Tag Archive: Articles

EM Preview for the Week Ahead

Over the weekend, China reported stronger than expected November PMI readings while Korea reported weaker than expected November trade data. While the China data is welcome, we put more weight on Korea trade numbers, which typically serve as a good bellwether for the entire region. Press reports suggest the Phase One trade deal has stalled due to Hong Kong legislation passed by the US Congress.

Read More »

Read More »

Dollar Builds on Recent Gains

The dollar remains resilient; optimism towards a Phase One deal continues to support risk appetite. There was also optimism from Fed Chairman Powell yesterday; the US economy is not out of the woods yet. Turkish President Erdogan started deploying Russia’s S-400 missile system, raising the specter of sanctions. Hong Kong reported weak October trade data; Philippine central bank Governor Diokno said a December cut was possible.

Read More »

Read More »

Drivers for the Week Ahead

The dollar was surprisingly resilient last week; we look for further dollar gains ahead. It is a holiday shortened week in the US, but there are still some major data releases. There is a fair amount of eurozone data this week; UK Prime Minister Johnson unveiled his Tory manifesto. Hong Kong held local elections this weekend; tensions between Japan and Korea appear to have eased, but questions remain.

Read More »

Read More »

Dollar and Equities Sink as Trade Pessimism Rises

Pessimism regarding a Phase One trade deal has intensified; further muddying the waters are recent US Congressional actions. FOMC minutes contained no surprises; regional Fed manufacturing surveys for November continue. South Africa is expected to cut rates by 25 bp to 6.25%. Korea reported trade data for the first twenty days of November; Indonesia kept rates steady at 5.0%, as expected.

Read More »

Read More »

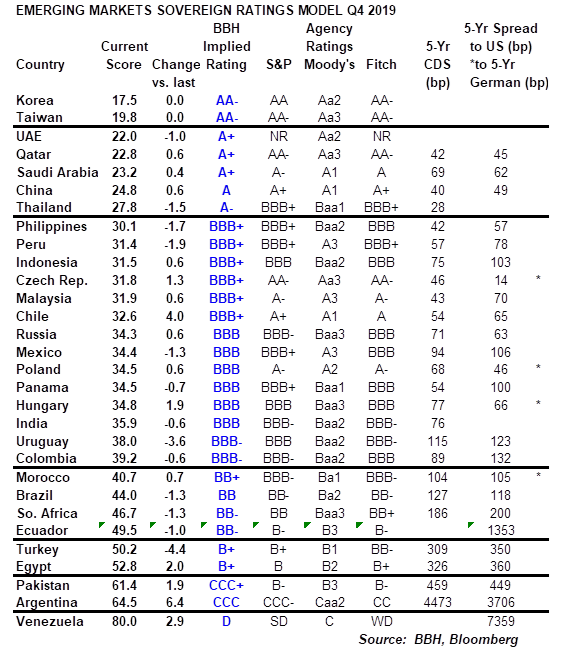

EM Sovereign Rating Model For Q4 2019

We have produced the following Emerging Markets (EM) ratings model to assess relative sovereign risk. An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance.

Read More »

Read More »

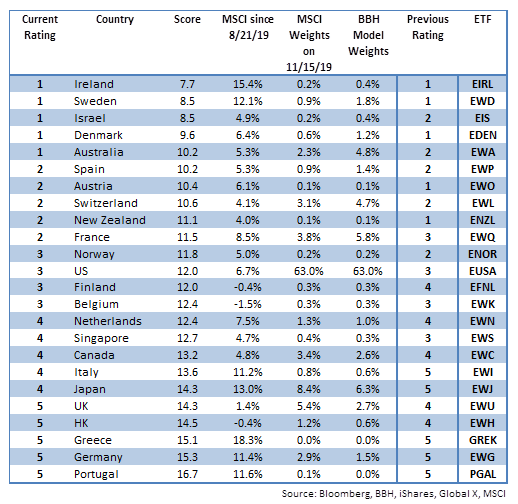

DM Equity Allocation Model For Q4 2019

Global equity markets continue to power higher US-China trade tensions have eased. MSCI World made a new all-time high today near 2290 and is up 23% YTD. Our 1-rated grouping (outperformers) for Q4 2019 consists of Ireland, Sweden, Israel, Denmark, and Australia. Our 5-rated grouping (underperformers) for Q4 2019 consists of the UK, Hong Kong, Greece, Germany, and Portugal.

Read More »

Read More »

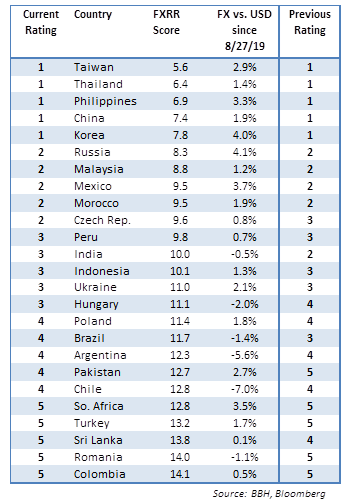

EM FX Model for Q4 2019

EM FX has rallied sharply in recent weeks, helped by growing optimism that we’ve seen the worst of the US-China trade war. Given our more constructive outlook on EM, we believe MSCI EM FX should eventually test the 1657.50 high from July. We see continued divergences within the asset class. Our 1-rated (strongest fundamentals) grouping for Q4 2019 consists of TWD, THB, PHP, CNY, and KRW.

Read More »

Read More »

Dollar Stabilizes as Markets Await Fresh Drivers

Press reports suggest that the mood in Beijing is pessimistic after President Trump pushed back against tariff rollbacks. Fed Chair Powell met with President Trump and Treasury Secretary Mnuchin yesterday. Hungary is expected to keep rates steady; the deadline to form a government in Israel is fast approaching. RBA released dovish minutes from its November policy meeting.

Read More »

Read More »

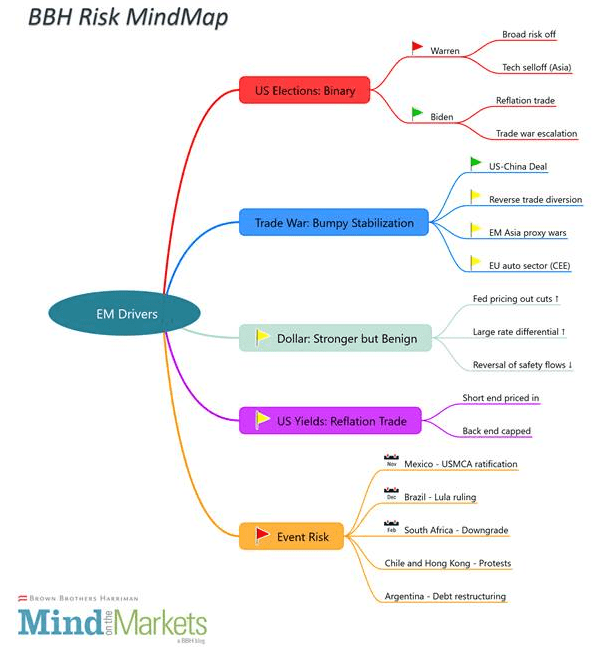

Emerging Market Risk Map

With year-end upon us, we review some of the key risks to EM assets and how we think they progress from here. In short, the two most significant downside risks would be a decisive improvement in Elizabeth Warren’s polling figures and an upset in the US-China trade negotiations.

Read More »

Read More »

EM Preview for the Week Ahead

EM was mostly lower last week, as doubts crept in about the recent trade optimism. Some events also served as reminders of idiosyncratic EM risk that can’t be overlooked, such as downgrade risks (South Africa), failed oil auctions (Brazil), and violent protests (CLP). EM may remain on its back foot until we get further clarity on the US-China talks, but we remain confident in our call that a deal will be struck soon that lower existing tariffs.

Read More »

Read More »

Dollar Rally Stalls as Fresh Drivers Awaited

US-China relations continue to improve with news of cooperation in a major fentanyl case. Eurozone final services and composite PMIs surprised on the upside; UK Parliament will be dissolved today. Poland is expected to keep rates steady at 1.5%; Russia October CPI is expected to rise 3.8% y/y. China sold €4 bn in its first euro-denominated bond since 2004; Thailand cut rates 25 bp to 1.25%, as expected.

Read More »

Read More »

EM Preview for the Week Ahead

EM should continue to benefit from the generalized improvement in the global backdrop. Trade tensions have eased whilst the risks of a hard Brexit have fallen, at least for now. Yet recent developments in some major EM countries underscores how important it is for investors to differentiate between the strong credits and the weak ones.

Read More »

Read More »

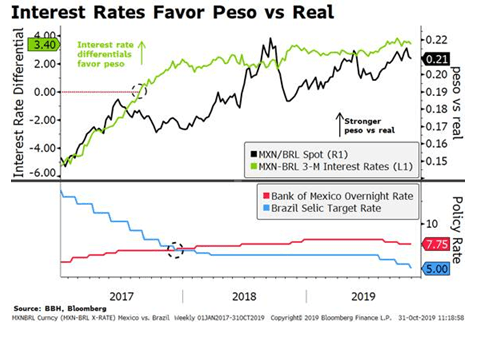

Mexico vs. Brazil Near-Term Outlook

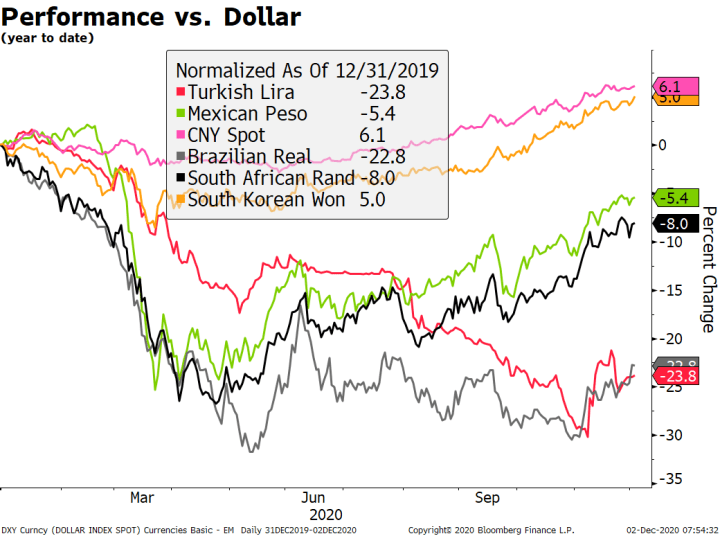

Both Brazil and Mexico are in a good position to benefit from the current improvement in market sentiment. However, when comparing the factors driving the currencies of both countries, we think there are relatively more near-term positives for the Mexican peso than for the Brazilian real.

Read More »

Read More »

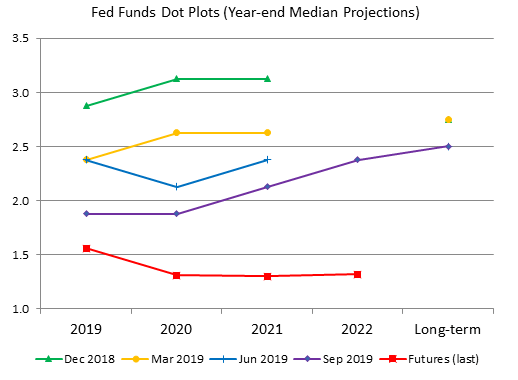

FOMC Preview

The FOMC begins a two-day meeting today with the decision due out tomorrow afternoon. The Fed is widely expected to cut rates 25 bp for the third meeting in a row. What’s next? US data have undeniably softened in September. Weakness in the manufacturing sector appears to have spread to the wider economy. ISM PMI, jobs, CPI, PPI, and retail sales all came in weaker than expected.

Read More »

Read More »

Dollar Firm as Two-Day FOMC Meeting Begins

The dollar continues to gain traction as the two-day FOMC begins; US political uncertainty has entered a new phase. Yesterday marked the third time that UK Prime Minister Johnson lost a vote for elections; he will try again today. Weak South Africa data support our call for imminent easing; the threat of sanctions against Turkey are back on the table.

Read More »

Read More »

EM Preview for the Week Ahead

EM has been on a good run but this week will be a big test. Brexit uncertainty may finally end. Or it may not. A delay would be positive for EM, whilst a potential hard Brexit would be negative. The Fed meets Wednesday and key US data will be reported during the week, culminating with the jobs report Friday.

Read More »

Read More »

A New Stage of the US-China Conflict

The US-China diplomatic relationship may be entering a new stage. The balance of power between the key players – Trump, China, the US Congress, and the Democrats – is changing and their roles are being reshuffled. This might be enough to break the endless cycle of agreements and re-escalations. In short, we think both Trump and Chinese officials have a greater incentive to reach a deal (or at least not to escalate) this time around.

Read More »

Read More »

EM Preview for the Week Ahead

We are beginning to become more constructive on EM. The main trigger for some optimism is the shifting US-China dynamic. In our view, the partial trade deal reveals weakness on the part of the US. Reports suggest China will begin pushing for all existing tariffs to be dropped as part of Phase 2, which would be very positive for EM. That is still likely months away but this shifting dynamic bears watching.

Read More »

Read More »

Dollar Broadly Weaker as Brexit Deal Takes Shape

The dollar remains under pressure due to weak US retail sales and rising optimism on Brexit and the trade war. Brexit negotiations remain tense and we should expect a higher than usual noise-to-signal ratio at this stage. China said its goal is to stop the trade war and remove all tariffs. US has a full data schedule; we remain constructive on the US economic outlook.

Read More »

Read More »

Dollar Resilient as Cracks in Risk-On Appear

Some cracks have appeared in the market’s risk-on sentiment. We continue to believe that recent developments take some pressure off the Fed to cut rates again this month. Our base case for a Brexit delay has been strengthened; UK reported weak labor market data. The situation is Turkey continues to develop negatively for asset prices; trade data out of China once again showed the impact of the trade war and the resulting global slowdown.

Read More »

Read More »