Category Archive: 1.) CHF

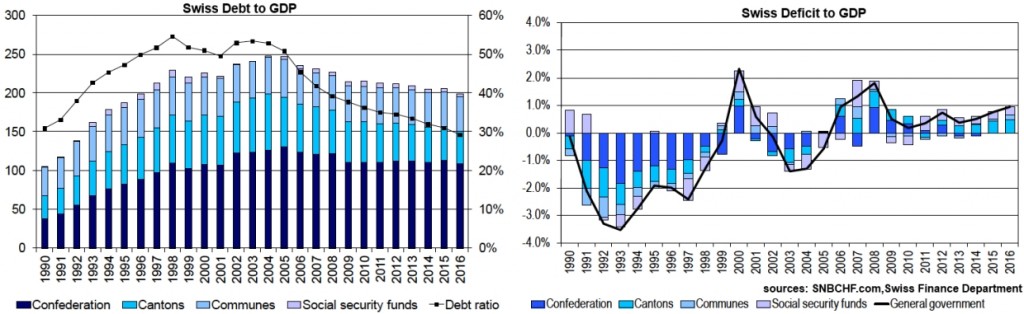

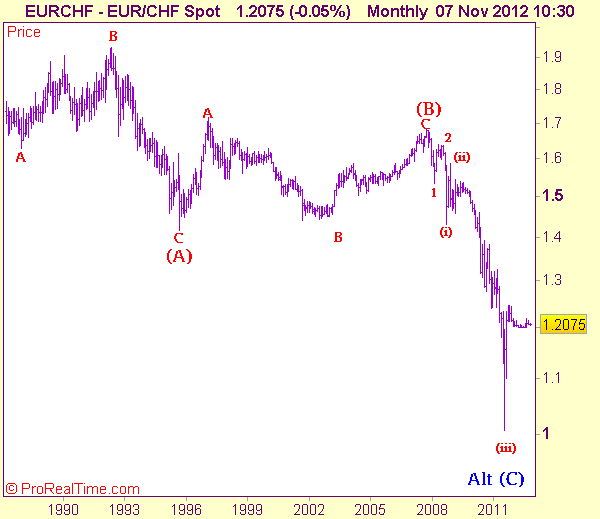

Debt Reduction, the new Financial Cycle, an Important Driver of EUR/CHF

In this analysis we describe why the long-lasting financial cycle of debt reduction is one key driver of the EUR/CHF exchange rate. We claim that EUR/CHF can rise more strongly only when the competitiveness of the European periphery increases. When this happens, then debt will be reduced and both public and private deficit spending will stop.

Read More »

Read More »

Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years

The Swiss ZEW investor sentiment has risen to 4.8 by 2.6 points, news that do not influence markets. More interesting is the following: Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years * Majority see no change in euro/franc for next 6 months (Reuters) – The Swiss National Bank will most … Continue reading »

Read More »

Read More »

Swiss Franc History, 2012: CHF becomes a “safe” Risk-On Currency

At the end of May, SNB president Jordan admitted that the EUR/CHF floor will not raised (here also cited by Bloomberg): “We cannot arbitrarily manipulate our currency. In an even worse crisis situation this would be disastrous and counterproductive. The floor must be legitimized. The current minimum exchange rate is realistic and has helped the Swiss economy.”

Read More »

Read More »

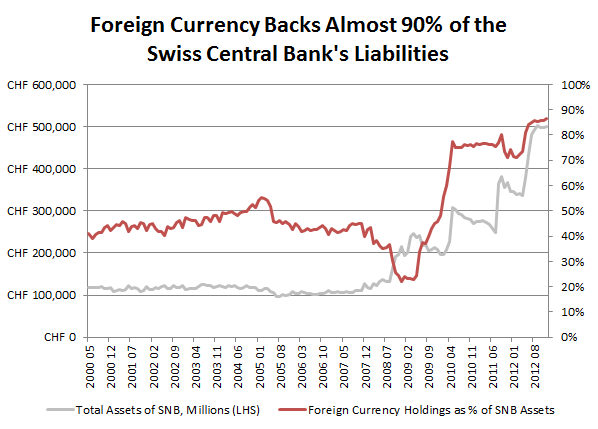

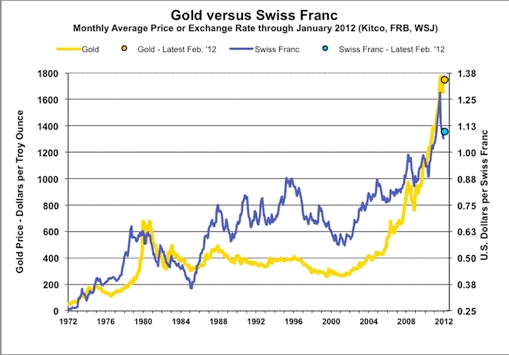

How Modern Monetary Policy Changed CHF from Gold-Backed to a USD and Euro-Backed Currency

we slowly move into an inflationary environment and prices of German Bunds and US Treasuries are falling.... ECB and Fed interest rates seem to be nailed to zero for years.

Read More »

Read More »

Franc-ly we’re delighted, said the SNB

Here’s the Swiss franc at its weakest level against the euro since the Swiss National Bank put its cap into place in September 2011: The euro hit SFr1.2485 on Thursday, up 3.3 per cent since the 10th of January and back to levels not seen since May 2...

Read More »

Read More »

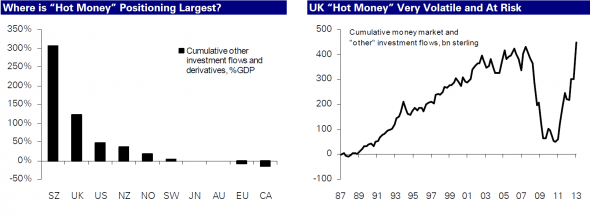

The wonders of the FX universe

Dark matter may more commonly be associated with physics, space exploration and Professor Brian Cox, but, according to Deutsche Bank’s FX strategist George Saravelos, there’s a good chance that it’s becoming a recognisable force in the world of forei...

Read More »

Read More »

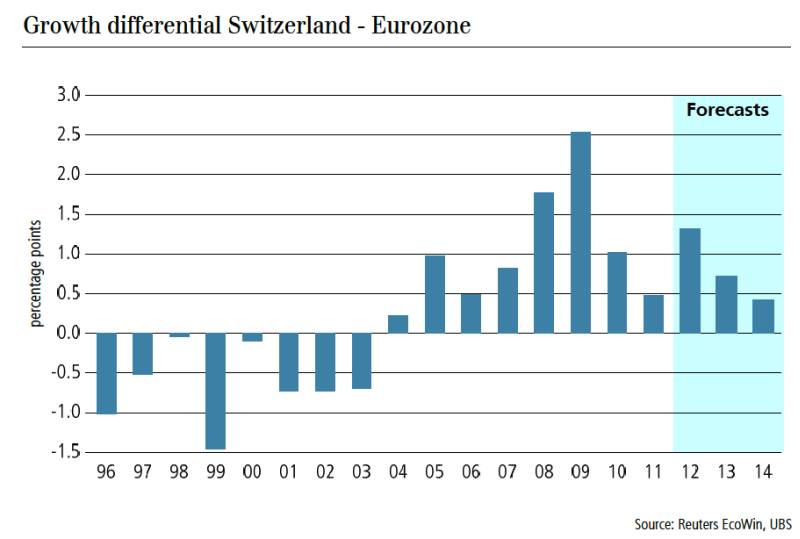

Correlations Between the Swiss Franc, Gold and the German Economy

In yesterday’s post we focused on several economic events that weakened the position of the Swiss National Bank (SNB). In this extended replacement post, we give several reasons for recent movements in the gold price and explain the correlation between German economic data, gold and the Swiss franc. IFO data shows that Germany will not …

Read More »

Read More »

‘Negative’ has such unfairly negative connotations

Dear people, ATTENTION: HEAD OF FINANCIAL INSTITUTIONS/NETWORKMANAGEMENT/TREASURY AND/OR CASH MANAGEMENT FURTHER TO OUR SWIFT DATED 26 08 2011 PLEASE BE INFORMED THAT DUE TO THE CONTINUED PREVAILING MARKET SITUATION AFFECTING THE SWISS FRANC, WE HAVE...

Read More »

Read More »

Jim Rogers, 2012: When Will the Peg Fall? Will Switzerland Become Bulgaria?

Given that most farmers are rather old, he says that the world should be very grateful to speculators that bet on food prices, this helps to obtain the required younger farmers. Jim Rogers has exchanged all his euros into francs, he thinks that the EUR/CHF peg will fall soon. Tagesanzeiger (

Read More »

Read More »

Gold, CHF, Brent Arbitrage Trading after Negative CS, UBS Interest Rates

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such news was worth 250 bps, on December 3 only 28 bips. One remembers August 26, 2011, when UBS only spoke of negative interests and consequently EUR/CHF rose from 1.1420 to 1.1688. At the time FX traders …

Read More »

Read More »

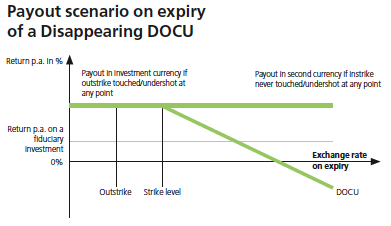

The Swiss National Bank straddle

It’s Swiss National Bank reserve figures Wednesday! That glorious day when we get to see how exactly the ingredients of the SNB’s cake have changed. Or to put it more literally, how have they been dealing with the masses of euro assets they are colle...

Read More »

Read More »

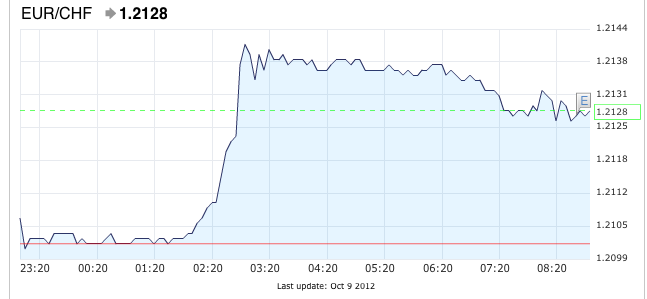

Strange movement in EUR/CHF in Asia session, a possible explanation

Strange movement in the EUR/CHF in the Asian session today The Asian session was a risk-on session, it recovered some of yesterday’s losses. After yesterday’s rather good HSBC services PMI, Shanghai Composite was up today by 1.97%. Therefore safe-havens like the yen and the Swissie were under pressure. At first, some Forex traders …

Read More »

Read More »

Isn’t it wonderful to trade with a strong central bank behind you?

Isn’t it wonderful to have a strong central bank like the SNB sitting behind you when trading Forex? Losses are limited to the floor of 1.20 and in the meantime you can gain forward swaps with the higher euro zone interest rates. Today the Swiss National Bank (SNB) decided in its monetary policy assessment …

Read More »

Read More »

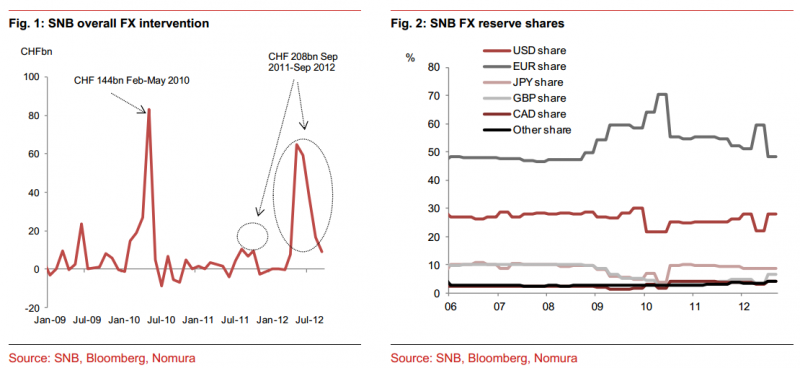

EUR/CHF, A History of Interventions: What markets say, July 2012

More Chatter About The EUR/CHF Peg The FT reports that Switzerland is ‘new China’ in currencies Chatter that the SNB was buying 3 billion francs worth of euros per day. “The picture is one of a central bank that’s not coping with how much money is coming in,” said Kit Juckes, foreign currency analyst at Société … Continue reading »

Read More »

Read More »