Category Archive: 2) Swiss and European Macro

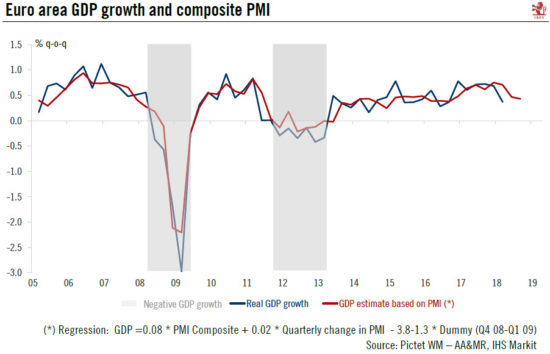

Euro area PMIs on the soft side

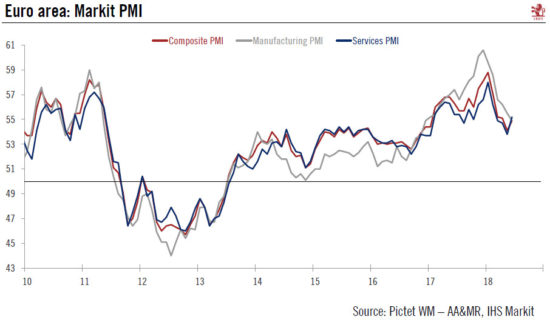

Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of decline.

Read More »

Read More »

Türkei: Kurssturz = Chance?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Aktien, ETFs, Gold, & Co. – 100% gratis: http://lars-erichsen.de/ Türkische Aktien sind in den letzten Monaten massiv eingebrochen. Die Türkei und insbesondere die Widerwahl Erdogans ist großes Thema in den Medien. Ist dieser Kurssturz in türkischen Aktien, für spekulative Investoren vielleicht auch eine Einstiegsgelegenheit? Das werden wir …

Read More »

Read More »

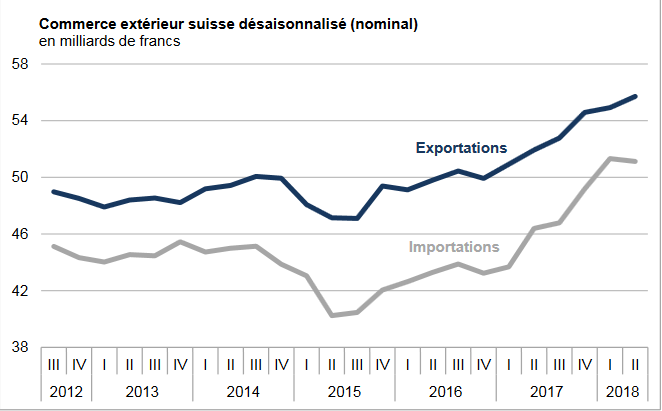

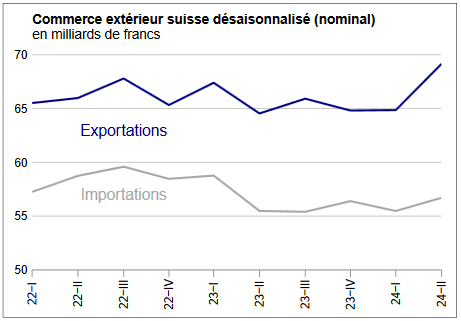

Swiss Trade Balance June 2018: Fifth consecutive record of exports

The dynamism shown by exports since the beginning of 2017 continued in the second quarter of 2018. They are thus flying from record to record for the fifth quarter in a row. Imports, on the other hand, came to a standstill, at a high level, however, after posting strong growth in previous quarters. The trade balance closes on a surplus of 4.6 billion francs.

Read More »

Read More »

Heiner Flassbeck zur Situation der Eurokrise

Videolink: Quelle: Rosa Luxemburg-Stiftung https://www.youtube.com/channel/UClp4017ICvSPjIEBZLeEwaQ Veröffentlicht: 26.11.2015

Read More »

Read More »

What will the rest of the year bring?

Risk assets have disappointed this year and global equities were trendless, but as long as fundamentals can re-assert themselves, there could still be some life in risk markets.Global equities were trendless and the overall performance of risk assets lacklustre in the first half of 2018.

Read More »

Read More »

In 5 Minuten die besten Dividenden-Aktien finden

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ In 5 Minuten die besten Dividenden-Aktien finden? Selbstverständlich ersetzt nichts, eine gründliche und seriöse Analyse. Aber es gibt durchaus einen Anhaltspunkt, der aus meiner Sicht eine so entscheidende und tragende Rolle spielt, dass man ihn als Filter verwenden …

Read More »

Read More »

Yanis Varoufakis – Iran Nuclear Deal, USA, Europe (Capitalism and right-wings) May 2018

Yanis Varoufakis (Cofounder of the grassrouts movement DiEM25), Greek economist, academic and politician, served as the Greek Minister of Finance (January to July 2015). Varoufakis taught economics and econometrics at the University of Essex and the University of East Anglia, and also taught at the University of Cambridge (1982 and 1988). He did not wish …

Read More »

Read More »

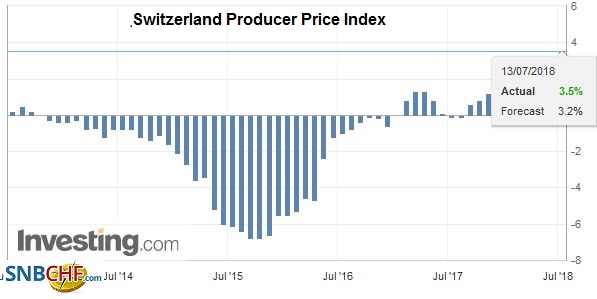

Swiss Producer and Import Price Index in June 2018: +3.5 YoY, +0.2 MoM

The Producer and Import Price Index increased in June 2018 by 0.2% compared with the previous month, reaching 103.2 points (December 2015 = 100). The rise is due in particular to higher prices for petroleum products and timber products. Compared with June 2017, the price level of the whole range of domestic and imported products rose by 3.5%.

Read More »

Read More »

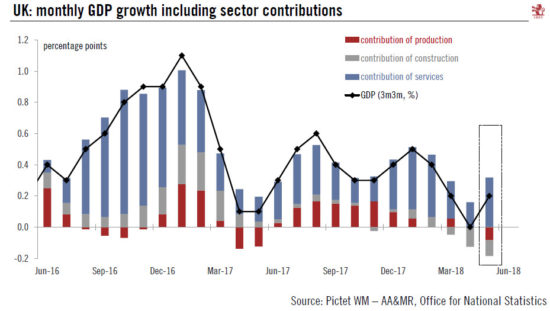

Europe chart of the week – UK GDP growth

Short-term rebound in the UK, driven by services.The Office for National Statistics (ONS) published this week a new rolling monthly estimate of UK GDP. The release pointed to a rebound of growth in Q2 (quarterly data will be published on August 8). According to the ONS, the rolling three-month growth to end-May was 0.2%, compared to 0% in the three months to end-April (see chart below).Looking at the details, the services sector (79% of the...

Read More »

Read More »

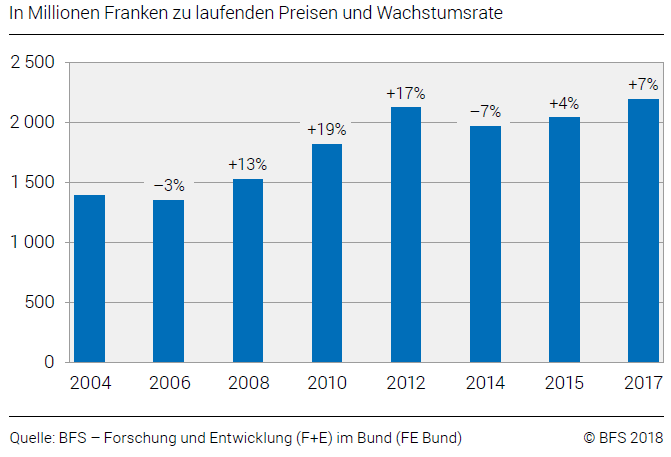

Research and Development: Federal Expenses and Staff in 2017

In 2017, the Confederation spent CHF 2.2 billion on research and experimental development (R&D). This represents a 7% increase compared with 2015, the year of the previous survey. This is a record amount, mainly paid in the form of contributions to support research activities. Over the same period, Confederation personnel employed in R&D activities declined by 4%, reaching 875 jobs in full-time equivalents.

Read More »

Read More »

Merkel, Trump, China… alles egal?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Merkel, Trump, China…wisst ihr, dass ist mir eigentlich alles egal. Es gibt, wenn wir über die Aktienanlage sprechen, ganz andere Faktoren auf die wir achten sollten und bei denen es ganz wichtig ist, dass wir uns von den …

Read More »

Read More »

Yanis Varoufakis: Has capitalism failed us? | On Civil Society | May 18, 2018.

“Money is a political construct, a construct of community, a construct of a society, that must be political. And if we do not control this, by definition, political force, because money is a force—it makes the world go round, as we know—if this political force it not controlled democratically, then we do not live in …

Read More »

Read More »

Europa nach der Euro-Krise – Impuls von Peter Bofinger

EUROPA IM AUFSCHWUNG – ERGEBNIS ERFOLGREICHER KRISENPOLITIK? Peter Bofinger, Universität Würzburg und Sachverständigenrat für Wirtschaft Wo stehen die Eurozone und ihre Mitgliedsstaaten heute konjunkturell? Welche wirtschaftspolitischen Maßnahmen zur Überwindung der Krise in der Eurozone haben gewirkt, welche nicht? Diese und weitere Fragen wurden auf unserer Europa-Konferenz am 12. Juni 2018 in Berlin diskutiert. Weitere Informationen …...

Read More »

Read More »

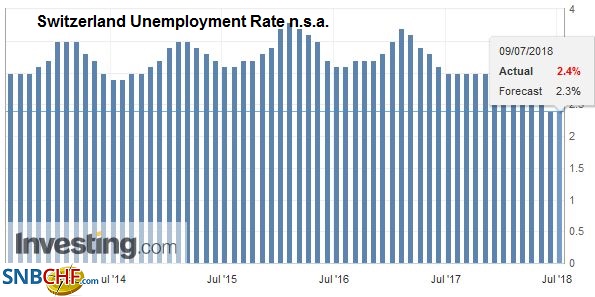

Switzerland Unemployment in June 2018: Up to 2.4percent from 2.3percent, seasonally adjusted up to 2.6percent from 2.5percent

Registered unemployment in June 2018 - According to SECO surveys, at the end of June 2018, 106,579 unemployed were registered at the regional employment agencies (RAV), 2,813 less than in the previous month. The unemployment rate remained at 2.4% in the month under review. Compared with the same month last year, unemployment fell by 27,024 people (-20.2%).

Read More »

Read More »

Commerzbank fliegt aus dem DAX: Jetzt kaufen?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Die Commerzbank fliegt – allem Anschein nach – aus dem Dax. Sollte man die Aktie vielleicht genau deshalb jetzt kaufen? In diesem Video nenne ich euch die konkrete Kaufmarke, bei der man aus meiner Sicht als spekulativer Anleger …

Read More »

Read More »

Euro area: a slight rebound

The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany.

Read More »

Read More »

Prof. Heiner Flassbeck – Die EUROKRISE bricht wieder auf

Heiner Flassbeck studierte von 1971 bis 1976 Volkswirtschaft an der Universität des Saarlandes. Als Assistent am Lehrstuhl von Wolfgang Stützel beschäftigte er sich schwerpunktmässig mit Währungsfragen. Bis 1980 war er im Assistentenstab des Sachverständigenrates zur Begutachtung der gesamtwirtschaftlichen Entwicklung. 1987 promovierte er zum Dr. rer. pol. an der Freien Universität Berlin. Thema seiner Dissertation: Preise, …

Read More »

Read More »

Credit Suisse: “Our Risk Appetite Index Is Near Panic”

Sure, it's been a bad year for investors, with the S&P posting the smallest of gains in the first half (all of which thanks to tech stocks) after several hair-raising, monthly incidents including February's vol-spike, April's real yield scare, May's Emerging Market massacre and June's trade war fears as shown in the following Citi chart...

Read More »

Read More »

UBI Supporter : Yanis Varoufakis – Greek Economist, Academic & Politician

Yanis Varoufakis : “Artificial intelligence will necessitate a Universal Basic Income.” #BasicIncome source : https://www.youtube.com/watch?time_continue=7&v=BJapiiBcHPs

Read More »

Read More »