Category Archive: 2) Swiss and European Macro

Kapitalmarktausblick 2018: Es spricht mehr für das 10. Jahr des Aktienaufschwungs als dagegen

Das grundsätzlich gute Börsenjahr 2017 neigt sich dem Ende zu. Wie entwickeln sich die Rahmenbedingungen für die Börsen 2018, konkret die Weltkonjunktur und vor allem die Geldpolitik als bislang bedeutendster Einflussfaktor? Wird 2018 wieder ein Aktienjahr und damit das 10. in Folge? Robert Halver mit seinen Prognosen aus dem Frankfurter Börsensaal

Read More »

Read More »

Switzerland’s Economic Recovery gains momentum

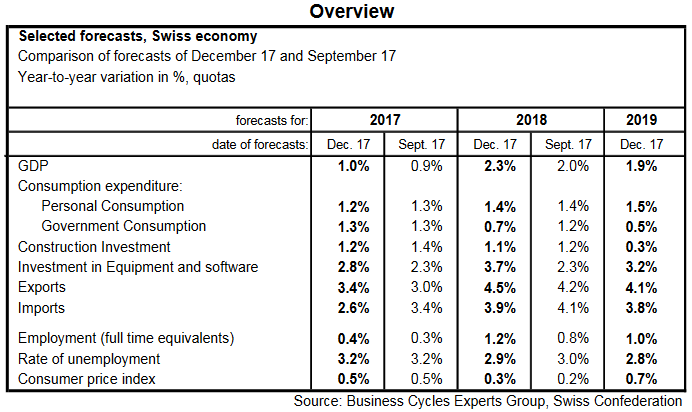

Economic forecasts by the Federal Government’s Expert Group – Winter 2017/2018* The Federal Government’s Expert Group expects the Swiss economy to make a speedy recovery over the next few quarters. While only moderate GDP growth of 1.0% is anticipated in 2017 due to a weak first half of the year, the forecast for GDP growth in 2018 is strong at 2.3% in the course of the global economic upturn.

Read More »

Read More »

Kursziele für 2018: JA oder NEIN?

Macht es überhaupt einen Sinn, Kursziele für 2018 zu nennen oder eine Jahresprognose zu erstellen? Wenn wir uns die Prognosen von 2017 anschauen müssen wir feststellen, dass die Analysten weit daneben lagen. Wie ich mit diesem Thema umgehe und mit welchen Verfahren ich versuche, der Zukunft Herr zu werden, erkläre ich euch in diesem Video. …

Read More »

Read More »

Pictet Multi-Generational Wealth, Singapore (Full version)

The fourth edition of the Asian Family Office Master Class took place in Singapore in November 2017, with about 70 guests attending. The focus was around the three pillars of Pictet’s Family Office offer: family governance, investment governance and operational governance. Among the speakers, we had the pleasure of welcoming José Leyte, Chief Executive Officer …

Read More »

Read More »

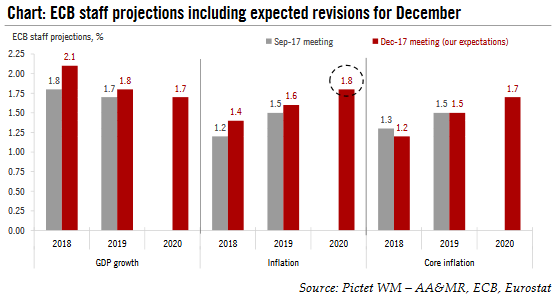

ECB preview: close to target…by 2020

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon. We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone.

Read More »

Read More »

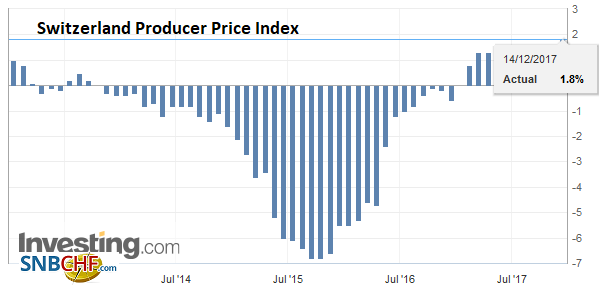

Swiss Producer and Import Price Index in November 2017: +1.8 YoY, +0.6 MoM

The Producer and Import Price Index rose in November 2017 by 0.6% compared with the previous month, reaching 101.6 points (base December 2015 = 100). The rise is due in particular to higher prices for petroleum products, chemical and pharmaceutical products and scrap. Compared with November 2016, the price level of the whole range of domestic and imported products rose by 1.8%.

Read More »

Read More »

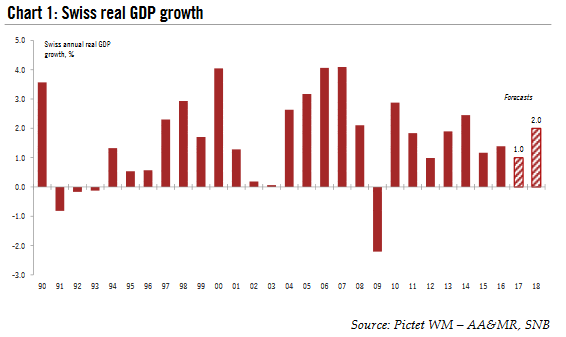

The Swiss economy is gaining momentum

Swiss growth was disappointing at the end of 2016 and in the first half of 2017. Consequently, GDP growth this year is likely to be just 1.0% , its lowest level since 2012 . However, a wide set of statistics are already painting a considerably more positive picture of strengthening growth as we approach the end of 2017. Of particular note is the increasing contribution of manufacturing to real GDP growth.

Read More »

Read More »

Perspectives Pictet – Back to normal in markets in 2018

2017 was a remarkable year, with positive returns for a wide array of risk assets. The environment will likely remain supportive as well, but Cesar Perez Ruiz, CIO at Pictet Wealth Management, says he expects more normal market conditions in 2018, with spikes in volatility that offer greater opportunities for active management.

http://perspectives.pictet.com

https://www.group.pictet/wealth-management

Read More »

Read More »

Perspectives Pictet – Back to normal in markets in 2018

2017 was a remarkable year, with positive returns for a wide array of risk assets. The environment will likely remain supportive as well, but Cesar Perez Ruiz, CIO at Pictet Wealth Management, says he expects more normal market conditions in 2018, with spikes in volatility that offer greater opportunities for active management. http://perspectives.pictet.com https://www.group.pictet/wealth-management

Read More »

Read More »

BITCOIN-Verbot: Möglich?

► TIPP: Sichere Dir mein E-Book „Bitcoins: Digitales Gold oder Luftblase?“, sowie wöchentlich meine Tipps zu Bitcoin & Co. – 100% gratis: http://www.lars-erichsen.de/bitcoins ➤ Link zum Video “BEREIT, falls BITCOIN CRASHT?”:https://youtu.be/Niumu7DqaHM Ein bekannter Ökonom und Nobelpreisträger aus den USA, fordert das Verbot von Bitcoin. Aber, ist das möglich? Meine Gedanken dazu, im heutigen Video. ——– …...

Read More »

Read More »

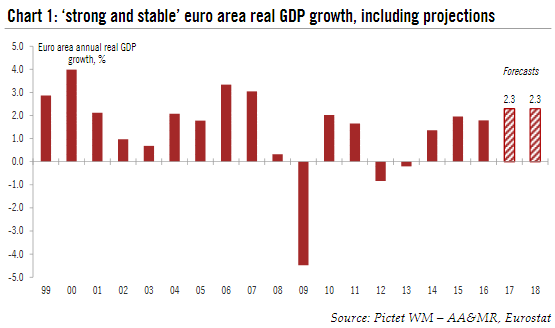

Euro Area Forecast to Grow 2.3percent in 2018

2017 was the year of the ‘Euroboom’ and the removal of political tail risks. Moving into 2018, we mark-to-market strong economic data, including carryover and revisions. We forecast annual GDP growth of 2.3% both in 2017 and 2018. Qualitatively, our forecasts reflect our view that the euro area has reached ‘escape velocity’, with important implications for investors.

Read More »

Read More »

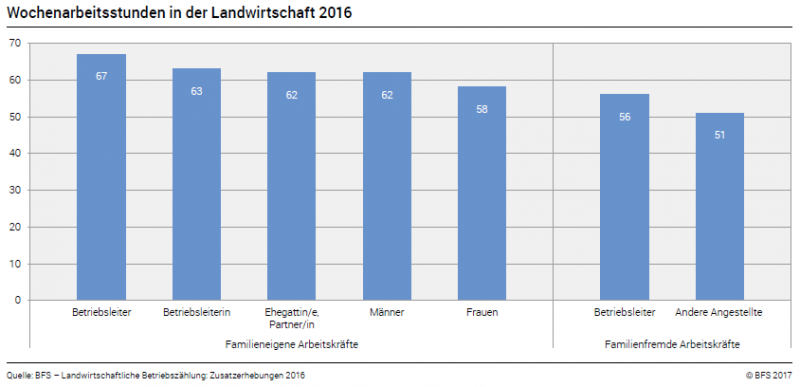

Farm Census 2016: Swiss farmers work well over 60 hours per week

For several years the average Swiss farmer has been working well over 60 hours per week. With their off-farm jobs, part-time farmers also work long hours. From 2010 to 2016, however, the hours worked fell by one hour per week. Over the same period, farms greatly increased the direct sale of farm products (+60%). Despite the long working hours, in many cases it is very likely that a family member will take over the farm. These are some of the latest...

Read More »

Read More »

Das Börsenwort des Jahres 2017: Risikounbekümmertheit

Früher galt einmal die eiserne Aktienregel: Keine Chance ohne Risiko. Doch heutzutage scheinen die Vorteile von Aktien mit denen des Sparbuchs gekreuzt zu sein: Hohe Chancen bei keinem Risiko. Haben wir es mit einer schönen neuen Anlagewelt zu tun oder droht irgendwann ein böses Ende der Aktienhausse? Robert Halver mit seinen Einschätzungen aus dem Börsensaal …

Read More »

Read More »

RUHE vor dem STURM?

Die Schwankungsbreite des Aktienmarktes ist so gering wie noch nie in der Geschichte der Börse. Es gibt Experten die meinen, das ist die Ruhe vor dem großen Sturm. Meine Meinung dazu, in diesem Video. ——– ➤ Hier anmelden und jeden Mittwoch meinen Report erhalten: http://lars-erichsen.de/ ► Mein Youtube-Kanal “Tradermacher”: http://youtube.com/tradermacherde ➤ Folge mir bei Facebook: …

Read More »

Read More »

L’Union européenne fait semblant de lutter contre l’évasion fiscale. Attac

Les paradis fiscaux lovés au coeur de l’UE, de l’Asie et des Etats-Unis d’Amérique sont occultés… L’analyse vire à la farce! Après avoir étudié la situation de 92 pays en matière de lutte contre l’évasion fiscale, l’Union européenne n’en retient donc que 17 sur sa liste noire des paradis fiscaux. Parmi ces États dits « non-coopératifs » on trouve, entre autres, le Panama, la Tunisie, les Emirats arabes unis, Trinité et...

Read More »

Read More »

Der einzige Weg zur Rettung Europas Dr Heiner Flassbeck 2017

Wellcome to my Channel ! If you love my videos, let subscribe and help us reach 10.000 Subscriber ! Die EZB flutet die Finanzmärkte weiter mit billigem Geld und fördert eine Umverteilung des weltweiten Besitzes von Arm zu Reich. Hier sehen Sie mögliche .

Read More »

Read More »

Hans-Werner Sinn zerlegt Norbert Röttgen (EU, Brexit, Flüchtlinge) – ANSEHEN

Hans-Werner Sinn über Brexit, EU und Flüchtlinge. (2/2017) Wird DIESE Zukunft wirklich kommen►►►https://goo.gl/AwFNo9 ↓ ↓ ↓ ↓ ↓ ↓ HIER ÖFFNEN! ↓ ↓ ↓ ↓ ↓ ↓ DIRK MÜLLER – Showdown: Der Kampf um Europa und unser Geld: https://goo.gl/aKrvES DIRK MÜLLER – Cashkurs – So machen Sie das Beste aus Ihrem Geld: Aktien, Versicherungen, Immobilien: …

Read More »

Read More »

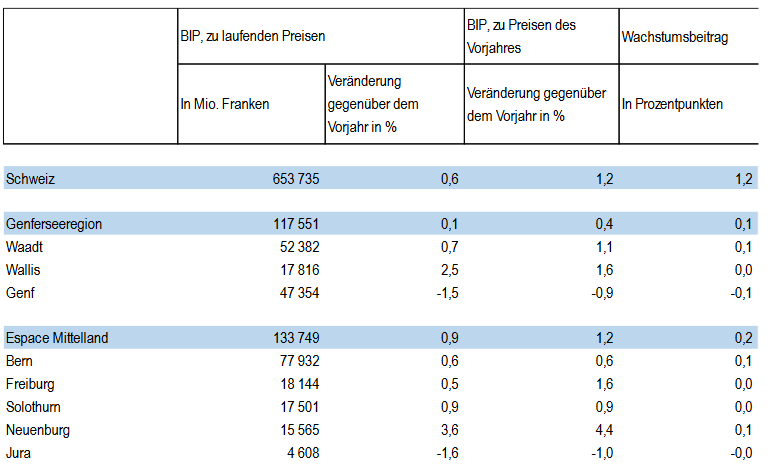

Gross domestic product by canton in 2015: Economic activity slowed down in Switzerland in 2015

Gross domestic product (GDP) growth slowed between 2014 and 2015 in most cantons. Nevertheless, the cantons of Neuchâtel (+ 4.4%), Schaffhausen (+ 2.9%), Schwyz (+ 2.9%) and Zug (+ 2.8%) recorded a clearly positive development. The canton of Zurich once again made the biggest contribution to the nationwide growth.

Read More »

Read More »