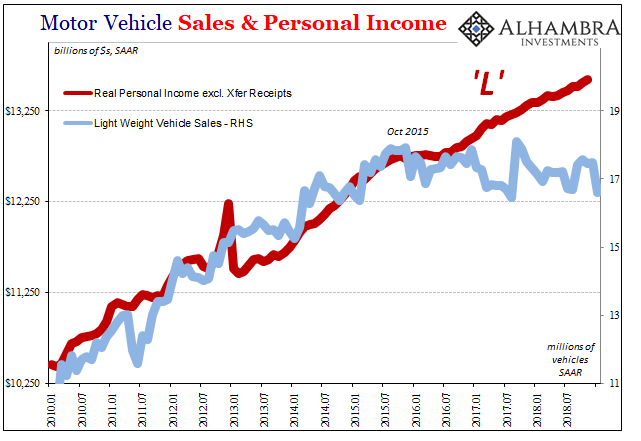

| Prior income trends had suggested slowing income gains, not accelerating as a LABOR SHORTAGE!!! would have it. With the Census Bureau on Friday finally putting out shocking retail sales numbers for Christmas, there is some added urgency to get the income picture behind them.

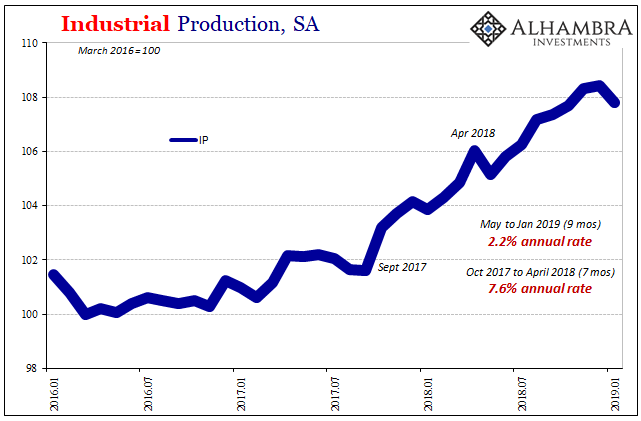

Elsewhere, the Federal Reserve wasn’t subject to funding issues due to the shutdown; with trillions now in “earning assets” on its balance sheet, the Fed can cover any significant costs all on its own (including, obviously, substantial monetary research; the issue isn’t money, which might have been true when M3 was shut down, rather it is willingness). Among the data series it collects is Industrial Production. And that’s right where this potential looming global downturn has shown up. Particularly Europe, the state of the worldwide goods economy does not look good at the moment. Lost in Friday’s flurry over Census’ retail sales report for December 2018, the Fed’s IP figures released on the same day were quite downbeat for the month of January 2019. Seasonally-adjusted, overall IP fell 0.6% from the prior month, after registering very little gain in December from November. The pace of industrial activity has clearly slowed for a total now of nine months. |

U.S. Industrial Production, Jan 2016 - 2019(see more posts on U.S. Industrial Production, ) |

| The further loss of momentum proposed by December and now January’s estimates are in keeping with the direction observed across the rest of the world. It is too early to put the US situation into the same pre-recessionary condition as, say, Germany, but even this more rounded trajectory suggests lagging along the same way. Consistent with market unease. |

U.S. Industrial Production, Manufacturing(see more posts on U.S. Industrial Production, ) |

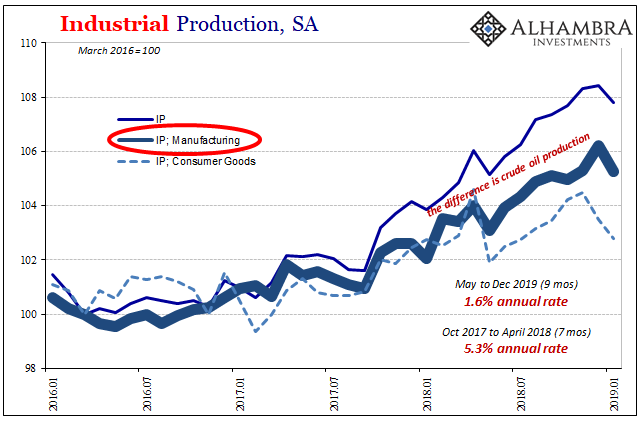

| To that end, it is the manufacturing sector which is leading the potential reverse; exactly what you would expect in this type of situation. According to the Fed’s updated assessment, US manufacturing overall is flat going back to August. That is the same timeframe in which markets began in unison to turn more ominous.

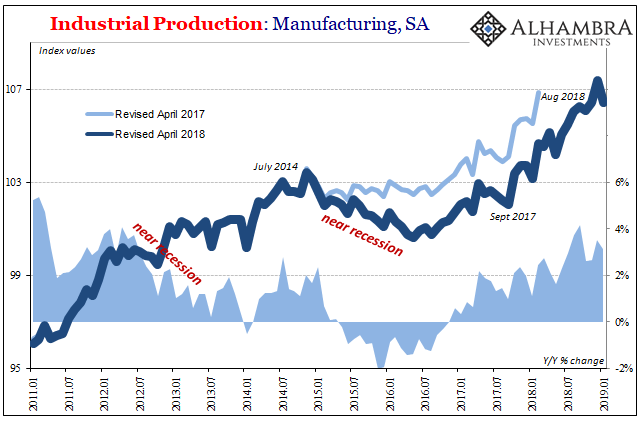

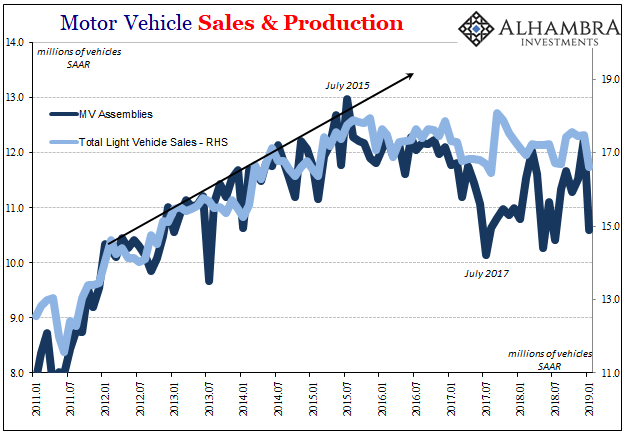

Finding itself once more at the bottom of this segment was the automobile industry. Motor Vehicle Assemblies (MVA), the Fed’s IP proxy for domestic vehicle production, collapsed in January after a somewhat surprising rebound in December. |

U.S. Industrial Production, Manufacturing, Jan 2011 - 2019(see more posts on U.S. Industrial Production, ) |

| At just 10.6 million (SAAR), that’s the lowest output for the auto industry since last July. Only, July is typically a weak month when factories are retooled for the model year changeover. MVA’s have become much more volatile on a monthly basis, suggesting perhaps carmakers are having trouble setting the right level of production.

This is understandable to a certain extent, given how such mainstream forecasting begins with the Federal Reserve’s models foreseeing an overheating/booming US economy and spreads out through mainstream Economists. The Census Bureau didn’t report bad retail sales for the car business, but automakers do pay attention to consumers in other ways. It wasn’t just markets that were uneasy over the final months of last year. If consumer spending really was unusually weak in December, as those other numbers suggest, then a downbeat reaction to them in January would make a lot of sense. I doubt producers have been preparing for a material economic slowdown; any buildup of unwanted inventory after a weak Christmas would have been at least a temporary warning warranting production adjustments in more than autos. |

U.S. Industrial Production, Motor Vehicle Sales and Production, Jan 2011 - 2019(see more posts on U.S. Industrial Production, U.S. Motor Vehicle Assemblies, ) |

As more data begins to surface about the US economy, is it going to play in the same direction as the rest of the world? That’s the crucial issue right now. So far it has. Is the US economy being subjected to the same negative forces that are much clearer already in other key places? The American economy certainly isn’t leading this downturn, but being toward the end of the line rather than right out in front with Germany and China would only mean a difference in timing.

Full story here Are you the author? Previous post See more for Next postTags: Auto Sales,consumer spending,Euro$ #4,industrial production,Markets,Motor Vehicle Assemblies,newsletter,recession,U.S. Industrial Production,U.S. Motor Vehicle Assemblies