Category Archive: 1.) CHF

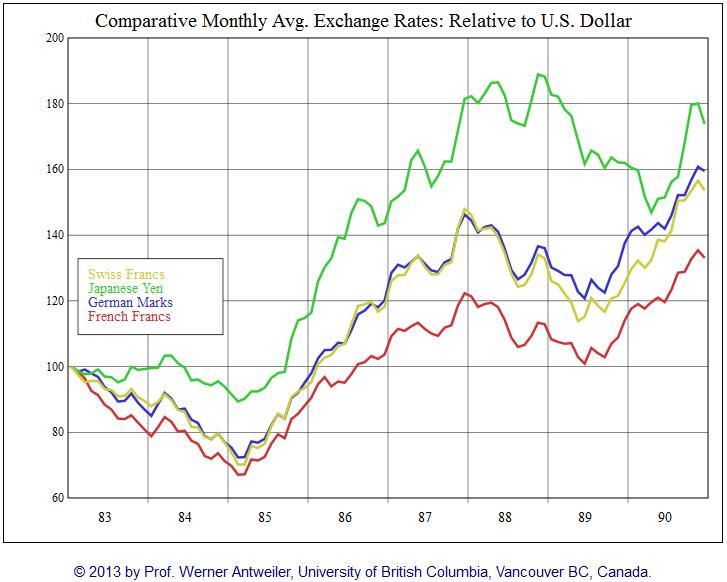

Swiss Franc History 1986-1996: Swiss real estate Boom and Bust

A critical Swiss franc history: This chapter describes the most controversial episode in the Swiss monetary history: How the Swiss National Bank helped to wreck the Swiss real estate market in the 1990s.

Read More »

Read More »

Swiss Franc History: Volcker Shock, Oil Glut and the Breakdown of Gold and Emerging Markets

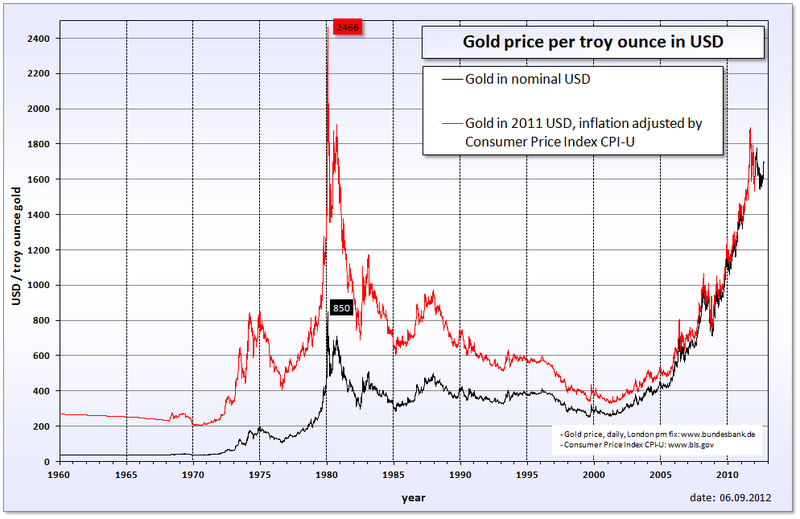

After the Volcker moment or sometimes called "Volcker shock", commodity prices plunged, the gold price collapsed. Thanks to additional supply, e.g. from Northsea oil, a so-called oil glut appeared. After the increase of debt in the 1970s, some economies in Southern America collapsed. The major reason was Volcker's tight monetary policy with high interest rates and the dependency on US funds.

Read More »

Read More »

Volckers Attack on Stagflation

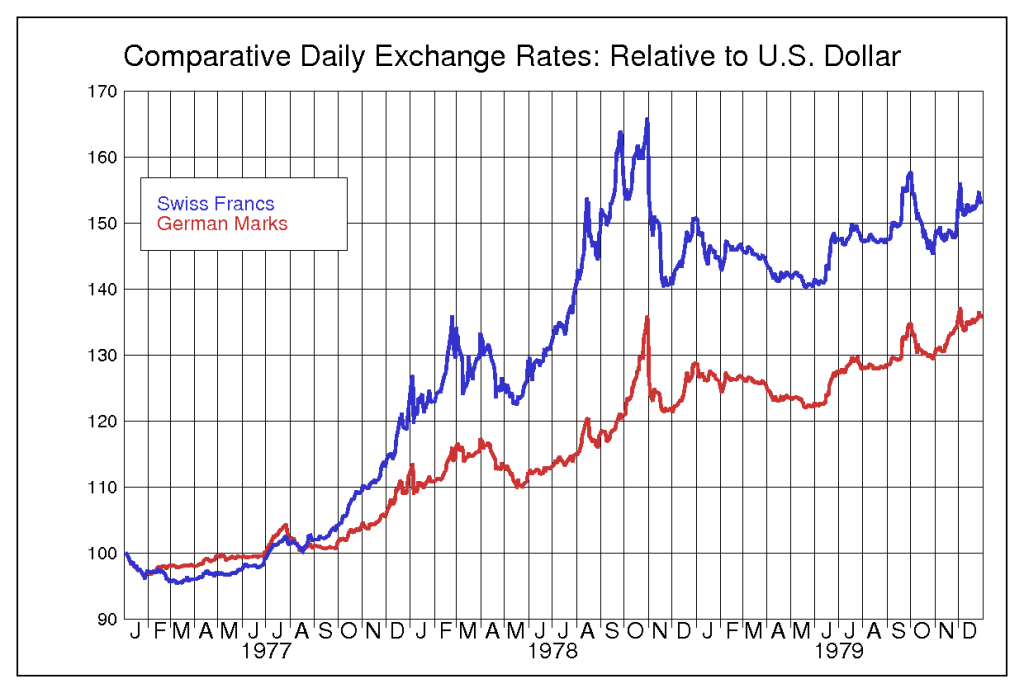

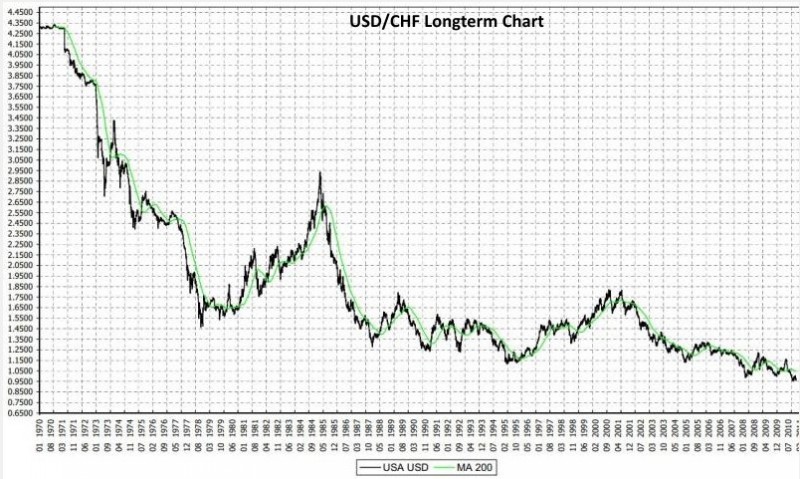

In this chapter we describe how Volcker managed to defeat stagflation; he applied the monetarist models that had been applied successfully in Switzerland and Germany. Thanks to this effort, the dollar stopped its secular decline.

Read More »

Read More »

Swiss Franc History, 1970s: Due to US Stagflation CHF Strengthens Massively

We shows the massive appreciation of Swiss franc and German mark in the 1970s, the reasons were: stagflation and the wage-price spiral.

Read More »

Read More »

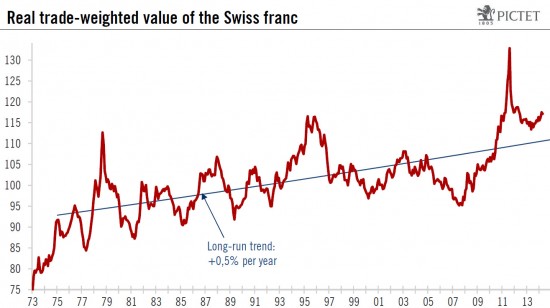

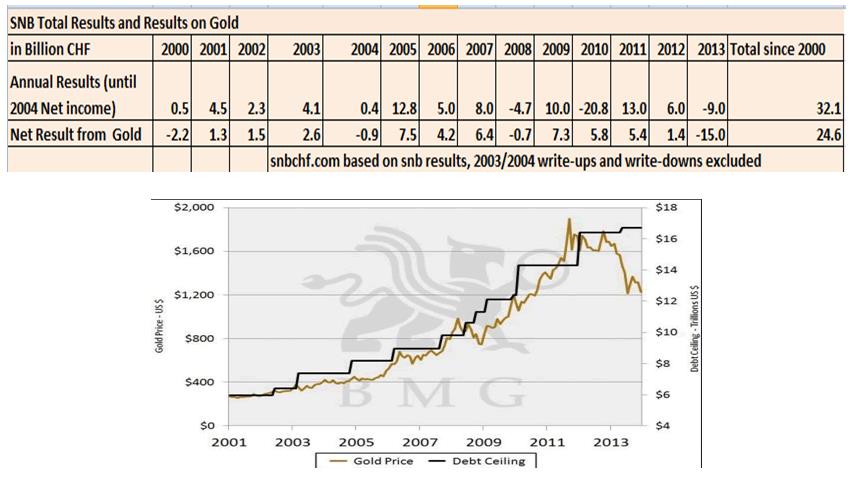

Swiss Franc History: The long-term view and the comparison with gold

We establish a long-term view and history of the Swiss franc. We compare the franc with gold.

Read More »

Read More »

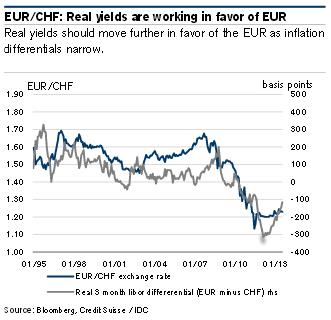

SNB Follows ECB? Pictet’s Negative SNB Interest Call

Pictet calls for negative interest rates in Switzerland in order to maintain rate differentials between the euro zone and Switzerland. Maintaining rate differentials would be useful for FX speculators and for money market funds that still invest in the euro zone.

Read More »

Read More »

Swiss Franc, Pseudo-Mathematics And Financial Charlatanism: Extended Version

We have published the extended version of “The Swiss Franc, Pseudo-Mathematics And Financial Charlatanism” on the investor site Seeking Alpha. The version is longer than the one published previously.

Read More »

Read More »

The IMF Assessment for Switzerland and our Critique

In the 2014 assessment for Switzerland by the International Monetary Fund several sentences caught our eyes; we will contrast them with our recent critique. The most important one was that for the IMF is only "moderately overvalued", this would have no negative effect for exporters.

Read More »

Read More »

The IMF Assessment for Switzerland 2014 and our critique

In the 2014 assessment for Switzerland by the International Monetary Fund, several sentences sparked in our eyes; we will contrast them with our recent critique.

Read More »

Read More »

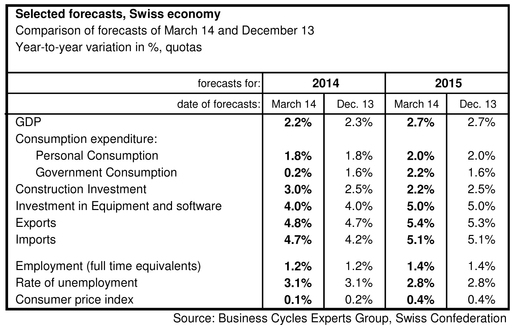

SECO expects 2.2% Swiss growth, further CHF strength ahead, understand why

The Swiss government see Swiss GDP growth at 2.2% in 2014 and 2.7% in 2015. Our estimate sees a divergence in the GDP components; we expects a lower trade surplus and higher spending. in both cases CHF should rise.

Read More »

Read More »

George Dorgan bei den Jungfreisinnigen Zürich, Teil 1: CHF und Schweizer Wirtschaft

Am 7. Februar hat George Dorgan eine Präsentation bei den Jungfreisinnigen Zürich gehalten. Themen waren die weitere Entwicklung des Frankens, die Schweizer Wirtschaft, die SNB und die Auswirkungen der Gold- und Masseneinwanderungsinitiativen.

Read More »

Read More »