Category Archive: 1) SNB and CHF

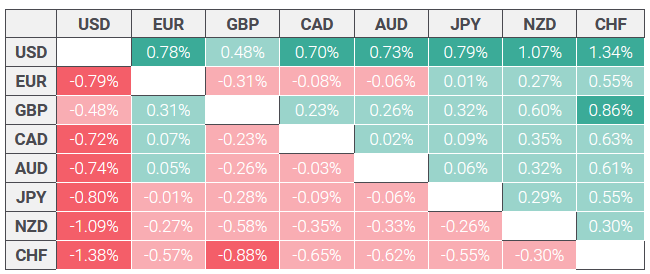

Weekly Sight Deposits and Speculative Positions: SNB intervenes, while Speculators go Long CHF

The Fed has hiked rates and with this fait accomplis speculators sold the news. They closed their short CHF and opened new CHF longs. The SNB, however, intervened again for 0.5 billion CHF.

Read More »

Read More »

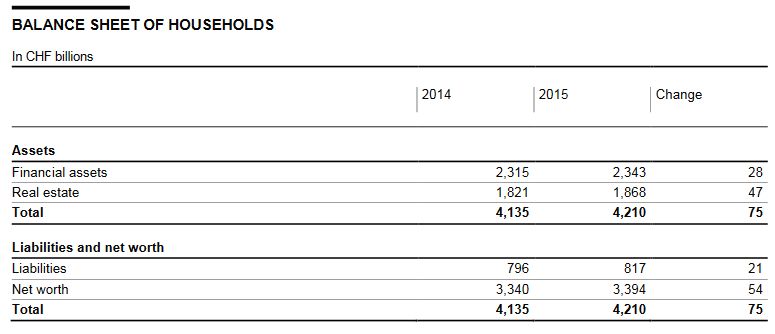

Swiss Financial Accounts, 2015 edition

This year, the Swiss financial accounts, which have been released by the Swiss National Bank since 2005, feature changes affecting both timeliness and presentation.

For the first time, data on the financial accounts are now published within eleven months of the reference date, reducing time to publication by one year. Moreover, the balance sheet of households, previously the subject of the press release on household wealth, is now included in the...

Read More »

Read More »

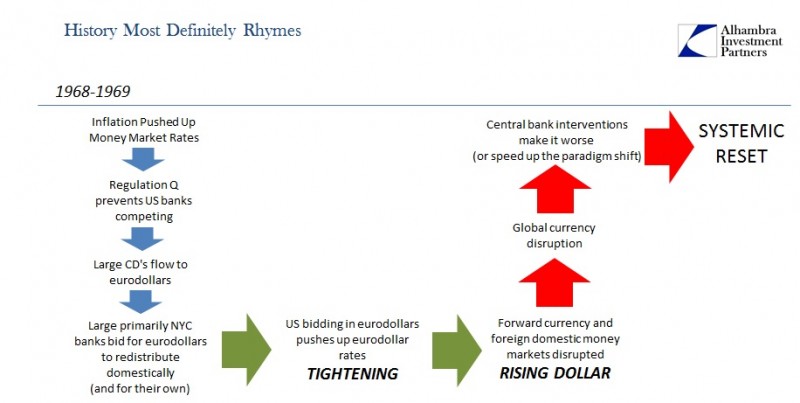

We Know How This Ends – Part 2

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »

Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle.

Read More »

Read More »

Swiss National Bank further strengthens provisions for currency reserves

The Swiss National Bank uses a strange formula on the basis of economic growth for the provisions for FX losses. It would be much easier to connect this number to the size of the balance sheet, e.g. 10% of the balance sheet.

Read More »

Read More »

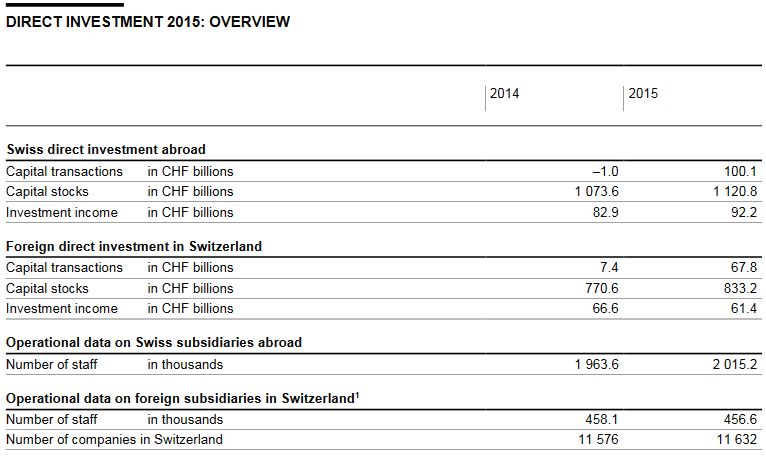

Direct Investments in 2015

Swiss direct investment abroad. Companies domiciled in Switzerland invested CHF 100 billion abroad, compared with disinvestment of CHF 1 billion the year before. Thus, Swiss direct investment abroad was significantly above the average for the past ten years. At CHF 54 billion, over half of the investment was made by finance and holding companies (2014: CHF 3 billion).

Read More »

Read More »

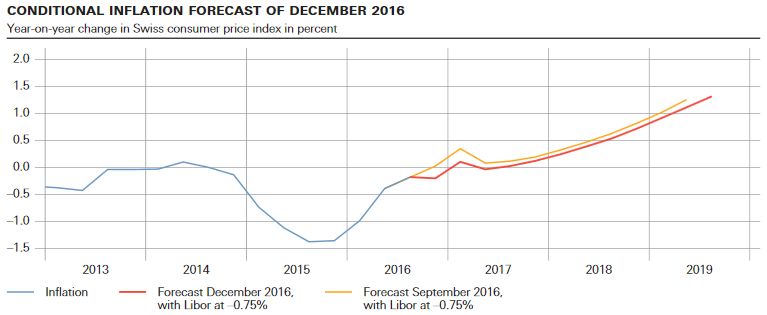

SNB Monetary policy assessment December 2016 and Comments

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. At the same time, the SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Swiss banks probed at home over Brazil’s ‘Carwash’ bribe scandal

The Switzerland attorney general’s office is shifting its focus to banks operating in the country as it continues to investigate Brazil’s bribery scandal, after plea deals with individual executives provided fresh insights into how the illicit funds flowed through the financial system.

Read More »

Read More »

Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday's agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its highest close since September...

Read More »

Read More »

Weekly Sight Deposits: No SNB Interventions, Short CHF nearing records

Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later.

Read More »

Read More »

Wie die SNB durch Kapitalsteuern die Schweizer Wirtschaft belastet

Vor dem Hintergrund eines angeblich „schwachen Wirtschaftswachstums“ rechtfertigte SNB-Chef Thomas Jordan neulich in einem Interview in der Tagespresse die SNB-Negativzinsen und bezeichnete diese als „expansiv“. Nur: Sind Negativzinsen wirklich „expansiv“? Sind diese nicht viel eher „restriktiv“ und bremsen unsere Wirtschaft – bewirken also genau das Gegenteil von dem, was die SNB behauptet?

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

Weekly Sight Deposits: Investors hedge with Swiss Franc again for the coming inflation cycle.

We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts – i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up U.S. wages.

Read More »

Read More »

Swiss banks taking more risks to compensate for record-low interest rates

Swiss banks focused on property lending are taking more risks to compensate for the impact of record-low interest rates, increasing the threat of a real-estate bubble, Swiss National Bank Vice President Fritz Zurbruegg said.

Read More »

Read More »

L’Allemagne est le patron-sponsor de l’Eurosystem.

Lors des échanges commerciaux et interbancaires, il y a des banques émettrices de monnaie et vis-à-vis une banque réceptrice. Normalement, à la fin de la journée, tout cela devrait être ramené à l’équilibre. Ceci n’est plus le cas depuis la crise américaine de 2007 (subprimes) comme nous le voyons sur le graphique ci-dessous de quelques pays de la zone euro.

Read More »

Read More »

Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks...

Read More »

Read More »

Weekly Sight Deposits: Investors hedge against Trump’s inflationary policy with Swiss Franc.

We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts - i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up wages. According to Lars Christensen Trumpeconomics is also about monetary stimulus: Trump would push for a more jobs and a dovish Fed, same as his fellow...

Read More »

Read More »

SNB sollte Bund bis 60 Milliarden ausschütten – nur so ist der Steuerzahler sicher

Letzte Woche gab die Schweizerische Nationalbank (SNB) bekannt, dass sie für dieses Geschäftsjahr eine Milliarde Franken an Bund und Kantone ausschütten wird. Von der Presse wird dies unterschiedlich interpretiert. Einerseits nimmt man mit Genugtuung zur Kenntnis, dass die SNB überhaupt eine Milliarde ausschütten kann. Andererseits wird mit Blick auf drohendes negatives Eigenkapital der SNB gewarnt, diese müsse dringend Reserven bilden.

Read More »

Read More »

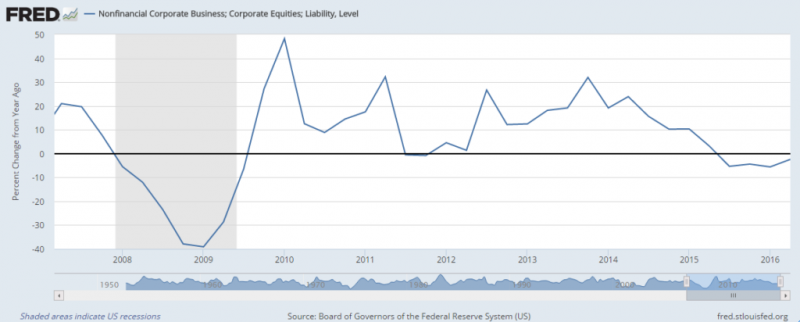

Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful initiatives of Ronald Reagan.

Read More »

Read More »

Swiss National Bank won’t cut record low interest rate again, survey shows

The Swiss National Bank, which has the lowest interest rate among the world’s major central banks, may be done cutting. SNB President Thomas Jordan and his fellow policy makers will keep the deposit rate unchanged at minus 0.75 percent until at least the end of the first quarter of 2019, according to the median forecast in Bloomberg’s monthly survey of economists. That would mean ignoring the International Monetary Fund’s advice to fend off inflows...

Read More »

Read More »

-638453232816314704.png)