Tag Archive: Articles

Drivers for the Week Ahead

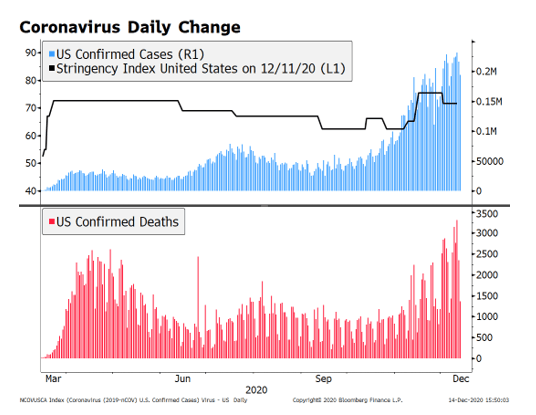

Risk sentiment is likely to remain under pressure this week as the impact of the coronavirus continues to spread; demand for dollars remains strong. As of this writing, the Senate-led aid bill has stalled; the US economic outlook is getting more dire; Canada is experiencing similar headwinds. This is a big data week for the UK; eurozone March flash PMIs will be reported Tuesday; oil prices continue to slide.

Read More »

Read More »

Dollar Firm, Markets Unsettled Despite Aggressive Policy Responses Worldwide

Markets remain unsettled even as policymakers worldwide continue to take aggressive emergency measures; the dollar continues to power higher. Fed rolled out another crisis-era program last night; US Senate passed the House virus relief bill by a 90-8 vote. ECB held an emergency call last night and announced an additional bond purchase program to the tune of €750 bln that now includes commercial paper.

Read More »

Read More »

EM Preview for the Week Ahead

Market sentiment is likely to open this week on an upswing after the Fed’s emergency rate cut and expanded QE were announced Sunday afternoon local time. Yet as we have seen time and again this past couple of weeks, added stimulus has had little lasting impact on markets as the virus numbers continue to worsen. Europe is now reporting more daily cases than China did at its peak. We remain negative on EM until the global growth outlook becomes...

Read More »

Read More »

Dollar Firms, Equities Sink Ahead of ECB Decision as US Fails to Deliver

President Trump spoke to the nation last night and did little to calm markets; reports suggest that the Democrats are working on a bill. Fed easing expectations are intensifying. The ECB decision will be out at 845 AM ET; over the past 17 ECB decision days, the euro has finished lower in 11 of them.

Read More »

Read More »

Dollar Soft as BOE Surprises Ahead of UK Budget

The dollar is stabilizing but remains vulnerable to disappointment as markets await details of US fiscal measures. US reports February CPI; Joe Biden moved closer to clinching the Democratic nomination. BOE delivered a surprise 50 bp rate cut to 0.25% and initiated a new lending scheme; UK government releases its budget today; UK reported weak data.

Read More »

Read More »

ECB Preview, March 11

Christine Lagarde will chair her third ECB meeting Thursday. She faces growing risks of recession but also widespread skepticism within the ECB regarding the efficacy of negative rates. Markets have priced in several rate cuts this year. Here, we discuss what measures the ECB may take this week.

Read More »

Read More »

Dollar Firm as Global Financial Markets Calm

Global financial markets are finally seeing a measure of calm return; local Chinese media is sounding more confident that the situation is now under control. The White House will announce fiscal measures today; five states hold primaries and one holds a caucus with 352 total pledged delegates up for grabs.

Read More »

Read More »

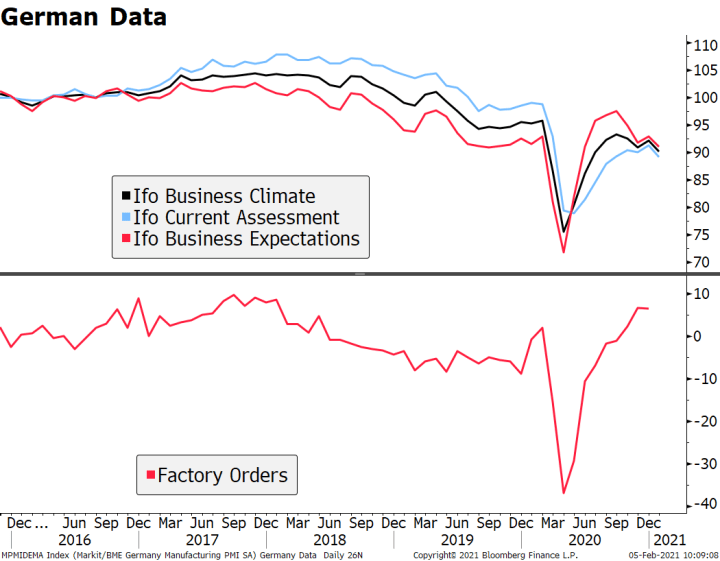

Drivers for the Week Ahead

Risk-off sentiment continues to build as the coronavirus spreads. Fed easing expectations continue to intensify; February inflation readings for the US will be reported this week. The ECB meets Thursday and markets are split; the stronger euro is doing the eurozone economy no favors. The UK has a heavy data release schedule Wednesday; UK government also releases its budget that day.

Read More »

Read More »

Updated Democratic Primary Timeline

Super Tuesday has come and gone. Bloomberg has suspended his campaign after an extremely poor showing, and Warren is expected to follow suit soon. Here is our updated take on the likely Democratic candidate.

Read More »

Read More »

Drivers for the Week Ahead

The dollar has softened as Fed easing expectations have picked up. Late Friday, Chair Powell issued an unscheduled statement saying the Fed is monitoring the virus and will act as appropriate. This is a big data week for the US; the Fed releases its Beige Book report Wednesday. Super Tuesday comes this week; Bank of Canada meets Wednesday.

Read More »

Read More »

Dollar Mixed as Coronavirus News Stream Deteriorates

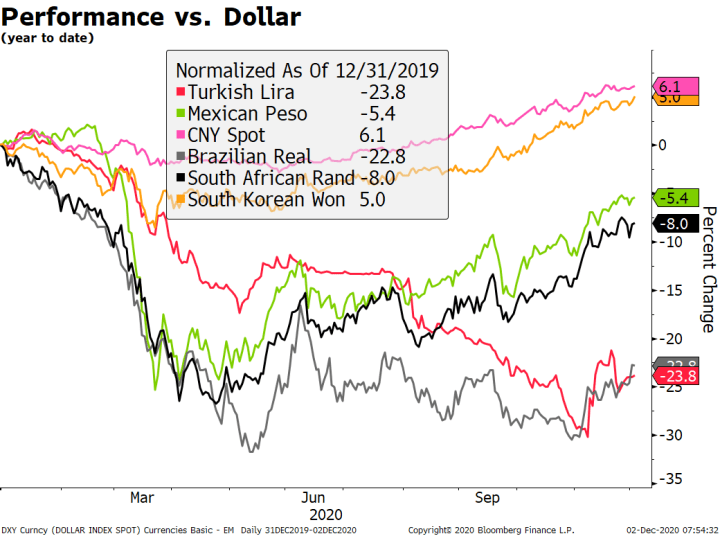

The virus news stream continues to deteriorate. Lower US yields and growing concerns about the spread of the coronavirus in the US are taking a toll on the greenback. OPEC officials are trying to work out another supply cut; The outlook for Turkey is going from bad to worse. Simply put, there is nothing the Fed can do to address the economic impact of supply chain disruptions and social distancing.

Read More »

Read More »

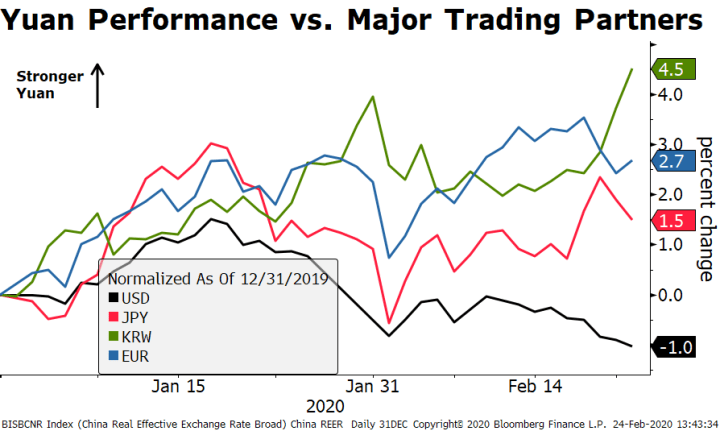

Seven Big-Picture Considerations for Covid-19

Below is a non-exhaustive list of medium- and long-term implications from the Covid-19. We discuss the yuan, China’s competitiveness, its position in the global production chains, the impact on the Phase One trade deal, and rising financial stability risks. Globally, the virus will bring about a new wave of fiscal spending and revive the discussions about the limits of monetary policy.

Read More »

Read More »

EM Preview for the Week Ahead

The still-growing impact of the coronavirus should keep EM and risk sentiment under pressure this week. The weekend G20 meeting in Saudi Arabia acknowledged the risks to the global economy and said participants agreed on a “menu of policy options.” However, the G20 offered little specific in terms of a coordinated policy response.

Read More »

Read More »

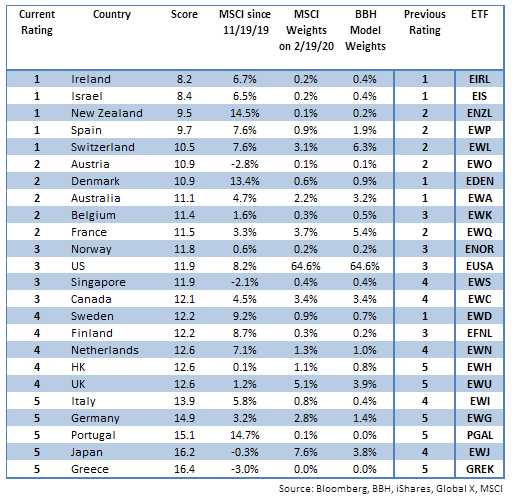

DM Equity Allocation Model For Q1 2020

Developed equity markets remain near the highs despite mounting concerns about the impact of the coronavirus. MSCI World made a new all-time high last week near 2435 and is up 2.5% YTD. Our 1-rated grouping (outperformers) for Q1 2020 consists of Ireland, Israel, New Zealand, Spain, and Switzerland.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Picks Up Again

Negative news on the coronavirus has kept risk appetite subdued across the board; the dollar rally continues. During the North American session, we will get some more clues to the state of the US economy; FOMC minutes were largely as expected. UK January retail sales came in firm; ECB releases the account of its January 23 meeting.

Read More »

Read More »

Drivers for the Week Ahead

We get the first February data from the US manufacturing sector this week; the US economy remains strong; FOMC minutes will be released Wednesday. Canada reports some key data this week. Preliminary eurozone February PMI readings will be reported Friday; UK has a busy data week.

Read More »

Read More »

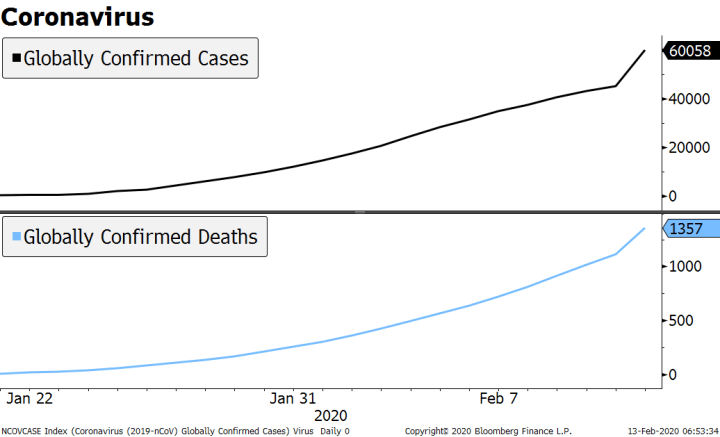

Virus Concerns Resurface

Markets are reacting badly to upward revisions to coronavirus cases in China. The euro fell to the weakest level since mid-2017 against the dollar. UK housing data adds to relatively upbeat figures since the December elections. Malaysia’s government is joining in the counter-cyclical fiscal effort.

Read More »

Read More »

Markets on Edge as New Week Begins

The coronavirus death toll is just over 900, exceeding the SARS epidemic; the dollar remains firm. President Trump will unveil his budget proposal for FY2021 beginning October 1 today. The faltering eurozone economy comes just as political uncertainty is picking up in Germany.

Read More »

Read More »

Drivers for the Week Ahead

Risk-off sentiment intensified last week; the dollar continues to climb. This is another big data week for the US; the US economy remains strong. Fed Chair Powell testifies before the House Tuesday and the Senate Wednesday; the Senate holds confirmation hearings for Fed nominees Shelton and Waller Thursday.

Read More »

Read More »

Dollar Firm Ahead of US Jobs Report

The number of confirmed coronavirus cases and deaths continue to rise; the dollar continues to climb. The January jobs data is the highlight for the week; Canada also reports jobs data. The Fed submits its semiannual Monetary Policy Report to Congress today; Mexico and Brazil report January inflation data.

Read More »

Read More »