Category Archive: 2) Swiss and European Macro

Swiss Trade Balance October 2021: chemistry-pharma tarnishes the foreign trade table

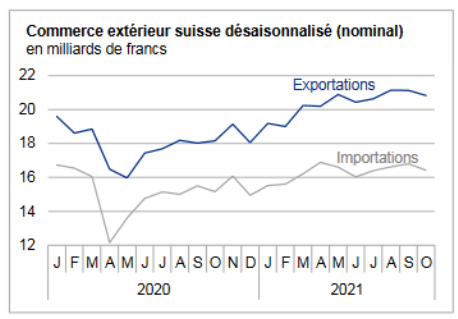

In October 2021, Swiss foreign trade lost its vigor. Exports declined 1.4% and imports 2.3% from the previous month. The chemicals and pharmaceuticals sector weighed on the results in both directions of traffic. The trade balance closed with a surplus of 4.4 billion francs, similar to that of previous months.

Read More »

Read More »

Weekly View – Big Splits

US prices continue to rise, with the US consumer price index (CPI) for October coming in at its highest in three decades. President Biden made a boldly worded response as inflation becomes a growing focus among politicians with their eyes fixed on next year’s midterm elections. Oil prices fell on investors’ expectations that the US could free up strategic reserves to combat energy inflation.

Read More »

Read More »

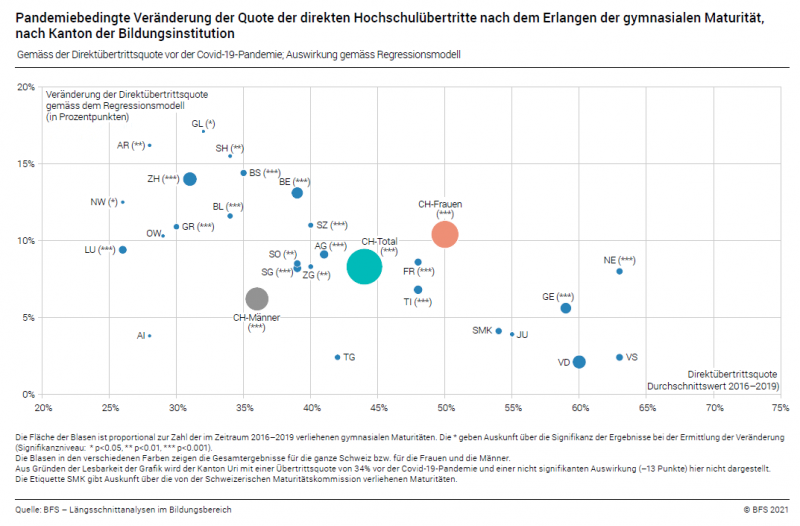

Wide variation in pandemic’s impact on post-compulsory education and training pathways

Due to the COVID-19 pandemic, academic Baccalaureate holders were much faster to transition to a higher education institution in 2020. This led to a record number of new students in the universities and institutes of technology. Transitions after a federal vocational or specialised Baccalaureate saw hardly any change.

Read More »

Read More »

Served sanctions fell by almost 21percent in 2020

15.11.2021 - In 2020, 10 945 sentences and measures were executed in Switzerland (2019: 13 810). More than two thirds (67%) were for imprisonment in a penal institution. Community service accounted for less than a third (30%) of executions of sentences while electronic monitoring made up 3%. 86% concerned males and 42% Swiss citizens.

Read More »

Read More »

Weekly View – Central Bank Halloween

Last week, the US GDP growth figure for Q3 came in lower than expected, while prices moved higher than anticipated and the US Employment Cost Index update rose at its fastest pace in 31 years. The headline increase was driven by the biggest surge in wages since 1982, up 1.5% in the third quarter.

Read More »

Read More »

Weekly View – Widening bottlenecks

After September’s negative performance, last week proved one of the strongest in a while for equity markets. This rebound followed news that the Biden administration will start to tackle the supply-chain and logistics issues that have been preventing deliveries.

Read More »

Read More »

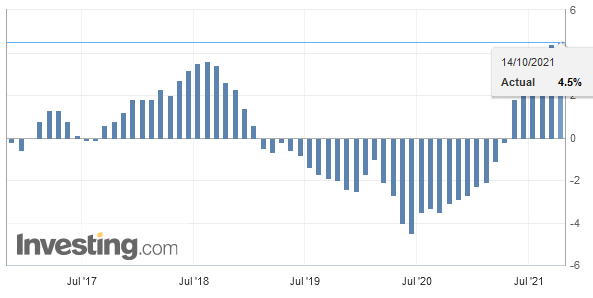

Swiss Producer and Import Price Index in September 2021: +4.5 percent YoY, +0.2 percent MoM

The Producer and Import Price Index rose in September 2021 by 0.2% compared with the previous month, reaching 104.1 points (December 2020 = 100). In particular, basic metals and semi-finished metal products as well as petroleum and natural gas saw higher prices. Compared with September 2020, the price level of the whole range of domestic and imported products rose by 4.5%.

Read More »

Read More »

Weekly View – Debt ceiling deadline postponed

China’s high-yield bond crisis continued last week, with yields on the ICE BofA index of Chinese high-yield US dollar bonds moving above 18% at one stage last week, the highest level in a decade. Further nervousness was caused by one real-estate issuer’s decision not to reimburse USD200 mn of offshore bonds--despite having USD4 bn in cash on its balance sheet.

Read More »

Read More »

UN World Data Forum in Bern mobilised experts to offer solutions for the 2030 Agenda

06.10.2021 - The UN World Data Forum 2021 (UNWDF) ended Wednesday 6 October in Bern with the adoption of the “Bern Data Compact for the Decade of Action on the Sustainable Development Goals”. This conference, held for the first time in a hybrid format, had a total of 7626 participants registered online, of whom 668 were present in Bern.

Read More »

Read More »

House View, October 2021

We maintain our tactically neutral position on equities, with the notable exception of Japan, where we see scope for a re-start to Abenomics and for Japanese stocks to continue to close their performance gap with their peers in other developed markets.

Read More »

Read More »

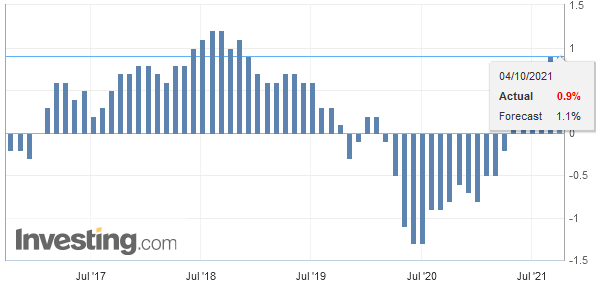

Swiss Consumer Price Index in September 2021: +0.9 percent YoY, +0.0 percent MoM

The consumer price index (CPI) remained stable in September 2021 compared with the previous month, remaining at 101.3 points (December 2020 = 100). Inflation was +0.9%. compared with the same month of the previous year.

Read More »

Read More »

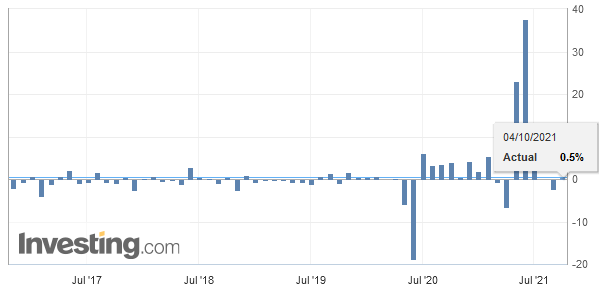

Swiss Retail Sales, August 2021: 0.2 percent Nominal and 0.5 percent Real

04.10.2021 - Turnover adjusted for sales days and holidays rose in the retail sector by 0.2% in nominal terms in August 2021 compared with the previous year. Seasonally adjusted, nominal turnover rose by 1.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

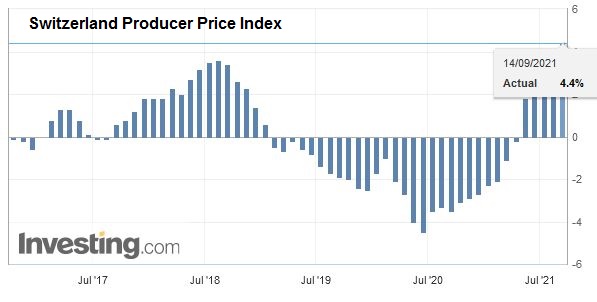

Swiss Producer and Import Price Index in August 2021: +4.4 percent YoY, +0.7 percent MoM

The Producer and Import Price Index rose in August 2021 by 0.7% compared with the previous month, reaching 103.9 points (December 2020 = 100). Chemical products and pharmaceutical products in particular saw higher prices. Compared with August 2020, the price level of the whole range of domestic and imported products rose by 4.4%.

Read More »

Read More »

Weekly View – “The lady is not tapering”

As expected, last week the European Central Bank hinted at a “moderate” reduction of the bond buying it undertakes as part of its Pandemic Emergency Purchase Programme (PEPP). But ECB president Christine Lagarde refrained from providing a precise timeline and she was adamant that a reduction in PEPP purchases did not mean the ECB would tighten financing conditions.

Read More »

Read More »

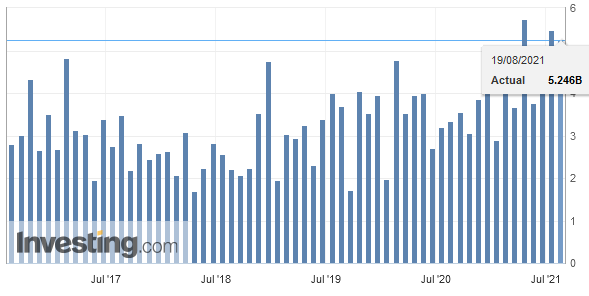

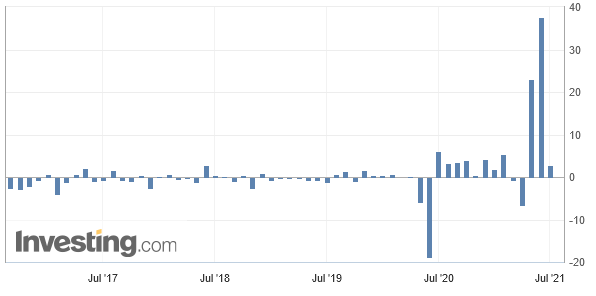

Swiss Trade Balance Q2 2021: secondary sector rose sharply in 2nd quarter 2021

Secondary sector production rose by 14.2% in 2nd quarter 2021 in comparison with the same quarter a year earlier. Turnover rose by 15.5%. These sharp increases can largely be explained by the weak 2nd quarter of 2020, during which measures against the COVID-19 pandemic came into effect.

Read More »

Read More »

Weekly View – 50 years later

The rosy US employment picture helped push equities to a new high as US inflation moderated in July. Those looking to fill roles now exceed those looking for work, compelling some small and mid-sized companies to raise wages. Higher prices seem to be keeping the US consumer in check, however, with consumer sentiment hitting its lowest level in a decade.

Read More »

Read More »

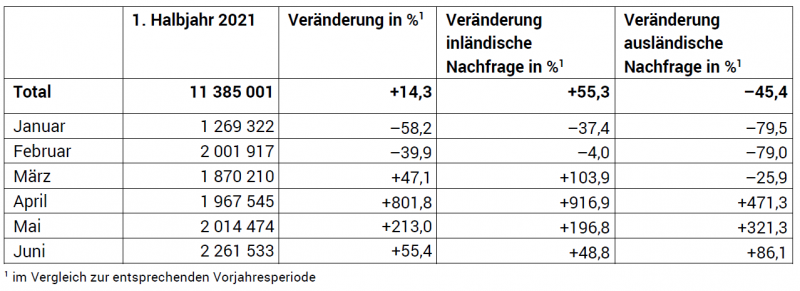

Swiss hotel sector: 14.3 percent rise in overnight stays in first six months of 2021

The hotel sector registered 11.4 million overnight stays in Switzerland in the first half of 2021, representing an increase of 14.3% (+1.4 million) compared with the same period of 2020. With a total of 9.2 million units, domestic demand rose by 55.3% (+3.3 million). Foreign visitors registered a 45.4% decrease (–1.8 million) with 2.2 million overnight stays.

Read More »

Read More »

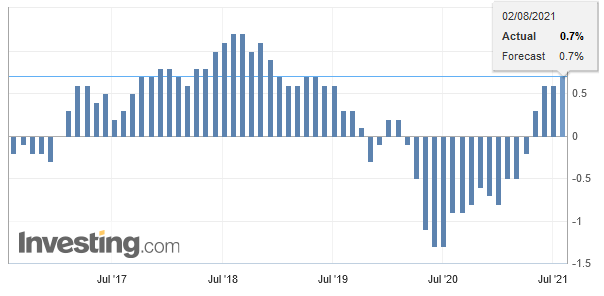

Swiss Consumer Price Index in July 2021: +0.7 percent YoY, -0.1 percent MoM

he consumer price index (CPI) fell by 0.1% in July 2021 compared with the previous month, reaching 101.0 points (December 2015 = 100). Inflation was +0.7% compared with the same month of the previous year.

Read More »

Read More »

Swiss Retail Sales, June 2021: -0.4 percent Nominal and +0.1 percent Real

Turnover adjusted for sales days and holidays fell in the retail sector by 0.4% in nominal terms in June 2021 compared with the previous year. Seasonally adjusted, nominal turnover fell by 3.6% compared with the previous month.

Read More »

Read More »

Weekly View – Staying on script

Big US banks released their 2Q earnings last week. The figures were good thanks to robust growth in investment-banking income as well as a drop in loan-loss provisions. But banks also reported that wage costs were beginning to rise, and while a booming housing market has boosted mortgage-loan business, the renewed retreat in long-term yields has been a drag on interest income.

Read More »

Read More »