Category Archive: 1) SNB and CHF

Dommage que Monnaie pleine ait omis de prévoir des mesures pour brider les risques que fait porter la BNS sur le contribuable.

Le peuple suisse va voter sur une initiative qui porte le nom de « monnaie pleine ». Cette initiative est partie du constat que les banques émettent de la monnaie scripturale dite monnaie-dette ou monnaie bancaire, et souhaite rendre la BNS seule responsable de la création monétaire, comme c’est d’ailleurs prévue par la Constitution.

Read More »

Read More »

Les réserves de la BNS au service des investisseurs étrangers

M Cedric Tille, professeur d’Economie (Cédric tille bns) vient de publier une étude fort intéressante qui gagne à être découverte. Elle cartographie la position économique de la Suisse par rapport au reste du monde.Il démontre à quel point la structure qui compose le moteur économique, financier et monétaire de la Suisse dans ses relations avec l’étranger avait changé en dix ans.

Read More »

Read More »

Court Upholds Fines for Leaking ex-SNB Chairman’s Bank Details

Switzerland’s highest court has imposed suspended fines on a local politician and a former bank worker for leaking the personal bank transactions of former Swiss National Bank (SNB) chairman Philipp Hildebrand. The leak forced Hildebrand to resign in 2012.

Read More »

Read More »

Que reste-t-il de la BNS? Liliane Held-Khawam

Nous alertons sur ce blog depuis des années sur le fait que la BNS, qui a récupéré grâce à la « réforme » de 2003 une levée des restrictions sur sa politique monétaire, mène une stratégie complaisante vis-à-vis du marché financier, et plus précisément américain.

Read More »

Read More »

Is the Yen or Swiss Franc a Better Funding Currency?

Yen and Swiss franc are funding currencies. This goes a long way to explaining why they rally on heightened anxiety. The Swiss have lower rates than Japan and the franc is less volatile than the yen, but technicals argue for caution.

Read More »

Read More »

Lions Trading Club – Nachtrag – Problem Finma – Deutsch

In diesem Video erhälst Du Informationen zur aktuellen Situation des Lions Trading Club`s. Risikohinweis & Einkommensdisclaimer: Online-Investments , können im Totalverlust der investierten Gelder enden! Investieren Sie kein Geld, dessen Verlust Sie nicht verkraften könnten! Die in unseren Videos gezeigten Informationen und Zahlen dienen weder als Versprechen noch als Kaufempfehlung. Dieses Video ist generell als …

Read More »

Read More »

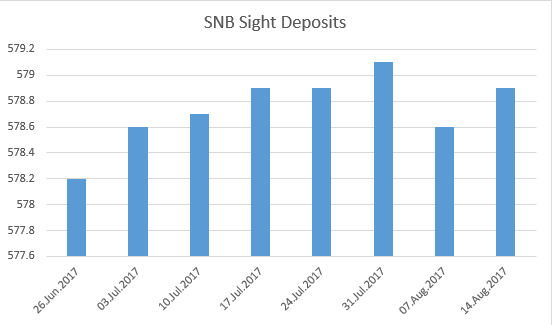

Weekly SNB Interventions and Speculative Positions: Investors do not take North Korea dispute seriously

Despite the tensions between Donald Trump and North Korea's Kim Jong-un, the EUR/CHF only depreciated to 1.13. In the last week, the SNB did not have to intervene. This proves that investors have not taken the tensions seriously.

Read More »

Read More »

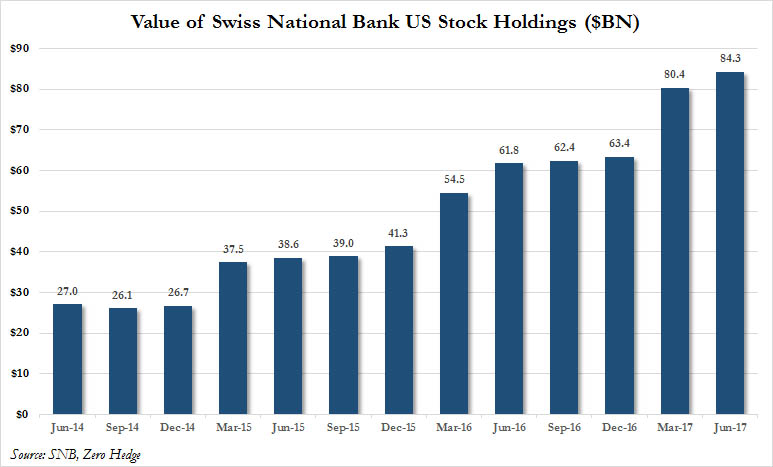

“Mystery” Central Bank Buyer Revealed: SNB Now Owns A Record $84 Billion In US Stocks

In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks.

Read More »

Read More »

Lions Trading Club News, Nicht einzahlen! Abwarten! Problem mit FINMA

In diesem Video erhälst Du Informationen zur aktuellen Situation des Lions Trading Club`s. Risikohinweis & Einkommensdisclaimer: Online-Investments , können im Totalverlust der investierten Gelder enden! Investieren Sie kein Geld, dessen Verlust Sie nicht verkraften könnten! Die in unseren Videos gezeigten Informationen und Zahlen dienen weder als Versprechen noch als Kaufempfehlung. Dieses Video ist generell als …

Read More »

Read More »

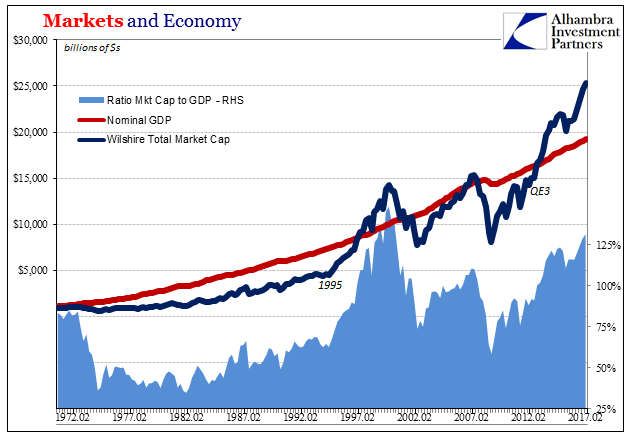

SNB Balance Sheet, Markets and Economy: As Good As It Gets?

Late 2014/early 2015 will perhaps be the closest to a real recovery from the Great “Recession” we shall see in this cycle. Q1 2015 marked the peak year over year growth rate of GDP in this recovery at 3.76%. That rate compares quite unfavorably with even the feeble post dot com crash recovery high of 4.41% in Q1 2004.

Read More »

Read More »

Can Switzerland Survive Today’s Assault On Cash And Sound Money?

“Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world than in Switzerland.”

Read More »

Read More »

Survey on the use of payment methods in Switzerland

The Swiss National Bank (SNB) is this year conducting a survey on payment methods for the first time. Over the coming months, 2,000 people resident in Switzerland will be asked about their habits regarding the use of payment methods. The aim of the survey is to obtain representative information on the Swiss population’s use of various payment methods and to identify any changes in this respect.

Read More »

Read More »

Worin die populäre Geldschöpfungskritik irrt – Teil 2

Wie der erste Teil darzulegen versuchte, muss einer Ausweitung der Geldmenge durch Geschäftsbanken zwangsläufig eine Vermehrung der Basisgeldmenge vorausgegangen sein. Ohne eine Entscheidung der Zentralbank, den Geschäftsbanken –vorgängig oder nachträglich – Basisgeld zur Verfügung zu stellen, ist eine jede Geschäftsbank aufgrund der gegenseitigen Konkurrenz untereinander in deren Möglichkeit, Geld zu schöpfen, beschränkt.

Read More »

Read More »

Switzerland’s Changing International Linkages

Over the last decade, the economic linkages between Switzerland and the rest of the world have been transformed. First, merchanting and the chemical industry account for an increasing share of international trade, with chemicals exports expanding robustly in recent years despite the European crisis and the strong Swiss franc.

Read More »

Read More »

Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

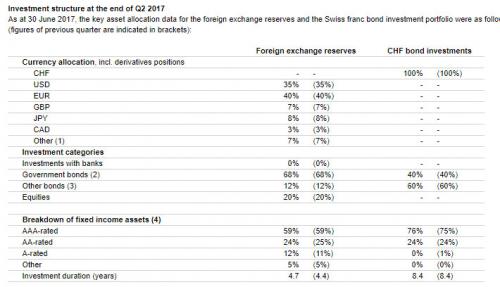

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and "other bonds", at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below.

Read More »

Read More »

Swiss franc slides 4 percent in one week

On 24 July 2017, the Swiss franc was 1.101 to the euro. One week later on 31 July 2017 it was 1.145, according to Bloomberg. Over the month it dropped from 1.095 to 1.145, a drop Reuters described as the biggest monthly drop in six years. The Swiss National Bank (SNB) has been working hard to bring down the value of the Swiss franc. Speaking to the newspaper Le Temps last week, SNB president Thomas Jordan described the currency as “significantly...

Read More »

Read More »

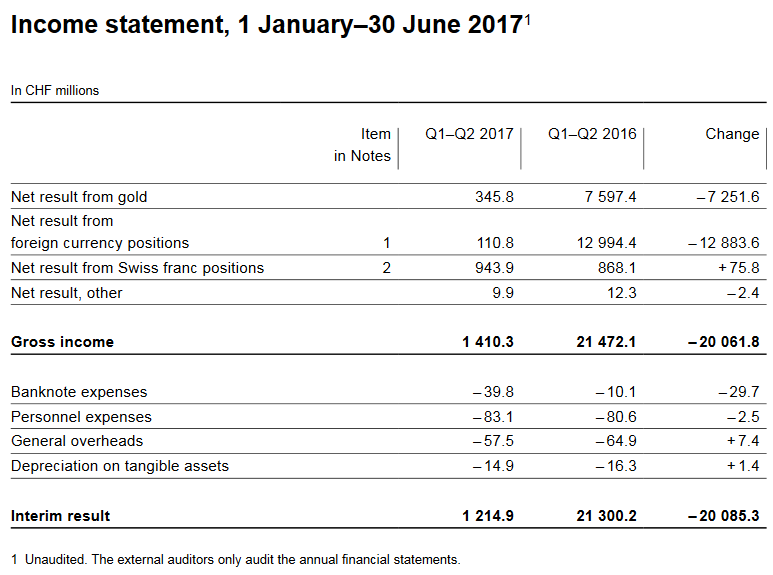

SNB reports a profit of CHF 1.2 billion for the first half of 2017

The Swiss National Bank (SNB) reports a profit of CHF 1.2 billion for the first half of 2017. A valuation gain of CHF 0.3 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 0.1 billion and the profit on Swiss franc positions stood at CHF 0.9 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets.

Read More »

Read More »